Students can Download Tamil Nadu 11th Accountancy Model Question Paper 3 English Medium Pdf, Tamil Nadu 11th Accountancy Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

TN State Board 11th Accountancy Model Question Paper 3 English Medium

General Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- All questions of Part I, II, III, and IV are to be attempted separately.

- Question numbers 1 to 20 in Part I are Multiple Choice Questions of one mark each.

These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer. - Question numbers 21 to 30 in Part II are two-mark questions. These are to be answered in about one or two sentences.

- Question numbers 31 to 40 in Part III are three-mark questions. These are to be answered in the above three to five short sentences.

- Question numbers 41 to 47 in Part IV are five-mark questions. These are to be answered in detail Draw diagrams wherever necessary.

Time: 3 Hours

Maximum Marks: 90

Part – I

Answer all the questions. Choose the correct answer. [20 × 1 = 20]

Question 1.

The root of financial accounting system is ……………………….

(a) Social accounting

(b) Stewardship accounting

(c) Management accounting

(d) Responsibility accounting

Answer:

(b) Stewardship accounting

![]()

Question 2.

The business is liable to the proprietor of the business in respect of capital introduced by the person according to ……………………….

(a) Money measurement concept

(b) Cost concept

(c) Business entity concept

(d) Dual aspect concept

Answer:

(c) Business entity concept

Question 3.

Accounting equation signifies ……………………….

(a) Capital of a business is equal to assets

(b) Liabilities of a business are equal to assets

(c) Capital of a business is equal to liabilities

(d) Assets of a business are equal to the total of capital and liabilities

Answer:

(d) Assets of a business are equal to the total of capital and liabilities

![]()

Question 4.

Main objective of preparing ledger account is to ……………………….

(a) Ascertain the financial position

(b) Ascertain the profit or loss

(c) Ascertain the profit or loss and the financial position

(d) Know the balance of each ledger account

Answer:

(d) Know the balance of each ledger account

Question 5.

Trial balance is a ……………………….

(a) Statement

(b) Account

(c) Ledger

(d) Journal

Answer:

(a) Statement

Question 6.

Purchases book is used to record ……………………….

(a) All purchases of goods

(b) All credit purchases of assets

(c) All credit purchases of goods

(d) All purchases of assets

Answer:

(c) All credit purchases of goods

Question 7.

Cash book is a ……………………….

(a) Subsidiary book

(b) Principal book

(c) Journal proper

(d) Both subsidiary book and principal book

Answer:

(d) Both subsidiary book and principal book

Question 8.

A bank reconciliation statement is prepared by ……………………….

(a) Bank

(b) Business

(c) Debtor to the business

(d) Creditor to the business

Answer:

(b) Business

Question 9.

Error of principle arises when ……………………….

(a) There is complete omission of a transaction

(b) There is partial omission of a transaction

(c) Distinction is not made between capital and revenue items

(d) There are wrong postings and wrong castings

Answer:

(c) Distinction is not made between capital and revenue items

![]()

Question 10.

Under straight line method, the amount of depreciation is ……………………….

(a) Increasing every year

(b) Decreasing every year

(c) Constant for all the year

(d) Fluctuating every year

Answer:

(c) Constant for all the year

Question 11.

Amount spent on increasing the seating capacity in a cinema hall is………

(a) Capital expenditure

(b) Revenue expenditure

(c) Deferred revenue expenditure

(d) None of the above

Answer:

(a) Capital expenditure

Question 12.

Closing stock is an item of ……………………….

(a) Fixed asset

(b) Current asset

(c) Fictitious asset

(d) Intangible asset

Answer:

(b) Current asset

Question 13.

A prepayment of insurance premium will appear in

(a) The trading account on the debit side

(b) The profit and loss account on the credit side

(c) The balance sheet on the assets side

(d) The balance sheet on the liabilities side

Answer:

(c) The balance sheet on the assets side

Question 14.

In accounting, computer is commonly used in the following areas:

(a) Recording of business transactions

(b) Payroll accounting

(c) Stores accounting

(d) All the above

Answer:

(d) All the above

![]()

Question 15.

Accounting software is an example of ……………………….

(a) System software

(b) Application software

(c) Utility software

(d) Operating software

Answer:

(b) Application software

Question 16.

If there is no existing provision for doubtful debts, provision created for doubtful debts is ……………………….

(a) Debited to bad debts account

(b) Debited to sundry debtors account

(c) Credited to bad debts account

(d) Debited to profit and loss account

Answer:

(d) Debited to profit and loss account

Question 17.

Pre-operative expenses are ……………………….

(a) Revenue expenditure

(b) Prepaid revenue expenditure

(c) Deferred revenue expenditure

(d) Capital expenditure

Answer:

(d) Capital expenditure

Question 18.

