Students can Download Commerce Chapter 20 International Finance Questions and Answers, Notes Pdf, Samacheer Kalvi 11th Commerce Book Solutions Guide Pdf helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

Samacheer Kalvi 11th Commerce Solutions Chapter 20 International Finance

Samacheer Kalvi 11th Commerce International Finance Textbook Exercise Questions and Answers

I. Choose the Correct Answer

Question 1.

An instrument representing ownership interest in securities of a foreign issuer is called …………….

(a) an ownership certificate

(b) a depositary receipt

(c) an ownership receipt

(d) None of the above

Answer:

(b) a depositary receipt

Question 2.

Issuance of DRs is based on the increase of demand in the ……………

(a) International market

(b) Local market

(c) Existing shareholders

(d) All of the above

Answer:

(a) International market

Question 3.

ADRs are issued in …………….

(a) Canada

(b) China

(c) India

(d) The USA

Answer:

(d) The USA

![]()

Question 4.

Depositary receipts that are traded in an international market other than the United States are called …………….

(a) Global Depositary Receipts

(b) International Depositary Receipts

(c) Open Market Depositary Receipts

(d) Special Drawing Rights

Answer:

(a) Global Depositary Receipts

Question 5.

……………. bond is a special type of bond issued in the currency other than the home currency.

(a) Government Bonds

(b) Foreign Currency Convertible Bond

(c) Corporate Bonds

(d) Investment Bonds

Answer:

(b) Foreign Currency Convertible Bond

II. Very Short Answer Questions

Question 1.

Who are Foreign Institutional Investors?

Answer:

The Non-residents of an investment in the equity of a domestic company without the intention of acquiring management control are known as Foreign Institutional Investors.

Question 2.

What is a Depository Receipt?

Answer:

A depository receipt is a negotiable financial instrument issued by a bank to represent a foreign company’s equity shares or securities. They are issued to attract a greater amount of investment from other countries.

Question 3.

What is a GDR (Global Depository Receipt)?

Answer:

GDR is an instrument issued abroad by a company to raise funds in some foreign currencies and is listed and traded on a foreign stock exchange.

![]()

Question 4.

What is an American Depositary Receipt (ADR)?

Answer:

ADR is a dollar-denominated negotiable certificate representing a non-US company in the US market which allows US citizens to invest in overseas securities.

Question 5.

What is a Foreign Currency Convertible Bond?

Answer:

A foreign currency convertible bond is a special type of bond issued in a currency other than the home currency.

III. Short Answer Questions

Question 1.

Explain the importance of international finance.

Answer:

- It helps in calculating the exchange rates of various currencies.

- It helps to compare the inflation rates.

- It leads to economic status can be ascertained.

- International Financial Reporting facilitates the comparison of financial statements made by various countries.

- It helps in understanding the basics of international organisations and maintaining the balance among them.

- International finance organisations mediate and resolve financial disputes among member nations.

Question 2.

What are Foreign Currency Convertible Bonds?

Answer:

A foreign currency convertible bond is a special type of bond issued in a currency other than the home currency. In other words, companies issue foreign currency convertible bonds to raise money in foreign currency.

![]()

Question 3.

Explain any three disadvantages of FDI.

Answer:

Exploiting Natural Resources: The FDI Companies deplete natural resources like water, forest, mines, etc. As a result, such resources are not available for the usage of the common man in the host country.

Heavy Outflow of capital: Foreign companies are said to take away huge funds in the form of dividends, royalty fees, etc. This causes a huge outflow of capital from the host country.

Not Transferring Technology: Some foreign enterprises do not transfer the technology to developing countries. They mostly transfer second-hand technology to the host country. They keep the fundamental aspects of technology with the parent company. In such a case, the host country may not get the advantage of technology transfer and consequently economic development.

Question 4.

State any three features of ADR.

Answer:

- ADRs are denominated only in US dollars.

- They are issued only to investors who are American residents.

- The depository bank should be located in US.

Question 5.

State any three features of GDR.

Answer:

- It is a negotiable instrument and can be traded freely like any other security. GDRs are issued to investors

- across the country. It is denominated in any acceptable freely convertible currency. GDR is denominated in

- any foreign currency but the underlying shares would be denominated in the local currency of the issuer.

IV. Long Answer Questions

Question 1.

Describe the importance of international finance?

Answer:

International finance plays a pivotal role in international trade and in the sphere of exchange of goods and services among the nations. The following points highlight the importance of international finance. International finance helps in calculating the exchange rates of various currencies of nations and the relative worth of each and every nation in terms thereof.

