Samacheer Kalvi 11th Chemistry Solutions Chapter 7 Thermodynamics

Students can Download Chemistry Chapter 7 Thermodynamics Questions and Answers, Notes Pdf, Samacheer Kalvi 11th Chemistry Solutions Guide Pdf helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

Tamilnadu Samacheer Kalvi 11th Chemistry Solutions Chapter 7 Thermodynamics

Samacheer Kalvi 11th Chemistry Thermodynamics Textual Evaluation Solved

I. Choose the correct answer from the following:

Question 1.

The amount of heat exchanged with the surrounding at constant temperature and pressure is called ………

(a) ΔE

(b) ΔH

(c) ΔS

(d) ΔG

Answer:

(b) ΔH

Question 2.

All the naturally occurring processes proceed spontaneously in a direction which leads to

(a) decrease in entropy

(b) increase in enthalpy

(c) increase in free energy

(d) decrease in free energy

Answer:

(d) decrease in free energy

Question 3.

In an adiabatic process, which of the following is true?

(a) q = w

(b) q = 0

(c) ΔE = q

(d) PΔV = 0

Answer:

(a) q = 0

Question 4.

In a reversible process, the change in entropy of the universe is ‘

(a) >0

(b) > 0

(c) < 0

(d) = 0

Answer:

(d) = 0

Question 5.

In an adiabatic expansion of an ideal gas

(a) w = -∆u

(b) w = ∆u + ∆H

(c) ∆u = 0

(d) w = 0

Answer:

(a) w = -∆u

Question 6.

The intensive property among the quantities below is

(a) mass

(b) volume

(c) enthalpy

(d) mass/volume

Answer:

(d) mass/volume

![]()

Question 7.

An ideal gas expands from the volume of 1 x 10-3 m3 to 1 x 10-2 m3 at 300K against a constant pressure at 1 x 105 Nm-2. The work done is ………..

(a) – 900 J

(b) 900 kJ

(c) 270 kJ

(d) – 900 kJ

Answer:

(a) – 900 J

Hint:

w = – P∆V

w = – (1 x 105 Nm-2) (1 x 10-2 m3 – 1 x 10-3 m3)

w = – 105 (10-2– 10-3)Nm

w = – 105 (10 – 1) 103-) J

w = – 105(9x 10-3) J

w = – 9 x 102 J

w = – 900 J

Question 8.

Heat of combustion is always

(a) positive

(b) negative

(c) zero

(d) either positive or negative

Answer:

(b) negative

Question 9.

The heat of formation of CO and CO2 are -26.4 kcal and -94 kcal, respectively. Heat of combustion of carbon monoxide will be

(a) +26.4 kcal

(b) -67.6 kcal

(c) -120.6 kcal

(d) +52.8 kcal

Answer:

(b) -67.6 kcal

Hint:

CO(g) + O2(g) → CO2(g)

∆HC0 (CO) = [∆Hf(CO2) – ∆Hf(CO) + ∆Hf(O2)]

∆HC0 (CO) = -94 KCal – [- 26.4 KCal + 0]

∆HC0 (CO) = -94 KCal + 26.4 KCal

∆HC0 (CO) = -67.4 KCal

Question 10.

C(diamond) → C(graphite), ∆H = -ve, this indicates that ………..

(a) graphite is more stable than diamond

(b) graphite has more energy than diamond

(c) both are equally stable

(d) stability cannot be predicted

Answer:

(a) graphite is more stable than diamond

![]()

Question 11.

The enthalpies of formation of Al2O3 and Cr2O3 are -1596 kJ and -1134 kJ, respectively. ∆H for reaction 2Al + Cr2O3 → 2Cr + Al2O3 is ……….

(a) -1365 kJ

(b) 2730 kJ

(c) -2730 kJ

(d) -462 kJ

Answer:

(d) -462 kJ

Answer:

2A1 + Cr2O3 → 2Cr + Al2O3

∆Hr0 = [2 ∆Hf (Cr) + ∆Hf (Al2O3)] – [2 ∆Hf (Al) + ∆Hf (Cr2O2)]

∆Hr0 = [0 + (- 1596 kJ)] – [0 + (- 1134)]

∆Hr0 = – 1596 kJ + 1134 kJ

∆Hr0 = – 462 kJ

Question 12.

Which of the following is not a thermodynamic function?

(a) internal energy

(b) enthalpy

(c) entropy

(d) frictional energy

Answer:

(d) frictional energy

Question 13.

If one mole of ammonia and one mole of hydrogen chloride are mixed in a closed container to form ammonium chloride gas, then …………

(a) ∆H > ∆U

(b) ∆H – ∆U = 0

(c) ∆H + ∆U = 0

(d) ∆H < ∆U

Answer:

(d) ∆H < ∆U

Question 14.

Change in internal energy, when 4 kJ of work is done on the system and 1 kJ of heat is given out by the system is ………….

(a) +1 kJ

(b) -5 kJ

(c) +3 kJ

(d) -3 kJ

Answer:

(c) +3 kJ

Hint:

∆U = q + w

∆U = – 1 kJ + 4 kJ

∆U = + 3 kJ

![]() c

c

Question 15.

The work done by the liberated gas when 55.85 g of iron (molar mass 55.85 g mol-1) reacts with hydrochloric acid in an open beaker at 25°C …………

(a) -2.48 kJ

(b) -2.22 kJ

(c) +2.22 kJ

(d) + 2.48 kJ

Answer:

(a)-2.48 kJ

Hint:

Fe + 2HCl → FeCl2 + H2

1 mole of Iron liberates 1 mole of hydrogen gas

55.85 g Iron = 1 mole Iron

∴ n = 1

T = 25°C = 298 K

w = -P\(\left(\frac{\mathrm{nRT}}{\mathrm{P}}\right)\)

w = -nRT

w = -1 x 8314 x 298 J

w = 2477.57 J

w = -2.48 k J

Question 16.

The value of AH for cooling 2 moles of an ideal monoatomic gas from 125°C to 25°C at constant pressure will be [given CP = \(\frac {5}{2}\) R] …………..

(a) -250 R

(b) -500 R

(c) 500 R

(d) +250 R

Answer:

(b) -500 R

Hint:

Ti = 125°C = 398K

Tf = 25°C = 298 K

∆H = nCp (Tf – Ti)

∆H = 2 x \(\frac {5}{2}\)R (298 – 398)

∆H = -500 R

Question 17.

Given that C(g) + O2(g) → CO2(g) ∆H°= a kJ; 2 CO(g) + O2(g) → 2CO2(g) ∆H° = -b kJ; Calculate the ∆H° for the reaction C(g) + H2O2(g) → CO(g)

(a) \(\frac {b + 2a}{2}\)

(b) 2a – b

(c) \(\frac {2a – b}{2}\)

(d) \(\frac {b – 2a}{2}\)

Answer:

(d) \(\frac {b – 2a}{2}\)

Hint:

C + O2 → CO2 ∆H° = -a kJ ……..(1)

2CO + O2 → 2CO2 ∆H° = -b kJ …….(2)

C + ½O2 → CO ∆H° = ?

(1) x (2)

2C + 2O2 → 2CO2 ∆H° = -2a KJ …….(3)

Reverse of equestion (2) will be

2CO2 → 2CO + O2 ∆H° = +b KJ …….(4)

(3) + (4)

2C + O2 → 2CO ∆H° = b – 2a KJ …….(5)

(5) ÷ 2

C + O2 → CO ∆H° = \(\frac {b – 2a}{2}\) KJ

![]()

Question 18.

When 15.68 litres of a gas mixture of methane and propane are fully combusted at 0°C and 1 atmosphere, 32 litres of oxygen at the same temperature and pressure are consumed. The amount of heat released from this combustion in kJ is (∆HC (CH4) = – 890 kJ mol-1 and ∆HC (C3H8) = -2220 kJ mol-1)

(a) -889 kJ

(b) -1390 kJ

(c) -3180 kJ

(d) -653.66 kJ

Answer:

(d) -653.66 kJ

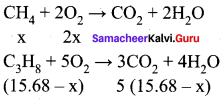

Hint:

Given,

∆HC (CH4) = -890 kJ mol-1

∆HC (C3H8) = -2220 kJ mol-1

Let the mixture contain x lit of and lit of propane.

Volume of oxygen consumed = 2 x + 5 (15.68 – x) = 32 lit

2x + 78.4 – 5 x = 321

78.4 – 3x = 32

3x = 46.41

x = 15.471

Given mixture contains 15.47 liters of methane and 0.2 13 liters of propane. Hence,

∆HC = [- 614.66 kJ mol-1] + [- 20.81 kJ mol-1]

∆HC = 635.47 kJ mol-1.

Question 19.

The bond dissociation energy of methane and ethane are 360 kJ mol-1 and 620 Id mol-1 respectively. Then, the bond dissociation energy of C-C bond is …………

(a) 170 kJ mol-1

(b) 50 kJ mol-1

(c) 80 kJ mol-1

(d) 220 kJ mol-1

Answer:

(c) 80 kJ mol-1

Hint:

4EC-H = 360 kJ mol-1

EC-H = 90 kJ mol-1

EC-C + 6EC-H = 620 KJ mol-1

EC-C + 6 x 9O = 62O kJ mol-1

EC-C + 540 = 620 kJ mol-1

EC-C = 80 kJ mol-1

Question 20.

The correct thermodynamic conditions for the spontaneous reaction at all temperature is (NEET phase – I)

(a) ∆H<0 and ∆S>0

(b) ∆H<0 and ∆S<0

(c) ∆S>0 and ∆S = 0

(d) ∆H<0 and ∆S>0

Answer:

(a) ∆H<0 and ∆S>0

![]()

Question 21.

The temperature of the system decreases in an …………

(a) isothermal expansion

(b) isothermal compression

(c) adiabatic expansion

(d) adiabatic compression

Answer:

(c) adiabatic expansion

Question 22.

In an isothermal reversible compression of an ideal gas the sign of q, AS and w are respectively

(a) +, -, –

(b) -, +, –

(c) +, -, +

(d) -, -, +

Answer:

(d) -, -, +

Hint:

During compression, the energy of the system increases, in isothermal condition, to maintain the temperature constant, heat is liberated from the system. Hence q is negative. During compression, entropy decreases. During compression work is done on the system, hence w is positive.

Question 23.

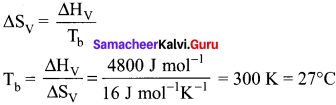

The molar heat of vaporization of a liquid is 4.8 kJ mol-1. If the entropy change is 16 J mol-1 K-1. the boiling point of the liquid is ………..

(a) 323 K

(b) 27°C

(c) 164 K

(d) 0.3 K

Answer:

(b) 27°C

Hint:

Question 24.

∆S is expected to be maximum for the reaction

(a) Ca(S) + O2(g) → CaO(S)

(b) C(S) + O2(g) → CO2(g)

(c) N2(g) + O2(g) → 2NO(g)

(d) CaCO3(S) → CaO(S) + CO2(g)

Answer:

(d) CaCO3(S) → CaO(S) + CO2(g)

Hint:

In CaCO3(S) → CaO(S) + CO2(g) entropy change is positive in (a) and (b) entropy change is negative; in (c) entropy change is zero.

Question 25.

The values of H and S for a reaction are respectively 30 kJ mol-1 and loo kJ mol-1. Then the temperature above which the reaction will become spontaneous is ………….

(a) 300 K

(b) 30 K

(c) 100 K

(d) 20°C

Answer:

(a) 300 K

Hint:

∆G = ∆H – T∆S

At 300 K.

∆G = 30000 J mol-1 – 300 K x 100 JK mol-1

∆G = 0

above 300 K;

∆G will be negative and reaction becomes spontaneous.

![]()

II . Answer these questions briefly.

Question 26.

State the first law of thermodynamics.

Answer:

The first law of thermodynamics, known as the law of conservation of energy, states that the total energy of an isolated system remains constant though it may change from one form to another.

The mathematical statement of the First Law as:

∆U = q + w

where q – the amount of heat supplied to the system; w – work done on the system.

Question 27.

Define Hess’s law of constant heat summation.

Answer:

Hess’s law:

The enthalpy change of a reaction either at constant volume or constant pressure is the same whether it takes place in a single or multiple steps.

Question 28.

Explain intensive properties with two examples.

Answer:

The property that is independent of the mass or the size of the system is called an intensive property. Refractive index, Surface tension, density, temperature, Boiling point, Freezing point, molar volume.

Question 29.

Define the following terms:

(a) isothermal process

(b) adiabatic process

(c) isobaric process

(d) isochoric process

Answer:

a. An isothermal process is defined as one in which the temperature of the system remains constant, during the change from its initial to final state. The system exchanges heat with its surroundings and the temperature of the system remains constant. For an isothermal process dT = 0.

b. An adiabatic process is defined as one in which there is no exchange of heat (q) between the system and surrounding during the process. Those processes in which no heat can flow into or out of the system are called adiabatic processes.

c. An isobaric process is defined as one in which the pressure of the system remains constant

during its change from the initial to final state.

For an isobaric process dP = 0.

d. An isochoric process is defined as the one in which the volume of system remains constant during its change from initial to final state. Combustion of fuel in a bomb calorimeter is an example of an isochoric process.

For an isochoric process, dV= 0.

![]()

Question 30.

What is the usual definition of entropy? What ¡s the unit of entropy?

Answer:

- Entropy is a thermodynamic state function that is a measure of the randomness or disorderliness of the system.

- For a reversible change taking place at a constant temperature (T). the change in entropy

- of the system is equal to heat energy absorbed or evolved (q) by the system divided by the constant temperature (T).

- SI unit of entropy is J K-1

Question 31.

Predict the feasibility of a reaction when

- both ∆H and ∆S positive

- both ∆H and ∆S negative

- AH decreases but ∆S increases

Answer:

- ∆Hr = + ve, ∆S = + ve; non-spontaneous at low temperature spontaneous at high temperature

- ∆Hr = – ve, ∆S = – ve; spontaneous at low temperature non-spontaneous at high temperature

- ∆H decreases but ∆S increases = Spontaneous at all temperatures.

Question 32.

Define Gibb’s free energy.

Answer:

G is expressed as G = H – TS, free energy change of a process is given by the relation ∆G = ∆H – T∆S.

Question 33.

Define enthalpy of combustion.

Answer:

Enthalpy of combustion of a substance is defined as “the change in enthalpy of a system when one mole of the substance is completely burnt in excess of air or oxygen”. it is denoted as AH.

Question 34.

Define molar heat capacity. Give its unit.

Answer:

Molar heat capacity is defined as “the amount of heat absorbed by one mole of a substance in raising the temperature by I Kelvin”. It is denoted as Cm

Unit of Molar heat capacity: SI unit of Cm is JK-1 mol-1.

![]()

Question 35.

Define the calorific value of food. What is the unit of calorific value?

Answer:

- The calorific value of food is defined as the amount of heat produced in calories (or Joules) when one gram of food is completely burnt.

- Unit of calorific value (a) Cal g-1 (b) J Kg-1

Question 36.

Define enthalpy of neutralization.

Answer:

The heat of neutralization is defined as “The change in enthalpy when one gram equivalent of an acid is completely neutralized by one gram equivalent of a base or vice versa in dilute solution”.

HCl(aq) + NaOH(aq) → NaCl(aq) + H2O

∆H = – 57.32 kJ

Question 37.

What is lattice energy?

Answer:

Lattice energy is defined as the amount of energy required to completely separate one mole of a solid ionic compound into a gaseous constituent.

Question 38.

What are state and path functions? Give two examples.

Answer:

State function:

A state function is a thermodynamic property of a system, which has a specific value for a given state and does not depend on the path (or manner) by which the particular state is reached.

Example:

Pressure (P), Volume (V), Temperature(T), Internal energy (U), Enthalpy (H), free energy (G) etc.

Path functions:

A path function is a thermodynamic property of the system whose value depends on the path by which the system changes from its initial to final states.

Examples: Work (w), Heat (q).

Question 39.

Give Kelvin a statement of the second law of thermodynamics.

Answer:

It is impossible to construct a machine that absorbs heat from a hot source and converts it completely into work by a cyclic process without transferring a part of heat to a cold sink.

Question 40.

The equilibrium constant of a reaction is 10, what will be the sign of ∆G? Will this reaction be spontaneous?

Answer:

∆G° = -2.303 RT log Keq

Keq = 10

∴ ∆G° = -ve value.

So the reaction will be spontaneous.

Question 41.

Enthalpy of neutralization is always a constant when a strong acid is neutralized by a strong base: account for the statement.

Answer:

It is because in dilution solution all strong acids and strong bases are completely ionized. The neutralization of strong acid and strong bases are completely ionized. The neutralization of a strong acid and strong base simply involves the combination of H+ ions (from acid) and OH– ions (from base) to form unionized water molecules with the evolution of 57.1 kJ heat.

H+(aq) + OH–(aq) → H2O(l),

∆2H° = -57.1 kJ

Since the same reaction takes place during neutralization of all strong acids and strong bases, the value of enthalpy of neutralization is constant.

![]()

Question 42.

State the third law of thermodynamics.

Answer:

It states that the entropy of pure crystalline substance at absolute zero is zero.

(or)

It can be stated as “it is impossible to lower the temperature of an object to absolute zero in a

finite number of steps”. Mathematically ![]()

Question 43.

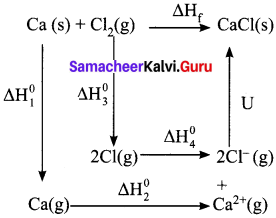

Write down the Born-Haber cycle for the formation of CaCl2

Answer:

Born – Haber cycle for the formation of CaCl2

Ca(S) + Cl2(l) → CaC2(S) ∆Hf°

Sublimation : Ca(S) → Ca(S) ∆H1°

Ionization : Ca(g) → Ca2+(g) + 2e– = ∆H2°

Vapourisation : Cl2(l) → Cl2(g) = ∆H3°

Dissociation : Cl2(g) → 2Cl(g) = ∆H4°

Electron affinity : 2Cl2(g) + 2e– → 2Cl–2(g)(g) = ∆H5°

Lattice enthalpy : Ca2+(g) + 2Cl–(g) → CaCl2(S) = ∆H6°

∆Hf° = ∆H1° + ∆H2° + ∆H3° + ∆H4° + ∆H5° + ∆H6°

Question 44.

Identify the state and path functions out of the following

(a) Enthalpy

(b) Entropy

(c) Heat

(d) Temperature

(e) Work

(f) Free energy.

Answer:

State function: Enthalpy, entropy, temperature, and free energy.

Path function: Heat and work.

![]()

Question 45.

State the various statements of the second law of thermodynamics.

Answer:

Entropy statement:

The second law of thermodynamics can be expressed in terms of entropy, i.e “the entropy of an isolated system increases during a spontaneous process”.

Kelvin-Planck statement:

It is impossible to construct a machine that absorbs heat from a hot source and converts it completely into work by a cyclic process without transferring a part of heat to a cold sink.

Clausius statement:

It is impossible to transfer heat from a cold reservoir to a hot reservoir without doing some work.

Question 46.

What are spontaneous reactions? What are the conditions for the spontaneity of a process?

Answer:

- A reaction that does occur under the given set of conditions is called a spontaneous reaction.

- The expansion of a gas into an evacuated bulb is a spontaneous process, the reverse process that is gathering of all molecules into one bulb is not spontaneous. This example shows that processes that occur spontaneously in one direction cannot take place in opposite

direction spontaneously. - Increase in randomness favours a spontaneous change.

- If enthalpy change of a process is negative, then the process is exothermic and occurs spontaneously. Therefore ∆H should be negative.

- if entropy change of a process is positive, then the process occurs spontaneously, therefore ∆S should be positive.

- If free energy of a process is negative, then the process occurs spontaneously, therefore ∆G should be negative.

- For a spontaneous. irreversible process. ∆H <0, ∆S > 0, ∆G < 0. i.e., ∆H = -ve, ∆S = +ve and ∆G = -ve.

Question 47.

List the characteristics of internal energy.

Answer:

The internal energy of a system is an extensive property. It depends on the amount of the substances present in the system. If the amount is doubled, the internal energy is also doubled.

The internal energy of a system is a state function. It depends only upon the state variables (T, P, V, n) of the system. The change in internal energy does not depend on the path by which the final state is reached.

The change in internal energy of a system is expressed as ∆U = Uf – Ui.

In a cyclic process, there is no internal energy change. ∆U(cyclic) = 0

If the internal energy of the system in the final state (Uf) is less than the internal energy of the system in its initial state (Ui), then ∆U would be negative.

∆U = Uf – Ui = -ve(Uf < Ui)

If the internal energy of the system in the final state (Uf) is greater than the internal energy of the system in its initial state (Ui), then ∆U would be positive.

∆U = Uf – Ui = + ve(Uf > Ui).

Question 48.

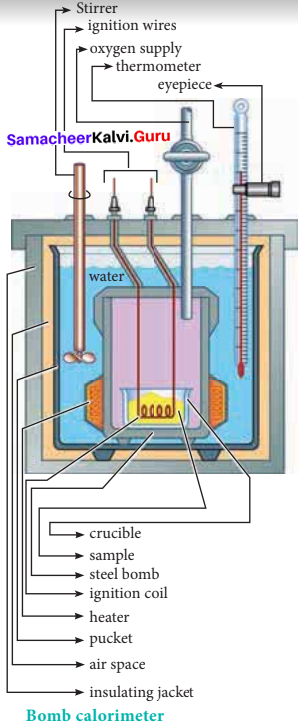

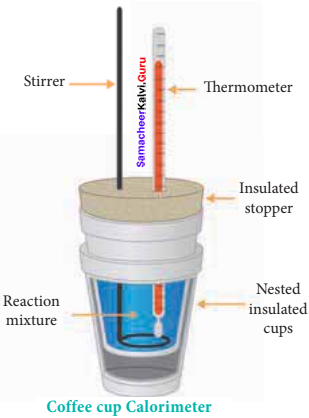

Explain how heat absorbed at constant volume is measured using a bomb calorimeter with a neat diagram.

Answer:

1. For chemical reactions, heal absorbed at constant volume, is measured in a bomb calorimeter.

2. Description of the apparatus and procedure:

The inner vessel and its cover are made of strong steel. The cover is fitted tightly to the vessel by means of metal lid and screws. A weighed amount of the substance is taken in a platinum cup connected with electrical wires for striking an arc instantly to kindle combustion. The bomb is then tightly closed and pressurizcd with excess

oxygen. The bomb is lowered in water, which is placed inside the calorimeter. A stirreris placed in the bomb to stir the water uniformly. The reaction is started by striking the substance through electrical heating.

3. During burning, the exothermic heat generated inside the bomb raises the temperature of the surrounding water bath. Temperature change can be measured accurately using Beckmann thermometer. Since the bomb calorimeter is sealed, its volume does not change, so the heat measurements, in this case, corresponds to the heat of reaction at constant volume.

4. In a bomb calorimeter experiment, a weighed sample of benzoic acid (w) is placed in the bomb which is then filled with excess oxygen and sealed. Ignition is brought about electrically. The rise in temperature (AT) is noted. Water equivalent or calorimetry equivalent of the calorimeter is known from the standard value of enthalpy of combustion of benzoic acid.

5. ∆HC(C6H5COOH) = -3227 kJ mol-1

6. By knowing o value, the enthalpy of combustion of any other substance is determined adopting the similar procedure and using the substance in place of’ benzoic acid. By this experiment, the enthalpy of combustion at constant volume (AUC°) is known,

∆UC° = ωe. ∆T

7. Enthalpy of combustion at constant pressure of the substance is calculated from the equation

∆U°C(pressure) = ∆U°C(volume) + ∆ng RT

![]()

Question 49.

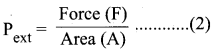

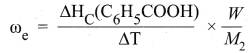

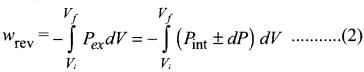

Calculate the work involved in the expansion and compression process.

Answer:

1. The essential condition of expansion or compression of a system is, there should be a difference between external pressure Pext and internal pressure (Pint).

2. If the volume of the system is increased against the external pressure. the work is done by the system. By convention work done by the system is given a negative sign (-w).

3. If the volume of the system decreased, the work is done on the system. By convention work done on the system is given a positive sign (+w).

4. For understanding pressure-volume work, let us consider a cylinder which contains one mole of an ideal gas fitted with a frictionless piston. Total volume of the gas is Vi and pressure of the gas inside is Pint.

5. If external pressure is Pext which is greater than Pint piston is moved inward till the pressure inside becomes equal to Pint It is achieved in a single step and the final volume be Vf.

6. During this compression, piston moves a distance x) and is the cross-sectional area of the piston is A, then, Change in volume = x A = ∆V = Vf – Vi ………..(1)

Pext = \(\frac {Force (F)}{Area(A)}\) ………(2)

F = Pext.A

7. if work is done by the system by pushing out the piston against external pressure (Pext) then according to the equation,

-w = F.x ………(3)

-w = Pext . A . x …….(4)

-w = Pext.∆V ……….(5)

-w = Pext . (Vf– Vi.) …..(6)

Simply w = – P∆V ………..(7)

8. From the above equation, we can predict the sign of work (w).

9. During expansion, work is done by the system, since Vf>Vi the sign obtained for work will be negative.

10. During compression, work is done on the system, since Vf<Vi the sign obtained for work will be positive.

Question 50.

Derive the relation between ∆H and ∆U for an ideal gas. Explain each term involved in the equation.

Answer:

When the system at constant pressure undergoes changes from an initial state with H1, U1 and V1 to a final state with H2, U2 and V2 the change in enthalpy

∆H can be calculated as follows:

H =U + PV

In the initial state

H1 = U1 + PV1 ………………(1)

In the final state

H2 = U2 + PV2 ……………..(2)

change in enthalpy is (2) – (1)

(H2 – H1) = (U2 – U1) + P(V2 – V1)

∆H = ∆U + P∆V ………………..(3)

As per first law of thermodynamics,

∆U = q + w

Equation (3) becomes

∆H = q + w+P∆V

w = -P∆V

∆H = qp – P∆V + P∆V

∆H = qp ………….(4)

qp – is the heat absorbed at constant pressure and is considered as heat content.

Consider a closed system of gases which are chemically reacting to form gaseous products at constant temperature and pressure with Vi and Vf, as the total volumes of the reactant and product gases respectively, and niand nfas the number of moles of gaseous reactants and products, then,

For reactants (initial state):

PVi = niRT ………..(5)

For products (final state):

PVf = nfRT ……………..(6)

(6) – (5)

P{Vf – Vi) = (nf – ni)RT

P∆V = ∆n(g) RT ………..(7)

Substituting in (7) in (3)

∆H = ∆U+ ∆n(g)RT …………….(8)

![]()

Question 51.

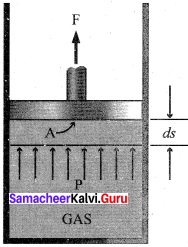

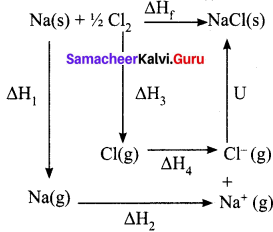

Suggest and explain an indirect method to calculate lattice enthalpy of sodium chloride crystal.

Answer:

The Born – Haber cycle is used to determine the lattice enthalpy of NaCl as follows:

Formation of NaCl can be considered in 5 steps. The sum of the enthalpy changes of these steps is equal to the enthalpy change for the overall reaction from which the lattice enthalpy of NaCl is calculated.

Na(s) + Vi Cl2(g) → NaCl(s) ∆Hf = -411.3 kJ mol-1

Sublimation : Na(s) → Na(g) ∆H1°

Dissociation : ½ Cl2(g) → Cl(g) ∆H2°

Ionisation : Na(s) → Na+(g) + e– ∆H3°

E1etron affinity : Cl(g) + e– → Cl–(g) ∆H4°

Lattice enthalpy : Na+(g) + Cl–(g) → NaCl(s) ∆H5° =?

∆H = ∆H1° + ∆H4° + ∆H4° + ∆H4° + ∆H4°

∆H = ∆Hf° – (∆H1° + ∆H2°+ ∆H3°+∆H4°)

∆H5°= Lattice enthalpy of NaCl.

By the above method, indirectly lattice enthalpy of NaCl is calculated if the values of ∆Hf°, ∆H1°, ∆H2°- ∆H3° and ∆H4° are given.

Question 52.

List the characteristics of Gibbs free energy.

Answer:

(i) G is defined as (H-TS) where H and S are the enthalpy and entropy of the system respectively. T = temperature. Since H and S are state functions, G is a state function.

(ii) G is an extensive property while ∆G = (G2 – G1) which is the free energy change between the initial (1) and final (2) states of the system becomes the intensive property when mass remains constant between initial and final states (or) when the system is a closed system.

(iii) G has a single value for the thermodynamic state of the system.

(iv) G and ∆G values correspond to the system only. There are three cases of ∆G in predicting the nature of the process. When, ∆G < 0 (negative), the process is spontaneous and feasible; ∆G = 0. The process is in equilibrium and ∆G > 0 (positive), the process is nonspontaneous and not feasible.

(v) ∆G = ∆H – T∆S. But according to I law of thermodynamics,

∆H = ∆G + P∆V and ∆U = q + w

∴ ∆G = q + w + P∆V – T∆S

But ∆S = \(\frac{T}{q}\) and T∆S = q = heat involved in the process.

∴ ∆G = q + w + P∆V – q = w + P∆V

(or) – ∆G = – w – P∆V = network.

The decrease in free energy – ∆G, accompanying a process taking place at constant temperature and pressure is equal to the maximum obtainable work from the system other than work of expansion.

This quantity is called the “network” of the system and it is equal to (- w – P∆V).

∴ Network = – w – P∆V

-∆G represents all others forms of work obtainable from the system such as electrical, chemical or surface work etc other than P-V work.

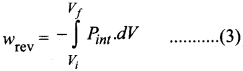

Question 53.

Calculate the work done when 2 moles of an ideal gas expands reversibly and isothermally from a volume of 500 ml to a volume of 2 L at 25°C and normal pressure.

Answer:

Given

n = 2 moles

Vi = 500 ml = 0.5 lit

Vf = 2 lit

T = 25°C = 298 K

w = -2.303 nRT log \(\left(\frac{V}{V_{i}}\right)\)

w = -2.303 x 2 x 8.314 x 298 x log \(\frac {2}{0.5}\)

w = -2.303 x 2 x 8.314 x 298 x log(4)

w = -2.303 x 2 x 8.314 x 298 x 0.6021

w = -6871 J

w =-6.871 kJ.

![]()

Question 54.

In a constant-volume calorimeter, 3.5 g of gas with molecular weight 28 was burnt ¡n excess oxygen at 298 K. The temperature of the calorimeter was found to increase from 298 K to 298.45 K due to the combustion process. Given that the calorimeter constant is 2.5 kJ K-1. Calculate the enthalpy of combustion of the gas in kJ mol-1.

Answer:

Given

Ti = 298 K

Tf = 298.45 K

k = 2.5 kJ K-1

m = 3.5g

Mm = 28

heat evolved = k∆T

= k(Tf – Ti)

= 2.5KJ K-1 (298.45 – 298)K = 1.125 kJ

∆Hc = \(\frac{1.125}{3.5}\) × 28 kJ mol-1

∆Hc = 9 kJmol-1

Question 55.

Calculate the entropy change in the system and surroundings and the total entropy change in the universe during a process in which 245 J of heat flow out of the system at 77°C to the surrounding at 33°C.

Answer:

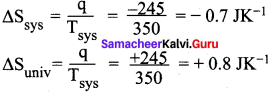

Given:

Tsys = 77°C = (77 + 273) = 350K

Tsys = 33°C = (33 + 273) = 306K

q = 245 J

∆Suniv = ∆Ssys + ∆Ssurr-245 = —07 3K’

∆Suniv = -0.7 JK-1 + 0.8 JK-1

∆Suniv = 0.1 JK-1

Question 56.

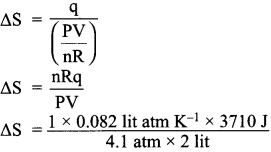

1 mole of an ideal gas, maintained at 4.1 atm and at a certain temperature, absorbs heat 3710 J and expands to 2 litres. Calculate the entropy change in expansion process.

Answer:

Given,

n = 1 mole

P = 4.1 atm

V = 2Lit

T = ?

q = 3710 J

∆S = \(\frac {q}{T}\)

∆S = 37.10 JK-1

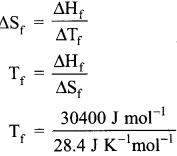

Question 57.

30.4 kJ is required to melt one mole of sodium chloride. The entropy change during melting is 28.4 JK-1 mol-1. Calculate the melting point of sodium chloride.

Answer:

Given,

∆Hf(NaCl) = 30.4 kJ = 30400 J mol-1

∆Sf (NaCl) = 28.4 JK-1 mol-1

Tf = ?

Tf = 1070.4 K.

![]()

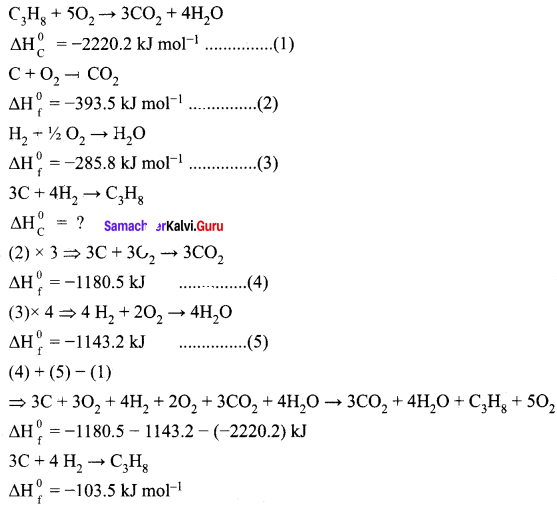

Question 58.

Calculate the standard heat of formation of propane, if its heat of combustion is -2220.2 KJ mol-1, the heats of formation of CO2(g) and H2O(l) are – 393.5 and -285.8 kJ mol-1 respectively.

Answer:

Given,

The standard heat of formation of propane is ∆Hf0(C3H8) = -103.5 kJ mol-1.

Question 59.

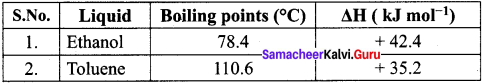

You are given normal boiling points and standard enthalpies of vaporization. Calculate the entropy of vaporization of liquids listed below.

Answer:

For ethanol:

Given:

Tb = 78.4°C = (78.4 + 273) = 351.4 K

∆Hv(ethanol) = + 42.4 kJ mol-1

∆Hv = + 91.76 J K-1 mol-1

For Toluene:

Given:

Tb = 110.6°C = (110.6 + 273) = 383.6 K

∆SV (toluene) = + 35.2 KJ mol-1

∆SV = + 91.76 J KJ mol-1

Question 60.

For the reaction Ag2O(s) → 2Ag(s) + ½ O2(g): ∆H = 30.56 kJ mol-1 and ∆S = 6.66 JK-1 mol-1 (at 1 atm). Calculate the temperature at which AG is equal to zero. Also predict the direction of the reaction (i) at this temperature and (ii) below this temperature.

Answer:

Given,

∆H = 30.56 kJ mol-1

∆H = 30560 J mol-1

∆S = 6.66 x 10-3 kJ K-1 mol-1

T = ? at which ∆G = 0

∆G = ∆H – T∆S

0 = ∆H – T∆S

T = \(\frac {∆H}{∆S}\)

![]()

T = 4589K

(i) At 4589K ; ∆G = 0, the reaction is in equilibrium.

(ii) At temperature below 4598 K, ∆H > T ∆ S

∆G = ∆H – T∆S > 0, the reaction in the forward direction, is non-spontaneous. In other words the reaction occurs in the backward direction.

Question 61.

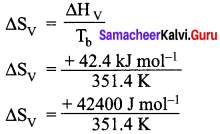

What is the equilibrium constant Keq for the following reaction at 400K.

2NOCl(g) ⇌ 2NO(g) + Cl2(g) given that AH° = 77.2 kJ mol-1 and ∆S° = 122 JK-1 mol-1

Answer:

Given,

T = 400 K ; ∆H° = 77.2 kJ mol-1 = 77200 J mol-1;

∆S° = 122 JK-1 mol-1

∆G° = -2.303 RT log Keq

log Keq = -3.7080

Keq = anti log(-3.7080)

Keq = 1.95 x 10-4

![]()

Question 62.

Cyan-amide (NH2CN) ¡s completely burnt in excess oxygen in a bomb calorimeter, ∆U was found to be -742.4 kJ mol-1 calculate the enthalpy change of the reaction at 298K.

NH2CN(s) + 3/2 O2(g) → N2(g) + CO2(g) + H2O(l) ∆H = ?

Answer:

Given

T = 298 K;

∆U = -742.4 kJ mol-1

∆H =?

∆H = ∆U + ∆n(g)RT

∆H = ∆U + (np – nr)RT

∆H = 742.4 + 2 – \(\frac{3}{2}\) × 8.314 × 10-3 × 298

= -742.4 + (0.5 × 8.314 ×10-3 × 298)

= -742.4 + 1.24

= -741.16 kJ mol-1

Question 63.

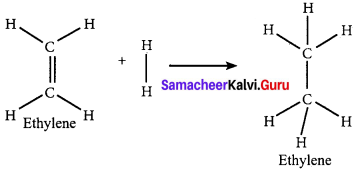

Calculate the enthalpy of hydrogenation of ethylene from the following data. Bond energies of C H, C – C, C = C and H – H are 414, 347, 618 and 435 kJ mol-1.

Answer:

Given,

EC-H = 414 kJ mol-1

EC-H = 347 kJ mol-1

EC-H = 618 kJ mol-1

EH-H = 435 kJ mol-1

∆Hr = ∑(Bond energy)r – ∑(Bond energy)P

∆Hr = (EC=C + 4EC-H + EH-H) – (EC-C + 6EC-H)

∆Hr = (618 + (4 x 414) + 435) – (347 + (6 x 414))

∆Hr = 2709 – 2831

∆Hr = -122 KJ mol-1

Question 64.

Calculate the lattice enegry of CaCl2 from the given data

Ca(s) + Cl2(g) → CaCl2(s) ∆Hf0 = -795 KJ mol-1

Atomisation : Ca(s) → Ca(g) ∆H1° = + 121 KJ mol-1

Ionization : Ca(g) → Ca2+(g) + 2e– ∆H2° = + 242.8 KJ mol-1

Dissociation : Cl2(g) → 2 Cl(g) ∆H3° = +242.8 KJ mol-1

Electron affinity : Cl(g) + e– → Cl–(g) ∆H3° = -355 KJ mol-1

Answer:

∆Hf = ∆H1 + ∆H2 + ∆H3 + 2∆H4 + u

-795 = 121 + 2422 + 242.8 + (2 x—355) + u

-795 = 2785.8 – 710 + u

-795 = 2075.8 + u

u = -795 – 2075.8

u = -2870.8 KJ mol-1

Question 65.

Calculate the enthalpy change for the reaction Fe2O3 + 3CO → 2Fe + 3CO2 from the following data.

2Fe + \(\frac{3}{2}\) O2 → Fe2O3; ∆H = -741 kJ

C + \(\frac{1}{2}\) O2 → CO; ∆H = -137 KJ

C + O2 → CO2 ∆H = -394.5 KJ

Answer:

Given,

∆Hf (Fe2O3) = -741 kJ mol-1

∆Hf(CO) = -137 kJ mol-1

∆Hf(CO2) = -394.5 kJ mol-1

Fe2O3 + 3CO → 2Fe + 3CO2 ∆Hr = ?

∆Hr = ∑(∆Hf)products – ∑(∆Hf)reactants

∆Hr = [2 ∆Hf(Fe) + 3 ∆Hf(CO2)] – [∆Hf(Fe2O3) + 3∆Hf(CO)]

∆Hr = [- 1183.5 ] – [-1152]

∆Hr = – 1183.5 + 1152

∆Hr = -31.5 KJ mol-1

Question 66.

When 1-pentyne (A) is treated with 4N alcoholic KOH at 175°C, it is converted slowly into an equilibrium mixture of 13% 1-pentyne(A), 95.2% 2-pentyne(B) and 3.5% of 1,2 pentadiene (C) the equilibrium was maintained at 175°C, calculate AG° for the following equilibria.

B ⇌ A ∆G1° = ?

B ⇌ C ∆G2° = ?

Answer:

Given

T = 175°

C = 175 + 273 = 448 K

Concentration of 1-pentyne [A] = 1.3%

Concentration of 2-pentyne [B] = 95.2%

Concentration of 1, 2-pentadiene [C] = 3.5%

At equilibrium

B ⇌ A

95.2% 1.3% ⇒

B ⇌ C

95.2% 3.5% ⇒

K2 = \(\frac{3.5}{95.2}\) = 0.0367

⇒ ∆G°1 = -2.303 RTlogK

∆G°1 = – 2.303 × 8.314 × 448 × log 0.0136

∆G°1 = +16010 J

∆G°1 = +16 kJ

⇒ ∆G°2 = – 2.303 RT log K2

∆ G°2 = -2.303 × 8.314 × 448 × log 0.0367

∆ G°2 = +12312J

∆G°2 = +12.312 kJ

![]()

Question 67.

At 33K. N2H4 is fifty percent dissociated. Calculate the standard free energy change at this temperature and at one atmosphere.

Answer:

T = 33K

N2O4 ⇌ 2NO2

Initial concentration 100%

Concentration dissociated 50%

Concentration remaining at equilibrium 50% – 100%

Keq = \(\frac{100}{50}\) = 2

∆G° = -2.303 RT log Keq

∆G° = -2.303 x 8.31 x 33 x 1og 2

∆G° = -190.18 J mol-1

Question 68.

The standard enthaipies of formation, of SO2 and SO3 are -297, kJ. rnol-1 and -396 kJ mol-1 respectively. Calculate the standard enthalpy of reaction for the reaction:

SO2 + \(\frac{1}{2}\) O2 → SO3

Answer:

Given

∆H°f(SO2) = – 297 kJ mol-1

∆H°f(SO3) = – 396 kJ mol-1

SO2 + 12O2 → SO3;

∆H°r =?

∆H°r = (∆H°f)compound – Σ( ∆Hf)elements

∆H°r =∆H°r(SO3) – ∆H°f

∆H°r = 396 kJ mol-1– (- 297 kJ mol-1 + 0)

∆H°r = – 396 kJ mol-1 + 297

∆H°r = -99 kJ mol-1

Question 69.

For the reaction at 298 K : 2A + B → C

∆H = 400 J mol-1 ∆S = 0.2 JK-1 mol-1

Determine the temperature at which the reaction would be spontaneous.

Answer:

Given,

T = 298K

∆H = 400 J mol-1

∆S = 0.2 J K-1 mol-1

∆G = ∆H – ThS

if T = 2000K

∆G = 400 – (0.2 x 2000) = 0

if T > 2000 K

∆G will be negative.

The reaction would be spontaneous only beyond 2000 K.

Question 70.

Find out the Value ofequilibrium constant for the following reaction at 298K,

2 NH3(g) + CO2(g) ⇌ NH2CONH2(aq) + H2O(l)

Standard Gibbs energy change, AGr° at the given temperature is – 13.6 kJ mol-1.

Answer:

Given,

T = 298 K

∆Gr° = – 13.6 kJ mol-1

= – 13600 J mol-1

∆G° = – 2.303 RT log Keq

log Keq = \(\frac{-∆G°}{2.303 RT}\)

log Keq ![]()

log Keq = 2.38

Keq = anti log(2.38)

Keq = 239.88.

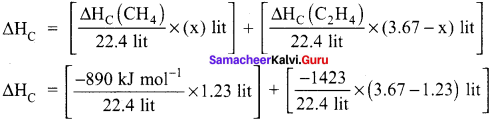

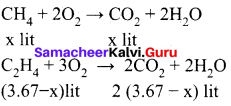

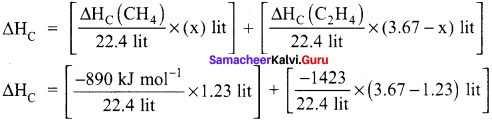

Question 71.

A gas mixture of 3.67 lit of ethylene and methane on complete combustion at 25°C and at I atm pressure produces 6.11 lit of carbon dioxide. Find out the amount of heat evolved in kJ, during this combustion. (∆HC(CH4) = – 890 kJ mol-1 and (∆HC(C2H4)= -1423 kJ mol-1.

Answer:

Given,

∆HC (CH4) = – 890 kJ mol-1

∆HC (C2H4) = -1423 kJ mol-1

Let the mixture contain x lit of CH4 and (3.67 – x) lit of ethylene.

Volume of carbon dioxide formed x + 2 (3.67 – x) 6.11 lit

x + 7.34 – 2x = 6.11

x = 1.23 lit

Given mixture contains 1.23 lit of methane and 2.44 lit of ethylene, hence

∆HC = [-48.87 kJ mol-1] + [-155 kJ mol-1]

∆HC = -203.87 kJ mol-1

In-Text Questions – Evaluate Yourself

Question 1.

Calculate AH for the reaction CO2(g) + H2(g) → CO(g) + H2O(g) given that ∆Hr° for CO2(g), CO(g) and H2O(g) are – 393.5, – 111.31 and – 242 kJ mol-1 respectively.

Given,

∆Hf° CO2 = -393.5 kJ mol-1

∆Hf° CO = -111.31 kJ mol-1

∆Hf° (H2O) = – 242 kJ mol-1

CO2(g) + H2(g) → CO(g) + H2O(g)

∆Hr° = ?

∆Hr° = ∑(∆Hf°)products – ∑(∆Hf°)products

∆Hr° = [∆Hf° (CO) + ∆Hf° (H2O)] – [∆Hf° (CO2) + ∆Hr° (H2)]

∆Hr° = [- 111.31 + (-242)] – [- 393.5 +(0)]

∆Hr° = [- 353.31] + 3935

∆Hr° = 40. 19

∆Hr° = 40.19 KJ mol-1

![]()

Question 2.

Calculate the amount of heat necessary to raise 180 g of water from 25°C to 100°C. Molar heat capacity of water is 75.3 J mol-1 K-1

Answer:

Given:

Number of moles of water n = \(\frac{180 \mathrm{g}}{18 \mathrm{g} \mathrm{mol}^{-1}}\) = 10 mol molar heat capacity of water

Cp = 75.3 J K-1 mol-1

T2 = 100°C = 373K

T1 = 25°C = 298K

∆H = ?

