Students can Download Tamil Nadu 12th Economics Model Question Paper 2 English Medium Pdf, Tamil Nadu 12th Economics Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

TN State Board 12th Economics Model Question Paper 2 English Medium

General Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- All questions of Part I, II, III and IV are to be attempted separately.

- Question numbers 1 to 20 in Part I are Multiple Choice Questions of one mark each.

These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer - Question numbers 21 to 30 in Part II are two-mark questions. These are to be answered in about one or two sentences.

- Question numbers 31 to 40 in Part III are three-mark questions. These are to be answered in above three to five short sentences.

- Question numbers 41 to 47 in Part IV are five-mark questions. These are to be answered in detail Draw diagrams wherever necessary.

Time: 3.00 Hours

Maximum Marks: 90

PART – I

Choose the correct answer. Answer all the questions: [20 × 1 = 20]

Question 1.

The Circular Flow Model that represents an open Economy.

(a) Two Sector Model

(b) Three Sector Model

(c) Four Sector Model

(d) All the above

Answer:

(c) Four Sector Model

Question 2.

Pick the odd one out……….

(a) Rapid Economic growth

(b) Balanced Economic growth

(c) Economic Equality

(d) Inefficiency

Answer:

(d) Inefficiency

Question 3.

Write the Four Sector Model of National Income?

(a) Y = C + I + G + (X – M)

(b) Y = C + I + G + X

(c) Y = C +1 + G + M

(d) Y = C + I + G(M – X)

Answer:

(a) Y = C + I + G + (X – M)

![]()

Question 4.

Which of the following is correctly matched?

(a) PQLI – Physical Quantity of Life Index

(b) PQLI – Personal Quantity of Life Index

(c) PQLI – Personal Quality of Life Index

(d) PQLI – Physical Quality of Life Index

Answer:

(d) PQLI – Physical Quality of Life Index

Question 5.

Say’s law stressed the operation of in the economy.

(a) Induced price mechanism

(b) Automatic price mechanism

(c) Induced demand

(d) Induced investment

Answer:

(b) Automatic price mechanism

Question 6.

Which of the following is correctly matched?

(a) Seasonal unemployment – Type of unemployment

(b) Technical unemployment – Some season only

(c) Cyclical unemployment – Public capital

(d) Full employment – Not willing to job

Answer:

(a) Seasonal unemployment – Type of unemployment

Question 7.

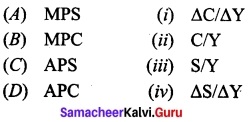

Match the following and choose the correct answer by using codes given below

Codes:

(a) A (iv) B (i) C (iii) D (ii)

(b) A (i) B (ii) C (iv) D (iii)

(c) A (ii) B (iii) C (i) D (iv)

(d) A (iii) B (iv) C(ii) D (i)

Answer:

(a) A (iv) B (i) C (iii) D (ii)

Question 8.

Which of the following is not correctly matched?

(a) Inflation – Rise in price

(b) Deflation – Fall in price

(c) Hyper Inflation – India

(d) Hyper deflation – Phases of Trade cycle

Answer:

(d) Hyper deflation – Phases of Trade cycle

Question 9.

2016 Demonetization of currency includes denominations of……….

(a) Rs 500 and Rs 1000

(b) Rs 1000 and Rs 2000

(c) Rs 200 and Rs 500

(d) All the above

Answer:

(a) Rs 500 and Rs 1000

Question 10.

To promote ………….. stability is one of the aims of IMF.

(a) Exchange

(b) Money

(c) Investment

(d) Finance

Answer:

(a) Exchange

Question 11.

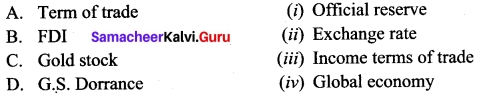

Match the following and choose the correct answer by using codes given below.

Codes:

(a) A (1) B (ii) C (iii) D (iv)

(b) A (iv) B (iii) C (ii) D (i)

(c) A (ii) B (iv) C (i) D (iii)

(d) A (iii) B (i) C (iv) D (ii)

Answer:

(c) A (ii) B (iv) C (i) D (iii)

Question 12.