Which of the following errors will be rectified using suspense account?

(a) Purchases returns book was undercast by ₹ 100

(b) Goods returned by Narendran was not recorded in the books

(c) Goods returned by Akila ? 900 was recorded in the sales returns book as ₹ 90

(d) A credit sales of goods to Ravivarman was not entered in the sales book

Answer:

(d) A credit sales of goods to Ravivarman was not entered in the sales book

![]()

Question 19.

Which one of the following is not a timing difference?

(a) Cheque deposited but not yet credited .

(b) Cheque issued but not yet presented for payment

(c) Amount directly paid into the bank

(d) Wrong debit in the cash book

Answer:

(d) Wrong debit in the cash book

Question 20.

Small payments are recorded in a book called ……………………….

(a) Cash book

(b) Purchase book

(c) Bills payable book

(d) Petty cash book

Answer:

(d) Petty cash book

Part – II

Answer any seven questions in which question No. 21 is compulsory: [7 × 2 = 14]

Question 21.

Mention any two steps involved in the accounting process?

Answer:

- Identifying the transactions and journalising

- Posting and balancing

Question 22.

What is opening entry?

Answer:

Through opening entry the balances of assets and liabilities at the end of the previous accounting year are brought forward to the current accounting year.

![]()

Question 23.

Mention any two utilities of ledger.

Answer:

- Quick information about a particular account.

- Control over business transactions.

Question 24.

Mention any two objectives of preparing trial balance.

Answer:

- Test of arithmetical accuracy.

- Basis for preparing final accounts.

Question 25.

What is Purchases book?

Answer:

Purchases book is a subsidiary book in which only credit purchases of goods are recorded. When business wants to know the information about the credit purchases of goods at a glance, the information can be made available if purchases of goods on credit are separately recorded.

Question 26.

What is retiring of bill?

Answer:

An acceptor may make the payment of a bill before its due date and may discharge the liability on the bill. It is called as retirement of a bill.

Question 27.

What is suspense account?

Answer:

When the trial balance does not tally, the amount of difference is placed to the debit (when the total of the credit column is higher than the debit column) or credit (when the total of the debit column is higher than the credit column, to a temporary account known as ‘suspense account’.

Question 28.

What is obsolescence?

Answer:

It is a reduction in the value of assets as a result of the availability of updated alternative assets. This happens due to new inventions and innovations. Though the original asset is in a usable condition, it is not preferred by the users and it loses its value.

![]()

Question 29.

What is prepaid expenses?

Answer:

Prepaid expenses refer to any expense or portion of expense paid in the current accounting year but the benefit or services of which will be received in the next accounting period. They are also called as unexpired expense.

Question 30.

What is operating system?

Answer:

A set of tools and programs to manage the overall working of a computer using a defined set of hardware components is called as operating system. It is the interface between the user and the computer system.

Part – III

Answer any seven questions in which question No. 31 is compulsory: [7 × 3 = 21]

Question 31.

What are the three different types of personal accounts?

Answer:

- Natural person’s account

- Artificial person’s account

- Representative personal account

Question 32.

