Students can Download Economics Chapter 5 Monetary Economics Questions and Answers, Notes Pdf, Samacheer Kalvi 12th Economics Book Solutions Guide Pdf helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

Tamilnadu Samacheer Kalvi 12th Economics Solutions Chapter 5 Monetary Economics

Samacheer Kalvi 12th Economics Monetary Economics Text Book Back Questions and Answers

Part – A

Multiple Choice Questions.

Question 1.

The RBI Headquarters is located at ………………………

(a) Delhi

(b) Chennai

(c) Mumbai

(d) Bengalore

Answer:

(c) Mumbai

Question 2.

Money is ………………………

(a) Acceptable only when it has intrinsic value

(b) Constant in purchasing power

(c) The most liquid of all assets

(d) Needed for allocation of resources

Answer:

(c) The most liquid of all assets

Question 3.

Paper currency system is managed by the ………………………

(a) Central Monetary authority

(b) State Government

(c) Central Government

(d) Banks

Answer:

(a) Central Monetary authority

Question 4.

The basic distinction between M1 and M2 is with regard to ………………………

(a) Post office deposits

(b) Time deposits of banks

(c) Saving deposits of banks

(d) Currency

Answer:

(b) Time deposits of banks

Question 5.

Irving Fisher’s Quantity Theory of Money was popularized in ………………………

(a) 1908

(b) 1910

(c) 1911

(d) 1914

Answer:

(c) 1911

Question 6.

MV stands for ………………………

(a) Demand for money

(b) Supply of legal tender money

(c) Supply of bank money

(d) Total supply of money

Answer:

(b) Supply of legal tender money

Question 7.

Inflation means ………………………

(a) Prices are rising

(b) Prices are falling

(c) Value of money is increasing

(d) Prices are remaining the same

Answer:

(a) Prices are rising

Question 8.

………………………. inflation results in a serious depreciation of the value of money.

(a) Creeping

(b) Walking

(c) Running

(d) Hyper

Answer:

(d) Hyper

Question 9.

…………………… inflation occurs when general prices of commodities increases due to increase in production costs such as wages and raw materials.

(a) Cost – push

(b) Demand pull

(c) Running

(d) Galloping

Answer:

(a) Cost – push

Question 10.

During inflation, who are the gainers?

(a) Debtors

(b) Creditors

(c) Wage and salary earners

(d) Government

Answer:

(a) Debtors

Question 11.

…………………… is a decrease in the rate of inflation.

(a) Disinflation

(b) Deflation

(c) Stagflation

(d) Depression

Answer:

(a) Disinflation

Question 12.

Stagflation combines the rate of inflation with ……………………

(a) Stagnation

(b) Employment

(c) Output

(d) Price

Answer:

(a) Stagnation

Question 13.

The study of alternating fluctuations in business activity is referred to in Economics as ……………………

(a) Boom

(b) Recession

(c) Recovery

(d) Trade cycle

Answer:

(d) Trade cycle

Question 14.

During depression the level of economic activity becomes extremely ……………………

(a) High

(b) Bad

(c) Low

(d) Good

Answer:

(c) Low

Question 15.

“Money can be anything that is generally acceptable as a means of exchange and that the same time acts as a measure and a store of value”, This definition was given by ……………………

(a) Crowther

(b) A.C.Pigou

(c) F.A.Walker

(d) Francis Bacon

Answer:

(a) Crowther

Question 16.

Debit card is an example of ……………………

(a) Currency

(b) Paper currency

(c) Plastic money

(d) Money

Answer:

(c) Plastic money

Question 17.

Fisher’s Quantity Theory of money is based on the essential function of money as ……………………

(a) Measure of value

(b) Store of value

(c) Medium of exchange

(d) Standard of deferred payment

Answer:

(c) Medium of exchange

Question 18.

V in MV = PT equation stands for ……………………

(a) Volume of trade

(b) Velocity of circulation of money

(c) Volume of transaction

(d) Volume of bank and credit money

Answer:

(b) Velocity of circulation of money

Question 19.

When prices rise slowly, we call it ……………………

(a) Galloping inflation

(b) Mild inflation

(c) Hyper inflation

(d) Deflation

Answer:

(b) Mild inflation

Question 20.

…………………… inflation is in no way dangerous to the economy.

(a) Walking

(b) Running

(c) Creeping

(d) Galloping

Answer:

(c) Creeping

Part – B

Answer The Following Questions In One or Two Sentences.

Question 21.

Define Money?

Answer:

- Many economists developed definition for money. Among these, definitions of Walker and Crowther are given below:

“Money is, what money does ” – Walker.

- “Money can be anything that is generally acceptable as a means of exchange and at the same time acts as a measure and a store of value”. – Crowther

- Money is anything that is generally accepted as payment for goods and services and repayment of debts and that serves as a medium of exchange.

- A medium of exchange is anything that is widely accepted as a means of payments.

Question 22.

What is barter?

Answer:

- Before money was invented, exchange took place by Barter, that is, commodities and services were directly exchanged for other commodities and services.

- Such exchange of goods for goods was known as “Barter Exchange” or “Barter System”.

Question 23.

What is commodity money?

Answer:

- After the barter system and commodity money system, modem money systems evolved.

- Among these, metallic standard is the premier one. ,

- Under metallic standard, some kind of metal either gold or silver is used to determine the standard value of the money and currency.

- Standard coins made out of the metal are the principal coins used under the metallic standard.

- These standard coins are full bodied or full weighted legal tender.

- Their face value is equal to their intrinsic metal value.

Question 24.

What is gold standard?

Answer:

- Gold Standard is a system in which the value of the monetary unit or the standard currency is directly linked with gold.

- The monetary unit is defined in terms of a certain weight of gold.

- The purchasing power of a unit of money is maintained equal to the value of a fixed weight of gold.

Question 25.

What is plastic money? Give example?