BENELUX is a form of

(a) Free trade area

(b) Economic Union

(c) Common market

(d) Customs union

Answer:

(d) Customs union

Question 13.

Which is the following is correctly matched:

(a) ITO – 1944

(b) World bank – 1946

(c) WTO – 1947

(d) IMF – 1995

Answer:

(a) ITO – 1944

Question 14.

Which one of the following deficits does not consider borrowing as a receipt?

(a) Revenue deficit

(b) Budgetary deficit

(c) Fiscal deficit

(d) Primary deficit

Answer:

(c) Fiscal deficit

Question 15.

Match the following and choose the correct answer by using codes given below.

Codes:

(a) A (i) B (ii) C (iii) D (iv)

(b) A (iii) B (iv) C (ii) D (i)

(c) A (ii) B (i) C (iv) D (iii)

(d) A (iv) B (iii) C (i) D (ii)

Answer:

(a) A (i) B (ii) C (iii) D (iv)

Question 16.

Alkali soils are predominantly located in the plains.

(a) Indus-Ganga

(b) North-Indian

(c) Gangetic plains

(d) All the above

Answer:

(d) All the above

![]()

Question 17.

Environmental externalities are called:

(a) Externality

(b) Economic externalities

(c) Negative externalities

(d) Positive externalities

Answer:

(d) Positive externalities

Question 18.

Assertion (A): Soil pollution is another form of water pollution.

Reason (R): The upper layer of the soil is damaged is caused by the over use of chemical fertilizers and pesticides.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(d) ‘A’ is false but ‘R’ is true

Question 19.

Which is the following is correctly matched:

(a) NITI Aayog – Union cabinet resolution

(b) Financial planning – Controlling plans

(c) Short term plans – Technique planning

(d) Indicative planning – Capitalist economy

Answer:

(a) NITI Aayog – Union cabinet resolution

Question 20.

The term regression was used by

(a) Newton

(b) Pearson

(c) Spearman

(d) Galton

Answer:

(d) Galton

PART – II

Answer any seven question in which Question No. 30 is compulsory. [7 × 2 = 14]

Question 21.

‘Circular Flow of Income’ – Define.

Answer:

- The circular flow of income is a model of an economy showing connections between different sectors of an economy.

- It shows flows of income, goods and services and factors of production between economic agents such as firms, households, government and nations.

- The circular flow analysis is the basis of national accounts and macroeconomics.

Question 22.

Define “Social and Environmental Cost”.

Answer:

Social and Environmental Cost: while producing economic goods, many environmental and social bads are also generated. Hence, they also must be considered while enumerating National income.

Question 23.

Write the types of unemployment.

Types of unemployment:

- Cyclical Unemployment

- Seasonal Unemployment

- Frictional Unemployment

- Educated Unemployment

- Technical Unemployment

- Structural Unemployment

- Disguised Unemployment

![]()

Question 24.

Define “Autonomous consumption”.

Answer:

Autonomous Consumption:

Autonomous consumption is the minimum level of consumption or spending that must take place even if a consumer has no disposable income, such as spending for basic necessities.

Question 25.

Mention the functions of agriculture credit department.

Answer:

Functions of Agriculture Credit Department :

- To maintain an expert staff to study all questions on agricultural credit;

- To provide expert advice to Central and State Government, State Co-operative Banks and other banking activities.

- To finance the rural sector through eligible institutions engaged in the business of agricultural credit and to co-ordinate their activities.

Question 26.

What are the functions of primary deposits?

Answer:

Primary Deposits:

- It is out of these primary deposits that the bank makes loans and advances to its customers.

- The initiative is taken by the customers themselves. In this case, the role of the bank is passive.

- So these deposits are also called “Passive deposits”.

Question 27.

What is Free trade area?

Answer:

A free trade area is the region encompassing a trade bloc whose member countries have signed a free-trade agreement (FTA). Such agreements involve cooperation between at least two countries to reduce trade barriers, e.g. SAFTA, EFTA.

Question 28.

What is “AoA”?

Answer:

AoA means Agreement on Agriculture. Agriculture was included for the first time under GATT. The important aspects of the agreement are Tariffication, Tariff cuts and Subsidy reduction.

Question 29.

Define “Public debt”.

Answer:

The debt is the form of promises by the Treasury to pay to the holders of these promises a principal sum and in most instances interest on the principal. Borrowing is resorted to in order to provide funds for financing a current deficit. – J. Philip E. Taylor

Question 30.

State the meaning of Environmental Economics.

Answer:

Environmental Economics is an area of economics that studies the financial impact of environmental issues and policies.

PART – III

Answer any seven question in which Question No. 40 is compulsory. [7 × 3 = 21]

Question 31.

State the importance of Macro Economics.

Answer:

The importance and the need for introducing a macro outlook of an economy are given below:

- There is a need to understand the functioning of the economy at the aggregate level to evolve suitable strategies and to solve the basic problems prevailing in an economy.

- Understanding the future problems, needs and challenges of an economy as a whole is important to evolve precautionary measures.

- Macro economics provides ample opportunities to use scientific investigation to understand the reality.

- Macro economics helps to make meaningful comparison and analysis of economic indicators.

- Macro economics helps for better prediction about future and to formulate suitable policies to avoid economic crises, for which Nobel Prize in Economic Sciences is awarded.

Question 32.

Discuss the limitations of Macro Economics.

Answer:

Macro economics suffers from certain limitations. They are:

- There is a danger of excessive generalisation of the economy as a whole.

- It assumes homogeneity among the individual units.

- There is a fallacy of composition. What is good of an individual need not be good for nation and vice versa. And, what is good for a country is not good for another country and at another time.

- Many non-economic factors determine economic activities; but they do not find place in the usual macroeconomic books.

![]()

Question 33.

Describe the features of classicism.

Answer:

- Long-run equilibrium

- Saving is a social virtue.

- The function of money is to act as a medium of exchange

- Micro foundation to macro problems

- Champions of Laissez-fair policy

- Applicable only to the full employment situation.

- Capitalism is well and good.

- Balanced budget

- The equality between saving and investment is achieved through changes of rate of interest.

- Rate of interest is determined by saving and investment.

- Rate of interest is a stock.

- Supply creates its own demand.

- Rate of interest is a reward for saving.

Question 34.

Explain the Deflation.

Answer:

Deflation:

The essential feature of deflation is falling prices, reduced money supply and unemployment. Though falling prices are desirable at the time of inflation, such a fall should not lead to the fall in the level of production and employment. But if prices fall from the level of full employment both income and employment will be adversely affected.

Question 35.

Write the mechanism of credit creation by commercial banks.

Answer:

Mechanism / Technique of Credit Creation by Commercial Banks :

- Bank credit refers to bank loans and advances.

- Money is said to be created when the banks, through their lending activities, make a net addition to the total supply of money in the economy.

- Money is said to be destroyed when the loans are repaid by the borrowers to the banks and consequently the credit already created by the banks is wiped out in the process.

- Banks have the power to expand or contract demand deposits and they exercise this power through granting more or less loans and advances and acquiring other assets.

- This power of commercial bank to create deposits through expanding their loans and advances is known as credit creation.

Question 36.

Mention the various forms of economic integration.

Answer:

An economic union is composed of a common market with a customs union. The participant countries have both common policies on product regulation, freedom of movement of goods, services and the factors of production and a common external trade policy. (e.g. European Economic Union)

EU > CM > CU > FTA

EU – Economic Union >

CM – Common-Market >

CU – Customs Union >

FTA – Free Trade Area

The regional economic integration among the trade blocks such as SAARC (South Asian nations), ASEAN (South East Asia) and BRICS and their achievements.

Question 37.

Mention any three similarities between public finance and private finance.

Answer:

Similarities:

1. Rationality:

- Both public finance and private finance are based on rationality.

- Maximization of welfare and least cost factor combination underlie both.

2. Limit to borrowing:

- Both have to apply restraint with regard to borrowing.

- The Government also cannot live beyond its meAnswer:

- There is a limit to deficit financing by the state also.

3. Resource utilisation:

- Both the private and public sectors have limited resources at their disposal.

- So both attempt to make optimum use of resources.

Question 38.

Write the Determinants of Investment Function?

Answer:

The classical economists believed that investment depended exclusively on rate of interest. In reality investment decisions depends on a number of factors. They are as follows:

However, Keynes contended that business expectations and profits are more important in deciding investment. He also pointed out that investment depends on MEC (Marginal Efficiency of Capital) and rate of interest.

(i) Private investment is an increase in the capital stock such as buying a factory or machine.

(ii) The marginal efficiency of capital (MEC) states the rate of return on an investment project. Specifically, it refers to the annual percentage yield (output) earned by the last additional unit of capital.

![]()

Question 39.

Explain the disadvantages of FDI.

Answer:

The following criticisms are leveled against foreign direct investment.

- Private foreign capital tends to flow to the high profit areas rather than to the priority sectors.

- The technologies brought in by the foreign investor may not be appropriate to the consumption needs, size of the domestic market, resource avilabilities, stage of development of the economy, etc.

- Foreign investment, sometimes, have unfavourable effect on the the Balance of Payments of a country because when the drain of foreign exchange by way of royalty, dividend, etc. is more than the investment made by the foreign concerns.

- Foreign capital sometimes interferes in the national politics.

- Foreign investors sometimes engage in unfair and unethical trade practices.

- Foreign investment in some cases leads to the destruction or weakening of small and medium enterprises.

- Sometimes foreign investment can result in the dangerous situation of minimizing / eliminating competition and the creation of monopolies or oligopolistic structures.

- Often, there are several costs associated with encouraging foreign investment.

Question 40.

Mention the sources of revenue municipalities.

Answer:

- Taxes on property.

- Taxes on goods, particularly octroi and terminal tax.

- Personal taxes, taxes on profession, trades and employment.

- Taxes on vehicles and animals.

- Theatre or show tax, and

- Graints – in – aid from State Government.

PART – IV

Answer all the questions. [7 × 5 = 35]

Question 41 (a).

Discuss the scope of Macro Economics.

Answer:

The study of macro economics has wide scope and it covers the major areas as follows:

1. National Income: Measurement of national income and its composition by sectors are the basic aspects of macroeconomic analysis. The trends in National Income and its composition provide a long term understanding of the growth process of an economy.

2. Inflation: It refers to steady increase in general price level. Estimating the general price level by constructing various price index numbers such as Wholesale Price Index, Consumer Price Index, etc, are needed.

3. Business Cycle: Almost all economies face the problem of business fluctuations and business cycle. The cyclical movements (boom, recession, depression and recovery) in the economy need to be carefully studied based on aggregate economic variables.

4. Poverty and Unemployment: The major problems of most resource – rich nations are poverty and unemployment. This is one of the economic paradoxes. A clear understanding about the magnitude of poverty and unemployment facilitates allocation of resources and initiating corrective measures.

5. Economic Growth: The growth and development of an economy and the factors determining them could be understood only through macro analysis.

6. Economic Policies: Macro Economics is significant for evolving suitable economic policies. Economic policies are necessary to solve the basic problems, to overcome the obstacles and to achieve growth.

![]()

[OR]

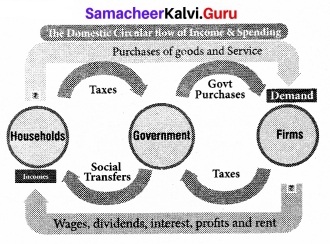

(b) Briefly explain circular flow of Income in a Three Sector Economy.

Answer:

Circular Flow of Income in a Three-Sector Economy:

- In addition to household and firms, inclusion of the government sector makes this model a three-sector model.

- The government levies taxes on households and firms, purchases goods and services from firms, and receive factors of production from household sector.

- On the other hand, the government also makes social transfers such as pension, relief, subsidies to the households.

- Similarly, Government pays the firms for the purchases of goods and services. The Flow Chart illustrates three-sector economy model:

- Under three sector model, national income (Y) is obtained by adding Consumption expenditure (C), Investment expenditure (I) and Government expenditure (G).

- Therefore:

Y = C + I + G.

Question 42 (a).

Explain the importance of national income.

Answer:

Importance of National Income Analysis:

National income is of great importance for the economy of a country. Nowadays the national income is regarded as accounts of the economy, which are known as social accounts. It enables us-

1. To know the relative importance of the various sectors of the economy and their contribution towards national income; from the calculation of national income, we could find how income is produced, how it is distributed, how much is spent, saved or taxed.

2. To formulate the national policies such as monetary policy, fiscal policy and other policies; the proper measures can be adopted to bring the economy to the right path with the help of collecting national income data.

3. To formulate planning and evaluate plan progress; it is essential that the data pertaining to a country’s gross income, output, saving and consumption from different sources should be available for economic planning.

4. To build economic models both in short – run and long – run.

5. To make international comparison, inter – regional comparison and inter – temporal comparison of growth of the economy during different periods.

6. To know a country’s per capita income which reflects the economic welfare of the country (Provided income is equally distributed)

7. To know the distribution of income for various factors of production in the country.

8. To arrive at many macro economic variables namely, Tax – GDP ratio, Current Account Deficit – GDP ratio, Fiscal Deficit – GDP ratio, Debt – GDP ratio etc.

[OR]

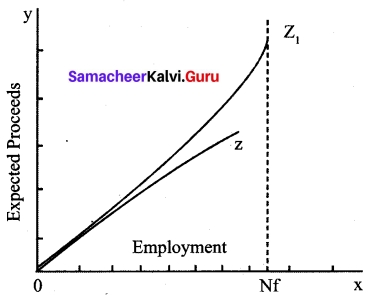

(b) Explain about aggregate supply with the help of diagram.

Answer:

- Aggregate supply function is an increasing function of the level of employment.

- Aggregate supply refers to the value of total output of goods and services produced in an economy in a year.

- In other words, aggregate supply is equal to the value of national product, i.e., national income.

- Aggregate Supply = C + S + T + Rf = Aggregate income generated in the economy.

- The following figure shows the shape of the two aggregate supply curves drawn for the assumption of fixed money wages and variable wages.

AGGREGATE SUPPLY CURVE:

- Z curve is linear where money wages remains fixed; Z1 curve is non – linear since wage rate increases with employment.

- When full employment level of Nf is reached it is impossible to increase output by employing more men.

- So aggregate supply curve becomes inelastic (Vertical straight line).

- The slope of the aggregate supply curve depends on the relation between the employment and productivity.

- Based upon this relation, the aggregate supply curve can be expected to slope upwards.

- In reality the aggregate supply curve will be like Z1.

- Therefore, the aggregate supply depends on the relationship between price and wages.

![]()

Question 43 (a).

Describe the Say’s Law of Market.

Answer:

- Say’s law of markets is the core of the classical theory of employment.

- J.B.Say (1776 – 1832) was a French Economist and an industrialist.

- He was influenced by the writings of Adam Smith and David Ricardo.

- J.B. Say enunciated the proposition that “Supply creates its own demand”.

- Hence there cannot be general over production or the problem of unemployment in the economy.

- According to Say, “When goods are produced by firms in the economy, they pay reward to the factors of production.

- The households after receiving rewards of the factors of production spend the amount on the purchase of goods and services produced by them.

- Therefore, each product produced in the economy creates demand equal to its value in the market.

- In short, this classical theory explains that “A person receives his income from production which is spent on the purchase of goods and services produced by others.

- For the economy as a whole, therefore, total production equals total income”.

[OR]

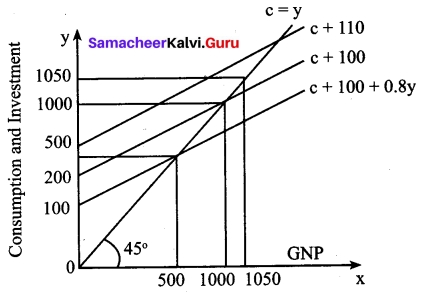

(b) Explain Marginal Propensity to Consume [MPC] and Multiplier with diagram and Diagrammatic explanation.

Answer:

Marginal propensity to consume and multiplier:

The propensity to consume refers to the portion of income spent on consumption.

The MPC refers to the relation between change in consumption (C) and change in income (Y).

Symbolically MPC = AC/AY The value of multiplier depends on MPC

Multiplier (K)= 1/1-MPC The multiplier is the reciprocal of one minus marginal propensity to consume.

Since marginal propensity to save is 1 – MPC. (MPC + MPS = 1). Multiplier is 1/ MPS. The multiplier is therefore defined as reciprocal of MPS.

Multiplier is inversely related to MPS and directly with MPC.

Numerically if MPC is 0.75, MPS is 0.25 and k is 4.

Using formula k = 1/1 – MPC

1/1 – 0.75 = 1/0.25 = 4

Taking the following values, we can explain the functioning of multiplier.

| MPC | MPS | K |

| 0.00 | 1.00 | 1 |

| 0.10 | 0.90 | 1.11 |

| 0.50 | 0.50 | 2.00 |

| 0.75 | 0.25 | 4.00 |

| 0.90 | 0.10 | 10.00 |

| 1.00 | 0.00 | α |

C = 100 + 0.8 y;

I = 10

Y = C + I

Y= 100 + 0.8y + 100

0. 2y = 200

Y= 1000

Here, C = 100 + 0.8y = 100 + (1000) = 900;

S= 100 = I

After I is raised by 10, now I = 110,

Y = 100 + 0.8y + 110

0. 2y = 210

y = \(\frac{210}{0.2}\) = 1050

Here C = 100 = 0.8 (1050) = 940; S = 110 = I

Diagrammatic Explanation.

At 45° line y = C + S

It implies the variables in axis and axis are equal.

The MPC is assumed to be at 0.8 (C = 100 + 0.8y)

The aggregate demand (C +1) curve intersects 45° line at point E.

The original national income is 500.

(C = 100 + 0.8y = 100 + 0.8 (500) = 500) ,

When I is 100, y = 1000, C = 900;

S = 100 = I

The new aggregate demand curve is C + F = 100 + 0.8y + 100 + 10

y = \(\frac{210}{0.2}\) = 1050

S = 110 = I

![]()

Question 44 (a).

Write the types of inflation.

Answer:

The four types of inflation are

(i) Creeping Inflation: Creeping inflation is slow-moving and very mild. The rise in prices will not be perceptible but spread over a long period. This type of inflation is in no way dangerous to the economy. This is also known as mild inflation or moderate inflation.

(ii) Walking Inflation: When prices rise moderately and the annual inflation rate is a single digit (3% – 9%), it is called walking or trolling inflation.

(iii) Running Inflation: When prices rise rapidly like the running of a horse at a rate of speed of 10% – 20% per annum, it is called running inflation.

(iv) Galloping inflation: Galloping inflation or hyper inflation points out to unmanageably high inflation rates that run into two or three digits. By high inflation the percentage of the same is almost 20% to 100% from an overall perspective.

Other types of inflation (on the basis of inducement):

- Currency inflation: The excess supply of money in circulation causes rise in price level.

- Credit inflation: When banks are liberal in lending credit, the money supply increases and thereby rising prices.

- Deficit induced inflation: The deficit budget is generally financed through printing of currency by the Central Bank. As a result, prices rise.

- Profit induced inflation: When the firms aim at higher profit, they fix the price with higher margin. So prices go up.

- Scarcity induced inflation: Scarcity of goods happens either due to fall in production (e.g. farm goods) or due to hoarding and black marketing. This also pushes up the price. (This has happened is Venezula in the year 2018).

- Tax induced inflation: Increase in indirect taxes like excise duty, custom duty and sales tax may lead to rise in price (e.g. petrol and diesel). This is also called taxflation.

[OR]

(b) What are the functions of NABARD?

Answer:

Functions of NABARD:

NABARD has inherited its apex role from RBI i.e, it is performing all the functions performed by RBI with regard to agricultural credit.

(i) NABARD acts as a refinancing institution for all kinds of production and investment credit to agriculture, small-scale industries, cottage and village industries, handicrafts and rural crafts and real artisans and other allied economic activities with a view to promoting integrated rural development.

(ii) NABARD gives long-term loans (upto 20 Years) to State Government to enable them to subscribe to the share capital of co-operative credit societies.

(iii) NABARD gives long-term loans to any institution approved by the Central Government or contribute to the share capital or invests in securities of any institution concerned with agriculture and rural development.

(iv) NABARD has the responsibility of co-ordinating the activities of Central and State Governments, the Planning Commission (now NITI Aayog) and other all India and State level institutions entrusted with the development of small scale industries, village and cottage industries, rural crafts, industries in the tiny and decentralized sectors, etc.

(v) It maintains a Research and Development Fund to promote research in agriculture and rural development

Question 45 (a).

Briefly explain facilities offered by IMF.

Answer:

Facilities offered by IMF:

The Fund has created several new credit facilities for its members. Chief among them are:

(i) Basic Credit Facility:

- The IMF provides financial assistance to its member nations to overcome their temporary difficulties relating to balance of payments.

- A member nation can purchase from the Fund other currencies or SDRs, in exchange for its own currency, to finance payment deficits.

- The loan is repaid when the member repurchases its own currency with other currencies or SDRs.

- A member can unconditionally borrow from the Fund in a year equal to 25% of its quota.

- This unconditional borrowing right is called the reserve tranche.

(ii) Extended Fund Facility:

- Under this arrangement, the IMF provides additional borrowing facility up to 140% of the member’s quota, over and above the basic credit facility.

- The extended facility is limited for a period up to 3 years and the rate of interest is low.

(iii) Compensatory Financing Facility:

- In 1963, IMF established compensatory financing facility to provide additional financial assistance to the member countries, particularly primary producing countries facing shortfall in export earnings.

- In 1981, the coverage of the compensatory financing facility was extended to payment problem caused by the fluctuations in the cost of cereal inputs.

(iv) Buffer Stock Facility:

- The buffer stock financing facility was started in 1969.

- The purpose of this scheme was to help the primary goods (food grains) producing countries to finance contributions to buffer stock arrangements for the stabilisation of primary product prices.

(v) Supplementary Financing Facility:

Under the supplementary financing facility, the IMF makes temporary arrangements to provide supplementary financial assistance to member countries facing payments problems relating to their present quota sizes.

(vi) Structural Adjustment Facility:

- The IMF established Structural Adjustment Facility (SAF) in March 1986 to provide additional balance of payments assistance on concessional terms to the poorer member countries.

- In December 1987, the Enhanced Structural Adjustment Facility (ESAF) was set up to augment the availability of concessional resources to low income countries.

- The purpose of SAF and ESAF is to force the poor countries to undertake strong macroeconomic and structural programmes to improve their balance of payments positions and promote economic growth.

![]()

[OR]

(b) Briefly explain effects of Noise pollution.

Answer:

Effects of Noise Pollution:

(a) Hearing Loss:

- Chronic exposure to noise may cause noise-induced hearing loss.

- Older people are exposed to significant occupational noise and thereby reduced hearing sensitivity.

(b) Damage Physiological and Psychological health:

- Unwanted noise can damage physiological and psychological health.

- For example, annoyance and aggression, hypertension, and high stress levels.

(c) Cardiovascular effects:

High noise levels can contribute to cardiovascular problems and exposure to blood pressure.

(d) Detrimental effect on animals and aquatic life:

Noise can have a detrimental effect on animals, increasing the risk of death.

(e) Effects on wildlife and aquatic animals:

It creates hormone imbalance, chronic stress, panic and escape behavior and injury.

Question 46 (a).

State the classification of public expenditure.

Answer:

1. Classification on the Basis of Benefit:

- Public expenditure benefiting the entire society, e.g., the expenditure on general administration, defence, education, public health, transport.

- Public expenditure conferring a special benefit on certain people and at the same time common benefit on the entire community, e.g., administration of justice etc.

- Public expenditure directly benefitting particular group of persons and indirectly the entire society, e.g., social security, public welfare, pension, unemployment relief etc.

- Public expenditure conferring a special benefit on some individuals, e.g., subsidy granted to a particular industry.

2. Classification on the Basis of Function:

Adam Smith classified public expenditure on the basis of functions of government in the

following main groups:

- Protection Functions: This group includes public expenditure incurred on the security of the citizens, to protect from external invasion and internal disorder, e.g., defence, police, courts etc.

- Commercial Functions: This group includes public expenditure incurred on the development of trade and commerce, e.g., development of means of transport and communication etc.

- Development Functions: This group includes public expenditure incurred for the development infrastructure and industry.

[OR]

(b) Explain the effects of Air pollution.

Answer:

1. Respiratory and heart problems: It creates several respiratory and heart ailments along with cancer. Children are highly vulnerable and exposed to air pollutants and commonly suffer from pneumonia and asthma.

2. Global warming: Increasing temperature in the atmosphere leads to global warming and thereby to increase sea level rise and melting of polar icebergs, displacement and loss of habitat.

3. Acid rain: Harmful gases like nitrogen oxides and sulfur oxides are released into the atmosphere during the burning of fossil fuels. Acid rain causes grate damage to human beings, animals and crops.

4. Eutrophication: Eutrophication is a condition where high amount of nitrogen present in some pollutants which adversely affects fish, plants and animal species.

5. Effect on Wildlife: Toxic chemical present in the air can force wildlife species to move to new place and change their habitat.

6. Depletion of Ozone layer: Ozone exists in earth’s atmosphere and is responsible for protecting humans from harmful ultraviolet (UV) rays. Earth’s Ozone layer is depleting due to presence of chlorofluorocarbons and hydro chlorofluorocarbons in the atmosphere.

7. Human Health: Outdoor air pollution is a major cause of death and disease globally. The health effects range from increased hospital admissions and emergency room visits, to increase risk of premature death. An estimated 4.2 billion premature deaths globally are linked to ambient air pollution.

Question 47 (a).

What are the types of Public Debt?

Answer:

1. Internal Public debt

An internal public debt is a loan taken by Government from the citizens or from different institutions within the country. An internal public debt only involves transfer of wealth. The main sources of internal public debt are as follows:

- Individuals, who purchase government bonds and securities;

- Banks, both private and public, buy bonds from the Government.

- Non-fmancial institutions like UTI, LIC, GIC etc. also buy the Government bonds.

- Central Bank can lend the Government in the form of money supply. The Central Bank can also issue money to meet the expenditure of the Government.

2. External public debt

When a loan is taken from abroad or from an international organization it is called external public debt. The main sources of External public debt are IMF, World Bank, IDA and ADB etc. Loan from other countries and the Governments.

![]()

[OR]

(b) Write the State Financial Corporations (SFCs) Act.

Answer:

State Financial Corporation (SFCs)

The government of India passed in 1951 the State Financial Corporation Act and SFCs were set up in many states. The SFCs are mainly intended for the development of small and medium industrial units within their respective states. However, in some cases they extend to neighboring states as well.

The SFCs provide loans and underwriting assistance to industrial units having paid – up capital and reserves not exceeeding Rs 1 crore. The maximum amount that can be sanctioned to an industrial concern by SFC is Rs 60 lakhs.

SFCs depend upon the IDBI for refinance in respect of the term loans granted by them. Apart from these, the SFCs can also make temporaiy borrowings from the RBI and borrowings from IDBI and by the sale of bond