Students can Download Tamil Nadu 12th Accountancy Model Question Paper 5 English Medium Pdf, Tamil Nadu 12th Accountancy Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

TN State Board 12th Accountancy Model Question Paper 5 English Medium

General Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- All questions of Part I, II, III and IV are to be attempted separately.

- Question numbers 1 to 20 in Part I are Multiple Choice Questions of one mark each.

These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer . - Question numbers 21 to 30 in Part II are two-mark questions. These are to be answered in about one or two sentences.

- Question numbers 31 to 40 in Part III are three-mark questions. These are to be answered in above three to five short sentences.

- Question numbers 41 to 47 in Part IV are five-mark questions. These are to be answered in detail Draw diagrams wherever necessary.

Time: 2.30 Hours

Maximum Marks: 90

Part – I

Answer all the questions. Choose the correct answer. [20 × 1 = 20]

Question 1.

Which one of the following statements is not true in relation to incomplete records?

(a) It is an unscientific method of recording transactions

(b) Records are maintained only for cash and personal accounts

(c) Tax authorities do not accept

(d) It is suitable for all types of organisations

Answer:

(d) It is suitable for all types of organisations

Question 2.

What is the amount of capital of the proprietor, if his assets are ₹ 85,000 and liabilities are ₹ 20,000?

(a) ₹ 65,000

(b) ₹ 1,06,000

(c) ₹ 21,000

(d) ₹ 85,000

Answer:

(a) ₹ 65,000

Question 3.

Which of the following should not be recorded in the income and expenditure account?

(a) Sale of old newspapers

(b) Loss on sale of asset

(c) Honorarium paid to the secretary

(d) Sale proceeds of furniture

Answer:

(d) Sale proceeds of furniture

![]()

Question 4.

There are 100 members in a club each paying ₹ 500 as annual subscription. Subscription due but not received for the current year is ₹ 200; Subscription received in advance is ₹ 300. The amount of subscription to be shown in the income and expenditure account is __________.

(a) ₹ 50,000

(b) ₹ 50,200

(c) ₹ 49,900

(d) ₹ 49,800

Answer:

(a) ₹ 50,000

Question 5.

Which of the following is the incorrect pair?

(a) Interest on drawings – Debited to capital account

(b) Interest on capital – Credited to capital account

(c) Interest on loan – Debited to capital account

(d) Share of profit – Credited to capital account

Answer:

(c) Interest on loan – Debited to capital account

Question 6.

In the absence of an agreement among the partners, interest on capital is _________.

(a) Not allowed

(b) Allowed at bank rate

(c) Allowed @ 5% per annum

(d) Allowed @ 6% per annum

Answer:

(d) Allowed @ 6% per annum

Question 7.

Which of the following statement is true?

(a) Goodwill is an intangible asset

(b) Good will is a current asset

(c) Goodwill is a fictitious asset

(d) Good will cannot be acquired

Answer:

(a) Goodwill is an intangible asset

Question 8.

When the average profit is ₹ 50,000 and the normal profit is ₹ 30,000, super profit is ________.

(a) ₹ 80,000

(b) ₹ 40,000

(c) ₹ 20,000

(d) ₹ 15,000

Answer:

(c) ₹ 20,000

![]()

Question 9.

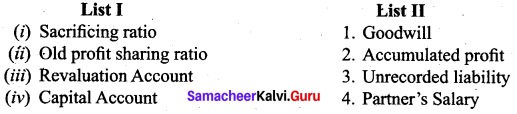

Match List I with List II and select the correct answer using the codes given below:

Answer:

(b) i – 3, ii – 2, iii – 4, iv – 1

Question 10.

Bala and Keerthana are sharing profits and losses in the ratio of 5:3. They admit Eshwar as a partner giving him 1/5 share of profits. The sacrificing ratio is ________.

(a) 1:3

(b) 3:1

(c) 5:3

(d) 3:5

Answer:

(c) 5:3

Question 11.

On retirement of a partner, general reserve is transferred to the _______.

(a) Capital account of all the partners

(b) Capital account of retiring partners only

(c) Capital account of the continuing partners

(d) None of the above

Answer:

(a) Capital account of all the partners

Question 12.

A, B and C are partners sharing profits in the ratio 2:2:1. On retirement of B, goodwill of the firm was valued as ₹ 30,000. The contribution of A and C to compensate B is ______.

(a) ₹ 20,000 and ₹ 10,000

(b) ₹ 8,000 and ₹ 4,000

(c) ₹ 10,000 and ₹ 20,000

(d) ₹ 15,000 and ₹ 15,000

Answer:

(b) ₹ 8,000 and ₹ 4,000

Question 13.

A preference share is one _______.

(i) which carries preferential right with respect to payment of dividend at fixed rate

(ii) which carries preferential right with respect to repayment of capital on winding up

(a) Only (i) is correct

(b) Only (ii) is correct

(c) Both (i) and (ii) are correct

(d) Both (i) and (ii) are incorrect

Answer:

(c) Both (i) and (ii) are correct

![]()

Question 14.

Super Ltd. forfeited 100 shares of ₹ 10 each for non- payment of final call of ₹ 2 per share.

All these shares were re-issued at ₹ 9 per share. The amount will be transferred to capital reserve account is _______.

(a) ₹ 700

(b) ₹ 800

(c) ₹ 900

(d) ₹ 1,000

Answer:

(a) ₹ 700

Question 15.

Which of the following tools of financial statement analysis is suitable when data relating to several years are to be analysed?

(a) Cash flow statement

(b) Common size statement

(c) Comparative statement

(d) Trend analysis

Answer:

(d) Trend analysis

Question 16.

Expenses for a business for the first year were ₹ 70,000. In the second year, it was increased to ₹ 77,000. The trend percentage in the second year is _______.

(a) 10%

(b) 110%

(c) 90%

(d) 11%

Answer:

(b) 110%

Question 17.

Debt equity ratio is a measure of _________.

(a) Short term solvency

(b) Long term solvency

(c) Profitability

(d) Efficiency

Answer:

(b) Long term solvency

Question 18.

