Students can Download Accountancy Chapter 2 Conceptual Framework of Accounting Questions and Answers, Notes Pdf, Samacheer Kalvi 11th Accountancy Book Solutions Guide Pdf helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

Tamilnadu Samacheer Kalvi 11th Accountancy Solutions Chapter 2 Conceptual Framework of Accounting

Samacheer Kalvi 11th Accountancy Conceptual Framework of Accounting Text Book Back Questions and Answers

I. Multiple Choice Questions

Choose the Correct Answer

Question 1.

The business is liable to the proprietor of the business in respect of capital introduced by the person according to ………………

(a) Money measurement concept

(b) Cost concept

(c) Business entity concept

(d) Dual aspect concept

Answer:

(c) Business entity concept

Question 2.

The concept which assumes that a business will last indefinitely is ………………

(a) Business Entity

(b) Going concern

(c) Periodicity

(d) Conservatism

Answer:

(b) Going concern

![]()

Question 3.

GAAPs are:

(a) Generally Accepted Accounting Policies

(b) Generally Accepted Accounting Principles

(c) Generally Accepted Accounting Provisions

(d) None of these

Answer:

(c) Generally Accepted Accounting Provisions

Question 4.

The rule of stock valuation ‘cost price or realisable value’ whichever is lower is based on the accounting principle of ………………

(a) Materiality

(b) Money measurement

(c) Conservatism

(d) Accrual

Answer:

(c) Conservatism

Question 5.

In India, Accounting Standards are issued by ………………

(a) Reserve Bank of India

(b) The Cost and Management Accountants of India

(c) Supreme Court of India

(d) The Institute of Chartered Accountants of India

Answer:

(d) The Institute of Chartered Accountants of India

II. Very Short Answer Questions

Question 1.

Define book – keeping.

Answer:

“Book – keeping is an art of recording business dealings in a set of books”. (J.R.Batlibai)

“Book – keeping is the science and art of recording correctly in the books of account all those business transactions of money or money’s worth”. (R.N. Carter)

Question 2.

What is meant by accounting concepts?

Answer:

Accounting concepts are the basic assumptions or conditions upon which accounting has been laid. Accounting concepts are the results of broad consensus. The word concept means a notion or abstraction which is generally accepted. Accounting concepts provide unifying structure to the accounting process and accounting reports.

![]()

Question 3.

Briefly explain about revenue recognition concept.

Answer:

According to accrual concept, the effects of the transactions are recognised on mercantile basis, i.e., when they occur and not when cash is paid or received. Revenue is recognised when it is earned and expenses are recognised when they are incurred. All expenses and revenues related to the accounting period are to be considered irrespective of the fact that whether revenues are received in cash or not and whether expenses are paid in cash or not.

Question 4.

What is “Full Disclosure Principle” of accounting.

Answer:

It implies that the accounts must be prepared honestly and all material information should be disclosed in the accounting statement. This is important because the management is different from the owners in most of the organisations.

Question 5.

Write a brief note on ‘Consistency’ assumption.

Answer:

The consistency convention implies that the accounting policies must be followed consistently from one accounting period to another. The results of different years will be comparable only when same accounting policies are followed from year to year.

III. Short Answer Questions

Question 1.

What is matching concept? Why should a business concern follow this concept?

Answer:

Matching concept: According to this concept, revenues during an accounting period are matched with expenses incurred during that period to earn the revenue during that period. This concept is based on accrual concept and periodicity concept. Periodicity concept fixes the time frame for measuring performance and determining financial status. All expenses paid during the period are not considered, but only the expenses related to the accounting period are considered.

On the basis of this concept, adjustments are made for outstanding and prepaid expenses and accrued and unearned revenues. Also due provisions are made for depreciation of the fixed assets, bad debts, etc., relating to the accounting period. Thus, it matches the revenues earned during an accounting period with the expenses incurred during that period to earn the revenues before sharing any profit or loss.

![]()

Question 2.

“Only monetary transactions are recorded in accounting”. Explain the statement.

Answer:

This concept implies that only those transactions, which can be expressed in terms of money, are recorded in the accounts. Since, money serves as the medium of exchange transactions expressed in money are recorded and the ruling currency of a country is the measuring unit for accounting. Transactions which do not involve money will not be recorded in the books of accounts. For example, working conditions in the work place, strike by employees, efficiency of the management, etc. will not be recorded in the books, as they cannot be expressed in terms of money.

Question 3.

“Business units last indefinitely”. Mention and explain the concept on which the statement is based.

Answer:

This concept implies that a business unit is separate and distinct from the owner or owners, that is, the persons who supply capital to it. Based on this concept, accounts are prepared from the point of view of the business and not from the owner’s point of view. Hence, the business is liable to the owner for the capital contributed by him/her.

According to this concept, only business transactions are recorded in the books of accounts. Personal transactions of the owners are not recorded. But, their transactions with the business such as capital contributed to the business or cash withdrawn from the business for the personal use will be recorded in the books of accounts. It implies that the business itself owns assets and owes liabilities.

Question 4.

Write a brief note on Accounting Standards.

Answer:

Accounting Standards provide the framework and norms to be followed in accounting so that the financial statements of different enterprises become comparable. It is necessary to standardise the accounting principles to ensure consistency, comparability, adequacy and reliability of financial reporting. Thus, Accounting Standards are written policy documents issued by the expert accounting body or by government or other regulatory body covering the aspects of recognition, measurement, treatment, presentation and disclosure of accounting transactions and events in the financial statements.

Textbook Case Study Solved

Magesh started a new trading business. He buys and sells packing materials. He wants to be honest in doing his business. He has plans to establish his business in the future. He has little accounting knowledge but has excellent business skills. At the end of his first year of trading, he wanted to value his closing stock. He finds some of the goods are damaged. If he wants to sell them, then he has to • spend some amount for making them in a saleable condition. He also takes some money from his business bank account for his personal use. But, he forgot to record that.