Answer:

- The latest type of money is plastic money.

- Plastic money is one of the most evolved forms of financial products.

- Plastic money is an alternative to the cash or the standard “money”.

- Plastic money is a term that is used predominantly in reference to the hard plastic cards used every day in place of actual bank notes.

- Plastic money can come in many different forms such as Cash cards, Credit cards, Debit cards, Pre-paid Cash cards, Store cards, Forex cards and Smart cards.

- They aim at removing the need for carrying cash to make transactions.

Question 26.

Define inflation?

Answer:

- Inflation is a consistent and appreciable rise in the general price level.

- In other words, inflation is the rate at which the general level of prices for goods and services is rising and consequently the purchasing power of currency is falling.

- “Too much of Money chasing too few goods” – Coulbourn

- “A state of abnormal increase in the quantity of purchasing power” – Gregorye

Question 27.

What is Stagflation?

Answer:

Stagflation is a combination of stagnant economic growth, high unemployment and high inflation.

Part – C

Answer The Following Questions In One Paragraph.

Question 28.

Write a note on metallic money?

Answer:

- After the barter system and commodity money system, modem money systems evolved.

- Among these, metallic standard is the premier one.

- Under metallic standard, some kind of metal either gold or silver is used to determine the standard value of the money and currency.

- Standard coins made out of the metal are the principal coins used under the metallic standard. Monetary Economics 93

- These standard coins are full bodied or Ml weighted legal tender.

- Their face value is equal to their intrinsic metal value.

Question 29.

What is money supply?

Answer:

- Money supply means the total amount of money in an economy.

- It refers to the amount of money which is in circulation in an economy at any given time.

- Money supply plays a crucial role in the determination of price level and interest rates.

- Money supply viewed at a given point of time is a stock and over a period of time it is a flow.

Question 30.

What are the determinants of money supply?

Answer:

Determinants of Money Supply:

- Currency Deposit Ratio (CDR); It is the ratio of money held by the public in currency to that they hold in bank deposits.

- Reserve deposit Ratio (RDR); Reserve Money consists of two things (a) vault cash in banks and (b) deposits of commercial banks with RBI.

- Cash Reserve Ratio (CRR); It is the fraction of the deposits the banks must keep with RBI. (z’v) Statutory Liquidity Ratio (SLR); It is the fraction of the total demand and time deposits of the commercial banks is the form of specified liquid assests.

Question 31.

Write the types of inflation?

Answer:

The four types of inflation are –

1. Creeping Inflation:

Creeping inflation is slow-moving and very mild. The rise in prices will not be perceptible but spread over a long period. This type of inflation is in no way dangerous to the economy. This is also known as mild inflation or moderate inflation.

2. Walking Inflation:

When prices rise moderately and the annual inflation rate is a single digit . (3% – 9%), it is called walking or trolling inflation.

3. Running Inflation:

When prices rise rapidly like the running of a horse at a rate of speed of 10% – 20% per annum, it is called running inflation.

4. Galloping inflation:

Galloping inflation or hyper inflation points out to unmanageably high inflation rates that run into two or three digits. By high inflation the percentage of the same is almost 20%

to 100% from an overall perspective.

Other types of inflation (on the basis of inducement):

1. Currency inflation:

The excess supply of money in circulation causes rise in price level.

2. Credit inflation:

When banks are liberal in lending credit, the money supply increases and thereby rising prices. .

3. Deficit induced inflation:

The deficit budget is generally financed through printing of currency by the Central Bank. As a result, prices rise.

4. Profit induced inflation:

When the firms aim at higher profit, they fix the price with higher margin. So prices go up.

5. Scarcity induced inflation:

Scarcity of goods happens either due to fall in production (e.g. farm goods) or due to hoarding and black marketing. This also pushes up the price. (This has happened is Venezula in the year 2018).

6. Tax induced inflation:

Increase in indirect taxes like excise duty, custom duty and sales tax may lead to rise in price (e.g. petrol and diesel). This is also called taxflation.

Question 32.

Explain Demand-pull and Cost push inflation?

Answer:

Demand – Pull Vs Cost – Push inflation:

1. Demand – Pull Inflation:

Demand and supply play a crucial role in deciding the inflation levels in the society at all points of time. For instance, if the demand is high for a product and supply is low, the price of the products increases.

2. Cost – Push Inflation:

When the cost of raw materials and other inputsrises inflation results. Increase in wages paid to labour also leads to inflation.

Question 33.

State Cambridge equations of value of money?

Answer:

Cambridge Approach (Cash Balances Approach):

1. Marshall’s Equation:

The Marshall equation is expressed as:

M = KPY

Where

M is the quantity of money Y is the aggregate real income of the community . P is Purchasing Power of money

K represents the fraction of the real income which the public desires to hold in the form of money.

Thus, the price level P = M/KY or the value of money (The reciprocal of price level) is 1/P = KY/M

The value of money in terms of this equation can be found out by dividing the total quantity of goods which the public desires to holdout of the total income by the total supply of money. According to Marshall’s equation, the value of money is influenced not only by changes in M, but also by changes in K.

2. Keynes’Equation

Keynes equation is expressed as:

n = pk (or) p = n / k

Where

n is the total supply of money p is the general price level of consumption goods

k is the total quantity of consumption units the people decide to keep in the form of cash, Keynes indicates that K is a real balance, because it is measured in terms of consumer goods. According to Keynes, peoples’ desire to hold money is unaltered by monetary authority. So, price level and value of money can be stabilized through regulating quantity of money (n) by the monetary authority.

Later, Keynes extended his equation in the following form:

n = p (k + rk’) or p = n / (k + rk’)

Where,

n = total money supply p = price level of consumer goods

k = peoples’ desire to hold money in hand (in terms of consumer goods) in the total income of them

r = cash reserve ratio

k’ = community’s total money deposit in banks, in terms of consumers goods.