Current liabilities ₹ 40,000; current assets ₹ 1,00,000; Inventory ₹ 20,000. Quick ratio is _____.

(a) 1 : 1

(b) 5 : 1

(c) 1 : 2

(d) 2 : 1

Answer:

(d) 2 : 1

![]()

Question 19.

Contra voucher used in Tally for ______.

(a) Master entry

(b) Withdrawal of cash from bank for office use

(c) Reports

(d) Credit purchase of assets

Answer:

(b) Withdrawal of cash from bank for office use

Question 20.

In which voucher type credit purchase of furniture is recorded in Tally _______.

(a) Receipt voucher

(b) Journal voucher

(c) Purchase voucher

(d) Payment voucher

Answer:

(b) Journal voucher

Part – II

Answer any seven questions in which question No. 30 is compulsory. [7 × 2 = 14]

Question 21.

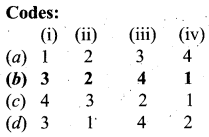

From the following particulars ascertain profit or loss:

| Particulars | ₹ |

| Capital at the beginning of the year | 5,00,000 |

| Capital at the end of the year | 8,50,000 |

| Additional capital introduced during the year | 2,00,000 |

| Drawings during the year | 1,50,000 |

Answer:

![]()

Question 22.

Give four examples for capital receipts of not-for-profit organisation.

Answer:

- Life membership fees

- Legacies

- Special donations

- Sale of fixed assets

Question 23.

Balamurugan is a partner who withdrew ₹ 20,000 regularly in the middle of every month. Interest is charged on the drawings at 6% per annum. Calculate interest on drawings for the year ended 31st December, 2019?

Answer:

Balamurugan’s interest on drawing calculation:

Interest on drawings = Amount of drawings × Rate of interest × Period of interest

= 20,000 × 12 × \(\frac{6}{100} \times \frac{6}{12}\) = ₹ 7,200

Question 24.

State any two circumstances under which goodwill of a partnership firm is valued.

Answer:

- When there is a change in the profit sharing ratio.

- When a new partner is admitted into a firm.

- When an existing partner retires from the firm or when partner dies

- When a partnership firm is dissolved.

Question 25.

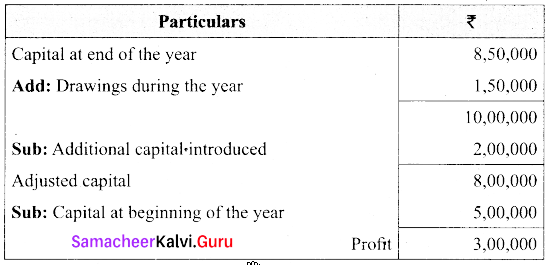

Sanjana and Bhavya are partners sharing profits and losses in the ratio of 4:3. On 31.3.2018, Sanjeev was admitted as a partner. On the date of admission, the book of the firm showed a general reserve of ₹ 42,000; Pass the journal entry to distribute the general reserve. ,

Answer:

![]()

Question 26.

What is gaining ratio?

Answer:

Gaining ratio is the proportion of the profit which is gained by the continuing partner.

Gaining ratio = Ratio of share gained by the continuing partners

Share gained = New Share – Old Share

Question 27.

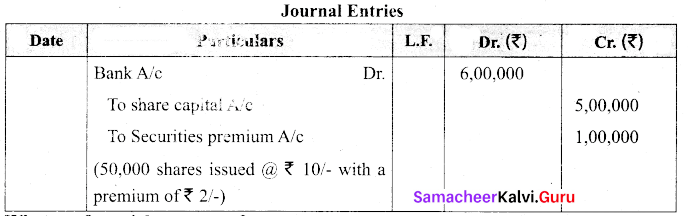

Manoharan Ltd. issues 50,000 shares of ₹ 10 each payable fully on application. Pass journal entries if shares are issued at a premium of ₹ 2 per share.

Answer:

Question 28.

What are financial statements?

Answer:

Financial statements are the statements prepared by the business concern at the end of the accounting period to ascertain the operating results and the financial position. The basic financial statements prepared by business concern are income statement and balance sheet.

Question 29.

State any two accounting reports used in Tally.

Answer:

- Day Book / Journal

- Ledgers

- Trial Balance

- Income statement

- Balance sheet

![]()

Question 30.

Calculate current ratio: Total current liabilities ₹ 2,40,000; Total current assets ₹ 4,80,000.

Answer:

Current Ratio = \(\frac{\text { Current Assets }}{\text { Current Liabilities }}\)

Current Liabilities

Current assets = ₹ 4,80,000

Current liabilities = ₹ 2,40,000

∴ Current Ratio = \(\frac{4,80,000}{2,40,000}\) = 2 : 1

Part – III

Answer any seven questions in which question No. 40 is compulsory. [7 × 3 = 21]

Question 31.

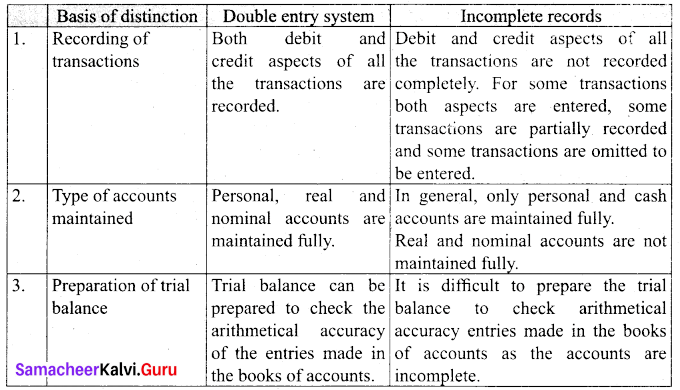

State any three differences between double entry system and incomplete records.

Answer:

Question 32.

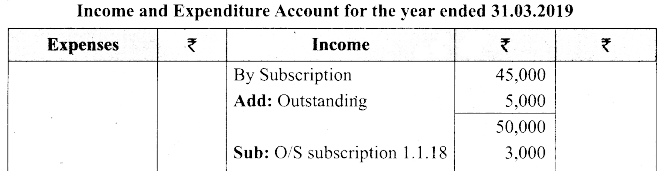

How the following items will appear in the final accounts of a club for the year ending 31st March, 2020?

Answer:

| Particulars | 1.4.2019(₹) | 31.3.2020 (₹) |

| Outstanding subscription | 3,000 | 5,000 |

| Subscription received in advance | 4,000 | 6,000 |

Subscription received during the year: ₹ 45,000.

Answer:

Income and Expenditure Account for the year ended 31.03.2019

![]()

Question 33.

Ravi, Sibi and Kumar are partners in a firm. There is no partnership deed. How will you deal with the following?

(i) Ravi has contributed maximum capital. He demands interest on capital @ 10% per annum.

(ii) Sibi demands the profit to be shared in the capital ratio. But, others do not agree.

(iii) Loan advanced by kumar to the firm is ₹ 50,000. He demands interest on loan @ 12% per annum.

Answer:

Since there is no partnership deed provisions of the Indian partnership Act 1932 will apply.

(i) No interest on capital is payable to any partner. Therefore Ravi is entitled to the interest on capital

(ii) Profits should be distributed equally

(iii) Interest on loan is payable @ 6% p.a. of ₹ 50,000

Question 34.

Explain any three factors determining the value of goodwill in a partnership firm.

Answer:

Factors determining goodwill:

- Profitability of the firm

- Favourable location of the business enterprise

- Good quality of good i and services offered

- Tenure of business enterprise

- Efficiency of management

- Degree of competition

- Other factors

Question 35.

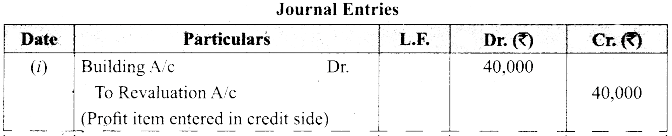

Ajay and Devan are partners sharing profits and losses in the ratio of 5:3. In the view of Gopal admission, they decided

(i) To increase the value of building by ₹ 40,000

(ii) To decrease the value of machinery by ₹ 14,000 and furniture ₹ 12,000

(iii) An unrecorded liability ₹ 6,000 has to be recorded now.

Answer:

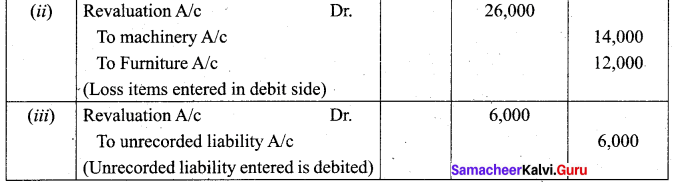

Question 36.

Nandhini, Sandhiya and Rajesh are partners sharing profits and losses in the ratio of 5 : 3 : 3 respectively. Nandhini retires from the firm on 31st December, 2019. On the date of retirement, her capital account shows a credit balance of ₹ 1,00,000.

Pass journal entries if:

(i) The amount due is paid off immediately.

(ii) The amount due is not paid immediately.

(iii) ₹ 50,000 is paid immediately by cheque.

Answer:

![]()

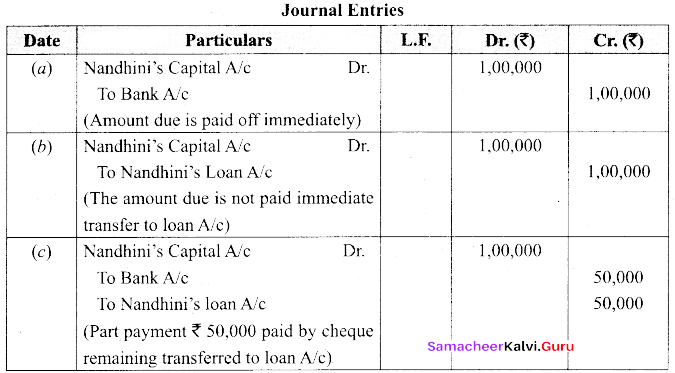

Question 37.

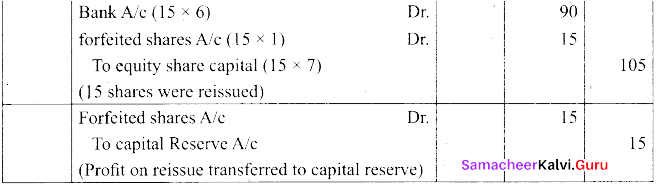

Senthil Ltd. forfeited 20 equity shares of ₹ 10 each, ₹ 7 called up, on which Sandeep had paid application and allotment money of ₹ 5 per share. Of these 15 shares were reissued to Magesh by receiving ₹ 6 per share paid up as ₹ 7 per share. Pass journal entries for forfeiture and reissue.

Answer:

Note:

No. of share reissued × profit on issue

= 15 (7 – 6)= 15 × 1 = ₹ 15

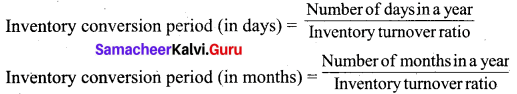

Question 38.

What is inventory conversion period? How is it calculated?

Answer:

It is the time taken to sell the inventory. A shorter inventory conversion period indicates more efficiency in the management of inventory. It is computed as follows.

Question 39.

Explain any three applications of computerized accounting system.

The applications of CAS are as follows:

Answer:

(i) Maintaining accounting records:

In CAS, accounting records can be maintained easily and efficiently for long time period. It facilitates fast and accurate retrieval of data and information.

(ii) Inventory management:

CAS facilitates efficient management of inventory. Updated information about availability of inventory level of inventory etc. can be obtained instantly.

(iii) Report generation:

CAS helps to generate various routine and special purpose reports.

