Students can Download Tamil Nadu 12th Economics Model Question Paper 4 English Medium Pdf, Tamil Nadu 12th Economics Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

TN State Board 12th Economics Model Question Paper 4 English Medium

General Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- All questions of Part I, II, III and IV are to be attempted separately.

- Question numbers 1 to 20 in Part I are Multiple Choice Questions of one mark each.

These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer - Question numbers 21 to 30 in Part II are two-mark questions. These are to be answered in about one or two sentences.

- Question numbers 31 to 40 in Part III are three-mark questions. These are to be answered in above three to five short sentences.

- Question numbers 41 to 47 in Part IV are five-mark questions. These are to be answered in detail Draw diagrams wherever necessary.

Time: 3.00 Hours

Maximum Marks: 90

PART – I

Choose the correct answer. Answer all the questions: [20 × 1 = 20]

Question 1.

Economic system representing equality in distribution is………..

(a) Capitalism

(b) Globalism

(c)Mixedism

(d) Socialism

Answer:

(d) Socialism

Question 2.

Which is the largest figure?

(a) Disposable income

(b) Personal income

(c) NNP

(d) GNP

Answer:

(d) GNP

Question 3.

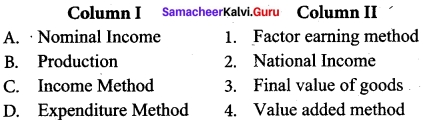

Match the following and choose the correct answer by using codes given below:

Code:

Answer:

(a) A-2, B-4, C-1, D-3

![]()

Question 4.

Classical theory advocates………..

(a) Balanced budget

(b) unbalanced budget

(c) Surplus budget

(d) deficit Budget

Answer:

(a) Balanced budget

Question 5.

Pick the odd one out.

Types of unemployment

(a) Cyclical unemployment

(b) seasonal unemployment

(c) Frictional unemployment

(d) nature unemployment

Answer:

(d) nature unemployment

Question 6.

The term MEC was introduced by

(a) Adam Smith

(b) J.M. Keynes

(c) Ricardo

(d) Malthus

Answer:

(b) J.M. Keynes

Question 7.

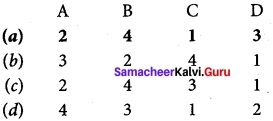

Match the following and choose the answer by using codes given below:

Code:

Answer:

(b) A-2, B-4, C-1, D-3

Question 8.

The RBI Headquarters is located at

(a) Delhi

(b) Chennai

(c) Mumbai

(d) Bengaluru

Answer:

(c) Mumbai

Question 9.

The direct exchange of goods for goods is known as

(a) Money exchange

(b) Money transfer

(c) Barter System

(d) Barter goods

Answer:

(c) Barter System

Question 10.

Monetary policy is formulated by

(a) Co-operative banks

(b) Commercial banks

(c) Central Bank

(d) Foreign banks

Answer:

(c) Central Bank

Question 11.

Assertion (A): Credit creation leads to increase in production.

Reason (R): Credit creation means the multiplication of loans and advances.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

Question 12.

Which of the following is correctly matched:

(a) FDI – Foreign Direct Investment

(b) FOREX – Foreign Export

(c) UDC – Under Development Consumption

(d) MNC – Multi National Country

Answer:

(a) FDI – Foreign Direct Investment

Question 13.

State whether the statement is true or false.

Major Functions of the ASEAN

(i) It fosters co-operations in many areas including agriculture.

(ii) It paves way for market and investment opportunities for the all nations.

(а) Both (i) and (ii) are true

(b) Both (i) and (ii) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(b) Both (i) and (ii) are false

Question 14.

………… is the duty of the state to make provisions for education, social security, social insurance, health and sanitation.

(a) Social Welfare

(b) Infrastructure

(c) Social Justice

(d) Macro Economic Policy

Answer:

(a) Social Welfare

Question 15.

Acid rain is one of the consequences of………….

(a) Water Pollution

(b) Land pollution

(c) Noise pollution

(d) Air pollution

Answer:

(a) Water Pollution

Question 16.

Soil pollution is another form of pollution.

(a) Land

(b) Fertilizer

(c) Chemical

(d) Medicinal

Answer:

(a) Land

![]()

Question 17.

State whether the statement is true or false.

(i) Environmental economics is a different branch of economics that recognizes the value of both the environment and economic activity.

(ii) Environmental Economics involves theoretical and empirical studies of the economic effects.

(a) Both (i) and (ii) are true

(b) Both (i) and (ii) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(a) Both (i) and (ii) are true

Question 18.

Short-term plan is also known as……….

(a) Controlling Plans

(b) De-controlling Plans

(c) Rolling Plans

(d) De-rolling Plans

Answer:

(a) Controlling Plans

Question 19

…………. to central and state governments on policy and programmes.

(a) Internal consultancy

(b) Interface consultancy

(c) Conflict consultancy

(d) Monitoring consultancy

Answer:

(a) Internal consultancy

Question 20.

Econometrics is the integration of

(a) Economics and Statistics

(b) Economics and Mathematics

(c) Economics, Mathematics and Statistics

(d) None of the above

Answer:

(c) Economics, Mathematics and Statistics

PART – II

Answer any seven question in which Question No. 30 is compulsory. [7 x 2 = 14]

Question 21.

Define the term ‘Inflation’.

Answer:

Inflation refers to steady increase in general price level. Estimating the general price level by constructing various price index numbers such as wholesale Price. Index, Consumer Price Index, etc, are needed.

Question 22.

Why is self consumption difficult in measuring national income?

Answer:

Farmers keep a large portion of food and other goods produced on the farm for self consumption. The problem is whether that part of the produce which is not sold in the market can be included in national income or not.

Question 23.

Define “Marginal propensity to consume”.

Answer:

Marginal Propensity to Consume is the additional consumption due to an additional unit of income.

Question 24.

Define Multiplier.

Answer:

The multiplier is defined as the ratio of the change in national income to change in investment. If AI stands for increase in investment and ΔY stands for resultant increase in income, the multiplier K = ΔY/ΔI.

Since ΔY results from AI, the multiplier is called investment multiplier.

Question 25.

What is Stagflation?

Answer:

Stagflation is a combination of stagnant economic growth, high unemployment and high inflation.

Question 26.

Define Central bank.

Answer:

A central bank, reserve bank, or monetary authority is an institution that manages a state’s currency, money supply, and interest rates. Central banks also usually oversee the commercial banking system of their respective countries.

Question 27.

Define RBI Rural credit.

Answer:

Reserve Bank of India and Rural Credit: In a developing economy like India, the Central bank of the country cannot confine itself to the monetary regulation only, and it is expected that it should take part in development function in all sectors especially in the agriculture and industry.

Question 28.

What is Free trade area?

Answer:

A free trade area is the region encompassing a trade bloc whose member countries have signed a free-trade agreement (FTA). Such agreements involve cooperation between at least two countries to reduce trade barriers, e.g. SAFTA, EFTA.

![]()

Question 29.

Write some of the tax revenue sources.

Answer:

Some of the tax revenue sources are

- Income tax

- Corporate tax

- Sales tax

- Surcharge and

- Cess

Question 30.

Mention the countries where per capita carbon dioxide emission is the highest in the world.

Answer:

- United States of America – (USA)

- European Union – (EU)

- Japan

- Russian Federation

- United Arab Emirates (UAE)

- Saudi Arabia

- China

PART- III

Answer any seven question in which Question No. 40 is compulsory. [7 x 3 = 21]

Question 31.

Distinguish between Capitalism and Globalism.

Answer:

| Capitalism | Globalism |

| The system where the means of production are privately owned and market determines the economic activities. | An economic system where the economic activities of a nation are inter connected and inter dependent on each other nation. |

Question 32.

Write a short note on per capita income.

Answer:

Per Capita Income

- The average income of a person of a country in a particular year is called Per Capita Income.

- Per capita income is obtained by dividing national income by population.

Per capita income = \(\frac{National Income}{Population}\)

Question 33.

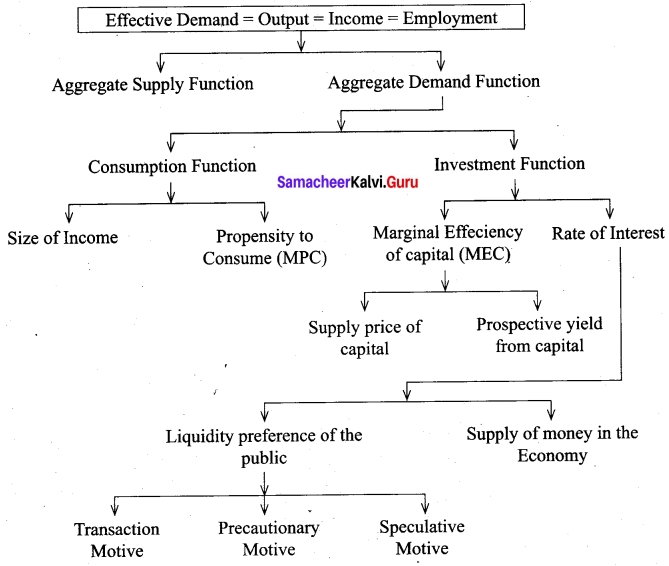

Explain Keynes’ theory in the form of flow chart.

Answer:

Question 34.

Define Accelerator.

Answer:

“The accelerator coefficient is the ratio between induced investment and an initial change in consumption.” Assuming the expenditure of ’50 crores on consumption goods, if industries lead to an investment of 100 crores in investment goods industries, we can say that the accelerator is 2.

Accelerator = \(\frac{100}{Δy}\) = 2

Question 35.

Specify the functions of IFCI.

Answer:

- Long-term loans; both in rupees and foreign currencies.

- Underwriting of equity, preference and debenture issues.

- Subscribing to equity, preference and debenture issues.

- Guaranteeing the deferred payments in respect of machinery imported from abroad or purchased in India; and

- Guaranteeing of loans raised in foreign currency from foreign financial institutions.

Question 36.

What are the ARDC – objectives?

Answer:

Objectives of the ARDO

- To provide necessary funds by way of refinance to eligible institutions such as the Central Land Development Banks, State Co-operative Banks, and Scheduled banks.

- To subscribe to the debentures floated by the Central Land Development banks, State Co-operative Banks, and Scheduled banks, provided they were approved by the RBI.

Question 37.

Define Terms of Trade.

Answer:

Terms of Trade:

- The gains from international trade depend upon the terms of trade which refers to the ratio of export prices to import prices.

- It is the rate at which the goods of one country are exchanged for goods of another country.

- It is expressed as the relation between export prices and import prices.

- Terms of trade improves when average price of exports is higher than average price of imports.

![]()

Question 38.

Write the World Bank’s Lending Procedure?

Answer:

- Loans out of its own fund

- Loans out of borrowed capital and

- Loans through Bank’s guarantee

Question 39.

What are the remedial measures to control noise pollution?

Answer:

Remedial measures to control Noise Pollution

- Use of noise barriers

- Newer roadway for surface transport

- Traffic control

- Regulating times for heavy vehicles

- Installations of noise barriers in the workplace

- Regulation of Loudspeakers

Question 40.

Distinguish between functional and structural planning.

Answer:

| Functional planning | Structural planning |

| Functional planning refers to that planning which seeks to remove economic difficulties by directing all the planning activities within the existing economic and social structure. | The structural planning refers to a good deal of changes in the socio-economic framework of the country. This type of planning is adopted mostly in under developed countries. |

PART – IV

Answer all the questions. [7 x 5 = 35]

Question 41 (a).

Briefly explain the two sector circular flow model.

Answer:

Circular Flow of Income in a Two-Sector Economy:

There are only two sectors namely, household sector and firm sector.

(i) Household Sector:

- The household sector is the sole buyer of goods and services, and the sole supplier of factors of production, i.e., land, labour, capital and organisation.

- It spends its entire income on the purchase of goods and services produced by other business sector.

- The household sector receives income from firm sector by providing the factors of production owned by it.

(ii) Firms:

- The firm sector generates its revenue by selling goods and services to the household sector.

- It hires the factors of production, i.e., land, labour, capital and organisation, owned by the household sector.

- The firm sector sells the entire output to households.

- In a two-sector economy, production and sales are equal and there will be a circular flow of income and goods.

- The outer circle represents real flow (factors and goods) and the inner circle represents the monetary flow (factor prices and commodity prices).

- Real flow indicates the factor services flow from household sector to the business sector, and goods and services flow from business sector to the household.

- The basic identities of the two-sector economy are as under:

Y = C + I

Where

Y is Income; C is Consumption; I is investment.

![]()

[OR]

(b) List out the uses of national income.

Answer:

The following are some of the concepts used in measuring national income.

GDP:

- GDP is the total market value of final goods and services produced within the country during a year.

- This is calculated at market prices and is known as GDP at market prices. Thus GDP by expenditure method at market prices = C + I + G + (X – M)

Where C – Consumption goods, I – Investment goods, G – Government purchases; (X – M) is net export which can be positive or negative.

Net National Product (NNP) (at Market price):

- Net National Product refers to the value of the net output of the economy during the year.

- NNP is obtained by deducting the value of depreciation, or replacement allowance of the capital assets from the GNP. It is expressed as,

NNP = GNP – depreciation allowance.

NNP at Factor cost:

- NNP refers to the market value of output.

- NNP at factor cost is the total of income payment made to factors of production.

Personal Income:

Personal income is the total income received by the individuals of a country from all sources before payment of direct taxes in a year.

Per Capita Income:

- The average income of a person of a country in a particular year is called Per Capita Income.

- Per capita income is obtained by dividing national income by population.

Per capita income = \(\frac{National Income}{Population}\)

Disposable Income:

- Disposable Income is also known as Disposable personal income.

- It is the individuals income after the payment of income tax.

- This is the amount available for households for consumption.

Real Income:

Nominal income is national income expressed in terms of a general price level of a particular year in other words, real income is the buying power of nominal income.

GDP deflator:

- GDP deflator is an index of price changes of goods and services included in GDP.

- It is a price index which is calculated by dividing the nominal GDP in a given year by the real GDP for the same year and multiplying it by 100.

Question 42 (a).

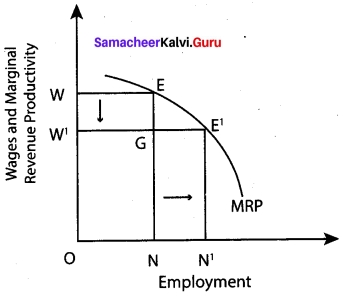

According to classical theory of employment, how wage reduction solves the problem of unemployment? Diagrammatically explain.

Answer:

The classical theory of employment assumes that the economy operates at the level of foil employment without inflation in the long period. It also assumes that wages and prices of goods are flexible and the competitive market exists in the economy (laissez-faire economy). According to the classical theory of employment, foil employment condition can be achieved by cutting down the wage rate. Unemployment would be eliminated when wages are determined by the mechanism of economy itself. The following figure shows the relationship between wage rate and employment:

In the figure, when the wage rate is OW, then the employment is ON. As the wage rate is reduced to OW1 then the employment has increased to ON1 Prof. Pigou has taken this theory as base for developing the solution of unemployment problem.

[OR]

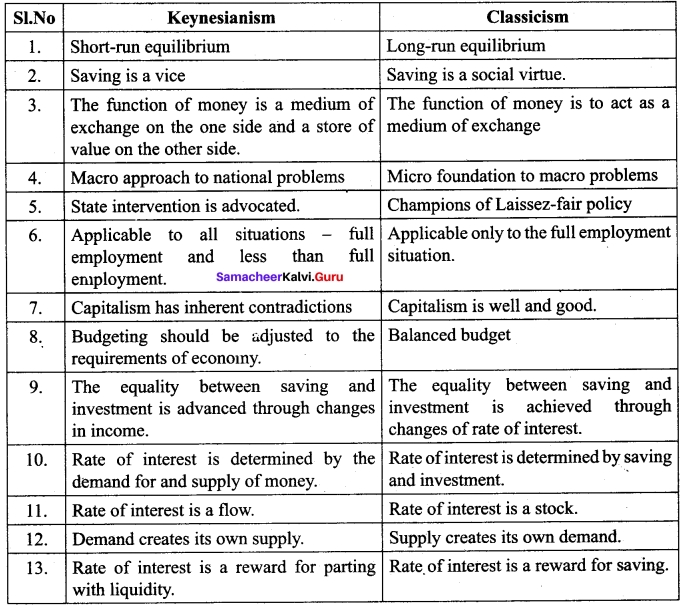

(b) Explain the differences between classical theory and Keynes theory.

Answer:

Question 43 (a).

Explain the operation of the Accelerator.

Answer:

Operation of the Acceleration Principle

- Let us consider a simple example. The operation of the accelerator may be illustrated as follows.

- Let us suppose that in order to produce 1000 consumer goods, 100 machines are required.

- Also suppose that working life of a machine is 10 years.

- This means that every year 10 machines have to be replaced in order to maintain the constant flow of 1000 consumer goods. This might be called replacement demand.

- Suppose that demand for consumer goods rises by 10 percent (i.e. from 1000 to 1100).

- This results in increase in demand for 10 more machines.

- So that total demand for machines is 20. (10 for replacement and 10 for meeting increased demand).

- It may be noted here a 10 percent increase in demand for consumer goods causes a-100 percent increase in demand for machines (from 10 to 20).

- So we can conclude even a mild change in demand for consumer goods will lead to wide change in investment.

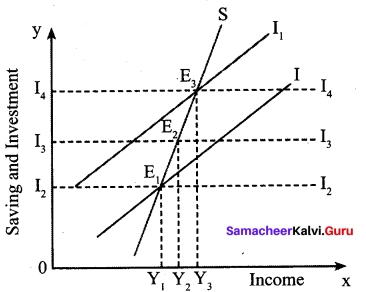

Diagrammatic illustration:

Operation of Accelerator.

- SS is the saving curve. II is the investment curve. At point E1 the economy is in equilibrium with OY1, income. Saving and investment are equal at OL2. Now, investment is increased from OI2 to OI4.

- This increases income from OY1 to OY3, the equilibrium point being E3 If the increase in investment by I2, I4 is purely exogenous, then the increase in income by Y1, Y3 would have been due to the multiplier effect.

- But in this diagram it is assumed that exogenous investment is only by I213 and induced investment is by I314.

- Therefore, increase in income by Y1Y2 is due to the multiplier effect and the increase in income by Y2 Y3 is due to the accelerator effect.

![]()

[OR]

(b) Briefly explain the Leakages of Multiplier.

Answer:

Leakages of multiplier:

- The multiplier assumes that those who earn income are likely to spend a proportion of their additional income on consumption.

- But in practice, people tend to spend their additional income on other items. Such expenses are known as leakages.

Payment towards past debts:

If a portion of the additional income is used for repayment of old loan, the MPC is reduced and as a result the value of multiplier is cut.

Purchase of existing wealth:

- If income is used in purchase of existing wealth such as land, building and shares money is circulated among people and never enters into the consumption stream.

- As a result the value of multiplier is affected.

Import of goods and services:

- Income spent on imports of goods or services flows out of the country and has little chance to return to income stream in the country.

- Thus imports reduce the value of multiplier.

Non availability of consumer goods:

- The multiplier theory assumes instantaneous supply of consumer goods following demand.

- But there is often a time lag.

- During this gap (D > S) inflation is likely to rise.

- This reduces the consumption expenditure and there by multiplier value.

Full employment situation:

- Under conditions of full employment, resources are almost fully employed.

- So, additional investment will lead to inflation only, rather than generation of additional real income.

Question 44 (a).

Illustrate Fisher’s Quantity theory of money.

Answer:

Fisher’s Quantity Theory of Money: The quantity theory of money is a very old theory. It was first propounded in 1588 by an Italian economist, Davanzatti. But, the credit for popularizing this theory in recent years rightly belongs to the well-known American economist, Irving Fisher who published his book, ‘The Purchasing Power of Money” in 1911. He gave it a quantitative form in terms of his famous “Equation of Exchange”.

The general form of equation given by Fisher is

MV = PT

1. Fisher points out that in a country during any given period of time, the total quantity of money (MV) will be equal to the total value of all goods and services bought and sold (PT).

MV = PT

Supply of Money = Demand for Money.

2. This equation is referred to as “Cash Transaction Equation”.

Where M = Money Supply/quantity of Money

V = Velocity of Money

P = Price level

T = Volume of Transaction.

It is expressed as P = MV / T which implies that the quantity of money determines the price level and the price level in its turn varies directly with the quantity of money, provided ‘V’ and ‘T’ remain constant.

4. According to Marshall, peoples desire to hold money (the coefficient, K) is more powerful in determination of money, rather than quantity of money (M). So, peoples desire to hold money is a determinant of value of money.

5. The above equation considers only currency money. But, in a modem economy, bank’s demand deposits or credit money and its velocity play a vital part in business. Therefore, Fisher extended his original equation of exchange to include bank deposits Mj and its velocity Vr The revised equation was:

PT = MV + M1V1

P = \(\frac{MV + M1V1}{T}\)

6. From the revised equation, it is evident, that the price level is determined by (a) the quantity of money in circulation ‘M’ (b) the velocity of circulation of money ‘V’ (c) the volume of bank credit money M1, (d) the velocity of circulation of credit money V1, and the volume of trade (T)

Quantity of Money:

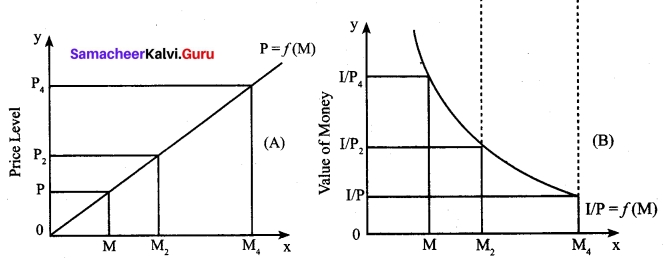

1. Figure (A) shows the effect of changes in the quantity of money on the price level. When the quantity of money is OM, the price level is OP. When the quantity of money is doubled to 0M2, the price level is also doubled to 0P2. Further, when the quantity of money is increased four-fold to 0M4, the price level also increases by four times to 0P4. This relationship is expressed by the curve OP =/(M) from the origin at 45°.

2. Figure (B), shows the inverse relation between the quantity of money and the value of money, where the value of money is taken on the vertical axis. When the quantity of money is 0M1 the value of money is 01 / Pr But with the doubling of the quantity of money to 0M2, the value of money becomes one-half of what it was before, (01 / P2). But, with the quantity of money increasing by four-fold to 0M4, the value of money is reduced by 01 / P4. This inverse relationship between the quantity of money and the value of money is shown by downward sloping curve 1 / 0P = f(M).

![]()

[OR]

(b) Explain the Measures of control inflation.

Answer:

Measures to Control Inflation:

Keynes and Milton Friedman together suggested three measures to prevent and control of inflation.

- Monetary measures,

- Fiscal measures (J.M. Keynes) and (in) Other measures.

1. Monetary Measures:

These measures are adopted by the Central Bank of the country. They are

- Increase in Bank rate

- Sale of Government Securities in the Open Market

- Higher Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR)

- Consumer Credit Control and

- Higher margin requirements

- Higher Repo Rate and Reverse Repo Rate.

2. Fiscal Measures:

- Fiscal policy is now recognized as an important instrument to tackle an inflationary situation.

- The major anti-inflationary fiscal measures are the following: Reduction of Government Expenditure and Public Borrowing and Enhancing taxation.

3. Other Measures:

These measures can be divided broadly into short-term and long-term measures.

(a) Short-term measures can be in regard to public distribution of scarce essential commodities through fair price shops (Rationing). In India whenever shortage of basic goods has been felt, the government has resorted to import so that inflation may not get triggered.

(b) Long-term measures will require accelerating economic growth especially of the wage goods which have a direct bearing on the general price and the cost of living. Some restrictions on present consumption may help in improving saving and investment which may be necessary for accelerating the rate of economic growth in the long run.

Question 45 (a).

Explain the types of exchange rate systems and types of exchange rates?

Answer:

Types of Exchange Rate Systems

Broadly, there are two major exchange rate systems, namely,

(1) fixed (or pegged) exchange rate system and

(2) flexible (or floating) exchange rate system. Managed Floating Exchange Rate system also prevails in some countries (like India).

1. Fixed Exchange Rates

Countries following the fixed exchange rate (also known as stable exchange rate and pegged exchange rate) system agree to keep their currencies at a fixed rate as determined by the Government. Under the gold standard, the value of currencies was fixed in terms of gold.

2. Flexible Exchange Rates

Under the flexible exchange rate (also known as floating exchange rate) system, exchange rates are freely determined in an open market by market forces of demand and supply.