∆H = nCp(T2 – T1)

∆H = 10 mol x 75.3 J mol-1 K-1 x (373 – 298) K

∆H = 56475 J

∆H = 56.475 kJ

Question 3.

From the following data at constant volume for combustion of benzene, calculate the heat of this reaction at constant pressure conditions.

C6H6(l) + \(\frac {7}{2}\) O2(g) → 6 CO6(g)+ 3 H2O(l)

∆U at 25°C = -3268.12 kJ

Answer:

Given,

T = 25°C = 298 K;

∆U = -3268.12 KJ mol-1

∆H = ?

∆H = ∆U + ∆ng RT

∆H = ∆U + (np – nr)RT

∆H = 3268.12 + [6 – \(\frac{7}{2}\) x 8.314 x 10-3 x 298

∆U = -3268.12 + (2.5 x 8.314 x 10-3 x 298)

∆U = – 3268.12+6.L9

∆U = -3261.93 kJ mol-1

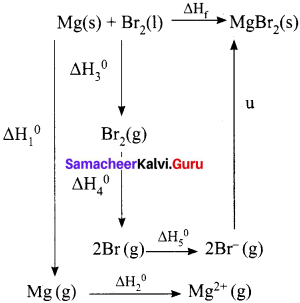

Question 4.

When a mole of magnesium bromide is prepared from 1 mole of magnesium and 1 mole of liquid bromine, 524 kJ of energy is released. The heat of sublimation of Mg metal is 148 kJ mol-1. The heat of dissociation of bromine gas into atoms is 193 kJ mol-1. The heat of vapourisation of liquid bromine is 31 kJ mol-1. The ionisation energy of magnesium is 2187 kJ mol-1 and the electron affinity of bromine is – 662 kJ mol-1. Calculate the lattice energy of magnesium bromide.

Answer:

Given,

Mg(s) + Br2(l) MgBr2(s) – ∆Hf° = – 524 KJ mol-1

Sublimation:

Mg(s) → Mg(g) – ∆Hf° = +148 KJ mol-1

Ionisation:

Mg(g) → Mg2+(g) + 2e– 2187 – ∆Hf° = 2187 KJ mol-1

Vapourisation:

Br2(l) → Br2(g) – ∆Hf° = + 31 KJ mol-1

Dissociation:

Br2(g) → 2Br(g) – ∆Hf = + 193 KJ mol-1

Electron affinity:

Br(g) + e – → Br– (g) – ∆Hf = -331 KJ mol-1

∆Hf = ∆H1 + ∆H2 + ∆H3 + ∆H4 + 2AH5 + u

-524 = 148 + 2187 + 31 + 193 + (2 x – 331) + u

-524 = 1897 + u

u = -524 -1897

u = – 2421 kJ mol-1

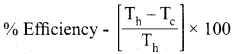

Question 5.

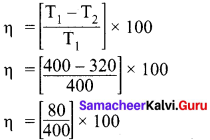

An engine operating between 127°C and 47°C takes some specified amount of heat from a high-temperature reservoir. Assuming that there are no frictional losses, calculate the percentage efficiency of an engine.

Answer:

Given,

T1 = 127°C = 127 + 273 = 400 K

T2 = 47°C = 47 + 273 = 320 K

% efficiency η = ?

η = 20%

![]()

Question 6.

Urea on hydrolysis produces ammonia and carbon dioxide. The standard entropies of urea, H2O. CO2, NH3 are 173.8, 70, 213.5 and 192.5 J mole-1K-1 respectively. Calculate the entropy change for this reaction.

Answer:

Given,

S°(urea) = 173.8 J mol-1K-1

S° (H2O) = 70 J mol-1 K-1

S° (CO2) = 213.5 J mol-1 K-1

S° (NH3) = 192.5 J mol-1 K-1

NH2 – CO – NH2 + H2O → 2NH3 + CO2

∆Sr° = ∑(S°)product – ∑(S°)reactants

∆Sr° = [2 S°(NH3) + S°(CO2)] — [S°(urea) + S°(H2O)]

∆Sr° = [2 x 192.5 + 213.5] – [173.8 + 70]

∆Sr° = [598.5] – [243.8]

∆Sr° = 354.7 J mol-1 K-1

Question 7.

Calculate the entropy change when I mole of ethanol is evaporated at 351 K. The molar heat of vapourisation of ethanol is 39.84 kJ mol-1

Answer:

Given,

Tb = 351 K

∆Hvap = 39840 J mol-1

∆HV = ?

∆HV = \(\frac{\Delta \mathrm{H}_{\mathrm{vap}}}{\mathrm{T}_{\mathrm{b}}}\)

∆HV = 113.5 JK-1mol-1

Question 8.

For a chemical reaction, the values of ∆H and ∆S at 300 K are – 10 kJ mol-1 and -20 J mol-1 respectively. What is the value of AG of the reaction? Calculate the ∆G of a reaction at,600K assuming ∆H and AS values are constant. Predict the nature of the reaction.

Answer:

Given,

∆H =- 10 kJ mol = -10000 J mol-1

∆S = -20 JK-1 mol-1

T = 300 K

∆G = ?

∆G = ∆H – T∆S

∆G = – lo kJ mol-1 -300 K x (-20 x 10-3)kJ K-1 mol-1

∆G = (-10 + 6) kJ mol-1

∆G =-4 kJ mol-1

At 600 K,

∆G = – 10 kJ mol-1 -600 K x (-20 x 10-3)kJ K-1 mol-1

∆G =(-10+12) kJ mol-1

∆G = +2 kJ mol-1

The value of ∆G is negative at 300K and the reaction is spontaneous, but at 600K the value ∆G becomes positive and the reaction is non-spontaneous.

In-Text Example Problems

Question 1.

A gas contained in a cylinder fitted with a frictionless piston expands against a constant external pressure of 1 atm from a volume of 5 litres to a volume of 10 litres. In doing solt absorbs 400 J of thermal energy from its surroundings. Determine the change in internal energy of system.

Answer:

Given data q = 400 J; V1 = 5L; V2 = 10L

Au = q – w (heat is given to the system (±q); work is done by the system(-w)

Au = q – PdV

= 400 J – 1 atm (10 – 5)L

= 400 J – 5 atm L [∴ 1L atm = 101.33 J]

= 400 J – 5 x 101.33 J

= 4003 – 506.65 J

= – 106,65 J

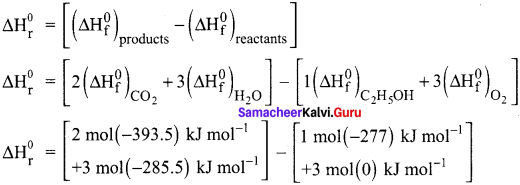

Question 2.

The standard enthalpies of formation of C2H5OH(l), CO2(g) and H2O(l) are – 277, -393.5 and -285.5 kJ mol-1 respectively. Calculate the standard enthalpy change for the reaction. C2H5OH(l) + 3O2(g) → 2CO2(g) + 3H2O(l). The enthalpy of formation of O2(g) in the standard state is zero by definition.

Answer:

The standard enthalpy change for the combustion of ethanol can be calculated from the strndard enthalpies of formation of C2H5OH(l), CO2(g) and H2O(l). The enthalpies of formation are – 277, – 393.5 and – 285.5 kJ mol-1 respectively.

C2H5OH(l) + 3O2(g) → 2CO2(g) + 3H2O(l).

= [-787 – 856.5] – [-277]

= -1643.5 + 277

∆Hr° = -1366.5 KJ.

Question 3.

Calculate the value of AU and AH on heating 128 g of oxygen from 0°C to 100°C. C. and C, on an average are 21 and 29 J mol-1 K-1. (The difference is 8 J mol-1 K-1 which is approximately equal to R)

Answer:

We know

∆U = n CV (T2 – T1)

∆H = n CP (T2 – T1)

Here n = \(\frac {128}{32}\)4 moles;

T2 = 100°C = 373 K

T1 = O°C = 273 K

∆U = n CV(T2 – T1)

∆U = 4 x 21 x (373 – 273)

∆U = 8400 J

∆U = 8.4 kJ

∆H = nCP (T2 – T1 )

∆H = 4 x 29 x (373 – 273)

∆H = 11600 J

∆H = 11.6 KJ.

![]()

Question 4.

Calculate the enthalpy of combustion of ethylene at 300 K at constant pressure, If Its heat of combustion at constant volume (∆U) is – 1406 KJ.

Answer:

The complete ethylene combustion reaction can be written as,

C2H4(g) + 3O2(g) → 2CO2(g) + 2H2O(l)

∆U = -1406 kJ

∆n = np(g) – nr(g)

∆n = 2 – 4 = -2

∆H = U + RT ∆n(g)

∆H = -1406 + (8.314 x 10-3 x 300 x (-2))

∆H = – 1410.9 kJ

Question 5.

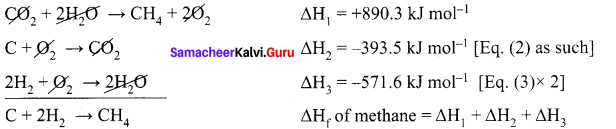

Calculate the standard enthalpy of formation ∆H°f of CH4 from the values of enthalpy of combustion for H2, C (graphite) and CH4 which are -285.8, -393.5, and -890.4 KJ mol-1 respectively.

Answer:

Let us interpret the information about enthalpy of formation by writing out the equations. It is important to note that the standard enthalpy of formation of pure elemental gases and elements is assumed to be zero under standard conditions. The thermochemical equation for the formation of methane from its constituent elements is,

C(graphite) + 2H2(g) → CH4(g)

∆Hf0 = X kJ mol-1 …………(i)

Thermo chemical equations for the combustion of given substances are,

2H2(g) + \(\frac {1}{2}\) O2 → H2O(l)

∆H0 = – 285.8 KJ mol-1 …………..(ii)

C(graphite) + O2 → CO2

∆H0 = -393.5 KJ mol-1 …………….(iii)

CH4(g) + 2O2 → CO2(g) + 2H2O(l)

∆H0 = -890.4 KJ mol-1 ……………(iv)

Since methane is in the product side of the required equation (i), we have to reverse the equation (iv)

CO4(g) + 2H2O(l) → CH4(g) + 2O2

∆H° = + 890.4 kJ mol-1 …………….(v)

In order to get equation (i) from the remaining, (i) = [(ii) x 2] + (iii) + (v)

X = [(-285.8) x 2] + [-393.5] + [+ 890.4] = -74.7kJ

Hence, the amount of energy required for the formation of I mole of methane is -74.7 kJ The heat of formation methane -74.7 kJ mol-1

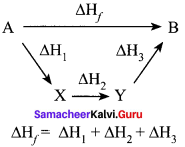

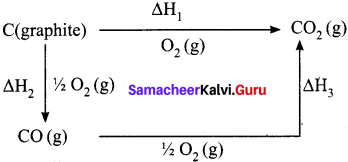

Question 6.

Enthalpy for the oxidation of graphite to CO2 and CO to CO2 can easily be measured. For these conversions, the heat of combustion values are -393.5 kJ and -283.5 kJ respectively.

Answer:

From these data the enthalpy of combustion of graphite to CO can be calculated by applying Hess’s law. The reactions involved in this process can be expressed as follows:

According to Hess law,

∆H1 = ∆H2 + ∆H3

-393.5 kJ = X – 283.5 kJ

X = – 110.5 kJ

Question 7.

Calcu late the lattice energy of sodium chloride using Born-Haber cycle.

Answer:

∆Hf = heat of formation of sodium chloride = 411.3 kJ mol-1

∆H1 = heat of sublimation of Na(s) = 108.7 kJ mol-1

∆H2 = ionisation energy of Na(s) = 495 kJ mol-1

∆H3 = dissociation energy of Cl2(s) = 244 kJ mol-1

∆H4 = Electron affinity of Cl(s) = – 349 kJ mol-1

U = lattice energy of NaCl

∆Hf = ∆H1 + ∆H2 + ½ ∆H3 + ∆H4 + U

∴U = (∆Hf) – (∆H1 +∆H2 + ½ ∆H3 + ∆H4)

=>U = (-411.3) – (108.7 + 495 + 122 – 349)

U = (-41 1.3) – (376.7)

∴U = -788 kJ mol-1

This negative sign in lattice energy indicates that the energy is released when sodium is the time from its constituent gaseous ions Na+ and Cl–

![]()

Question 8.

If an automobile engine burns petrol at a temperature of 8 16°C and if the surrounding temperature is 21°C, calculate its maximum possible efficiency.

Answer:

Here

Th = 816 + 273 = 1098 K

Tc = 21 + 273 = 294 K

Samacheer Kalvi 11th Chemistry Solutions Chapter 7 Thermodynamics

% Efficiency = 73%.

Question 9.

Calculate the standard entropy change for the following reaction (∆Hf°), given the standard entropies of COf (g), C(s), O2(g) as 213.6, 5.740 and 205 JK-1 respectively.

C(g) + O2(g) → CO2(g)

∆Sr° = ∑ Sproducts° – Sreactants°‘

∆Sr° = {SCO2°°} – {Sc° + SO2°°}

∆Sr° = 213.6 – [5.74 + 205]

∆Sr° = 213.6 – [210.74]

∆Sr° = 2.86 JK-1.

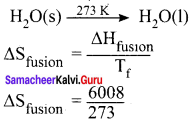

Question 10.

Calculate the entropy change during the melting of one mole of ice into water at 0°C and I atm pressure. Enthalpy of fusion of ice is 6008 J mol-1.

Answer:

Given,

∆Sfusion = 6008 J mol-1

Tf = 0°C = 273 K

∆Sfusion = 22.007 JK-1 mol-1

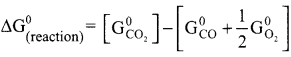

Question 11.

Show that the reaction CO +½ O2 → CO2 at 300 K is spontaneous. The standard Gibbs free energies of formation of CO2 and CO are -394.4 and -137.2 kJ mole respectively.

Answer:

CO + ½ O2 → CO2

∆G(reaction)° = ∑Gf(products)° – ∑Gf(reactants)°

∆G(reaction)° = -394.4 + [137.2 + 0]

∆G(reaction)° = -257.2 KJ mol-1

∆G(reaction)° of a reaction at a given temperature is negative hence the reaction is spontaneous.

Question 12.

Calculate G° for conversion of oxygen to ozone 3/2 O2 ⇌ O3(g) at 298 K, if Kp for this conversion is 2.47 x 10-29 in standard pressure units.

Answer:

∆G° = -2.303 RT log Kp

Where

R = 8.314 JK-1mol-1

K = 2.47 x 10-29

T = 298 K

∆G° = – 2.303(8.314)(298) log (2.47 x 10-29)

∆G°= 16300 J mol-1

∆G° = 16.3 KJ mol-1

Additional:

Question 1.

Calculate the maximum % efficiency of thermal engine operating between 110°C and 25°C.

Answer:

% Efficiency = \(\left[\frac{\mathrm{T}_{1}-\mathrm{T}_{2}}{\mathrm{T}_{1}}\right]\) x 100

T1 = 110°C + 273 = 383 K.

T2 = 25°C – 273 = 298 K.

% Efficiency = \(\left[\frac{383 – 298}{383}\right]\) x 100

% Efficiency = \(\left[\frac{85 × 100}{383}\right]\) = \(\left[\frac{8500}{383}\right]\) % Efficiency = 22.2%

Question 2.

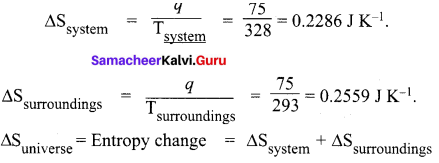

Calculate the entropy change in the system. and in the surroundings and the total entropy change in the universe when during a process 75 J of heat flow out of the system at 55°C to the surrounding at 20°C.

Answer:

Heat flow (q) = 75 J

Entropy change = ∆S = ?

Temperature of the system = 55°C + 273 = 328 K

Temperature of the surroundings = 20°C + 273 = 293 K

= 0.2286 + 0.2559 = ∆Suniverse = 0.4845 JK-1

Question 3.

1 mole of an ideal gas is maintained at 4.1 atm and at a certain temperature absorbs 3710 J heat and expands to 2 litres. Calculate the entropy change in expansion process.

Answer:

Pressure of an ideal gas Pi = 4.1 atm.

Expansion in volume = ∆V = 2 litres

Heat absorbed = q = 3710 J

Entropy change = ∆S = ?

For an ideal gas PV = RT for one mole.

T = \(\frac {PV}{R}\) = \(\frac {4.1 x 2}{0.0830}\) = 100°C

T = 100 + 273 = 373 K.

∆S = \(\frac{q}{\mathrm{T}_{(\mathrm{K})}}\) = \(\frac{3710}{373}\)

Entropy change = 9.946 JK-1.

Question 4.

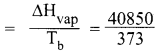

Calculate the entropy change of a process H2O(l) → H2O(g) at 373K. Enthalpy of vaporization of water is 40850 J Mole-1.

Answer:

H2O(l) → H2O(g)

Temperature T = 373 K

Enthalpy of vapourisation of water = ∆Vvap = 40580 J mol-1

∆S = entropy change

∆S(entropy change) = 109.51 J mol-1 K-1

Question 5.

30.4 KJ is required to melt one mole of sodium chloride. The entropy change during melting is 28.4 JK-1 mol-1 Calculate the melting point of sodium chloride.

Answer:

Heat required for I mole of NaCl for melting (q) = 30.4 K J

= 30.4 x 1000 J

∆S – entropy change = 28.4 J K-1 mol-1

Melting point = Tm = ?

∆S = \(\frac{q}{\Gamma_{m}}\)

∴ Tm = \(\frac{q}{∆S}\)

Tm = \(\frac{30.4 x 1000}{28.4}\) = 10704 K

Melting point of NaCl = 1070.4 K.

![]()

Question 6.

Calculate the standard heat of formation of propane, if its heat of combustion is 0-2220.2 KJ mol-1 [he heats of formation of CO2(g) and H2(g)O(l) are -393.5 and -285.8 kJ mol-1 respectively.

Solution:

Standard heat of formation of propane,

3C(g) + 4H2(g) → C3H8(g) ∆Hf° = ?

Data given:

C3H8(g) + 5O2(g) → 3CO2 + 4H2O(l) ∆H = -2220.2 KJ mol-1

C(s) + O2(g) → CO2(g) ∆H = -393.5 KJ mol-1

H2(g)(g) + ½ O2(g) → H2 O(l) ∆H = -285.8 KJ mol-1

According to Hes&s law, equation

Equation (1) is reversed.

Equation (2) is x 3

Equation (3) is x 4

Then add all the equations.

3CO2(g) + 4H2O(l) → C3H8(g) + 5O2(g) ∆H1 = + 2220.2 KJ mol-1

3C(s) + 3O2(g) → 3CO22(g) ∆H2 = -1180.5 KJ mol-1

4H2(g) + 2O2(g) → 4H2O(l) ∆H3 = -1143.2 KJ mol-1

3C(S) + 4H2(g) → C3H8(g) ∆Hf° = -103.5 KJ mol-1

Standard enthalpy of formation of propane ∆Hf° = -103.5 K.J mol-1

Question 7.

The boiling point of water at a pressure of 50 atm is 265°C. Compare the theoretical efficiencies of a steam engine operating between the boiling point of water at

1. 1 atm pressure

2. 50 atm pressure, assuming the temperature of the sink to be 35°C in each case.

Answer:

Boiling point of water at 50 atm pressure (Tb) = 265°C = 265 + 273 = 538K

1. Boiling point of water at 1 atm pressure (Tb) = 100°C = 100 + 273 = 373K

% Efficiency of steam engine = \(\left[\frac{\mathrm{T}_{1}-\mathrm{T}_{2}}{\mathrm{T}_{1}}\right]\) x 100 = \(\left[\frac{538-373}{538}\right]\) x 100 = 0.3066 x 100 = 30.66%

2. BoiLing point of water at 50 atm pressure (Tb) = 35°C = 35 + 273 = 328 K

% Efficiency of steam engine = \(\left[\frac{\mathrm{T}_{1}-\mathrm{T}_{2}}{\mathrm{T}_{1}}\right]\) x 100 \(\left[\frac{538-328}{538}\right]\) x 100 = \(\left[\frac{210 x 100}{538}\right]\) = 39.03 %

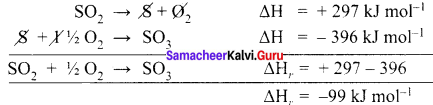

Question 8.

The standard enthalpies of formation of SO2 and SO3 are -297 kJ mol-1 and -396 kJ mol-1 respectively. Calculate the standard enthalpy of reaction for the reaction: SO2 + ½ O2 → 4 SO3

Solution:

Data are given,

(1) ⇒ S + O2 → SO2 ∆Hf° = -297 KJ mol-1

(2) ⇒ S + 1½O2 → SO3 ∆Hf° = -396 KJ mol-1

SO2 + ½ O2 →SO3 ∆Hr = ?

Equation (1) is reversed and added with equestion (2)

Question 9.

For the reaction at 298 K : 2A + B → C

∆H = 400 KJ mol-1: ∆S = 0.2 JK-1 mol-1

Determine the temperature at which the reaction would be spontaneous.

Solution:

Data given,

2A + B → C at 298 K

∆H = 400 KJ mol-1

∆S = 0.2 JK-1 mol-1

T = 298 K

[∆G = ∆H – T∆S]

if ∆G = 0

∆H – T∆S = 0

∆S = \(\frac {∆H}{T}\)

For ∆G = 0, ∆S = \(\frac {∆H}{T}\) = \(\frac {400}{0.2}\) = \(\frac {4000}{2}\) = 2000K

∴ T = 2000K

At 2000 K. the reaction is in equilibrium. So. above 2000 K, the reaction will be spontaneous.

Question 10.

Calculate the heat of glucose and its calorific value

1. C(graphite) + O2(g) → CO2(g) ∆H = -395 KJ

2. H2(g) + hO2 → H2O(l) ; ∆H = -269.4 KJ

3. C + 6H2(g) + 3O2(g) → C6H12O6(S) ∆H = -1169.8 KJ

Solution:

The calorific value of glucose ∆HC =?

![]()

Data given are.

1. C(graphite) + O2(g) → CO2(g) ∆H = -395 KJ ………….(1)

2. H2(g) + 1/2 O2 → H2O(l) ∆HC ∆H = -269. 4 KJ ………….(2)

3. C + 6H2(g) + 3O2(g) → C6H12O6(S) ∆H = – 1169.8 KJ …………(3)

Equation (1) x 6 6C + 6O2 → 6CO2 ∆H = – 2370 KJ

Equation (2) x 6 6H2 + 3O2 → 6H2O ∆H = – 1616.4 KJ

Equation (3) is reversed,

C6H12O6 → 6C + 6H2 +3O2 ∆H = + 1169.8 KJ

Add all equations,

C6H12O6 + 6O2 → 6CO2 + 6H2O

∆H = – 2370 – 1616.4 + 1169.8

∆H = – 3986.4 + 1169.8

∆H = – 2816.6 KJ

Calorific value of C6H12O6 = -2816.6 KJ mol-1

![]()

Question 11.

Calculate the entropy change when 1 mole of ethanol is evaporated at 351 K. The molar heat of vapourisation of ethanol is 39.84 kJ mol-1

Answer:

Given,

∆Hvap = 39840 J mol-1

∆Hv = \(\frac{\Delta \mathrm{H}_{\mathrm{vap}}}{\mathrm{T}_{b}}\)

Tb = 351 K

∆Hv = \(\frac{39840}{351}\)

∆Hv = 113.5 J k-1 mol-1

Question 12.

Calculate the entropy change of a process possessing ∆Ht = 2090 J mole-1

Answer:

Given,

Sn(α 13°C) – Sn(β 13°C)

∆Ht = 2090 J mol-1

∆St = \(\frac{\Delta \mathrm{H}_{t}}{\mathrm{T}_{t}}\)

∆St = \(\frac{2090}{286}\)

∆St = 7.307 J K-1 mol-1

Question 13.

Calculate the standard enthalpy of formation of CH3OH(l) from the following data:

(i) CH3OH(l) + 3/2O2(g) → CO2(g) + 2H3O(l) ∆r\({ H }^{ \ominus }\) = -726 kJ mol-1

(ii) C(S) + O2(g) → CO2(g); ∆C \({ H }^{ \ominus }\) = – 393 kJ mol-1

(iii) H2(g) + ½ O2(g) → H2O(l) ∆f \({ H }^{ \ominus }\) = – 286 kJ mol-1

Answer:

The equation we aim at;

C(S) + 2H2(g) + O2(g) → CH3OH(l) ∆f \({ H }^{ \ominus }\) = ± ? ………..(iv)

Multiply equation (iii) by 2 and add to equation (ii)

C(S) + 2H2(g) + 2O2(g) → CO2(g) + 2H2O(l) ∆H = – (393 + 522) = – 965 kJ mol-1

Subtract equation (iv) from equation (i)

CH3OH(l) + 3/2 O2(g) → CO2(g) + 2H2O(l) ∆H = -726 kJ mol-1

Subtract:

C(S) + 2H2(g) + ½ O2(g) → CH3OH(l) ∆f\({ H }^{ \ominus }\)= -239 kJ mol-1

Question 14.

The equilibrium constant for the reaction is 10. Calculate the value of ∆G-;

Given R = 8.3 14 JK-1 mol-1; T = 300 K.

Answer:

∆Ge = -RT in K = -2.303 RT log K

R = 8.314 JK-1 mol-1; T = 300 K; K = 10

∆Ge = – 2.303 x 8.314 JK-1 mol-1 x (300 K) x log 10

= -5527 J mol-1 = -5.527 kJ mol-1

Question 15.

Calculate the entropy change in surroundings when 1 mol-1 of H2O(l) is formed under standard conditions. Given ∆H = – 286 kJ mol-1

Answer:

qrev = (-Δf\({ H }^{ \ominus }\)) = -286 KJ mol = 286000 J mol

![]()

Question 16.

The enthalpy of formation of methane at constant pressure and 300 K is – 78.84 kJ.What will be the enthalpy of formation at constant volume?

Answer:

The equation representing the enthalpy of formation of methane is:

C(S) + 2H2(g) – CH2(g);

∆H = – 78.84 kJ

∆U = 78.84 kJ;

∆ng = 1 – 2 = -1 mol

R = 8.314 x 10-13 KJ K-1 mol-1; T = 300 K.

According to the relation,

∆H = ∆U + ∆ng RT – 78.84 kJ

∆U = ∆H – ∆ng RT

∆U = (- 78.84 kJ) – (1 mol) x (8.314 x 10-3 KJ K-1 mol-1 ) x 300K.

= – 78.84 – 2.49 = -8.314 KJ.

![]()

Question 17.

Calculate ∆rGe for conversion of oxygen to ozone 3/2 O2(g) → O3(g) at 298 Kp If for this conversion is 2.47 x 10-29.

Solution:

We know

∆r\({ G }^{ \ominus }\) = -2.303 RT log Kp

R = 8.314 JK-1 mol-1

∆r\({ G }^{ \ominus }\)= -2.303 (8.314 J K-1 mol-1) x (298 K) (log 2.47 x 10-29)

= 163000 J mol-1 = 163 mol-1

Question 18.

(a) Under what condition, the heat evolved or absorbed in a reaction ¡s equal to its free energy change?

(b) Calculate the entropy change for the following reversible process.

H2O(s) ⇌ H2O(l) ∆fusH is 6 kJ mol-1

(a) ∆G = ∆H – T∆S

When the reaction is carried out at 0°K

or ∆S = 0

∆G = ∆H

H2O(s) ⇌ H2O(l)

∆fusH = 6 kJ mol-1 = 6000Jmol-1

∆fusH = 6 kJ mol-1

6000 J mol-1

Samacheer Kalvi 11th Chemistry Thermodynamics Additional Questions Solved

I. Choose the correct answer from the following:

Question 1.

_______is a part of the universe which is separated from the rest of the universe by real or imaginary boundaries.

(a) Surroundings

(b) boundary

(c) system

(d) matter

Answer:

(c) system

Question 2.

if ∆G for a reaction is negative, the change is ……….

(a) spontaneous

(b) non-spontaneous

(c) reversible

(d) equilibrium

Answer:

(a) spontaneous

Question 3.

Which of the following is/are extensive properties?

1. volume

2. Surface tension

3. mass

4. internal energy

(a) 1, 2 and 4

(b) 1, 3 and 4

(c) 1 and 3

(d) 1, 2 and 3

Answer:

(b) 1, 3 and 4

Question 4.

Change in Gibbs free energy is given by

(a) ∆G = ∆H +T∆S

(b) ∆G = ∆H – T∆S

(c) ∆G = H x T∆S

(d) none of these

Answer:

(b) ∆G = ∆H – T∆S

Question 5.

For an isothermal process _______.

(a) dT = 0

(b) dV = 0

(c) dq = 0

(d) dP = 0

Answer:

(a) dT = 0

![]()

Question 6.

Calculate the entropy change during the melting of one mole of ice into water at 0°C and 1 atm pressure. Enthalpy of fusion of ice is 6008 J Mole-1.

(a) 22.007 J K-1Mole-1

(b) 22.007 J K-1 Mole-1

(c) 220.07 J K-1 Mole-1

(d) 2.2007 J K-1 Mole-1

Answer:

(a) 22.007 J K-1 Mole-1

Hint:

Enthalpy of fusion of ice 6008 J mol-1 = ∆H

∆S = \(\frac{\Delta \mathrm{H}}{\mathrm{T}_{\mathrm{m}}}\) Tm = 0°C = 273 K

![]()

∆S = \(\frac{6008}{273}\) = 22.007 J K-1 mol-1

Question 7.

Which of the following is/are path functions?

1. pressure

2. work

3. internal energy

4. Free energy

5. heat

(a) 1, 2 and 4

(b) 1, 3 and 4

(c) 2 and 5

(d) 2, 3 and 4

Answer:

(c) 2 and 5

Question 8.

The final temperature of an engine whose initial temperature is 400K and having an efficiency of 25%.

(a) 200K

(b) 400K

(c) 300K

(d) 450K

Answer:

(c) 300K

Solution:

Initial temperature = T1 = 400 K

Final temperature = T2 = ?

Efficiency = 25%

η = \(\left[\frac{\mathrm{T}_{1}-\mathrm{T}_{2}}{\mathrm{T}_{1}}\right]\) x 100

25 = \(\left[\frac{400-\mathrm{T}_{2}}{400}\right]\) x 100

\(\frac{400-T_{2}}{4}\) = 25

400 – T2 = 100

– T2 = 100 – 400

∴ -T2 = -300

T2 = 300 K

Question 9.

When solid melts there is ………

(a) an increase of entropy

(b) a decrease in entropy

(c) an increase in free energy

(d) an increase of heat of fusion

Answer:

(a) an increase of entropy

Question 10.

The unit of entropy is ………

(a) J K-1 mol-1

(b) J mol-1

(c) J K mol-1

(d) J-1 K-1

Answer:

(a) J K-1 mol-1

Question 11.

If G = 0. then the process is …………

(a) equilibrium

(b) spontaneous

(c) non-spontaneous

(d) none of these

Answer:

(a) equilibrium

Question 12.

The standard conditions for G° are ………..

(a) 1 mm Hg / 25°C

(b) 1 atm /25 K

(c) 1 attn / 298 K

(d) 1 atm / 0K

Answer:

(c) 1 atm / 298 K

![]()

Question 13.

The efficiency of engine working between 100 to 400 K

(a) 25%

(b) 75%

(c) 100%

(d) 50%

Answer:

(b) 75%

Solution:

η = \(\left[\frac{\mathrm{T}_{1}-\mathrm{T}_{2}}{\mathrm{T}_{1}}\right]\) x 100

T1 = 400K

T2 = 100 K

∴ η = \(\left[\frac{\mathrm{T}_{1}-\mathrm{T}_{2}}{\mathrm{T}_{1}}\right]\) x 100

![]()

= 75%

Question 14.

Entropy is a ………. function.

(a) state

(b) path

(c) defined

(d) undefined

Answer:

(a) state

Question 15.

An efficiency of an engine is always ………..

(a) = 0%

(b) > 100%

(c) < 100%

(d) = 100%

Answer:

(c) < 100%

Question 16.

if the system moves from ordered state to disordered state, its entropy ………..

(a) decreases

(b) increases

(c) become zero

(d) increases then decrease

Answer:

(b) increases

Question 17.

In a reversible process, the entropy of Universe is ………..

(a) greater than zero

(b) less than zero

(c) equal to zero

(d) remains constant

Answer:

(c) equal to zero

Question 18.

In which of the following entropy increases?

(a) Condensation of water vapour

(b) Liquid freezes to solid

(c) Sublimation

(d) Gas freezes to a solid

Answer:

(c) Sublimation

Question 19.

Which of the following is a state function?

(a) q

(b) ∆q

(c) w

(d) ∆S

Answer:

(d) ∆S

Question 20.

Which of the following is correct option for free expansion of an ideal gas under adiabatic condition?

(a) q = 0, ∆T ≠ 0, w = 0

(b) q ≠ 0, ∆T = 0, w = 0

(c) q = 0, ∆T = 0, w = 0

(d) q = 0, ∆T < 0, w ≠ 0

Answer:

(b) q ≠ 0, ∆T = 0, w = 0

Question 21.

Which of the following is not a state function?

(a) S

(b) H

(c) G

(d) q

Answer:

(d) q

![]()

Question 22.

The net work done by the system ………..

(a) w – P∆V

(b) w +P∆V

(c) -w + P∆V

(d) -w – P∆V

Answer:

(d) – w – P∆V

Question 23.

– ∆G is the net work done by the system except ………..

(a) electrical work

(b) expansion work

(c) chemical work

(d) photochemical work

Answer:

(b) expansion work

Question 24.

The subject matter of thermodynamics comprises

(a) energy transformations in a system

(b) mass changes in molecular reactions

(c) total energy of system

(d) rates of chemical reactions

Answer:

(a) energy transformations in a system

Question 25.

In a reversible process ∆Ssys + ∆Ssurr is ………..

(a) >0

(b)<0

(c) ≥0

(d) = 0

Answer:

(d) = 0

Question 26.

Which of the following does not result in an increase in the entropy?

(a) Crystallization of sucrose from solution

(b) Rusting of Iron

(c) Conversion of ice to water

(d) Vaporization of camphor

Answer:

Crystallization of sucrose from solution

Question 27.

The standard free energy change (∆G°) is related to equilibrium constant (K) as …………

(a) ∆G° = – 1303 RT in K

(b) ∆G° = 2.303 RT log K

(c) ∆G° = RT in K

(d) ∆G° = -2.303 RT log K

Answer:

(d) ∆G° = -2.303 RT log K

![]()

Question 28.

enropy change involved in the conversion of I mole of liquid water at 373K to vapour at the same temperature will be (∆Hvap = 2.257 kJ g-1)

(a) 0.119 kJ

(b) 0.109 kJ

(c) 0.129 k

(d) 0. 120 kJ

Answer:

(b) 0.109 kJ

Solution:

∆Hvap = 2.257 kJ g-1

1 mole of H2O = 18 g

∴∆Hvap for 1 mole = 2.257 x 18 = 40.626 k J g-1

Tb = 373K

∆Hvap = \(\frac{40.626}{373}\) = 0.1089 KJ g-1

= 0.109 kJ mol-1

Question 29.

Which of the following units represent largest amount of energy?

(a) calories

(b) Joule

(c) erg

(d) eV

Answer:

(a) calories

Question 30.

The intensive property among these quantities is

(a) mass

(b) volume

(c) enthalpy

(d) mass / volume

Answer:

(d) mass /volume

Question 31.

System in which there is no exchange of matter, work or energy from surrounding is

(a) closed

(b) isolated

(c) adiabatic

(d) isothermal

Answer:

(b) isolated

Question 32.

Which of the following is not an intensive property?

(a) Pressure

(b) Density

(c) Volume

(d) Surface tension

Answer:

(c) Volume

Question 33.

A gas can expand from loo ml to 250 ml under constant pressure of 2 atm. The work done by the gas is ………..

(a) -30.39 J

(b) 25 J

(c) 5 kJ

(d) 16 J

Answer:

(a) -30.39 J

Solution:

∆V = expansion in volume = 100 to 250

∆V = V2 – V2 = 250 – 100

∆V = 150 ml = 0.15 litre

Work done = ?

Pressure = 2 atm

w = -P∆V

= -2 x 0.15 litre x 101.3 JL-1 atm-1

= -30.39 J.

![]()

Question 34.

An ideal gas expands in volume from 1 x 10-3 m3 to 1 x 10-2 m3 at 300K against a constant pressure at 1 x 105 Nm5. The work done is ………..

(a) -900 J

(b) 900 kJ

(c) 270 kJ

(d) -900 kJ

Answer:

(a) -900 J

Question 35.

Identify the state quantity among the following

(a) q

(b) q – w

(c) q + w

(d) q/w

Answer:

(b) q – w

Question 36.

In general, for an exothermic reaction to be spontaneous

(a) temperature should be high

(b) temperature should be zero

(c) temperature should be low

(d) temperature has no effect

Answer:

(c) temperature should be low

Question 37.

Heat of neutralization of a strong acid by a strong base is a constant value because

(a) only OH+ and OH– ions react in every case

(b) the strong base and strong acid react completely

(c) the strong base and strong acid react in aqueous solution

(d) salt formed does not hydrolyse

Answer:

(a) only OH+ and OH– ions react in every case

Question 38.

The heat absorbed at constant volume is equal to the system’s change in

(a) enthalpy

(b) entropy

(c) internal energy

(d) free energy

Answer:

Answer:

(c) internal energy

Question 39.

Heat of neutralization is always

(a) positive

(b) negative

(c) zero

(d) positive or negative

Answer:

(b) negative

![]()

Question 40.

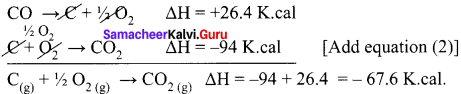

The heat of formation CO and CO2 are -26.4 Kcal and -94 Kcal respectively. Heat of combustion of carbon monoxide will be …………

(a) + 26.4 KCal

(b) – 67.6 KCal

(c) – 120.6 K Cal

(d) + 52.8 K Cal

Answer:

(b) -67.6 KCal

Solution:

C + ½ O2 → CO ∆H = -26.4 K.cal ……….(1)

C + O2 → CO2 ∆H = -94 K.cal ……..(2)

Heat of combustion of CO is

C + ½O2 → CO2 ∆H = ?

Equation (1) is reversed.

ΔH= -67.6 K. cal

Question 41.

For the reaction H2 + I2 ⇌ 2HI, ∆H = 12.40 Kcal the heat of formation of HI is ……….

(a) 12.4 Kcal mol-1

(b) -12.4 Kcal mol-1

(c) -6.20 Kcal mol-1

(d) 6.20 Kcal mol-1

Answer:

(d) 6.20 Kcal mol-1

Solution:

H2 + I2 → 2HI ∆H = 12.40K.cal

½ H2 + ½ I2 → HI = ∆H/2

∴ \(\frac {12.40}{2}\) = 6.20 K.cal mol-1.

Question 42.

Heat capacity is ……….

(a) \(\frac {dq}{dT}\)

(b) dq.dT

(c) ∑q. \(\frac {1}{dT}\)

(d) none of these

Answer:

(a) \(\frac {dq}{dT}\)

Question 43.

The relation between Cp and Cv is…………

(a) Cp – Cv = R

(b) Cp + Cv = R

(c) – 285 KJ

(d) R – Cv = Cp

Answer:

(a) Cp – Cv = R

Question 44.

The heat required to raise the temperature of a body by I K is called ……….

(a) specific heat

(b) thermal capacity

(c) water equivalent

(d) none of these

Answer:

(b) thermal capacity

Question 45.

Heat liberated when 100 ml of IN NaOH is neutralized by 300 ml of in HCl ………..

(a) 22.92 Ici

(b) 17.19 kJ

(c) 11.46 kJ

(d) 5.73 Id

Answer:

Base = V1 = 100ml

N1 = 1N

Acid = V2 = 300ml

N2 = 1N

Enthalpy of neutralization of 1000 ml = 57.3 kJ.

∴ Enthalpy of neutralization of 100 ml x 100 = \(\frac {5.73 kJ}{1000}\) x 100 = 5.73 kJ.

![]()

Question 46.

In order to decompose 9g of water, 142.5 kJ of heat is required. Hence enthalpy of formation of water is ………..

(a) -142.5 kJ

(b) 142.5 kJ

(c) -285 kJ

(d) 285 kJ

Answer:

(c) -285 kJ

Solution:

H2O → H2 + ½ O2

18(g)

9g H2O is decomposed by – 142.5 kJ amount of heat.

:. 18g H2O will be decomposed by ![]() = +285 kJ.

= +285 kJ.

:. 18g of H2O is formed by – 285 kJ amount of heat. (Evolution of heat = – ve sign)

Question 47.

Assertion (A) : Combustion of all organic compounds is an exotherinic reaction ………….

Reason (R) : The enthalpies of all elements in their standard state are zero.

Which of the above statement isare not correct?

(a) both A and R are true and R is the correct explanation of A

(b) both A and R are true and R is not correct explanation of A

(c) both A and R are false

(d) A is false but R is true

Answer:

(b) both A and R are true and R is not correct explanation of A

Question 48.

Assertion (A) : Spontaneous process is an irreversible process and may be reversed by same external agency.

Reason (R) : Decrease in enthalpy is a contributory factor for spontaneity.

(a) both A and R are true and R is the correct explanation of A

(b) both A and R are true and R is not correct explanation of A

(c) both A and R are false

(d) A is false but R is true

Answer:

(b) both A and R are true and R is not correct explanation of A

Question 49.

Assertion (A) : A liquid crystallizes into a solid and accompanied by decrease in entropy.

Reason (R) : In crystals molecules are organised in an ordered manner.

(a) both A and R are true and R is the correct explanation of A

(b) both A and R are true and R is not correct explanation of A

(c) both A and R are false

(d) A is false but R is true

Answer:

(a) both A and R are true and R is the correct explanation of A

Question 50.

Thermodynamics is applicable to ………….

(a) macroscopic system only

(b) microscopic system only Thermodynamics

(c) homogeneous system only

(d) heterogeneous system only

Answer:

(a) macroscopic system only

Question 51

An isochoric process takes place at constant …………

(a) temperature

(b) pressure

(c) volume

(d) concentration

Answer:

(c) volume

![]()

Question 52.

For a cyclic process, the change in internal energy of the system is …………

(a) always + ve

(b) equal to zero

(c) always – ve

(d) none of the above

Answer:

(b) equal to zero

Question 53.

Which of the following properties is not a fùnction of state?

(a) Concentration

(b) Internal energy

(c) Enthalpy

(d) Entropy

Answer:

(u) Concentration

Question 54.

Which of the following relation is true?

(a) Cp >Cv

(b)Cv > Cp

(c) Cp = Cv

(d) Cp = Cv = 0

Answer:

(a) Cp >Cv

Question 55.

Which of the following always has a negative value?

(a) heat of reaction

(b) heat of solution

(c) heat of combustion

(d) heat of formation

Answer:

(c) beat of combustion

Question 56.

The bond energy depends upon ………..

(a) size of the atom

(b) electronegativity

(c) bond length

(d) all of the above

Answer:

(d) all of the above

Question 57.

For an endothermic reaction ………..

(a) ∆H is -ve

(b) ∆H is +ve

(e) ∆H is zero

(d) none of these

Answer:

(b) AH is +ve

Question 58.

The process depicted by the equation.

H2O(s) → H2O(l)

∆H = + 1.43 kcal represents

(a) fusion

(b) melting

(c) evaporation

(d) boiling

Answer:

(a) fusion

Question 59

Which one is the correct unit for entropy?

(a) KJ mol

(b) JK-1 mol

(c) JK-1 mol-1

(d) KJ mol-1

Answer:

(c) JK-1 mol-1

Question 60.

A thermodynamic state function is a quantity ………….

(a) used to determine heat changes

(b) whose value is independent of path

(c) used to determine pressure volume work

(d) whose value depends on temperature only

Answer:

(b) whose value is independent of path

![]()

Question 61.

For the process to occur under adiabatic conditions, the correct condition is ………..

(a) ∆T = 0

(b) ∆p = 0

(c) q = 0

(d) w = 0

Answer:

(c) q = 0

Question 62.

The enthalpies of all elements in their standard states are …………

(a) unity

(b) zero

(c) <0

(d) different for each element

Answer:

(b) zero

Question 63.

∆\({ U }^{ \ominus }\) of combustion of methane is -X kJ mol-1. The value of ∆He is ………..

(a) = ∆\({ U }^{ \ominus }\)

(b) > ∆\({ U }^{ \ominus }\)

(c) < ∆\({ U }^{ \ominus }\)

(d) 0

Answer:

(c) < ∆U\({ U }^{ \ominus }\)

Question 64.

The enthalpy of combustion of methane, graphite and dihydrogen at 298K are -890.3 kJ mol-1 -393.5 kJ mol-1 and 285.8 kJ mol-1 respectively. Enthalpy of formation of CH4 will be ………..

(a) – 74.8 kJ mol-1

(b) – 52.27 k mol-1

(c) 74.8 kJ mol-1

(d) + 52.26 kJ mol-1

Answer:

(a) – 74.8 kJ mol-1

Solution:

CH4 + 3O4 → CO + 2H2O ∆H1 = – 89O.3 kJ mol-1 ……….(1)

C + O2 → CO2 = -393.5 kJ mol-1 ……….(2)

H5 + 1/2 O2 → H2O = – 285.8 kJ mol-1 ……….(3)

Equation (1) is reversed.

Equation (3) x 2

∆Hf = +890.3 – 965.1 = -74.8 KJ mol-1

Question 65.

A reaction, A + B → C + D + q is found to have a positive entropy change. The reaction will be ………..

(a) possible at high temperature

(b) possible only at low temperature

(c) not possible at any temperature

(d) possible at any temperature

Answer:

(d) possible at any temperature

Question 66.

Consider the following statements.

(i) Thermodynamics is independent of atomic and molecular structure.

(ii) It includes whether a particular reaction is feasible or not under a given set of temperature and concentration of reactants and products.

(iii) It can determine the rate at which the reaction take place.

Which of the above statements is/are not correct’?