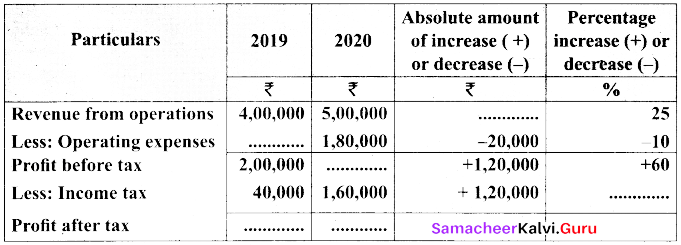

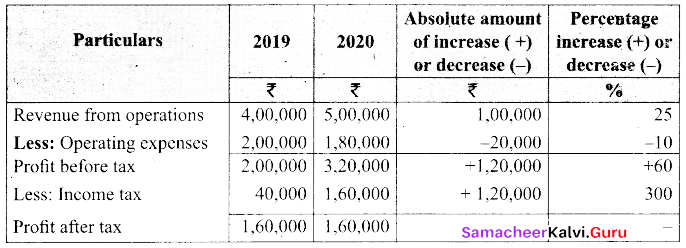

Question 40.

Complete the following comparative statement.

Answer:

Answer:

Part – IV

Answer all the questions. [7 × 5 = 35]

Question 41.

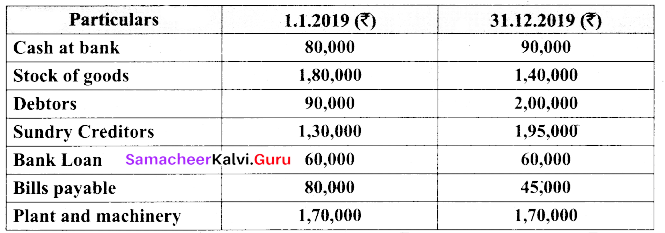

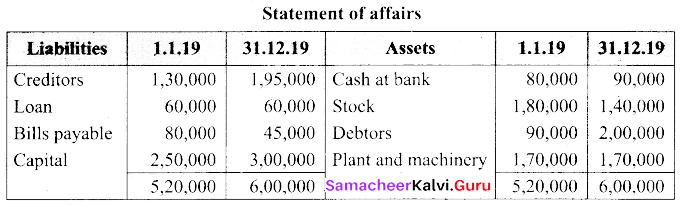

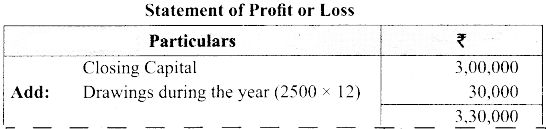

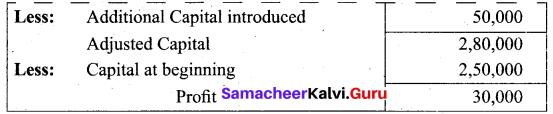

(a) Raj an does not keep proper books of accounts. Following details are taken from his records.

Answer:

During the year he introduced further capital of ₹ 50,000 and withdrew ₹ 2,500 per month from the business for his personal use. Prepare statement of profit or loss with the above information.

Answer:

[OR]

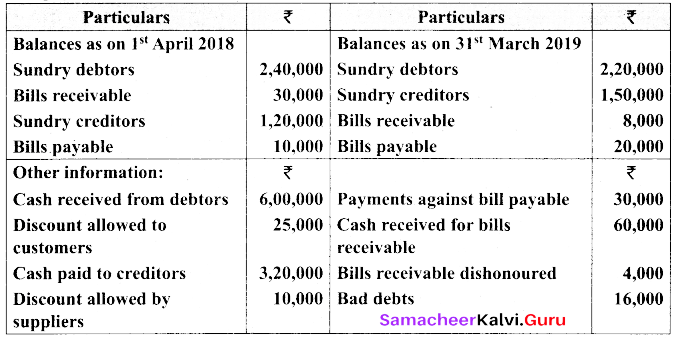

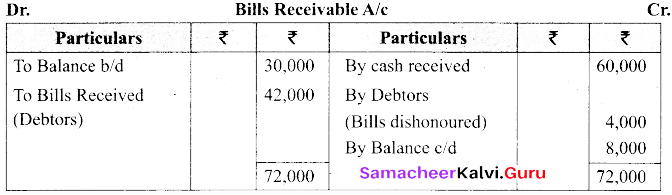

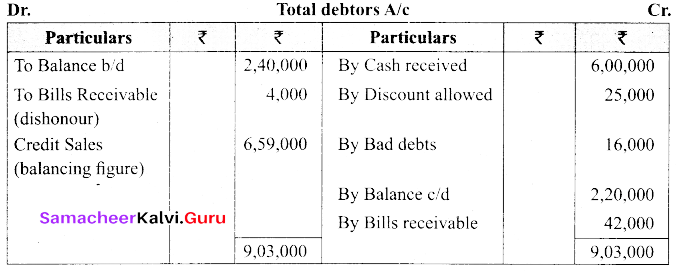

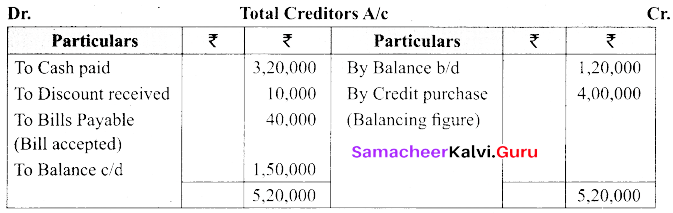

(b) From the following details you are required to calculate credit sales and credit purchases by preparing total debtors account, total creditors account, bills receivable account and bills payable account.

Answer:

Answer:

![]()

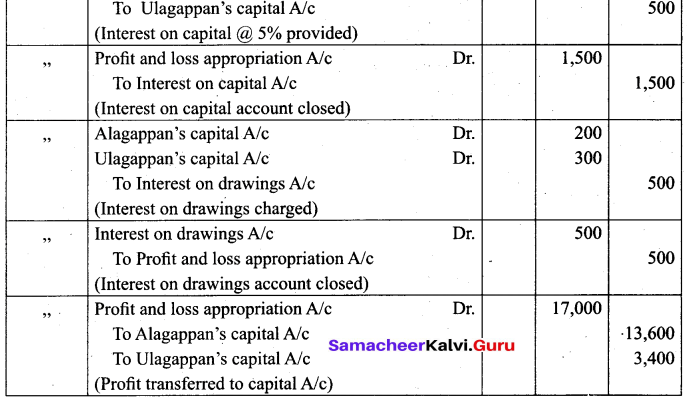

Question 42.