- It helps in comparing the inflation rates and getting an idea about investing in international debt securities.

- It helps in ascertaining the economic status of the various countries and in judging the foreign market.

- International Financial Reporting System (IFRS) facilitates comparison of financial statements made by

- various countries.

- It’ helps in understanding the basics of international organisations and maintaining the balance among them.

- International finance organisations such as IMF, World Bank, etc. mediate and resolve financial disputes among member nations.

Question 2.

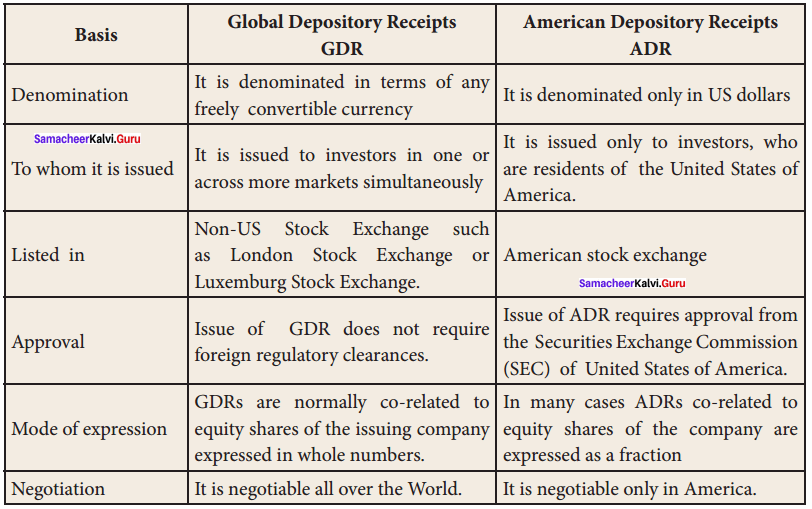

Distinguish between GDR and ADR.

Answer:

Question 3.

State any five features of FCCB.

Answer:

- FCCB is issued by an Indian company in foreign currency.

- These are listed and traded in the foreign stock exchange and similar to the debenture.

- It is a convertible debt instrument. It carries an interest coupon. It is unsecured.

- It gives its holders the right to convert for a fixed number of shares at a predetermined price.

- It can be converted into equity or Repository receipt after a certain period.

![]()

Question 4.

Explain any five advantages of FDI.

Answer:

- Achieving Higher Growth in National Income: Developing countries get much-needed capital through FDI to achieve a higher rate of growth in national income.

- Help in Addressing BOP Crisis: FDI provides an inflow of foreign exchange resources into a country. This helps the country to solve the adverse balance of payment position.

- Faster Economic Development FDI brings technology, management, and marketing skills along with it. These are crucial for achieving faster economic development in developing countries.

- Generating Employment Opportunities FDI generates a lot of employment opportunities in developing countries, especially in high skill areas.

- Encouraging Competition in Host Countries Entry of FDI into developing countries promotes healthy competition therein. This leads to enterprises in developing countries operating efficiently and effectively in the market. Consumers get a variety of products of good quality at a market-determined price which usually benefits the customers.

Samacheer Kalvi 11th Commerce International Finance Additional Questions and Answers

I. Choose the Correct Answer

Question 1.

…………….. is a section of financial economics that deals with the monetary interactions that occur between two or more countries.

(a) International finance

(b) Business finance

(c) DR

(d) GDR

Answer:

(a) International finance

Question 2.

From …………….., Foreign International Investors have been allowed to invest in all securities traded on the primary and secondary markets.

(a) 1992

(b) 1991

(c) 1995

(d) 1996

Answer:

(a) 1992

![]()

Question 3.

………………. is an instrument issued abroad by a company to raise funds in some foreign currencies and is listed and traded on a foreign stock exchange.

(a) GDR

(b) DR

(c) FDI

(d) FII

Answer:

(a) GDR

II. Very Short Answer Questions

Question 1.

Define Foreign Direct Investment (FDI).

Answer:

Foreign direct investment (FDI) is an investment made by a company or an individual in one country with business interests in another country, in the form of either establishing business operations or acquiring business assets in the other country, such as ownership or controlling interest in a foreign company.

![]()

Question 2.

What are Commercial Banks?

Answer:

Most of the commercial banks extend foreign currency loans for promoting business opportunities. The loans and services of various types, provided by banks differ from country to country.

Question 3.

What is International capital markets?

Answer:

Modem organisations including multinational companies depend upon sizeable borrowings in rupees as well as in foreign currencies. Prominent financial instruments used for this purpose are Depository Receipts.