In this extended equation also, Keynes assumes that, k, k’ and r are constant. In this situation, price level (P) is changed directly and proportionately changing in money volume (n).

Question 34.

Explain disinflation?

Answer:

Disinflation:

Disinflation is the slowing down the rate of inflation by controlling the amount of credit (bank loan, hire purchase) available to consumers without causing more unemployment. Disinflation may be defined as the process of reversing inflation without creating unemployment or reducing output in the economy.

Part – D

Answer the following questions in one page.

Question 35.

Illustrate Fisher’s Quantity theory of money?

Answer:

(a) Fisher’s Quantity Theory of Money:

The quantity theory of money is a very old the¬ory. It was first propounded in 1588 by an Italian economist, Davanzatti. But, the credit for popularizing this theory in recent years rightly belongs to the well-known American economist, Irving Fisher who published his book, ‘The Purchasing Power of Money” in 1911. He gave it a quantitative form in terms of his famous “Equation of Exchange”.

The general form of equation given by Fisher is –

MV = PT

1. Fisher points out that in a country during any given period of time, the total quantity of money (MV) will be equal to the total value of all goods and services bought and sold (PT). MV = PT

Supply of Money = Demand for Money

2. This equation is referred to as “Cash Transaction Equation”.

Where M = Money Supply/quantity of Money

V = Velocity of Money

P = Price level

T = Volume of Transaction.

It is expressed as P = MV / T which implies that the quantity of money determines the price level and the price level in its turn varies directly with the quantity of money, provided ‘V’ and ‘T’ remain constant.

3. According to Marshall, peoples desire to hold money (the coefficient, K) is more powerful in determination of money, rather than quantity of money (M). So, peoples’ desire to hold money is a determinant of value of money.

4. The above equation considers only currency money. But, in a modem economy, bank’s demand deposits or credit money and its velocity play a vital part in business. Therefore, Fisher extended his original equation of exchange to include bank deposits M, and its velocity Vr The revised equation was:

PT = MV + M1V1

P = \(\frac { MV+M_{ 1 }V_{ 1 } }{ T } \)

5. From the revised equation, it is evident, that the price level is determined by (a) the quantity of money in circulation ‘M’ (b) the velocity of circulation of money ‘V’ (c) the volume of bank credit money M1 (d) the velocity of circulation of credit money V1, and the volume of trade (T)

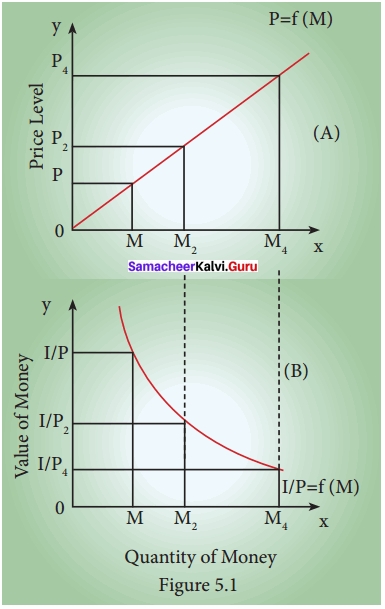

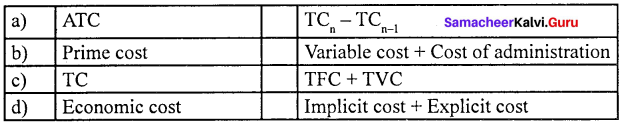

Diagramatic Illustration:

Quantity of Money

1. Figure (A) shows the effect of changes in the quantity of money on the price level. When the quantity of money is OM, the price level is OP. When the quantity of money is doubled to OM2, the price level is also doubled to OP2. Further, when the quantity of money is increased four – fold to OM4, the price level also increases by four times to OP4. This relationship is expressed by the curve OP = f (M) from the origin at 45°.

2. Figure (B), shows the inverse relation between the quantity of money and the value of money, where the value of money is taken on the vertical axis. When the quantity of money is OM1, the value of money is 01 / P1. But with the doubling of the quantity of money to OM2, the value of money becomes one – half of what it was before, (01 / P2). But, with the quantity of money increasing by four – fold to OM4, the value of money is reduced by 01 / P4. This inverse relationship between the quantity of money and the value of money is shown by downward sloping curve 1 / OP = f (M).

Question 36.

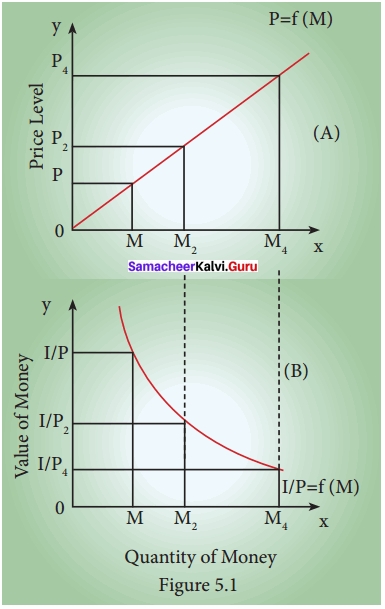

Explain the functions of money?

Answer:

1. Primary Functions:

(I) Money as a medium of exchange:

This is considered as the basic function of money. Money has the quality of general acceptability, and all exchanges take place in terms of money.

(II) Money as a measure of value:

The second important function of money is that it measures the value of goods and services. In other words, the prices of all goods and services are expressed in terms of money. Money is thus looked upon as a collective measure of value.

2. Secondary Functions:

(I) Money as a Store of value:

Savings done in terms of commodities were not permanent. But, with the invention of money, this difficulty has now disappeared and savings are now done in terms of money. Money also serves as an excellent store of wealth, as it can be easily converted into other marketable assets, such as, land, machinery, plant etc.