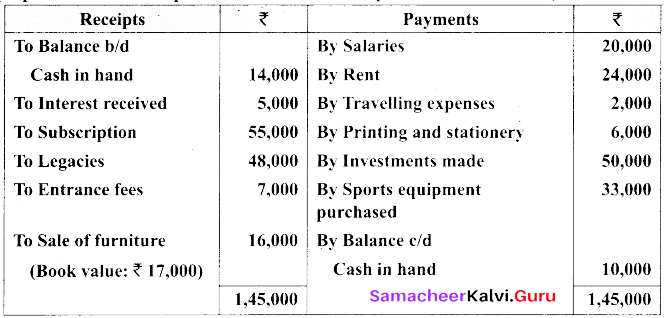

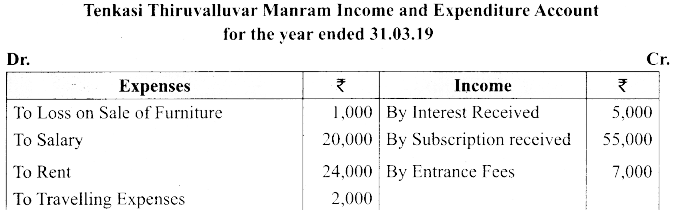

(a) From the following receipts and payments account of Tenkasi Thiruvalluvar Manram, prepare income and expenditure account for the year ended 31st March, 2019.

Answer:

[OR]

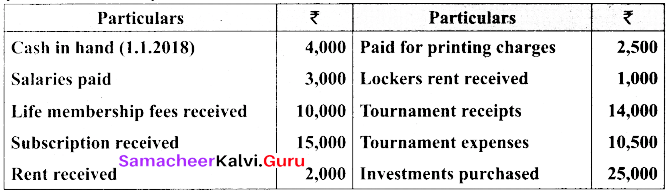

(b) From the information given below, prepare Receipts and Payments account of Kurunji Sports Club for the year ended 31st December, 2018.

Answer:

Question 43.

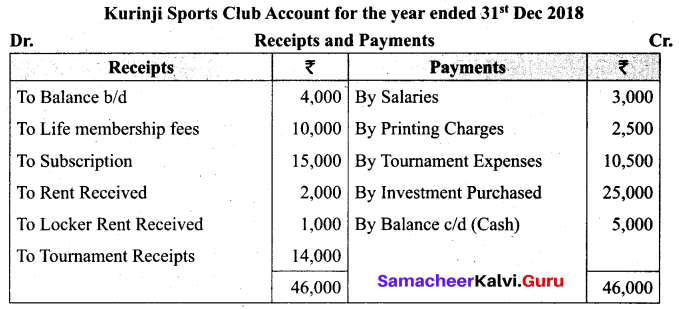

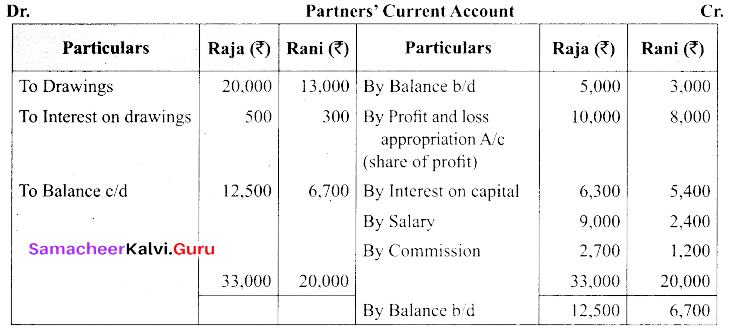

(a) From the following information, prepare capital accounts of partners Raja and Rani, when their capitals are fixed.

Answer:

Answer:

[OR]

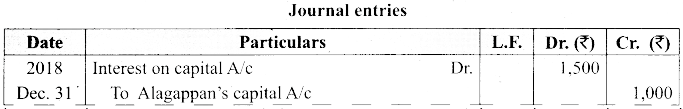

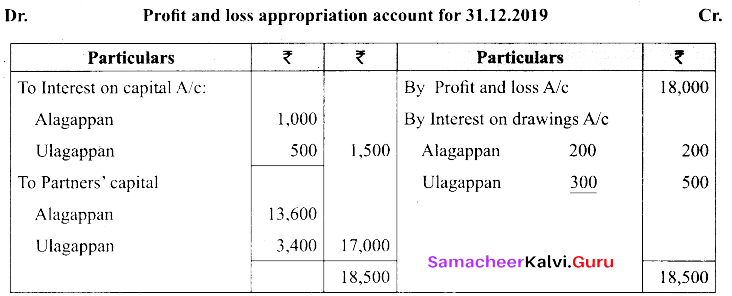

(b) Alagappan and Ulagappan are partners in a firm sharing profits and losses in the ratio of 10:7. On 1st January 2018, their capitals were ₹ 20,000 and ₹ 10,000, respectively. The partnership deed specifies the following:

(a) Interest on capital is to be allowed at 5% per annum.

(b) Interest on drawings charged to Alagappan and Ulagappan are ₹ 200 and ₹ 300 respectively.

(c) The net profit of the firm before considering interest on capital and interest on drawings amounted to ₹ 18,000.

Give necessary journal entries and prepare Profit and loss appropriation account for the year ending 31st December 2018. Assume that the capitals are fluctuating.

Answer:

![]()

Question 44.

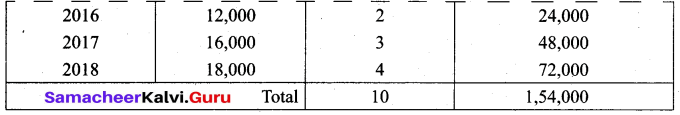

(a) Find out the value of goodwill at three years purchase of weighted average profit of last four years.

| Year | Profit (₹) | Weight |

| 2015 | 10,000 | 1 |

| 2016 | 12,000 | 2 |

| 2017 | 16,000 | 3 |

| 2018 | 18,000 | 4 |

Answer:

Calculation of weighted average

Goodwill = Weighted average profit × No. of years purchase

= ₹ 15,400 × 3 = ₹ 46,200

[OR]

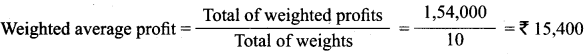

(b) Calculate the value of goodwill at 5 years purchase of super profit from the following information:

(а) Capital employed: ₹ 1,20,000

(b) Normal rate of profit: 20%

(c) Net profit for 5 years:

2014: ₹ 30,000; 2015: ₹ 32,000; 2016: ₹ 35,000; 2017: ₹ 37,000 and 2018: ₹ 40,000

(d) Fair remuneration to the partners ? 2,800 per annum.