Types of Exchange Rates

Exchange rates are also in the form of (a) Nominal exchange rate (b) Real exchange rate (c) Nominal Effective Exchange Rate (NEER) and (d) Real Effective Exchange Rate (REER)

If 1 US Dollar = Rs 75,

Nominal exchange rate = 75/1 =75.

This is the bilateral nominal exchange rate. ePf

Real Exchange rate = \(\frac{eP_f}{P}\)

P = Price levels in India

Pf = Price levels in abroad (say US)

e = nominal exchange rate.

If a pen costs Rs 50 in India and it costs 5

USD in the US,

Real Exchange Rate = \(\frac{75×5}{50}\) = 7.5

If real exchange rate is equal to 1, the currencies are at purchasing power parity.

It the price of the pen in US is 0.66 USD,

then the real exchange rate = \(\frac{0.66×75}{50}\)

then it could be said that the USD and Indian rupee are at purchasing power parity.

NEER and REER are not explained here.

Interested students and teachers can search for them.

![]()

[OR]

(b) Bring out the objectives of IBRD.

Answer:

Objectives of World Bank

- Reconstruction and Development

- Encouragement to Capital Investment

- Encouragement to International Trade

- Establishment of Peace-time Economy

- Environmental Protection

The following are the objectives of the World Bank:

- To help member countries for economic reconstruction and development.

- To stimulate long-run capital investment for restoring Balance of Payments (BoP) equilibrium and thereby ensure balanced development of international trade among the member nations.

- To provide guarantees for loans meant for infrastructural and industrial projects of member nations.

- To help war ravaged economies transform into peace economies.

- To supplement foreign private investment by direct loans out of its own funds for productive purposes.

Question 46 (a).

Describe canons of Taxation.

Answer:

According to Adam Smith, there are four canons or maxims of taxation. They are as follows: Canons of Taxation:

- Economical

- Equitable

- Convenient

- Certain

- (Efficient and Flexible)

1. Canon of Ability:

- The Government should impose tax in such a way that the people have to pay taxes according to their ability.

- In such case a rich person should pay more tax compared to a middle class person or a poor person.

2. Canon of Certainty:

- The Government must ensure that there is no uncertainty regarding the rate of tax or the time of payment.

- If the Government collects taxes arbitrarily, then these will adversely affect the efficiency of the people and their working ability too.

3. Canon of Convenience:

- The method of tax collection and the timing of the tax payment should suit the convenience of the people.

- The Government should make convenient arrangement for all the tax payers to pay the taxes without difficulty.

4. Canon of Economy:

- The Government has to spend money for collecting taxes, for example, salaries are given to the persons who are responsible for collecting taxes.

- The taxes, where collection costs are more are considered as bad taxes.

- Hence, according to Smith, the Government should impose only those taxes whose collection costs are very less and cheap.

[OR]

(b) Specify the meaning of material balance principle.

Answer:

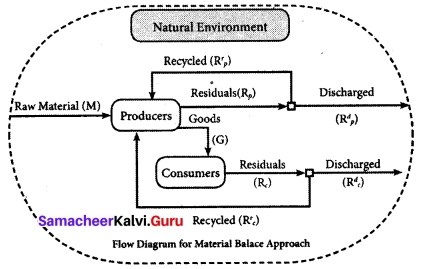

The relationship between the economy and the environment is generally explained in the form of a “Material Balance Model” developed by AlenKneese and R.V. Ayres.

The model considers the total economic process as a physically balanced flow between inputs and outputs.

Inputs are bestowed with physical property of energy which is received from the environment.

The interdependence of economics and environment.

The first law of thermodynamics, i.e. the law of conservation of matter and energy, emphasizes that in any production system “what goes in must come out”. This is known as the Material Balance Approach or Material Balance Principle.

Moreover, all resources extracted from the environment eventually become unwanted wastes and pollutants. Production of output by firms from inputs resulting in discharge of solid, liquid and gaseous wastes. Similarly, waste results from consumption activities by households. In its simple form the Material Balance Approach can be put in form equation.

![]()

Question 47 (a).

Elucidate major causes of vicious circle of poverty with diagram.

Answer:

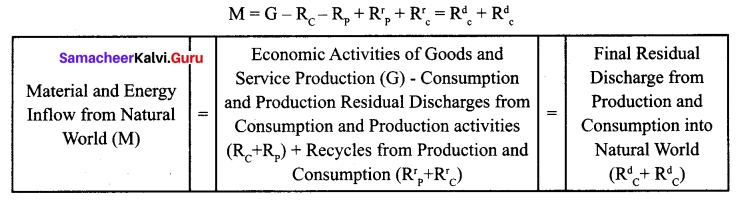

- There are circular relationships known as the ‘vicious circles of poverty’ that tend to perpetuate the low level of development in Less Developed Countries (LDCs).

- Nurkse explains the idea in these words: “It implies a circular constellation of forces tending to act and react upon one another in such a way as to keep a poor country in a state of poverty.

- For example, a poor man may not have enough to eat; being underfed, his health may be weak; being physically weak, his working capacity is low, which means that he is poor, which in turn means that he will not have enough to eat and so on.

- A situation of this sort relating to a country as a whole can be summed up in the proposition: “A county is poor because the country is poor”.

- The vicious circle of poverty operates both on the demand side and the supply side.

- On the supply side, the low level of real income means low savings.

- The low level of saving leads to low investment and to deficiency of capital.

- The deficiency of capital, in turn, leads to low levels of productivity and back to low income. Thus the vicious circle is complete from the supply side.

- The demand-side of the vicious circle is that the low level of real income leads to a low level of demand which, in turn, leads to a low rate of investment and hence back to deficiency of capital, low productivity and low income.

[OR]

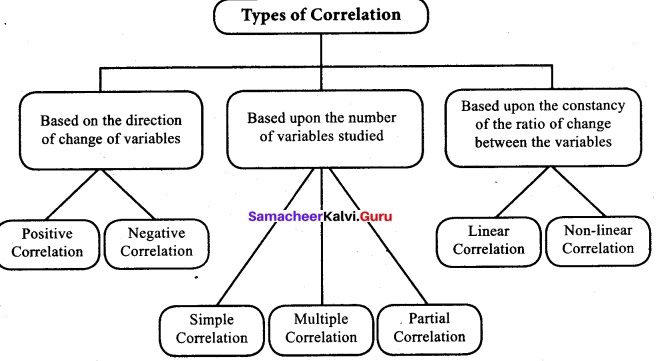

(b) State and explain the different kinds of Correlation.

Answer:

Type I: Based on the direction of change of variables

- Correlation is classified into two types as Positive correlation and Negative Correlation based on the direction of change of the variables.

- Positive Correlation: The correlation is said to be positive if the values of two variables move in the same direction.

Ex 1: If income and Expenditure of a Household may be increasing or decreasing simultaneously. If so, there is positive correlation. Ex. Y = a + bx

Negative Correlation: The Correlation is said to be negative when the values of variables move in the opposite directions. Ex. Y = a – bx

Ex 1: Price and demand for a commodity move in the opposite direction.

Type II: Based upon the number of variables studied

There are three types based upon the number of variables studied as

(a) Simple Correlation

(b) Multiple Correlation

(c) Partial Correlation

Simple Correlation: If only two variables are taken for study then it is said to be simple correlation. Ex. Y = a + bx

Multiple Correlations: If three or more than three variables are studied simultaneously, then it is termed as multiple correlation.

Ex: Determinants of Quantity demanded

Qd = f(P, Pc, Ps, t, y)

Where Qd stands for Quantity demanded,/stands for function.

P is the price of the goods,

Pc is the price of competitive goods

Ps is the price of substituting goods

t is the taste and preference

y is the income.

Partial Correlation: If there are more than two variables but only two variables are considered keeping the other variables constant, then the correlation is said to be Partial Correlation.

Type III: Based upon the constancy of the ratio of change between the variables

Correlation is divided into two types as linear correlation and Non-Linear, correlation based upon the Constancy of the ratio of change between the variables.

Linear Correlation: Correlation is said to be linear when the amount of change in one variable tends to bear a constant ratio to the amount of change in the other.

Ex. Y = a + bx

Non Linear: The correlation would be non-linear if the amount of change in one variable does not bear a constant ratio to the amount of change in the other variables.

Ex. Y = a + bx²

![]()