(II) Money as a Standard of Deferred Payments:

Borrowing and lending were difficult problems under the barter system. In the absence of money, the borrowed amount could be returned only in terms of goods and services. But the modem money – economy has greatly facilitated the borrowing and lending processes.

(III) Money as a Means of Transferring Purchasing Power:

The field of exchange also went on extending with growing economic development. The exchange of goods is now extended to distant lands.

3. Contingent Functions:

(I) Basis of the Credit System:

Money is the basis of the Credit System. Business transactions are either in cash or on credit.

(II) Money facilitates distribution of National Income:

The task of distribution of national income was exceedingly complex under the barter system.

(III) Money helps to Equalize Marginal Utilities and Marginal Productivities:

Consumer can obtain maximum utility only if he incurs expenditure on various commodities in such a manner as to equalize marginal utilities accruing from them. Now in equalizing these marginal utilities, money plays an important role, because the prices of all commodities are expressed in money.

(IV) Money Increases Productivity of Capital:

Money is the most liquid form of capital. In other words, capital in the form of money can be put to any use.

4. Other Functions:

(I) Money helps to maintain Repayment Capacity:

Money possesses the quality of general acceptability. To maintain its repayment capacity, every firm has to keep assets in the form of liquid cash. The firm ensures its repayment capacity with money.

(II) Money represents Generalized Purchasing Power:

Purchasing power kept in terms of money can be put to any use. It is not necessary that money should be used only for the purpose for which it has been served.

(III) Money gives liquidity to Capital:

Money is the most liquid form of capital. It can be put to any use.

Question 37.

What are the causes and effects of inflation on the economy?

Answer:

Causes of Inflation:

The main causes of inflation in India are as follows:

1. Increase in Money Supply:

Inflation is caused by an increase in the supply of money which leads to increase in aggregate demand. The higher the growth rate of the nominal money supply, the higher is the rate of inflation.

2. Increase in Disposable Income:

When the disposable income of the people increases, it raises their demand for goods and services. Disposable income may increase with the rise in national income or reduction in taxes or reduction in the saving of the people.

3. Increase in Pubiic Expenditure:

Government activities have been expanding due to developmental activities and social welfare programmes. This is also a cause for price rise.

4. Increase in Consumer Spending:

The demand for goods and services increases when they are given credit to buy goods on hire-purchase and installment basis.

5. Cheap Monetary Policy:

Cheap monetary policy or the policy of credit expansion also leads to increase in the money supply which raises the demand for goods and services in the economy.

6. Deficit Financing:

In order to meet its mounting expenses, the government resorts to deficit financing by borrowing from the public and even by printing more notes.

7. Black Assests, Activities and Money:

The existence of black money and black assests due to corruption, tax evasion etc., increase the aggregate demand. People spend such money, lavishly. Black marketing and hoarding reduces the supply of goods.

8. Repayment of Public Debt:

Whenever the government repays its past internal debt to the public, it leads to increase in the money supply with the public.

9. Increase in Exports:

When exports are encouraged, domestic supply of goods decline. So prices rise.

Effects of Inflation:

The effects of inflation can be classified into two heads:

- Effects on Production and

- Effects on Distribution.

1. Effects on Production:

When the inflation is very moderate, it acts as an incentive to traders and producers. This is particularly prior to full employment when resources are not fully utilized. The profit due to rising prices encourages and induces business class to increase their investments in production, leading to generation of employment and income.

(I) However, hyper – inflation results in a serious depreciation of the value of money.

(II) When the value of money undergoes considerable depreciation, this may even drain out the foreign capital already invested in the country.

(III) With reduced capital accumulation, the investment will suffer a serious set-back which may have an adverse effect on the volume of production in the country.

(IV) Inflation also leads to hoarding of essential goods both by the traders as well as the consumers and thus leading to still hiher inflation rate.

(V) Inflation encourages investment in speculative activities rather than productive purposes.

2. Effects on Distribution:

1. Debtors and Creditors:

During inflation, debtors are the gainers while the creditors are losers.

2. Fixed – income Groups:

The fixed income groups are the worst hit during inflation because their incomes being fixed do not bear any relationship with the rising cost of living.

3. Entrepreneurs:

Inflation is the boon to the entrepreneurs whether they are manufacturers, traders, merchants or businessmen, because it serves as a tonic for business enterprise.

4. Investors:

The investors, who generally invest in fixed interest yielding bonds and securities have much to lose during inflation.

Question 38.

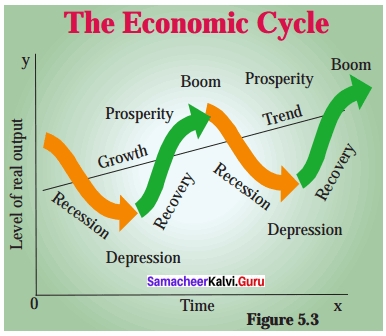

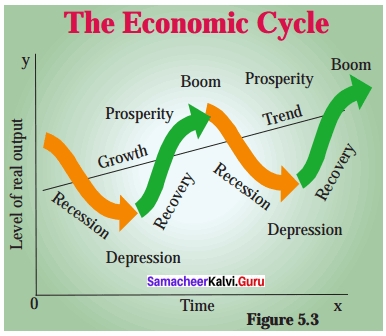

Describe the phases of Trade cycle?

Answer:

Phases of Trade Cycle

The four different phases of trade cycle is referred to as

- Boom

- Recession

- Depression and

- Recovery. These are illustrated in the figure:

Phases of Trade Cycle:

1. Boom or Prosperity Phase:

The full employment and the movement of the economy beyond full employment is characterized as boom period.

- During this period, there is hectic activity in economy.

- Money wages rise, profits increase and interest rates go up.

- The demand for bank credit increases and there is all – round optimism.

2. Recession:

- The turning point from boom condition is called recession.

- This happens at higher rate, than what was earlier.

- Generally, the failure of a company or bank bursts the boom and brings a phase of recession.

- Investments are drastically reduced, production comes down and income and profits decline.

- There is panic in the stock market and business activities show signs of dullness.

- Liquidity preference of the people rises and money market becomes tight.

3. Depression:

- During depression the level of economic activity becomes extremely low.

- Firms incur losses and closure of business becomes a common feature and the ultimate result is unemployment.

- Interest prices, profits and wages are low. The agricultural class and wage earners would be worst hit.

- Banking institutions will be reluctant to advance loans to businessmen.

- Depression is the worst phase of the business cycle.

- Extreme point of depression is called as “trough”, because it is a deep point in business cycle.

4. Recovery:

- After a period of depression, recovery sets in.

- This is the turning point from depression to revival towards upswing.

- It begins with the revival of demand for capital goods.

- Autonomous investments boost the activity.

- The demand slowly picks up and in due course the activity is directed towards the upswing with more production, profit, income, wages and employment.

- Recovery may be initiated by innovation or investment or by government expenditure (autonomous investment).

Samacheer Kalvi 12th Economics Consumption and Investment Functions Additional Questions

Part – A

I. Multiple Choice Questions.

Question 1.

During Inflation?

(a) Business men gain

(b) Wage earners gain

(c) Salary gain

(d) Renters gain

Answer:

(a) Business men gain

Question 2.

Galloping Inflation is also known as –

(a) Deflation

(b) Persistent Inflation

(c) Stagflation

(d) Cost – push Inflation

Answer:

(b) Persistent Inflation

Question 3.

The modem economy is described as –

(a) Demand Economy

(b) Supply Economy

(c) Money Economy

(d) Wage Economy

Answer:

(c) Money Economy

Question 4.

The term ………………………… refers to a phase or policy when interest rates are high.

(a) Purchasing money

(b) Power money

(c) Fiat money

(d) Dear money

Answer:

(d) Dear money

Question 5.

Currency notes in circulation are referred to as –

(b) Fiat money

(c) Value of money

(d) Cheap money

Answer:

(b) Fiat money

Question 6.

What is the name of inflation without a rise in price level?

(a) Repressed Inflation

(b) Hyper Inflation

(c) Galloping Inflation

(d) Cost – Push Inflation

Answer:

(a) Repressed Inflation

Question 7.

Give the example of a country that experienced hyper Inflation?

(a) India

(b) China

(c) Germany

(d) Africa

Answer:

(c) Germany

Question 8.

Which is the most important function of money?

(a) Measure of value

(b) Store of value

(c) Medium of exchange

(d) Standard of deferred payments

Answer:

(c) Medium of exchange

Question 9.

What is the other name for “Equation of Exchange”?

(a) Fisher’s Equation

(b) Keynes Equation

(c) Marshall’s Equation

(d) Equation of Exchange

Answer:

(a) Fisher’s Equation

Question 10.

What is the cheap money policy?

(a) High rates of Interest

(b) Low rates of Interest

(c) Medium rates of Interest

(d) Very high rates of Interest

Answer:

(b) Low rates of Interest

Question 11.

Monetary policy is controlled by –

(a) Central bank

(b) State Government

(c) Private sector

(d) Central Government

Answer:

(d) Central Government

Question 12.

………………………… is usually effective for controlling inflation.

(a) Monetary policy

(b) RBI

(c) State Government

(d) Central government

Answer:

(a) Monetary policy

Question 13.

Monetary policy is usually effective in controlling –

(a) Bank

(b) Inflation

(c) Deflation

(d) Stagflation

Answer:

(b) Inflation

Question 14.

Money acts as a common measure of –

(a) Reserve money

(b) Fiat money

(c) Value

(d) Broad money

Answer:

(c) Value

Question 15.

Bank rate is lowered during –

(a) Inflation

(b) Price

(c) Employment

(d) Deflation

Answer:

(d) Deflation

Question 16.

Under dear money policy is –

(a) Rate of Interest is low

(b) Rate of interest is high

(c) Bank rate is high

(d) Money supply is more

Answer:

(b) Rate of interest is high

Question 17.

M3 is called –

(a) Narrow money

(b) Reserve money

(c) Broad money

(d) Fiat money

Answer:

(c) Broad money

Question 18.

Price mechanism plays a vital role in –

(a) Capitalism

(b) Socialism

(c) Mixed economy

(d) Traditional economy

Answer:

(a) Capitalism

Question 19.

“Money is what money does” ………………………… this definition was given by –

(a) Crowther

(b) Fisher

(c) Grasham

(d) Walker

Answer:

(d) Walker

Question 20.

Currency with the public is known as –

(a) M1

(b) M2

(C) M3

(d) M4

Answer:

(a) M1

Question 21.

Cost – push inflation is induced by rising –

(a) Costs

(b) Money

(c) Broad money

(d) Inflation

Answer:

(b) Money

Question 22.

The direct exchange of goods for goods is known as –

(a) Money exchange

(b) Money transfer

(c) Barter System

(d) Barter goods

Answer:

(c) Barter System

Question 23.

Money is a matter of functions –

(a) One

(b) Two

(c) Three

(d) Four

Answer:

(d) Four

Question 24.

Deflation is a period marked by ………………………… prices.

(a) Increasing

(b) Falling

(c) Constant

(d) High

Answer:

(d) High

Question 25.

Dear money refers to ………………………… rate being high.

(a) Money

(b) Finance

(c) Interest

(d) Cost

Answer:

(c) Interest

II. Match the following and choose the correct answer by using codes given below

A. Deficit financing – (i) Monetary policy objectives

B. Store of value – (ii) Currency notes

C. Price stability – (iii) Causes inflation

D. Fiat money – (iv) Function of money

Codes:

(a) A (iii) B (iv) C (i) D (ii)

(b) A (ii) B (iii) C (iv) D (i)

(c) A (iv) B (ii) C (iii) D (i)

(d) A (i) B (iv) C (ii) D (iii)

Answer:

(a) A (iii) B (iv) C (i) D (ii)

Question 2.

A. Falling prices – (i) Black money

B. Government securities – (ii) Business loss

C. Bank rate – (iii) Open Market operation

D. Unaccounted money – (iv) Credit control

Codes:

(a) A (i) B (ii) C (iii) D (iv)

(b) A (ii) B (iii) C (iv) D (i)

(c) A (iii) B (iv) C (i) D (ii)

(d) A (iv) B (i) C (ii) D (iii)

Answer:

(b) A (ii) B (iii) C (iv) D (i)

Question 3.

A. Checking Inflation – (i) Irving Fisher

B. Great Depression – (ii) Narrow money

C. Quantity theory of money – (iii) Wage freeze

D. M1 – 1930

Codes:

(a) A (i) B (ii) C (iii) D (iv)

(b) A (iii) B (iv) C(i) D (ii)

(c) A (ii) B (iii) C (iv) D (i)

(d) A (iv) B (i) C (ii) D (iii)

Answer:

(b) A (iii) B (iv) C(i) D (ii)

Question 4.

A. Cheap money policy – (i) Purchasing money

B. Prices pushed – (ii) Creeping inflation

C. Value of money – (iii) Low rate of interest

D. Selective credit control – (iv) Moral suasion

Codes:

(a) A (iii) B (ii) C (i) D (iv)

(b) A (ii) B (i) C (iv) D (iii)

(c) A (iv) B (iii) C (ii) D (i)

(d) A (i) B (iv) C (iii) D (ii)

Answer:

(a) A (iii) B (ii) C (i) D (iv)

Question 5.

A. Galloping Inflation – (i) Money Act

B. M3is called – (ii) Hyperinflation

C. Measure of value – (iii) Broad money

D. Deflation Codes – (iv) Bank rate

Codes:

(a) A (i) B (ii) C (iv) D (iii)

(b) A (iv) B (i) C (iii) D (ii)

(c) A (iii) B (iv) C (ii) D (i)

(d) A (ii) B (iii) C (i) D (iv)

Answer:

(d) A (ii) B (iii) C (i) D (iv)

III. State whether the statements are true or false.

Question 1.

(i) Inflation is taxation without legislation was said by Milton Friedman.

(ii) Money is the most liquid form of capital.

(a) Both (i) and (ii) are true

(b) Both (i) and (ii) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(a) Both (i) and (ii) are true

Question 2.

(i) “The purchasing power of money” was a book published by Irving Fisher in 1911.

(ii) The general form of equation given by Fisher is M = KPY.

(a) Both (i) and (ii) are true

(b) Both (i) and (ii) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(c) (i) is true but (ii) is false

Question 3.

(i) The study of alternating fluctuations in business activity is referred to in Economics as Trade cycle.

(ii) During depression the level of economic activity becomes extremely high.

(a) Both (i) and (ii) are true

(b) Both (i) and (ii) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(c) (i) is true but (ii) is false

Question 4.

(i) Creeping Inflation is in no way dangerous to the economy.

(ii) Debit card is an example of paper currency.

(a) Both (i) and (ii) are true

(b) Both (i) and (ii) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(c) (i) is true but (ii) is false

Question 5.

(i) MV = PT equation stands for volume of Trade.

(ii) Fisher’s Quantity Theory of money is based on the essential function of money as measure of value.

(a) Both (i) and (ii) are true

(b) Both (i) and (ii) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(b) Both (i) and (ii) are false

IV. Which of the following is correctly matched:

Question 1.

(a) Medium of exchange – CRR

(b) Cash Reserve Ratio – Gold standard

(c) Goods exchange for goods – Barter system

(d) Full weighted legal tender – Plastic money

Answer:

(c) Goods exchange for goods – Barter system

Question 2.

(a) Depression – Starting stage

(b) Recession – Turning point from boom

(c) Boom – Economic activities

(d) Inflation – Hectic activity

Answer:

(b) Recession – Turning point from boom

Question 3.

(a) Store of value – Liquidity cash

(b) Deflation – Rise in price

(c) Trade cycle – Narrow money

(d) Quantity theory of money – J.M. Keynes

Answer:

(d) Quantity theory of money – J.M. Keynes

Question 4.

(a) The purchasing power of currency – Falling

(b) Monetary measures are adopted by – State bank

(c) The turning point from boom is – Inflation

(d) Money supply means the total – Inflation amount of money in – World

Answer:

(a) The purchasing power of currency – Falling

Question 5.

(a) The Marshall’s equation – MV = PT

(b) Cash Reserve Ratio – CRR

(c) Statutory Liquidity cash – SLC

(d) Functions of money – Money supply

Answer:

(b) Cash Reserve Ratio – CRR

Question 6.

(a) Barter System – Technology

(b) Gold Standard – Standard currency is directly linked with gold

(c) Plastic money – Money value

(d) Paper money – Smart card

Answer:

(b) Gold Standard – Standard currency is directly linked with gold

V. Which of the following is not correctly matched:

Question 1.

(a) Inflation – Rise in price

(b) Deflation – Fall in price

(c) Hyper Inflation – India

(d) Hyper deflation – Phases of Trade cycle

Answer:

(c) Hyper Inflation – India

Question 2.

(a) Currency Deposit Ratio – CDR

(b) Reserve Deposit Ratio – RDR

(c) Cash Reserve Ratio – CRR

(d) Statutory Liquidity Ratio – SRL

Answer:

(d) Statutory Liquidity Ratio – SRL

Question 3.

(a) M – Money supply / Quantity of money –

(b) V – Velocitu of money

(c) P – Price level

(d) T – Price rise slow moving

Answer:

(d) T – Price rise slow moving

Question 4.