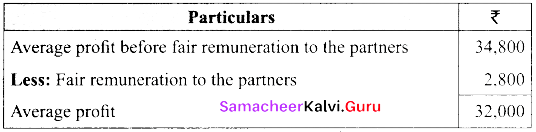

Answer:

Normal profit = Capital employed × Normal rate of return

= 1,20,000 × (20/100)

= ₹ 24,000

Super profit = Average profit – Normal profit

= 32,000 – 24,000

= ₹ 8,000

Goodwill = Super profit × Number of years of purchase

= 8,000 × 5

= ₹ 40,000

Question 45.

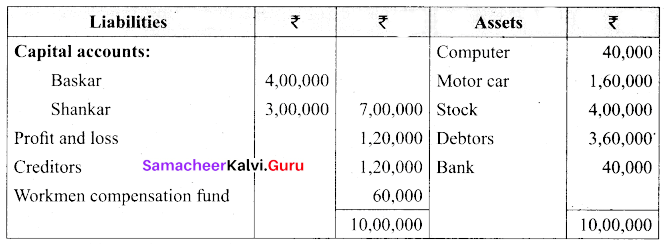

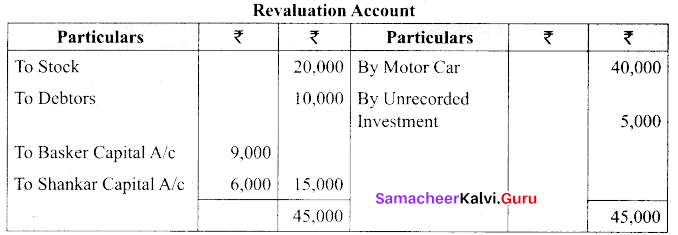

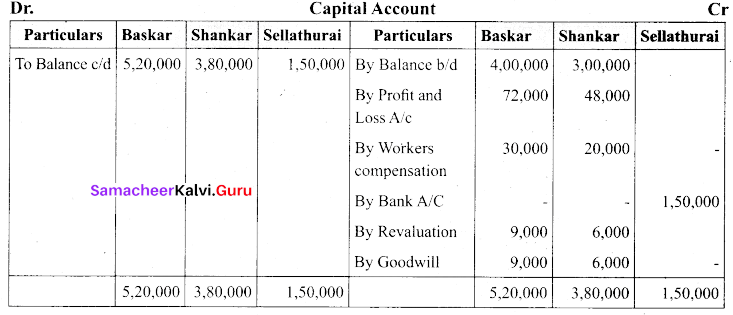

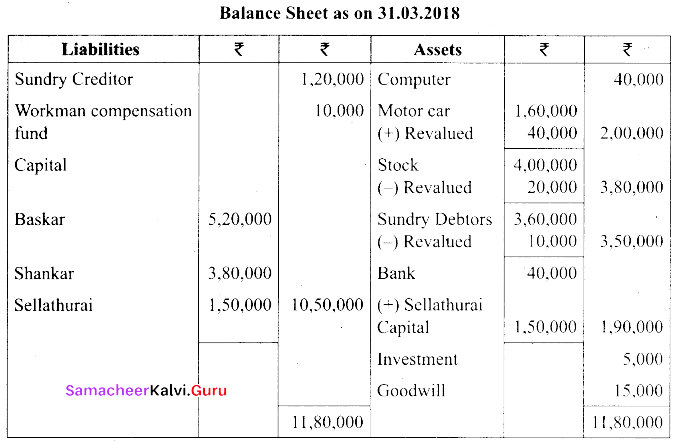

(a) Baskar and Shankar are partners in a business sharing profits and losses in the ratio of 3:2. The balance sheet of the partners on 31.03.2018 is as follows:

Sellathurai is admitted for 1/5 share on the following terms:

(i) Goodwill of the firm is valued at ₹ 75,000 and Sellathurai brought cash for his share of goodwill.

(ii) Sellathurai is to bring ₹ 1,50,000 as his capital.

(iii) Motor car is valued at ₹ 2,00,000; stock at ₹ 3,80,000 and debtors at ₹ 3,50,000.

(iv) Anticipated claim on workmen compensation fund is ₹ 10,000

(v) Unrecorded investment of ₹ 5,000 has to be brought into account.

(vi) Revaluation account shows the profit of 15,000 on the date of admission.

Prepare capital accounts and balance sheet after Sellathurai’s admission.

Answer:

[OR]

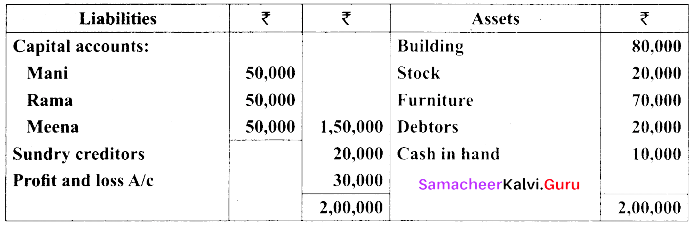

(b) Mani, Rama and Meena are partners in a firm sharing profits and losses in the ratio of 4:3:3. Their balance sheet as on 31st March, 2019 is as follows:

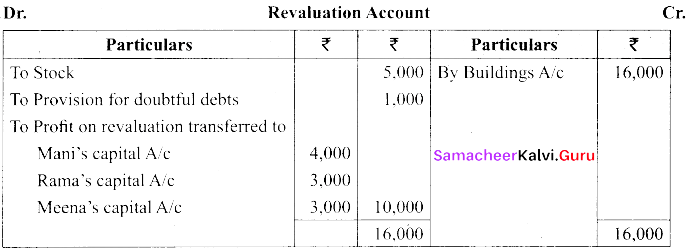

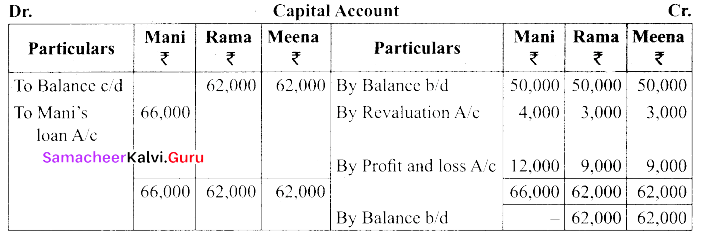

Mani retired from the partnership firm on 31.03.2019 subject to the following adjustments:

(i) Stock to be depreciated by ₹ 5,000

(ii) Provision for doubtful debts to be created for ₹ 1,000.

(iii) Buildings to be appreciated by ₹ 16,000

(iv) The final amount due to Mani is not paid immediately

Prepare revaluation account and capital account of partners after retirement.

Answer:

![]()

Question 46.

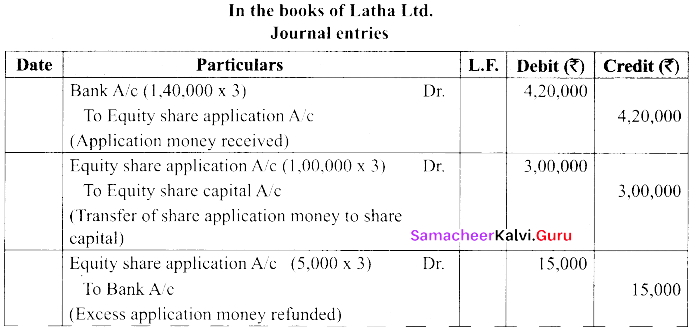

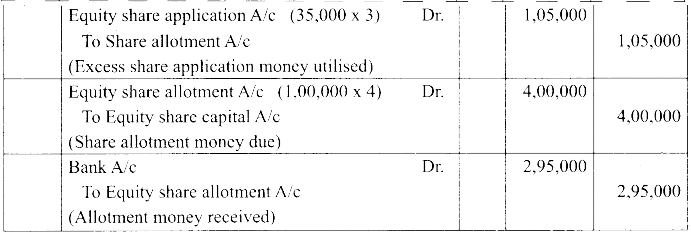

(a)Latha Ltd. offered 1,00,000 shares of ₹ 10 each to the public payable ₹ 3 on application, ₹ 4 on share allotment and the balance when required. Applications for 1,40,000 shares were received on which the directors allotted as:

Applicants for 60,000 shares – Full

Applicants for 75,000 shares – 40,000 shares (excess money will be utilised for allotment)

Applicants for 5,000 shares – Nil

All the money due was received. Pass journal entries upto the receipt of allotment money.

Also show the working notes, which is part of your answer.

Answer:

Working note:

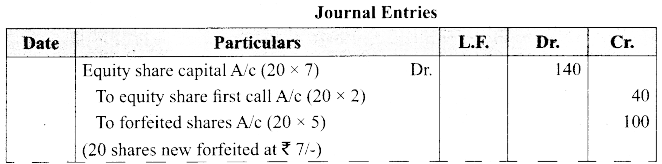

[OR]

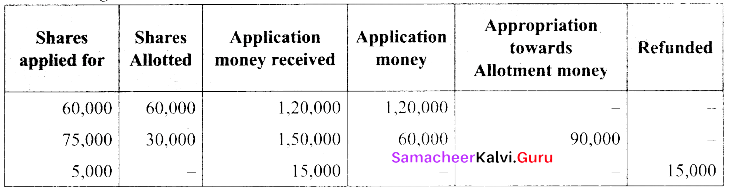

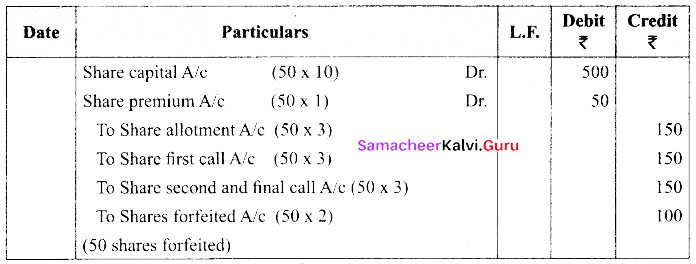

(b) Vikam Company issued shares of ₹ 10 each at 10% premium, payable ₹ 2 on application, ₹ 3 on allotment (including premium), ₹ 3 on first call and ₹ 3 on second and final call.

Journalise the transactions relating to forfeiture of shares for the following situations:

(i) Sasikumar who holds 50 shares failed to pay the second and final call and his shares were forfeited.

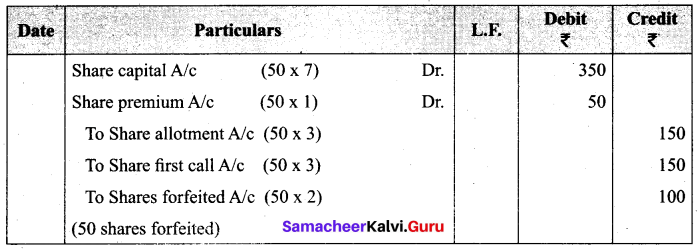

(ii) Vignesh who holds 50 shares failed to pay the allotment money, first call and second and final call money and his shares were forfeited.

(iii) Madhavan who holds 50 shares failed to pay the allotment money and first call and his shares were forfeited after the first call.

Answer:

Note: Since the premium amount is received by the company, premium should not be cancelled.