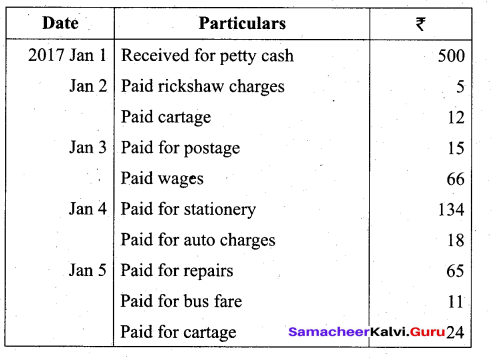

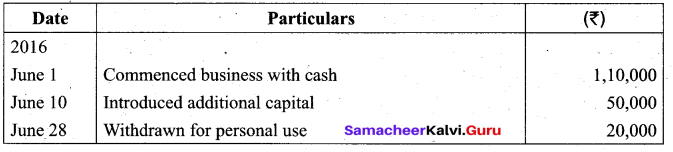

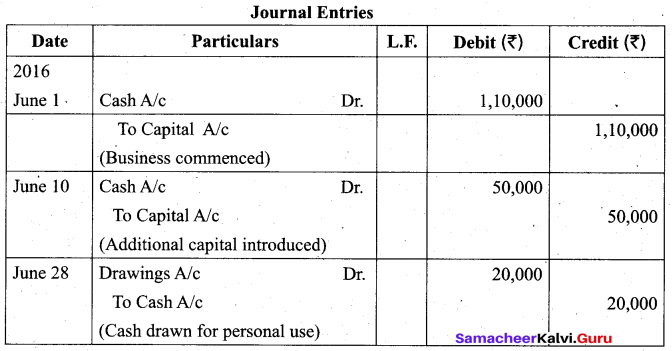

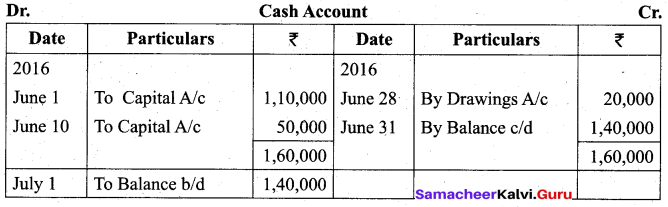

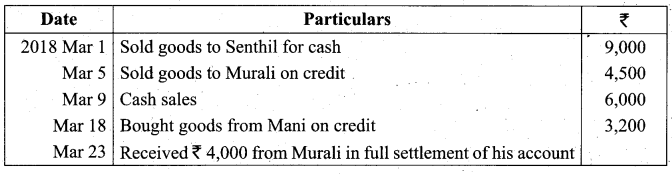

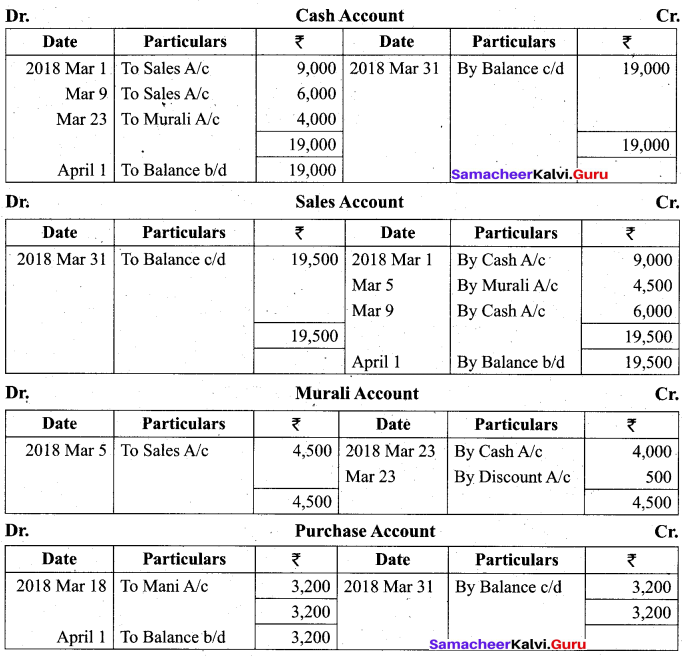

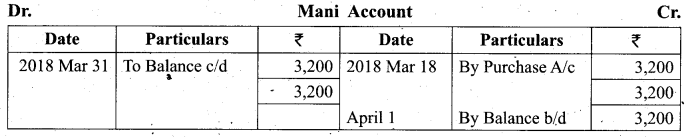

Give journal entries and post them to cash account.

Answer:

![]()

Question 33.

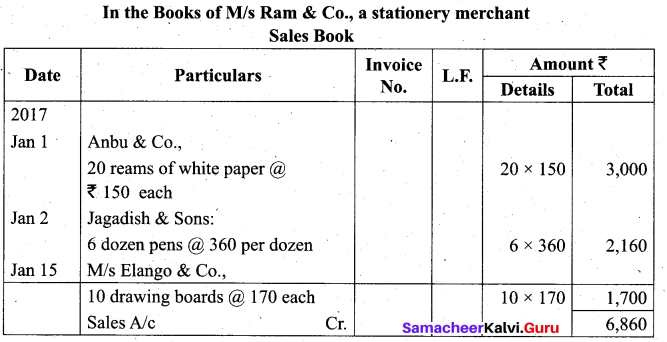

From the following transactions write up the sales day book of M/s; Ram and Co., a stationery merchant.

| Date |

Particulars |

| 2017 Jan 1 | Sold to Anbu & Co., on credit 20 reams of white paper @ ₹ 150 per ream. |

| Jan 2 | Sold to Jagadish & Sons on credit 6 dozen pens @ ₹ 360 per dozen. |

| Jan 10 | Sold old newspapers for cash @ ₹ 620. |

| Jan 15 | Sold on credit M/s. Elango & Co., 10 drawing boards @ ₹ 170 per piece. |

| Jan 20 | Sold to Kani & Co., 4 writing tables @ ₹ 1,520 per table for cash. |

Answer:

Question 34.

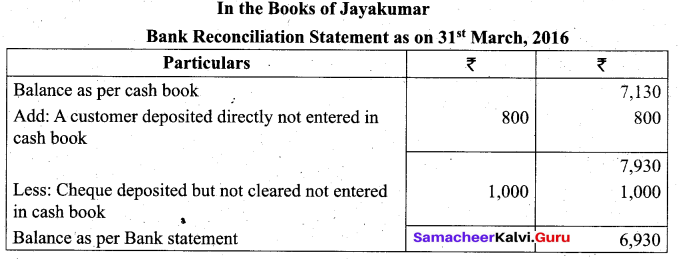

From the following particulars prepare a bank reconciliation statement of Jayakumar as on 31st March, 2016.

1. Balance as per cash book ₹ 7,130.

2. Cheque deposited but not cleared ₹ 1,000.

3. A customer has deposited ₹ 800 into the bank directly.

Answer:

Question 35.

Rectify the following errors.

1. Sales book was undercast by ₹ 100.

2. Purchases book was undercast by ₹ 600.

3. Sales return book was overcast by ₹ 500.

4. Purchases return book was overcast by ₹ 700.

Answer:

1. Sales account should be credited with ₹ 100.

2. Purchases account should be debited with ₹ 600.

3. Sales returns account should be credited with ₹ 500.

4. Purchases return account should be debited with ₹ 700.

Question 36.

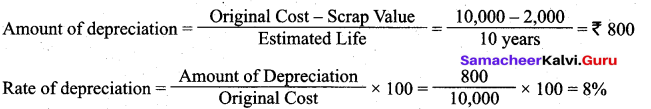

Find out the rate of depreciation under straight line method from the following details:

(a) Original cost of the assets = ₹ 10,000.

(b) Estimated life of the asset = 10 years.

(c) Estimated scrap value at the end = ₹ 2,000.

Answer:

Question 37.

Classify the following items into capital and revenue.

1. ₹ 50,000 spent for railways siding

2. Loss on sale of old furniture

3. Carriage paid on goods sold .

Answer:

1. Capital

2. Revenue and

3. Revenue

![]()

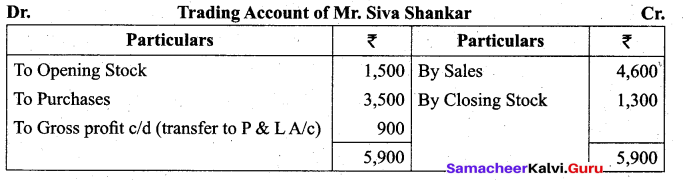

Question 38.

Prepare Trading account in the books of Siva Shankar from the following figures: Opening Stock ₹ 1,500; Purchases ₹ 3,500; Sales ₹ 4,600; Closing Stock ₹ 1,300.

Answer:

Question 39.

Mention any three limitations of computerised accounting systems.

Answer:

- Heavy cost of installation.

- Cost of training.

- Fear of unemployment.

Question 40.

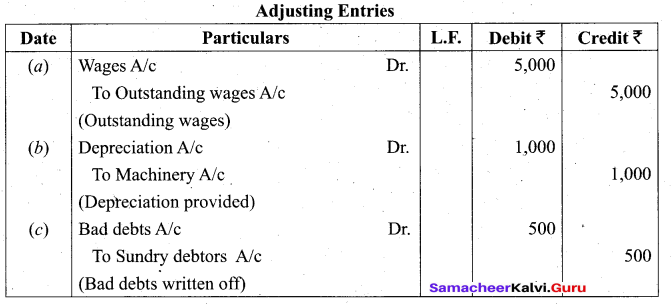

For the following adjustments, pass adjusting entries.

(a) Outstanding wages ₹ 5,000.

(b) Depreciation on machinery ₹ 1,000.

(c) Write off bad debts ₹ 500.

Answer:

![]()

Part – IV

Answer all the questions: [7 × 5 = 35]

Question 41.

(a) Rectify the following errors:

1. Purchases returns book is undercast by ₹ 500.

2. Sales returns book is undercast by ₹ 700.

3. The total of rent received account is carried forward ₹ 900 short.

4. The total of salary account is carried forward ₹ 1,200 short.

5. Purchases book is overcast by ₹ 400.

Answer:

1. Purchases returns account should be credited with ₹ 500.

2. Sales returns account should be debited with ₹ 700.

3. Rent received account is to be credited with ₹ 900.

4. Salary account is to be debited with ₹ 1,200.

5. Purchases account should be credited with ₹ 400.

[OR]

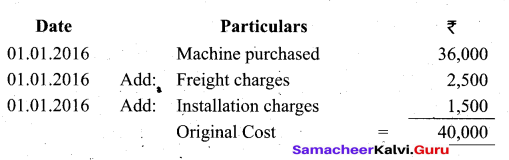

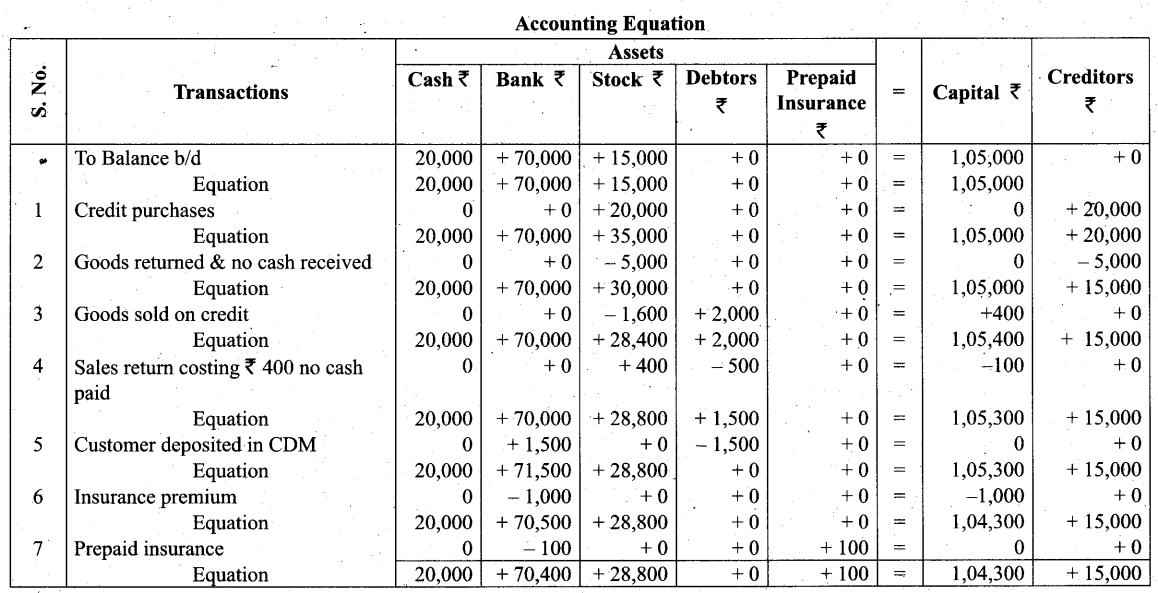

(b) From the following particulars, give journal entries for 2 years and prepare machinery account under straight line method of providing depreciation:

Machinery was purchased on 01.01.2016, Price of machine ₹ 36,000 Freight charges ₹ 2,500, Installation charges ₹ 1,500, Life of the machine 5 years.

Answer:

Question 42.

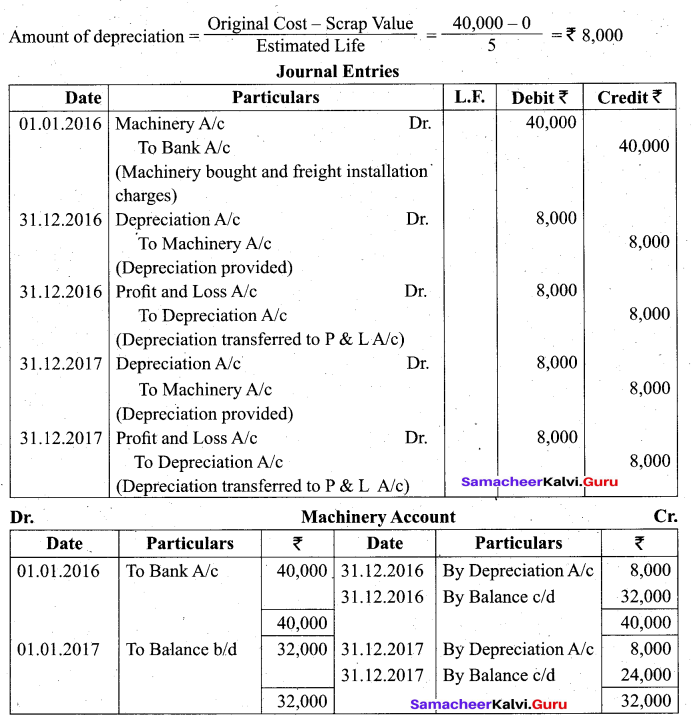

(a) Veena is a dealer in textiles. On January 1, 2018 her business showed the following balances:

Cash in hand ₹ 20,000; Bank balance ₹ 70,000; Stock ₹ 15,000. The following are the transactions made during January 2018. Show the effect of the transactions on accounting equation.

a. Purchased goods (readymade shirts) on credit from Subbu ₹ 20,000.

b. Goods returned to Subbu and no cash is received ₹ 5,000.

c. Goods (shirts) costing ₹ 1,600 was sold to Janani on credit ₹ 2,000.

d. Janani returned 1 shirt of sales value ₹ 500.

e. Janani deposited the money due in cash deposit machine in a bank ₹ 1,500.

f. Insurance on buildings paid through net banking ₹ 1,000.

g. Of the insurance paid, prepaid during the year is ₹ 100.