Now, discuss on the following points:

Question 1.

Does every businessman need accounting knowledge?

Answer:

No, Every businessman does not need accounting knowledge. The businessman is called sole trader. If he has little accounting knowledge, is enough, but he should have business skill.

Question 2.

Identify some of the accounting concepts in this case study.

Answer:

- Money measurement concept.

- Going concern concept.

- Matching concept.

- Realisation concept

- Accrual concept

![]()

Question 3.

How should his closing stock be valued?

Answer:

Convention of conservation or prudence concept. The closing stock will be valued at market price or cost price whichever is lower.

Question 4.

Is it possible for him to compare his business results with that of his competitors?

Answer:

Yes, it is possible for him to compare his business results with that of his competitors, but the method is not accurate. It may be approximated i.e., capital comparison method followed.

Samacheer Kalvi 11th Accountancy Conceptual Framework of Accounting Additional Questions and Answers

I. Multiple Choice Questions

Choose the correct answer

Question 1.

ASB was constituted in India in the year of ………………

(a) 1977

(b) 1978

(c) 1979

(d) 1976

Answer:

(a) 1977

Question 2.

……………… is the primary stage in accounting.

(a) Journal

(b) Book – keeping

(c) ledger

(d) Transactions

Answer:

(b) Book – keeping

![]()

Question 3.

According to ……………… concept, every transaction or event has two aspects i.e.,’dual effect.

(a) Dual aspect concept

(b) Periodicity concept

(c) Matching concept

(d) Cost concept

Answer:

(a) Dual aspect concept

Question 4.

……………… is routine and clerical in nature.

(a) Book – keeping

(b) Accounting

(c) Ledger

(d) Journal

Answer:

(a) Book – keeping

Question 5.

……………… requires analytical skill.

(a) Accounting

(b) Single entry

(c) Book – keeping

(d) Ledger

Answer:

(a) Accounting

Question 6.

The word convention refers ………………

(a) traditions

(b) trade

(c) business

(d) accounting

Answer:

(a) traditions

Question 7.

Capital + Liabilities = Assets

(a) Dual aspect concept

(b) Periodicity concept

(c) Matching concept

(d) Cost concept

Answer:

(a) Dual aspect concept

Question 8.

requires that all accounting transactions recorded should be based on objective evidence.

(a) Matching concept

(b) Cost concept

(c) Dual aspect concept

(d) Objective evidence concept

Answer:

(d) Objective evidence concept

II. Very Short Answer Questions

Question 1.

Write any two features of book – keeping.

Answer:

The main features of Book – keeping are:

- It is the process of recording transactions in the books of accounts.

- Monetary transactions only are recorded in the accounts.

Question 2.

Write any two limitations of book-keeping.

Answer:

The limitations of Book-keeping are:

- Only monetary transactions are recorded in the book accounts.

- Effects of price level changes are not considered.

![]()

Question 3.

Write any two advantages of book – keeping.

Answer:

The advantages of Book – keeping are:

- Transactions are recorded systematically in chronological order in the book of accounts. Thus, book – keeping provides a permanent and reliable record for all business transactions.

- Book – keeping is useful to get the financial information.

Question 4.

What is dual aspect concept?

Answer:

Accorcling to this concept, every transaction or event has two aspects, i.e., dual effect. This is the concept which recognises the fact that for every debit, there is a corresponding and equal credit. This is the basis of the entire system of double entry book – keeping.

Question 5.

Write any two needs for accounting standards.

Answer:

The need for accounting standards is:

- To promote better understanding of financial statements.

- To help accountants to follow uniform procedures and practices.

III. Short Answer Questions

Question 1.

What are the objectives of book-keeping?

Answer:

The main objectives of book – keeping are:

- To have a complete and permanent record of all business transactions in chronological order and under appropriate headings.

- To facilitate ascertainment of the profit or loss of the business during a specific period.

- To facilitate ascertainment of financial position.

- To know the progress of the business.

- To find out the tax liabilities.

- To fulfil the legal requirements.

Question 2.

What are the features of book-keeping?

Answer:

The main features of book-keeping are:

- It is the process of recording transactions in the books of accounts.

- Monetary transactions only are recorded in the accounts.

- Book – keeping is the primary stage in the accounting process.

- Book – keeping includes journalising and ledger processing.

![]()

Question 3.

What are the advantages of book – keeping?

Answer:

The advantages of book-keeping are:

- Transactions are recorded systematically in chronological order in the book of accounts. Thus, book-keeping provides a permanent and reliable record for all business transactions.

- Book – keeping is useful to get the financial information.

- It helps to have control over various business activities.

- Records provided by business serve as a legal evidence in case of any dispute.

- Comparison of financial information of different business units is facilitated.

- Book – keeping is useful to find out the tax liabilities.

Question 4.

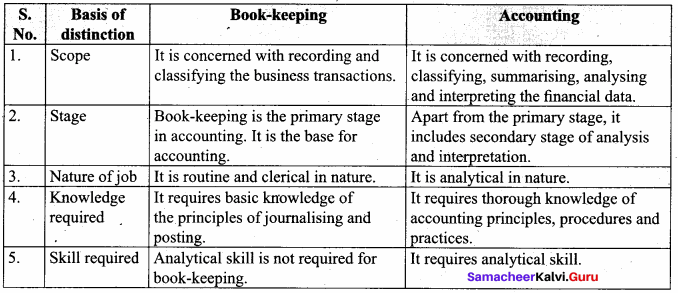

What are the differences between book – keeping and accounting?

Answer: