Students can Download Accountancy Chapter 3 Books of Prime Entry Questions and Answers, Notes Pdf, Samacheer Kalvi 11th Accountancy Book Solutions Guide Pdf helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

Tamilnadu Samacheer Kalvi 11th Accountancy Solutions Chapter 3 Books of Prime Entry

Samacheer Kalvi 11th Accountancy Books of Prime Entry Text Book Back Questions and Answers

I. Multiple Choice Questions

Choose the Correct Answer

Question 1.

Accounting equation signifies …………….

(a) Capital of a business is equal to assets

(b) Liabilities of a business are equal to assets

(c) Capital of a business is equal to liabilities

(d) Assets of a business are equal to the total of capital and liabilities

Answer:

(d) Assets of a business are equal to the total of capital and liabilities

Question 2.

‘Cash withdrawn by the proprietor from the business for his personal use’ causes …………….

(a) Decrease in assets and decrease in owner’s capital

(b) Increase in one asset and decrease in another asset

(c) Increase in one asset and increase in liabilities

(d) Increase in asset and decrease in capital

Answer:

(a) Decrease in assets and decrease in owner’s capital

![]()

Question 3.

A firm has assets of ₹ 1,00,000 and the external liabilities of ₹ 60,000. Its capital would be …………….

(a) ₹ 1,60,000

(b) ₹ 60,000

(c) ₹ 1,00,000

(d) ₹ 40,000

Answer:

(d) ₹ 40,000

Question 4.

The incorrect accounting equation is …………….

(a) Assets = Liabilities + Capital

(b) Assets – Capital + Liabilities

(c) Liabilities = Assets + Capital

(d) Capital = Assets – Liabilities

Answer:

(c) Liabilities = Assets + Capital

Question 5.

Accounting equation is formed based on the accounting principle of …………….

(a) Dual aspect

(b) Consistency

(c) Going concern

(d) Accrual

Answer:

(a) Dual aspect

Question 6.

Real account deals with …………….

(a) Individual persons

(b) Expenses and losses

(c) Assets

(d) Incomes and gains

Answer:

(c) Assets

Question 7.

Which one of the following is representative personal account?

(a) Building A/c

(b) Outstanding salary A/c

(c) Mahesh A/c

(d) Balan & Co. A/c

Answer:

(b) Outstanding salary A/c

Question 8.

Prepaid rent is a …………….

(a) Nominal A/c

(b) Personal A/c

(c) Real A/c

(d) Representative personal A/c

Answer:

(d) Representative personal A/c

![]()

Question 9.

Withdrawal of cash from business by the proprietor should be credited to …………….

(a) Drawings A/c

(b) Cash A/c

(c) Capital A/c

(d) Purchases A/c

Answer:

(b) Cash A/c

Question 10.

In double entry system of book keeping, every business transaction affects …………….

(a) Minimum of two accounts

(b) Same account on two different dates

(c) Two sides of the same account

(d) Minimum three accounts

Answer:

(a) Minimum of two accounts

II. Very Short Answer Questions

Question 1.

What are source documents?

Answer:

“Source documents are the authentic evidences of financial transactions. These documents show the nature of transaction, the date, the amount and the parties involved. Source documents include cash receipt, invoice, debit note, credit note, pay – in – slip, salary bills, wage bills, cheque record slips, etc.

Question 2.

What is accounting equation?

Answer:

Accounting equation is a mathematical expression which shows that the total of assets is equal to the total of liabilities and capital. This is based on the dual aspect concept of accounting. This means that total claims of outsiders and the proprietor against a business enterprise will always be equal to the total assets of the business enterprise.

Question 3.

Write any one transaction which

- Decreases the assets and decreases the liabilities

- Increases one asset and decreases another asset

Answer:

- Paid creditors

- Gash sales

Question 4.

What is meant by journalising?

Answer:

The word journal has been derived from the French word ‘Jour’ which means day. So, journal means daily. Journalising is the beginning of the accounting process for the financial transactions.

![]()

Question 5.

What is real account?

Answer:

All accounts relating to tangible and intangible properties and possessions are called real accounts.

Question 6.

How are personal accounts classified?

Answer:

Personal account: Account relating to persons is called personal account. The personal account may be natural, artificial or representative personal account.

Question 7.

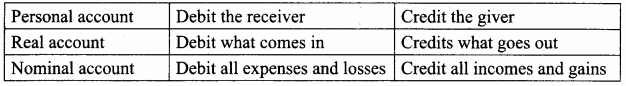

State the accounting rule for nominal account.

Answer:

Debit all expenses and losses credit all incomes and gains.

Question 8.

Give the golden rules of double entry accounting system.

Answer:

The consistency convention implies that

III. Short Answer Questions

Question 1.

Write a brief note on accounting equation approach of recording transactions.

Answer:

The relationship of assets with that of liabilities to outsiders and to owners in the equation form is known as accounting equation.

Under the double entry system of book keeping, every transaction has two fold effect, which causes the changes in assets and liabilities or capital in such a way that an accounting equation is completed and equated.

Capital + Liabilities = Assets

Capital can also be called as owner’s equity and liabilities as outsider’s equity.

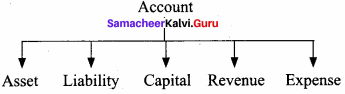

Question 2.

What is an Account? Classify the accounts with suitable examples.

Answer:

1. Asset account: Any physical thing or right owned that has a monetary value is called asset. The assets are grouped and shown separately; for example, Land and Buildings account, Plant and Machinery account.

2. Liability account: Financial obligations of the enterprise towards outsiders are shown under separate heads as liabilities; for example, creditors account, expenses outstanding account.

3. Capital account: Financial obligations of a business enterprise towards its owners are grouped under this category; for example, capital contributed by owner.

4. Revenue account: Accounts relating to revenues of an enterprise are grouped under this category, for example; revenues from sale of goods, rent received.

5. Expense account: Expenses incurred and losses suffered for earning revenue are grouped under this category; for example, purchase of goods, salaries paid.

Question 3.

What are the three different types of personal accounts?

Answer:

Under double entry system of book keeping, for the purpose of recording the various financial transactions, the accounts are classified as personal accounts and impersonal accounts.

1. Natural person’s account: Natural person means human beings. Example: Vinoth account, Malini account.

2. Artificial person’s account: Artificial person refers to the persons other than human beings recognised by law as persons. They include business concerns, charitable institutions, etc. Example: BHEL account, Bank account.

3. Representative personal accounts: These are the accounts which represent persons natural or artificial or a group of persons. Example: Outstanding salaries account, Prepaid rent account. When expenses are outstanding, it is payable to a person. Hence, it represents a person.

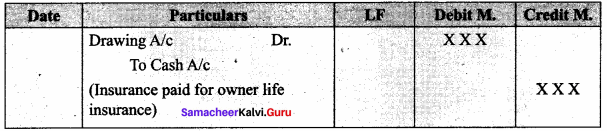

Question 4.

What is the accounting treatment for insurance premium paid on the life of the proprietor?

Answer:

Question 5.

State the principles of double entry system of bookkeeping.

Answer:

Following are the principles of double entry system:

- In every business transaction, there are two aspects.

- The two aspects involved are the benefit or value receiving aspect and benefit or value giving aspect.

- These two aspects involve minimum two accounts; at least one debit and at least one credit.

- For every debit, there is a corresponding and equivalent credit. If one account is debited the other account must be credited.

Question 6.

Briefly explain about steps in journalising.

Answer:

The following steps are followed in journalising:

- Analyse the transactions and identify the accounts (based on aspects) which are involved in the transaction.

- Classify the above accounts under Personal account, Real account or Nominal account

- Apply the rules of debit and credit for the above two accounts.

- Find which account is to be debited and which account is to be credited by the application of rules of double entry system.

- Record the date of transaction in the date column.

- Enter the name of the account to be debited in the particulars column very close to the left hand side of the particulars column followed by the abbreviation ‘Dr.’ at the end in the same line. Against this, the amount to be debited is entered in the debit amount column in the same line.

- Write the name of the account to be credited in the second line starting with the word ‘To’ prefixed a few spaces away from the margin in the particulars column. Against this, the amount to be credited is entered in the credit amount column in the same line.

- Write the narration within brackets in the next line in the particulars column.

![]()

Question 7.

What is double entry system? State its advantages.

Answer:

Double entry system of book keeping is a scientific and complete system of recording the financial transactions of an organisation. According to this system, every transaction has a two fold effect. That is, there are two aspects involved, namely, receiving aspect and giving aspect. It is denoted by debit (Dr.) and credit (Cr.). The basic principle of double entry system is that for every debit there must be an equivalent and corresponding credit. Debit denotes an increase in assets or expenses or a decrease in liabilities, income or capital. Credit denotes an increase in liabilities, income or capital or a decrease in assets or expenses.

IV. Exercises

Question 1.

Complete the accounting equation

(a) Assets = Capital + Liabilities

₹ 1,00,000 = ₹ 80,000 + 20,000

(b) Assets = Capital + Liabilities

₹ 2,00,000 = ₹ + ? 40,000

(c) Assets = Capital + Creditors

? = ₹ 1,60,000 + ₹ 80,000

Answer:

(a) Assets = Capital + Liabilities

₹ 1,00,000 = ₹ 80,000 + 20,000

(b) Assets = Capital + Liabilities

₹ 2,00,000 = ₹ 1,60,000 + ₹ 40,000

(c) Assets = Capital + Creditors

₹ 2,40,000 = ₹ 1,60,000 + ₹ 80,000

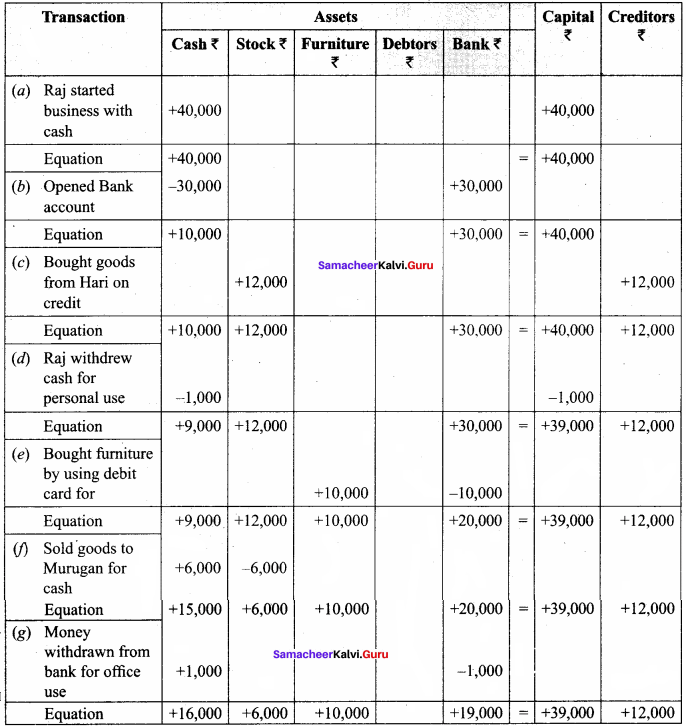

Question 2.

For the following transactions, show the effect on:

(a) Raj started business with cash – ₹ 40,000

(b) Opened bank account with a deposit of – ₹ 30,000

(c) Bought goods from Hari on credit for – ₹ 12,000

(d) Raj withdrew cash for personal use – ₹ 1,000

(e) Bought furniture by using debit card for – ₹ 10,000

(f) Sold goods to Murugan and cash received – ₹ 6,000

(g) Money withdrawn from bank for office use – ₹ 1,000

Answer:

Question 3.

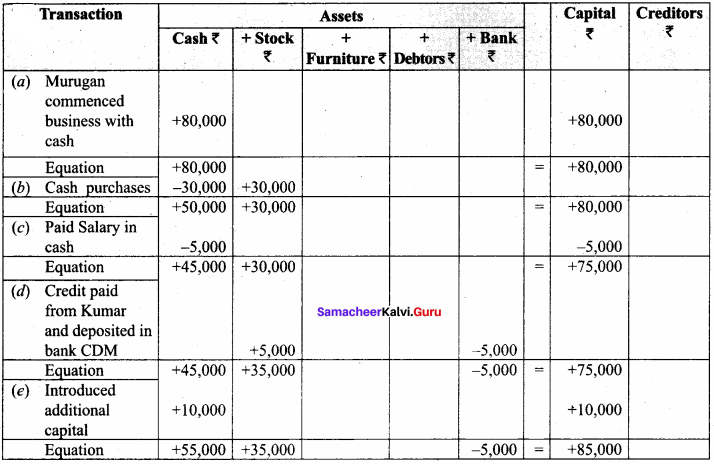

Prepare accounting equation for the following transactions. (5 Marks):

(a) Murugan commenced business with cash ₹ 80,000

(b) Purchased goods for cash ₹ 30,000

(c) Paid salaries by cash ₹ 5,000

(d) Bought goods from Kumar for ₹ 5,000 and deposited the money in CDM.

(e) Introduced additional capital of ₹ 10,000

Answer:

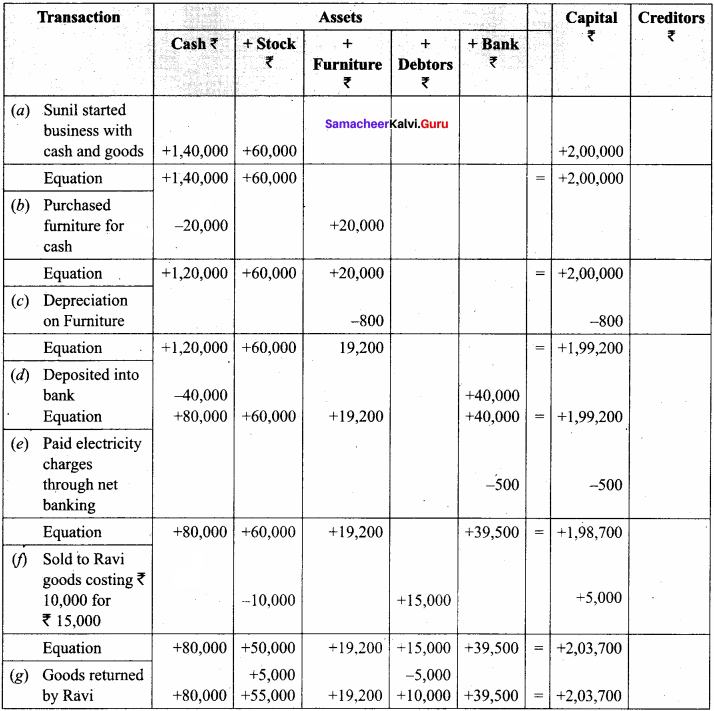

Question 4.

What will be the effect of the following on the accounting equation? (5 Marks)

(a) Sunil started business with ₹ 1,40,000 cash and goods worth ₹ 60,000

(b) Purchased furniture worth ₹ 20,000 by cash

(c) Depreciation on furniture ₹ 800

(d) Deposited into bank ₹ 40,000

(e) Paid electricity charges through net banking ₹ 500

(f) Sold goods to Ravi costing ₹ 10,000 for ₹ 15,000

(g) Goods returned by Ravi ₹ 5,000 (costing ₹ 4,000)

Answer:

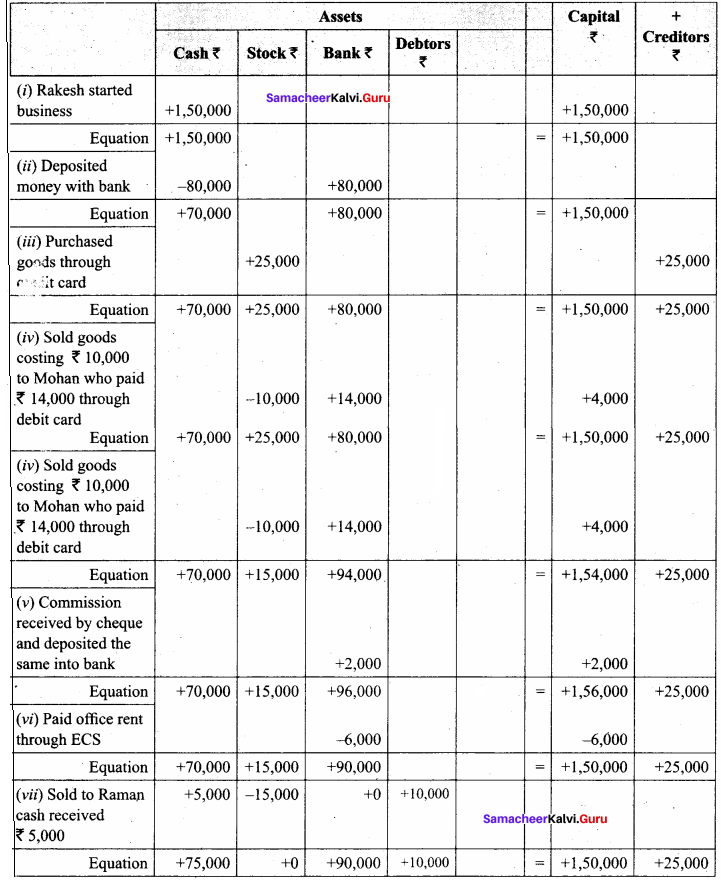

Question 5.

Create an accounting equation on the basis of the following transactions: (5 Marks)

- Rakesh started business with a capital of ₹ 1,50,000

- Deposited money with the bank ₹ 80,000

- Purchased goods from Mahesh and paid through credit card ₹ 25,000

- Sold goods (costing ₹ 10,000) to Mohan for ₹ 14,000 who pays through debit card

- Commission received by cheque and deposited the same in the bank ₹ 2,000

- Paid office rent through ECS ₹ 6,000

- Sold goods to Raman for ₹ 15,000 of which ₹ 5,000 was received at once

Answer:

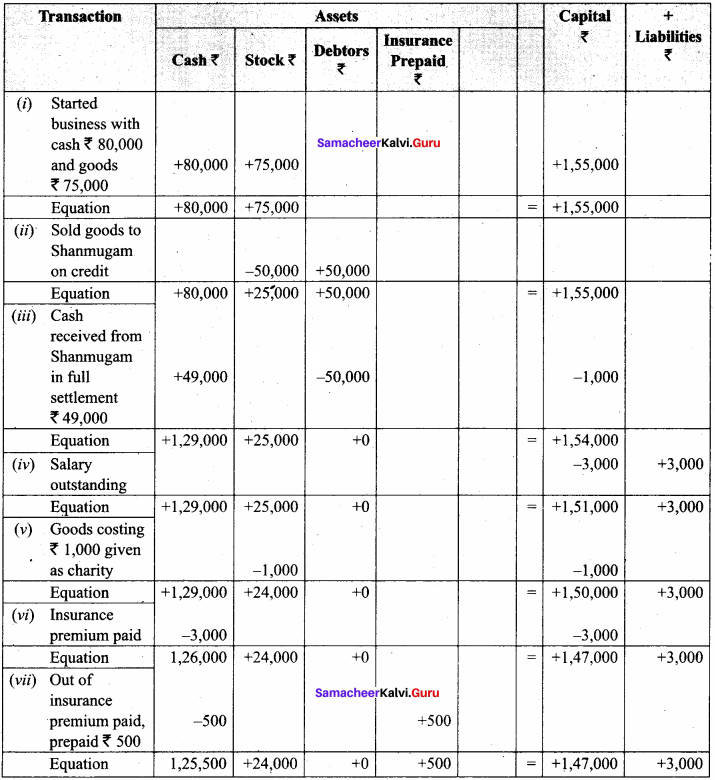

Question 6.

Create an accounting equation on the basis of the following transactions: (5 Marks)

- Started business with cash ₹ 80,000 and goods ₹ 75,000

- Sold goods to Shanmugam on credit for ₹ 50,000

- Received cash from Shanmugam in full settlement ₹ 49,000

- Salary outstanding ₹ 3,000

- Goods costing ₹ 1,000 given as charity

- Insurance premium paid ₹ 3000

- Out of insurance premium paid, prepaid is ₹ 500

Answer:

Question 7.

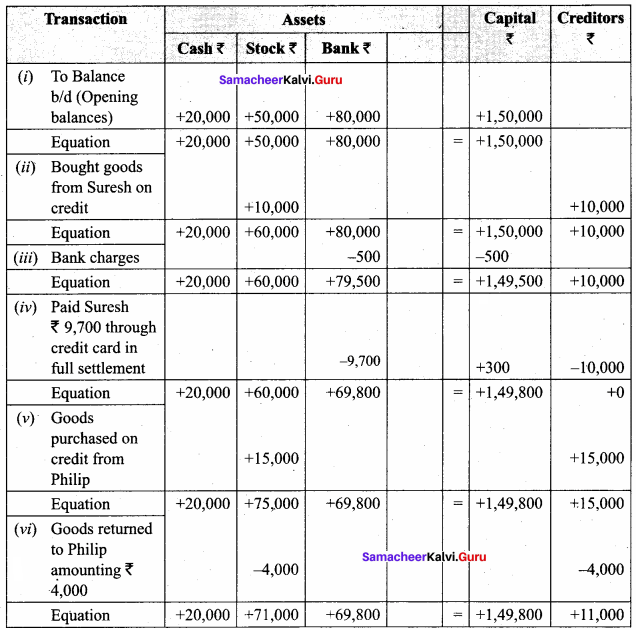

Create accounting equation on the basis of the following transactions:

- Opening balance on 1st January, 2018 : cash ₹ 20,000; stock ₹ 50,000 and bank ₹ 80,000

- Bought goods from Suresh ₹ 10,000 on credit

- Bank charges ₹ 500

- Paid Suresh ₹ 9,700 through credit card in full settlement.

- Goods purchased on credit from Philip for ₹ 15,000

- Goods returned to Philip amounting to ₹ 4,000

Answer:

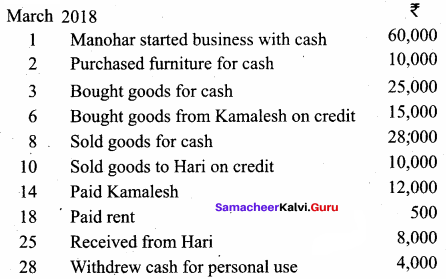

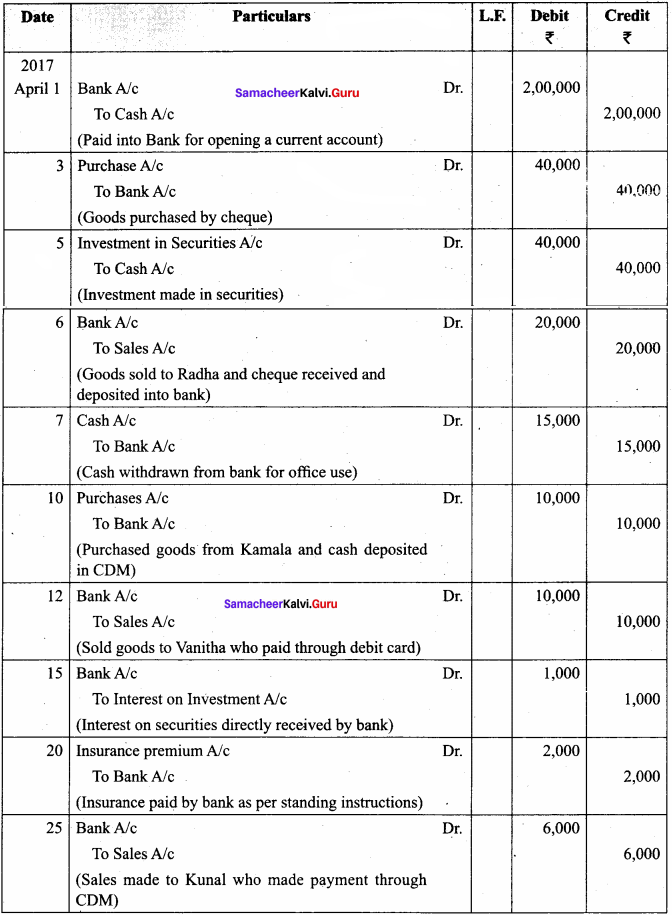

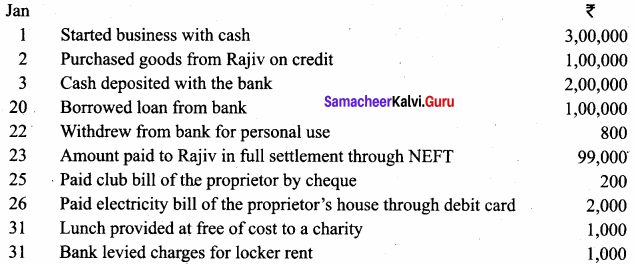

Question 8.