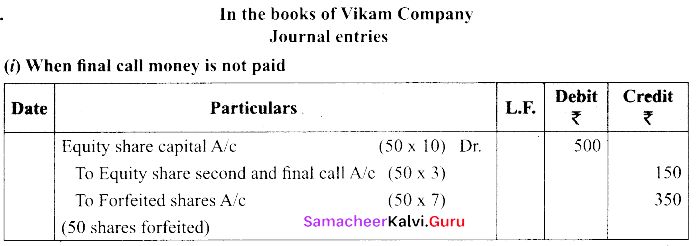

(ii) When allotment, first call money and second and final call money is not paid

(iii) When allotment and first call money is not paid

![]()

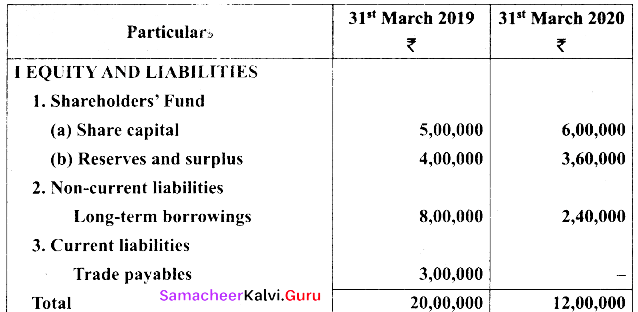

Question 47.

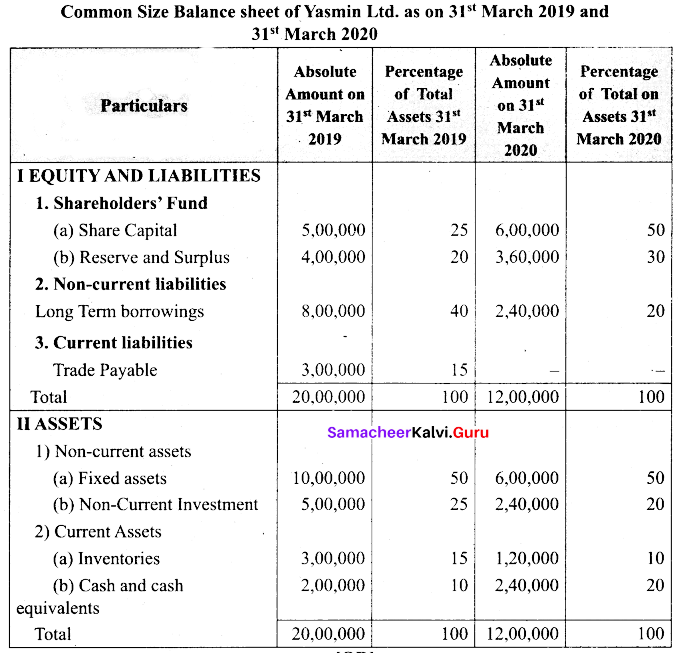

(a) Prepare common-size statement of financial position of Yasmin Ltd as on 31st March 2019 and 31st March 2020.

Answer:

[OR]

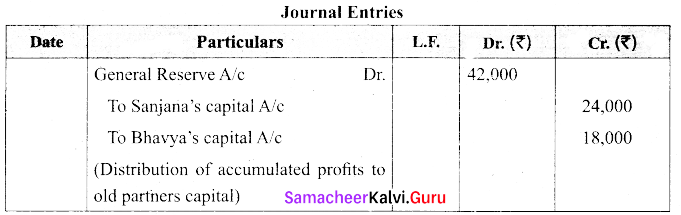

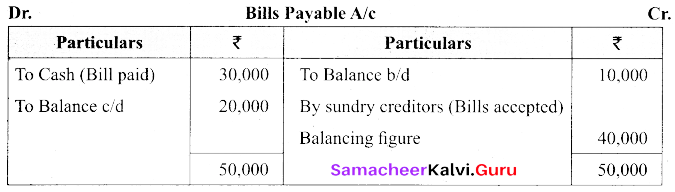

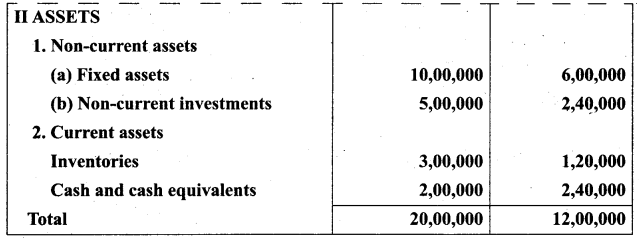

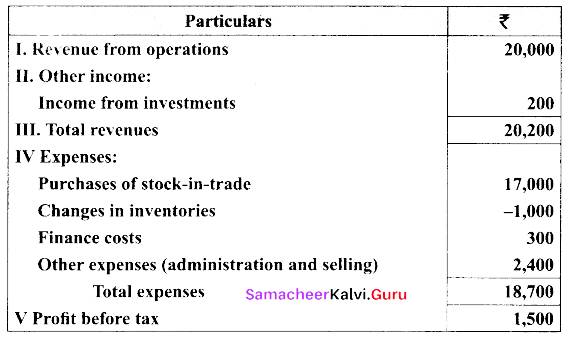

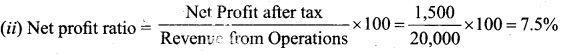

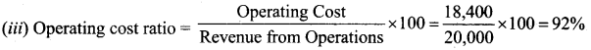

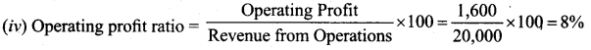

(b) From the following trading activities of Praveen Ltd. calculate

(i) Gross profit ratio

(ii) Net profit ratio

(iii) Operating cost ratio

(iv) Operating profit ratio

Answer:

![]()

Calculation of interest on drawings of Praveen (using average period)

Cost of revenue from operations = Purchase of stock-in-trade + Changes in inventory + Direct expenses

= 17,000 – 1,000 + 0 = ₹ 16,000

Gross profit = Revenue from operations – Cost of revenue from operations

= 20,000 – 16,000 = ₹ 4,000

Tutorial note:

It is assumed that there is no tax payable.

Operating cost = Cost of revenue from operations + Operating expenses

Operating expenses = Other expenses = ₹ 2,400

Operating cost = 16,000 + 2,400 = ₹ 18,400

Operating profit = Revenue from operations – Operating cost

= 20,000 – 18,400 = ₹ 1,600