(a) Creeping Inflation – Price rise slow moving

(b) Walking Inflation – Price rise moderately

(c) Running Inflation – Price rise rapidly running

(d) Galloping Inflation – Price rise very slow

Answer:

(d) Galloping Inflation – Price rise very slow

Question 5.

(a) Money supply – Central Bank

(b) Dear money policy – During Inflation

(c) Value of money – Purchasing power

(d) Black money – Narrow money

Answer:

(d) Black money – Narrow money

VI. Pick the odd one out.

Question 1.

The main functions of money can be classified

(a) Primary functions

(b) Secondary functions

(c) Contingent functions

(d) Territory functions

Answer:

(d) Territory functions

Question 2.

Money secondary functions are

(a) Money as a store of value

(b) Money as a standard of Deferred payments

(c) Money as a means of Transferring purchasing power

(d) Money as a modem exchange system

Answer:

(d) Money as a modem exchange system

Question 3.

Contingent functions are called

(a) Basis of the credit system

(b) Money facilitates distribution of state income

(c) Money’helps to equalize marginal utility

(d) Money increases productivity of capital

Answer:

(b) Money facilitates distribution of state income

Question 4.

RBI publishes information of money supply are

(a) M2 = Currency coins and demand deposits

(b) M2 = M1 + Saving deposits with post office savings banks and Total Deposits

(c) M3 = M2 + Time deposits of all commercial and co – operative banks

(d) M4 = M3 + Total deposits with post offices

Answer:

(b) M2 = M1 + Saving deposits with post office savings banks and Total Deposits

Question 5.

Determinants of money supply are

(a) Consumer Deposit Ratio (CDR)

(b) Reserve Deposit Ratio (RDR)

(c) Cash Reserve Ratio (CRR)

(d) Statutory Liquidity Ratio (SLR)

Answer:

(a) Consumer Deposit Ratio (CDR)

Question 6.

Types of Inflation are

(a) Currency Inflation

(b) Credit Inflation

(c) Demand Induced Inflation

(d) Profit Induced Inflation

Answer:

(c) Demand Induced Inflation

Question 7.

The four different phases of trade cycle is referred to as

(a) Regression

(b) Recession

(c) Depression

(d) Recovery

Answer:

(a) Regression

VII. Assertion and Reason.

Question 1.

Assertion (A): Stagflation is a combination of stagnant economic growth, high unemployment and high inflation.

Reason (R): Stagflation is the slowing down the rate of inflation by controlling the amount of credit.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(c) ‘A’ is true but ‘R’ is false

Question 2.

Assertion (A): Keynes and Milton Friedman together suggested Monetary measures, Fiscal measures and other measures to prevent and control of inflation.

Reason (R): Keynes and Milton Friedman together suggested other measures are Short term and Long – term measures.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

Question 3.

Assertion (A): A trade cycle refers to oscillations in aggregate economic activity particularly in employment, output, income, etc.

Reason (R): The four different phases of trade cycle is referred to Boom, Recession, Depression and Recovery.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

Question 4.

Assertion (A): Fiscal policy is now recognized as an important instrument to tackle an inflationary situation.

Reason (R): Monetary measures are adopted by the central bank.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

Question 5.

Assertion (A): Currency is created by the RBI and Union Government.

Reason (R): Bank deposits are created by commercial banks and co-operative banks.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

Question 6.

Assertion (A): Recovery may be initiated by Money balance.

Reason (R): Recovery may be government expenditure.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(d) ‘A’ is false but ‘R’ is true

Part – B

Answer The Following Questions In One or Two Sentences.

Question 1.

Define “Silver Standard”?

Answer:

Silver Standard: The silver standard is a monetary system in which the standard economic unit of account is a fixed weight of silver. The silver standard is a monetary arrangement in which a country’s Government allows conversion of its currency into fixed amount of silver.

Question 2.

What is paper currency?

Answer:

- The paper currency standard refers to the monetary system in which the paper currency notes issued by the Treasury or the Central Bank or both circulate as unlimited legal tender.

- The paper standard is also known as managed currency standard.

- The quantity of money in circulation is controlled by the monetary authority to maintain price stability.

Question 3.

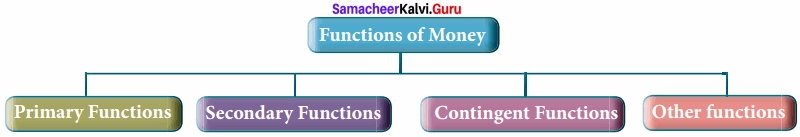

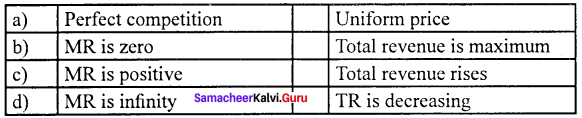

Name the main functions of money?

Answer:

Question 4.

Write RBI publishes information alternative measures of money supply?

Answer:

RBI publishes information for four alternative measures of Money supply, namely M2 , M2 and M3 and M4

M1 = Currency, coins and demand deposits

M2 = M1 + Savings deposits with post office savings banks

M3 = M2 + Time deposits of all commercial and cooperative banks.

M4 = M3 + Total deposits with Post offices.

Question 5.

Define “Currency symbol”?

Answer:

Currency Symbol ₹

The new symbol designed by D.Udaya Kumar, a post graduate of IIT Bombay was finally selected by the Union cabinet on 15th July, 2010. The new symbol, is an amalgamation of Devanagri ‘Ra’ and the Roman ‘R’ without the stem. The symbol of India rupee came into use on 15th July, 2010. After America, Britain, Japan, Europe Union. India is the 5th country to accept a unique currency symbol.

Question 6.

Write Fisher’s Quantity Theory of money equation?

Answer:

- The general form of equation given by Fisher is MV = PT.

- Fisher points out that in a country during any given period of time, the total quantity of money (MV) will be equal to the total value of all goods and services bought and sold (PT).