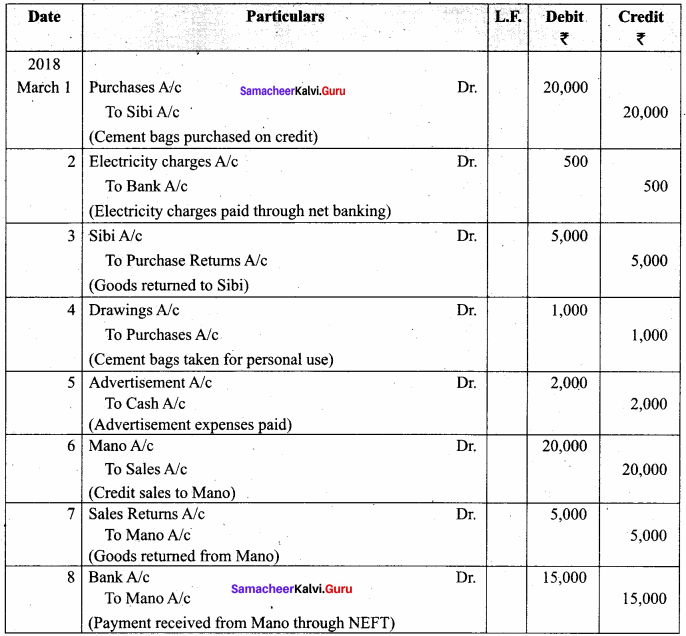

Enter the following transactions in the journal of Manohar who is dealing in textiles:

Answer:

In the books of Manohar

Journal Entries

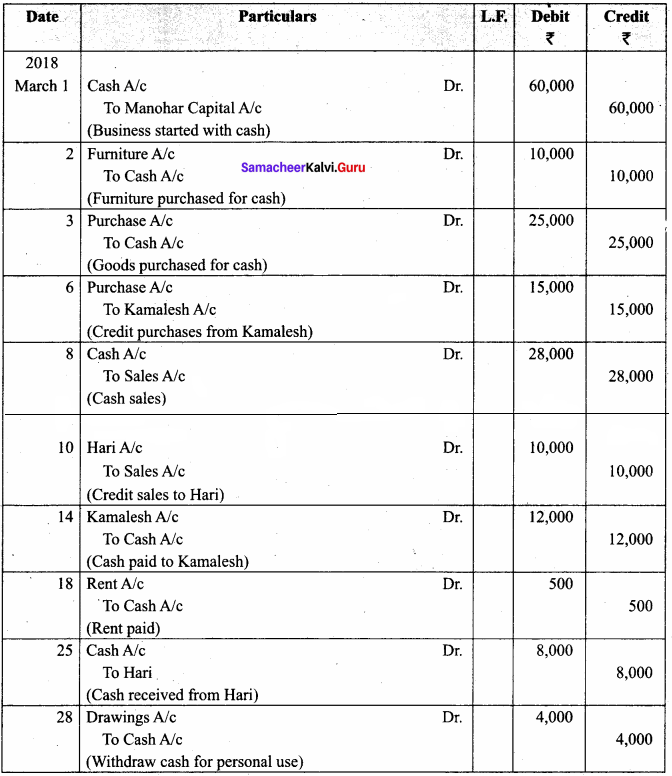

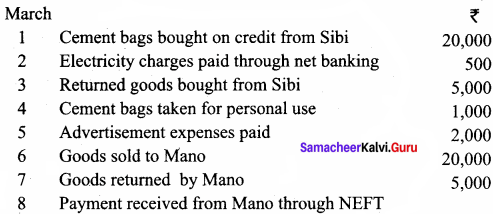

Question 9.

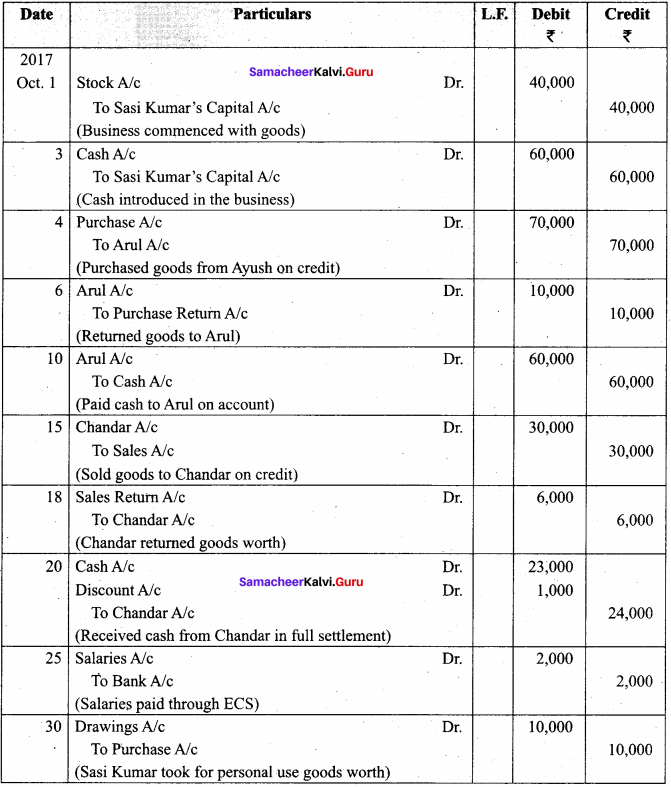

Pass journal entries in the books of Sasi Kumar who is dealing in automobiles.

Answer:

In the books of Sasi Kumar

Journal Entries

Question 10.

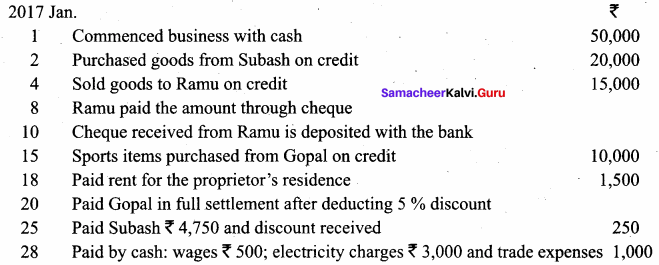

Pass Journal entries in the books of Hari who is a dealer in sports items

Answer:

In the Books of Hari

Journal Entries

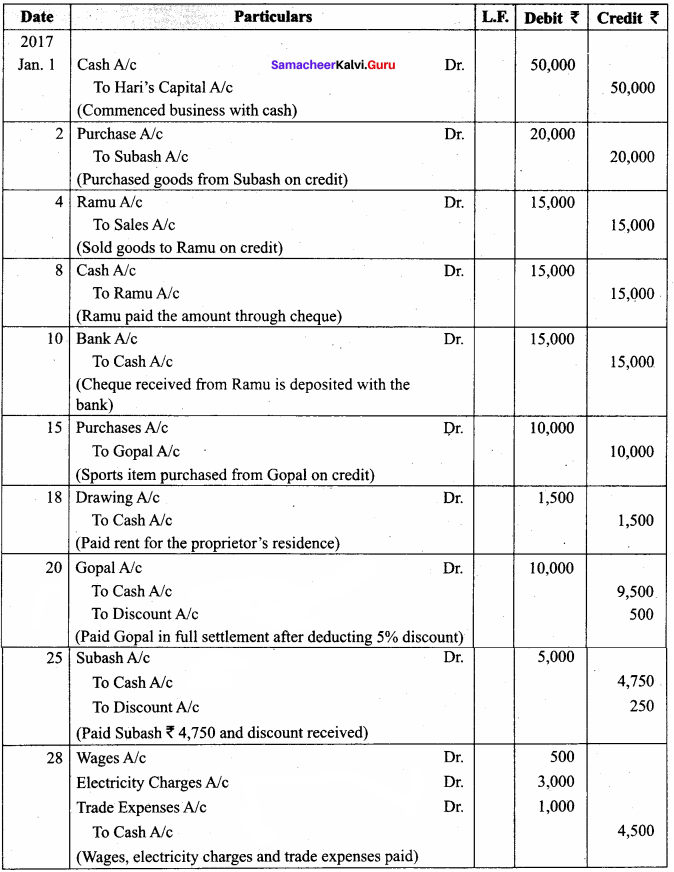

Question 11.

Karthick opened a provisions store on 1st April, 2017. Journalise the following transactions in his books:

Answer:

In the Books of Karthick

Journal Entries

Question 12.

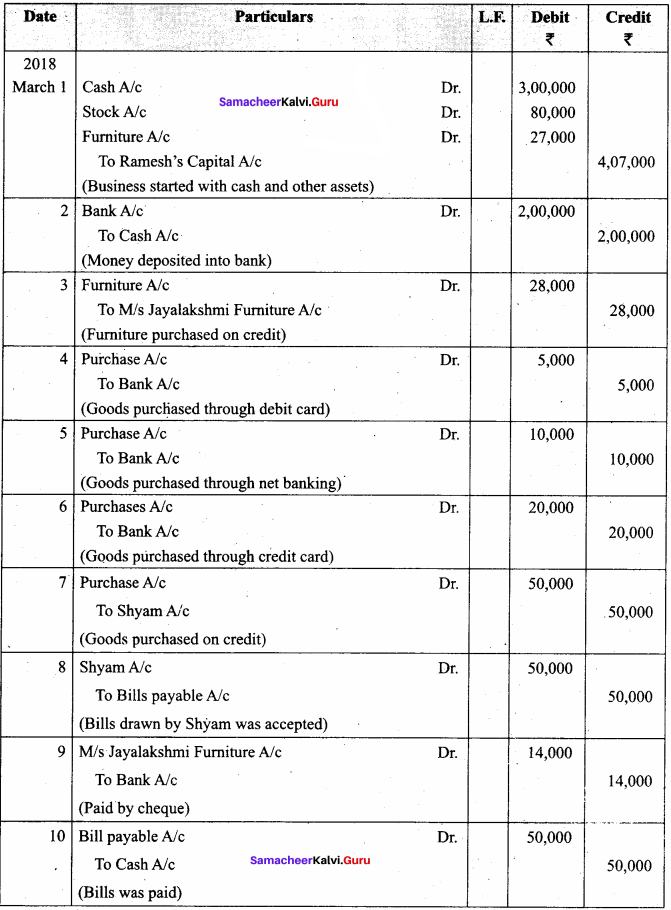

Journalise the following transactions in the books of Ramesh who is dealing in computers:

2018, March:

1 – Ramesh started business with cash ₹ 3,00,000, Goods ₹ 80,000 and Furniture ₹ 27,000.

2 – Money deposited into bank ₹ 2,00,000

3 – Bought furniture from M/s Jayalakshmi Furniture for ₹ 28,000 on credit.

4 – Purchased goods from Asohan for ₹ 5,000 by paying through debit card.

5 – Purchased goods from Guna and paid through net banking for cash ₹ 10,000

6 – Purchased goods from Kannan and paid through credit card ₹ 20,000

7 – Purchased goods from Shyam on credit for ₹ 50,000

8 – Bill drawn by Shyam was accepted for ₹ 50,000

9 – Paid half the amount owed to M/s Jayalakshmi Furniture by cheque

10 – Shyam’s bill was paid

Answer:

In the Books of Ramesh

Journal Entries

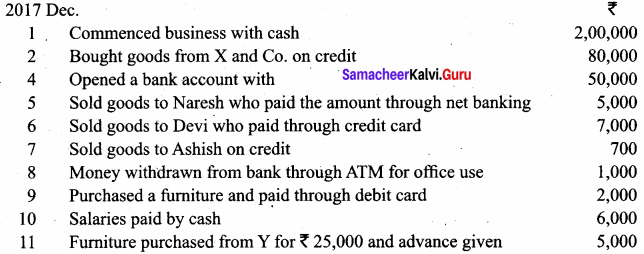

Question 13.

Journalise the following transactions in the books of Sundar who is a book seller.

Answer:

In the Books of Mr.Sundar

Journal Entries

Question 14.

Raja has a hotel. The following transactions took place in his business. Journalise them.

Answer:

In the Books of Raja

Journal Entries

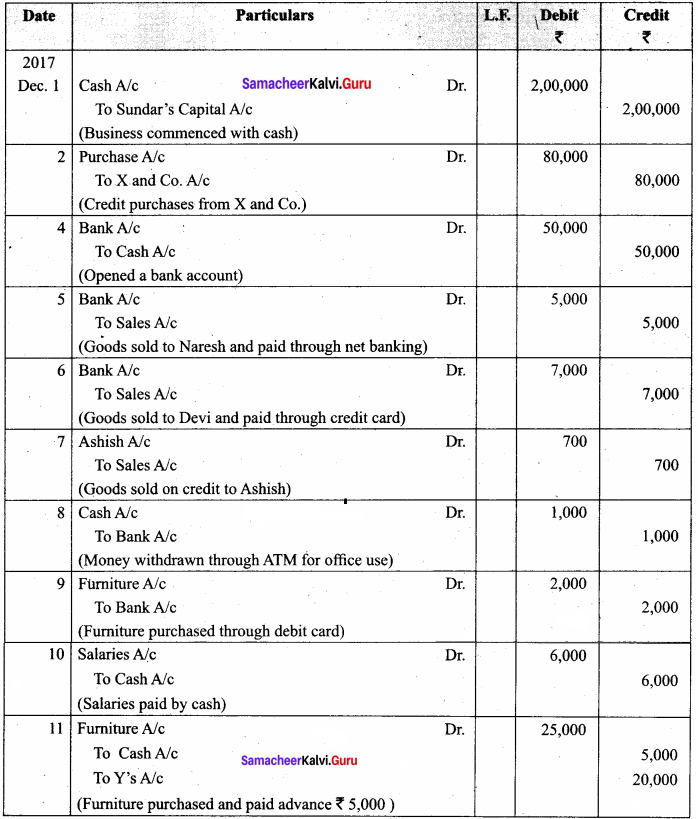

Question 15.

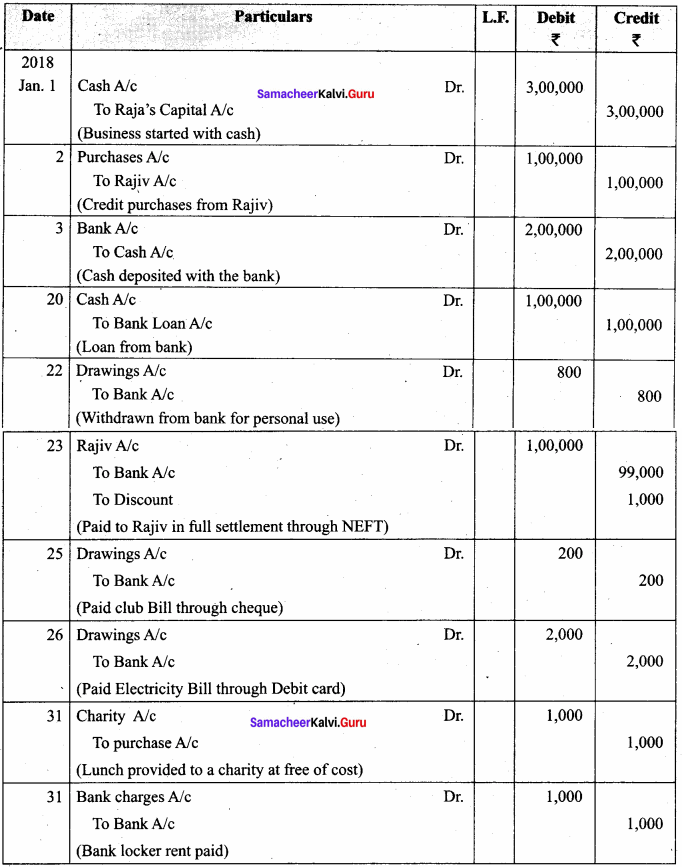

From the following transactions of Shyam, a stationery dealer, pass joumal entries for the month of August 2017.

August 2017 :

1 – Commenced business with cash ₹ 4,00,000, Goods ₹ 5,00,000

2 – Sold goods to A and money received through RTGS ₹ 2,50,000

3 – Goods sold to Z on credit for ₹ 20,000

5 – Bill drawn on Z and accepted by him ₹ 20,000

8 – Bill received from Z is discounted with the bank for ₹ 19,000

10 – Goods sold to M on credit ₹ 12,000

12 – Goods distributed as free samples for ₹ 2,000

16 – Goods taken for office use ₹ 5,000

17 – M became insolvent and only 0.80 paise per rupee is received in final settlement

20 – Bill of Z discounted with the bank is dishonoured

Answer:

In the Books of Shyam

Journal Entries

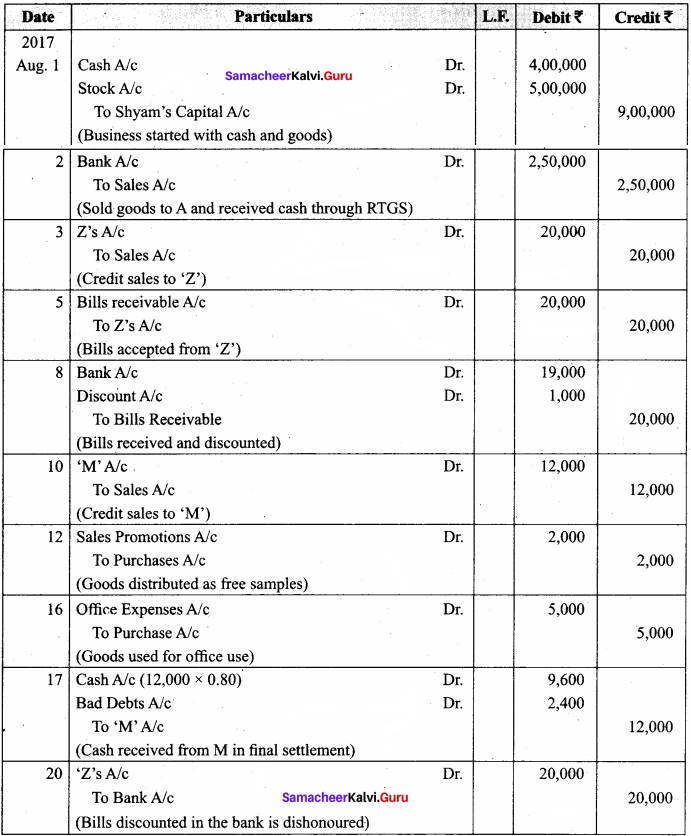

Question 16.

Mary is a cement dealer having business for more than 5 years. Pass journal entries in her books for the period of March, 2018.

Answer:

In the Books of Mary

Journal Entries

Textbook Case Study

Pearlita is a trader. She buys and sells electronic goods. She maintains double entry book – keeping. She purchases and sells goods both on cash and credit bases. If the purchased goods are not in good condition, she sends them back to her supplier. At the same time, she also accepts if her customers return the goods sold to them, when the goods are not in good condition. She maintains a bank account for her business. She receives and pays money through bank transactions.

Question 1.

Why does she maintain double entry book keeping?

Answer:

In this system the two aspects of each transaction are recorded in the books of account. This helps in checking the accuracy in accounting.

Question 2.

Do all the business units engage in credit transaction?

Answer:

No, she purchases and sells goods both on cash and credit basis.

Question 3.

Can you think of some business units that have only cash transactions?

Answer:

Yes, she has to spend money for expenses and capital also. Nominal accounts also maintained.

![]()

Question 4.

Is it necessary for Pearlita to maintain a separate bank account for business?

Answer:

Yes, she should maintain a bank account for her business.

Question 5.

What will happen if she uses her personal bank account for her business transactions?

Answer:

Because she maintains double entry book keeping, here the owner and the business are separated.

Question 6.

Identify the business documents involved in this case study.

Answer:

Debit note, credit note, Pay – in – slip, cash receipts, Invoice, cheques and vouchers.

Question 7.

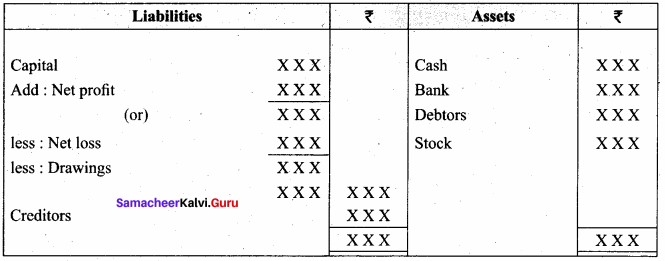

Can you think of some assets and liabilities for Pearlita’s business?

Answer:

Balance sheet of Pearlita

Samacheer Kalvi 11th Accountancy Books of Prime Entry Additional Questions and Answers

I. Multiple Choice Questions

Choose the correct answer

Question 1.

A debit note is also called as …………….

(a) Credit note

(b) Debit memo

(c) Vouchers

(d) Cash memo

Answer:

(b) Debit memo

Question 2.

A credit note is also called as ……………..

(a) Credit memo

(b) Debit note

(c) Vouchers

(d) Cash memo

Answer:

(a) Credit memo

![]()

Question 3.

When cash or cheque is deposited in bank, a form is to be filled by a customer is called as …………….

(a) Pay – in – slip

(b) Voucher

(c) Cash memo

(d) Invoice

Answer:

(a) Pay – in – slip

Question 4.

Owner’s equity is otherwise called as …………….

(a) Capital

(b) Creditors

(c) Debitors

(d) Assets

Answer:

(a) Capital

Question 5.

Outsider’s equity is otherwise called as …………….

(a) Capital

(b) liabilities

(c) debtors

(d) Assets

Answer:

(b) liabilities

Question 6.

The accounts relating to expenses, losses, revenues and gains are called …………….

(a) Nominal accounts

(b) Real accounts

(c) Personal accounts

(d) Tangible Real accounts

Answer:

(a) Nominal accounts

Question 7.

Goodwill is an example of accounts …………….

(a) Real

(b) Nominal

(c) Tangible real

(d) Intangible real

Answer:

(d) Intangible real

![]()

Question 8.

Outstanding salaries account is an example for accounts …………….

(a) Personal account

(b) Real account

(c) Nominal account

(d) Representative Personal account

Answer:

(d) Representative Personal account

Question 9.

Journal means …………….

(a) daily

(b) monthly

(c) yearly

(d) weekly

Answer:

(a) daily

Question 10.

Record of business transactions in the journal is known as ……………..

(a) Journal entry

(b) Ledger

(c) Book – keeping

(d) Accounting

Answer:

(a) Journal entry

II. Very Short Answer Questions

Question 1.

What is invoice?

Answer:

Invoice is used for credit purchases and credit of sales. The date, amount and details of credit purchases and credit sales are given in the invoices. Invoice is generally prepared by the seller in three copies.

Question 2.

What is Pay – in – slip?

Answer:

When cash or cheques is deposited in bank, a form is to be filled by a customer and submitted to the banker along with cash or cheque. This is called as Pay – in – slip or deposit slip.

![]()

Question 3.

What is cheque?

Answer:

Cheque is a negotiable instrument. Cheque book is issued by a bank to its customers for withdrawing money for own use or for making payment to others.

Question 4.

What is narration?

Answer:

A short description of each transaction which is written under each entry is called narration.

Question 5.

What is compound entry?

Answer:

Compound entry is an entry in which more than two accounts are involved. Either more than one account is debited or more than one account is credited or both.