Answer:

![]()

[OR]

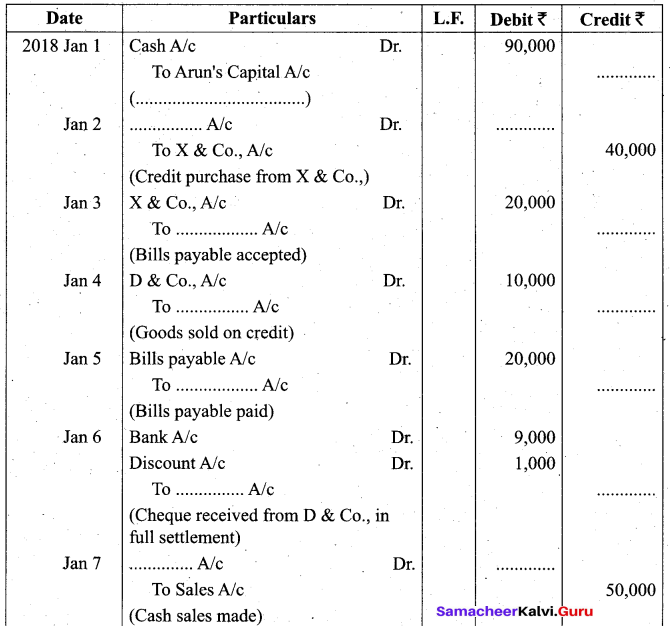

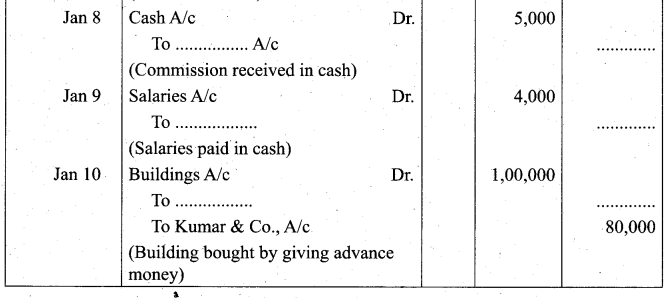

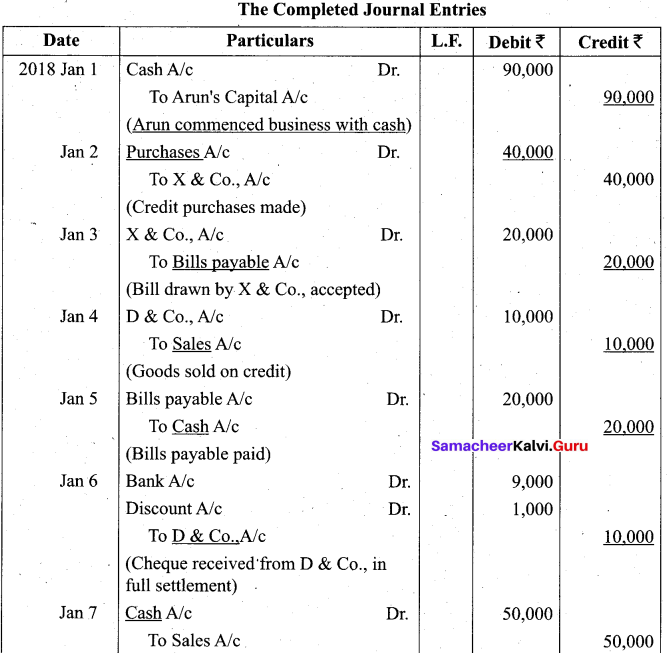

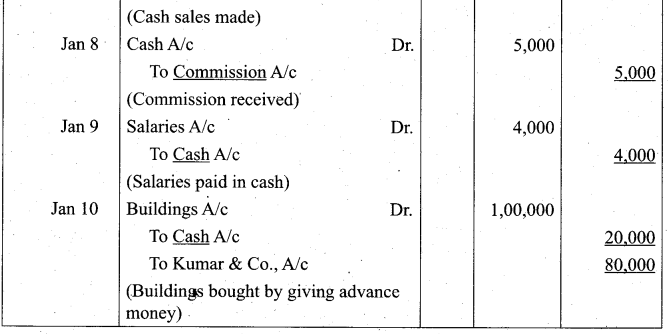

(b) Complete the missing informations:

Answer:

Question 43.