- MV = PT

Question 7.

Define “Trade cycle”?

Answer:

“A trade cycle is composed of periods of good trade characterised by rising prices and low unemployment percentages altering with periods of bad trade characterised by falling prices and high unemployment percentages”.

Part – C

Answer The Following Questions In One Paragraph.

Question 1.

Write the meaning of Money supply?

Answer:

Meaning of Money Supply

- In India, currency notes are issued by the Reserve Bank of India (RBI) and coins are issued by the Ministry of Finance, Government of India (GOI).

- Besides these, the balance is savings, or current account deposits, held by the public in commercial banks is also considered money.

- The currency notes are also called fiat money and legal tenders.

Question 2.

Explain the Deflation?

Answer:

Deflation:

- The essential feature of deflation is falling prices, reduced money supply and unemployment.

- Though falling prices are desirable at the time of inflation, such a fall should not lead to the fall in the level of production and employment.

- But if prices fall from the level of full employment both income and employment will be adversely affected.

Question 3.

What is the meaning of trade cycle?

Answer:

Meaning of Trade Cycle:

- A Trade cycle refers to oscillations in aggregate economic activity particularly in employment, output, income, etc.

- It is due to the inherent contraction and expansion of the elements which energize the economic activities of the nation.

- The fluctuations are periodical, differing in intensity and changing in its coverage.

Question 4.

Explain the Evolution of money?

Answer:

Barter System:

- The introduction of money as a medium of exchange was orje of the greatest inventions of mankind.

- Before money was invented, exchange took place by Barter, that is, commodities and services were directly exchanged for other commodities and services.

- Under the barter system, buyers and sellers of commodities had to face a number of difficulties.

- Surplus goods were exchanged for money which in turn was exchanged for other needed goods.

- Goods like furs, skins, salt, rice, wheat, utensils, weapons, etc. were commonly used as money.

- Such exchange of goods for goods was known as “Barter Exchange” or “Barter System”.

Question 5.

What is the meaning of Crypto currency?

Answer:

Crypto Currency:

- A digital currency in which encryption techniques are used to regulate the generation of units of currency and verify the transfer of funds, operating independently of a Central Bank.

- Decentralised crypto currencies such as Bitcoin now provide an outlet for Personal Wealth that is beyond restriction and confiscation.

Question 6.

Explain the Trade cycle Depression?

Answer:

Depression:

- During depression the level of economic activity becomes extremely low.

- Firms incur losses and closure of business becomes a common feature and the ultimate result is unemployment.

- Interest prices, profits and wages are low.

- The agricultural class and wage earners would be worst hit.

- Banking institutions will be reluctant to advance loans to businessmen.

- Depression is the worst phase of the business cycle.

- Extreme point of depression is called as “trough”, because it is a deep point in business cycle.

- Any person fell down in deeps could not come out from that without other’s help.

- Similarly, an economy fell down in trough could not come out from this without external help.

- Keynes advocated that autonomous investment of the government alone can help the economy to come out from the depression.

Part – D

Answer The Following Questions In One Page.

Question 1.

Explain the Measures of control inflation?

Answer:

Measures to Control Inflation:

Keynes and Milton Friedman together suggested three measures to prevent and control of inflation.

- Monetary measures

- Fiscal measures (J.M. Keynes) and

- Other measures.

1. Monetary Measures:

- These measures are adopted by the Central Bank of the country.

- They are

- Increase in Bankrate

- Sale of Government Securities in the Open Market

- Higher Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR)

- Consumer Credit Control and

- Higher margin requirements

- Higher Repo Rate and Reverse Repo Rate.

2. Fiscal Measures:

- Fiscal policy is now recognized as an important instrument to tackle an inflationary situation.

- The major anti – inflationary fiscal measures are the following:

Reduction of Government Expenditure and Public Borrowing and Enhancing taxation.

3. Other Measures:

These measures can be divided broadly into short – term and long – term measures.

(a) Short – term measures can be in regard to public distribution of scarce essential commodities through fair price shops (Rationing). In India whenever shortage of basic goods has been felt, the government has resorted to import so that inflation may not get triggered.

(b) Long – term measures will require accelerating economic growth especially of the wage goods which have a direct bearing on the general price and the cost of living. Some restrictions on present consumption may help in improving saving and investment which may be necessary for accelerating the rate of economic growth in the long run.

Question 2.

Briefly explain the Monetary Economics and money?

Answer:

- Monetary Economics is a branch of economics that provides a framework for analyzing money and its functions as a medium of exchange, store of value and unit of account.

- It examines the effects of monetary systems including regulation of money and associated financial institutions.

Meaning

- Money is anything that is generally accepted as payment for goods and services and repayment of debts and that serves as a medium of exchange.

- A medium of exchange is anything that is widely accepted as a means of payments.

- In recent years, the importance of credit has increased in all the countries of the world.

- Credit instruments are used on an extensive scale.

- The use of cheques, bills of exchange, etc. has gone up.

- It should however, be remembered that money is the basis of credit.

Question 3.

Explain the Inflation Effects of production?

Answer:

Effects on Production: When the inflation is very moderate, it acts as an incentive to traders and producers. This is particularly prior to full employment when resources are not fully utilized. The profit due to rising prices encourages and induces business class to increase their investments in production, leading to generation of employment and income.

1. However, hyper – inflation results in a serious depreciation of the value of money and it discourages savings on the part of the public.

2. When the value of money undergoes considerable depreciation, this may even drain out the foreign capital already invested in the country.

3. With reduced capital accumulation, the investment will suffer a serious set – back which may have an adverse effect on the volume of production in the country. This may discourage entrepreneurs and business men from taking business risk.

4. Inflation also leads to hoarding of essential goods both by the traders as well as the consumers and thus leading to still higher inflation rate.

5. Inflation encourages investment in speculative activities rather than productive purposes.

![]()

![]()

![]()

![]()