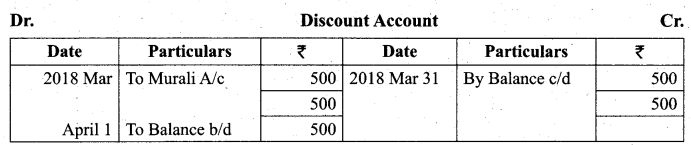

(a) Prepare direct ledger from the followings:

Answer:

[OR]

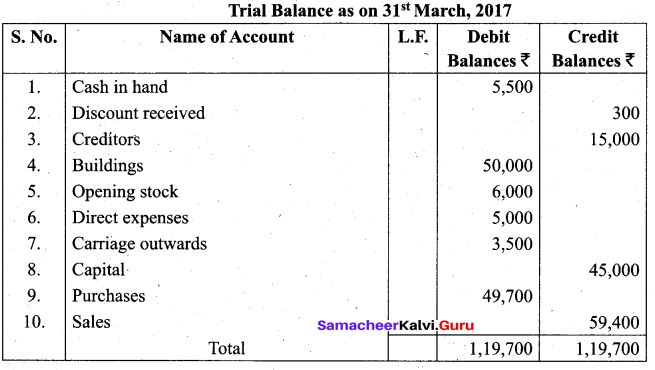

(b) Prepare Trial balance as on 31st March 2017.

Cash in hand ₹ 5,500; Discount received ₹ 300; Creditors ₹ 15,000; Buildings ₹ 50,000; Opening stock ₹ 6,000; Direct expenses ₹ 5,000; Carriage outwards ₹ 3,500; Capital ₹ 45,000; Purchases ₹ 49,700; Sales ₹ 59,400.

Answer:

![]()

Question 44.

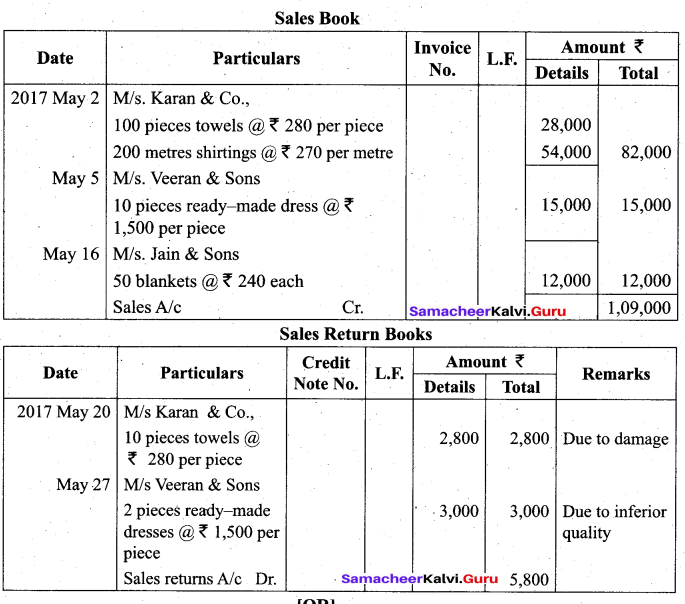

(a) Enter the following transactions in the sales book and sales returns book of M/s. Guhan & Sons, who is a textile dealer.

| Date |

Particulars |

| 2017 May 2 | Sold to M/s. Karan & Co., on credit 100 pieces towels @ ₹ 280 per piece 200 metres shirtings @ ₹ 270 per metre |

| May 5 Sold | Sold to M/s. Veeran & Sons on credit 10 pieces ready – made dress @ ₹ 1,500 per piece |

| May 16 | Sold to M/s. Jain & Sons on credit 50 blankets @ ₹ 240 each |

| May 20 | Damaged 10 pieces towels returned by Karan & Co., and cash not paid |

| May 25 | Sold old furniture to M/s. Saran & Co., on credit ₹ 18,000 |

| May 27 | Returned 1 pieces ready-made dresses by M/s. Veeran and sons due to inferior quality and cash not paid. |

Answer:

[OR]

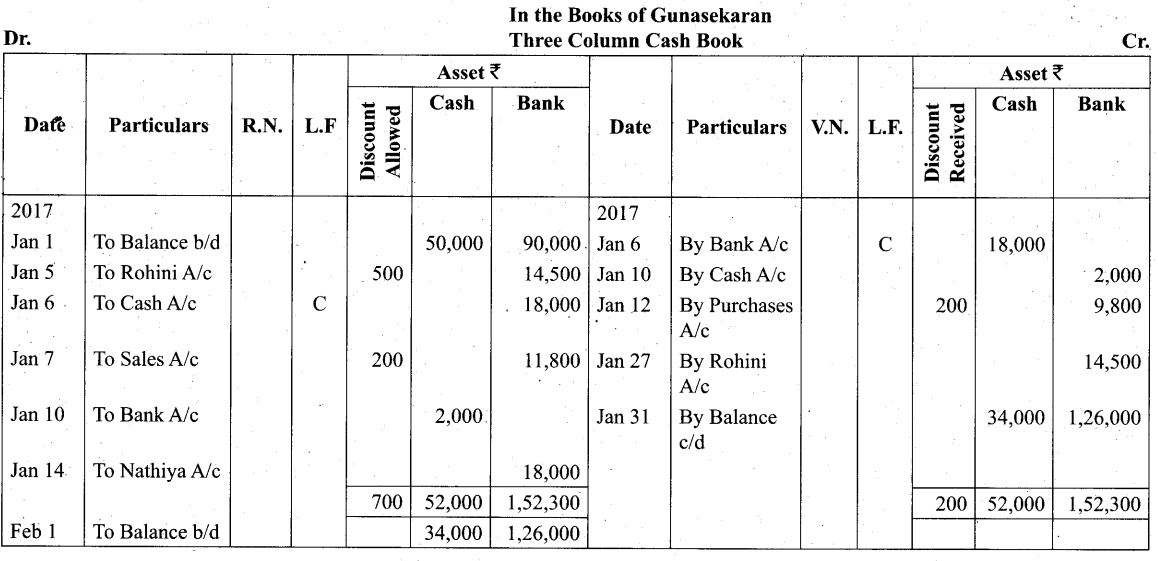

(b) Record the following transactions in three column cash book of Gunasekaran.

| Date | Particulars |

| 2017 Jan 1 | Cash in hand ₹ 50,000 |

| Jan 1 | Cash at bank ₹ 90,000 |

| Jan 2 | Goods sold on credit to Rohini ₹ 15,000 |

| Jan 5 | Cheque received from Rohini in full settlement and deposited into bank ₹ 14,500 |

| Jan 6 | Cash deposited into bank through cash deposit machine ₹ 18,000 |

| Jan 7 | Goods sold to Sridhar for ₹ 12,000. He made the payment of? 11,800 by debit card in full settlement by availing a cash discount of ₹ 200 |

| Jan 10 | Money withdrawn from bank for other use ₹ 2,000 |

| Jan 12 | Purchased goods from Raja for ₹ 10,000 and paid through credit card in full settlement by availing a cash discount of ₹ 200; 9,800 |

| Jan 14 | Nathiyq who owed money made the payment through NEFT ₹ 18,000 |

| Jan 27 | Cheque of Rohini dishonoured |

Answer:

![]()

Question 45.

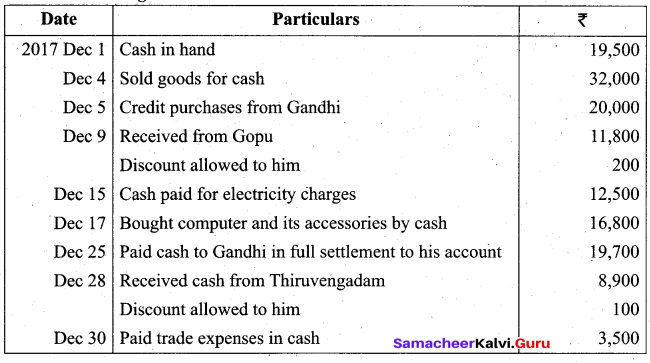

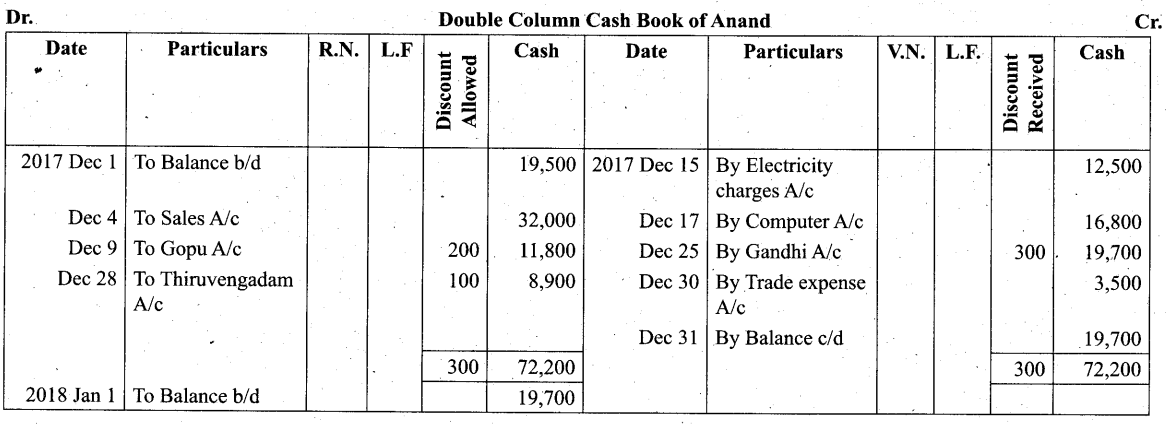

(a) Enter the following transactions in cash book with discount and cash column of Anand.

Answer:

[OR]

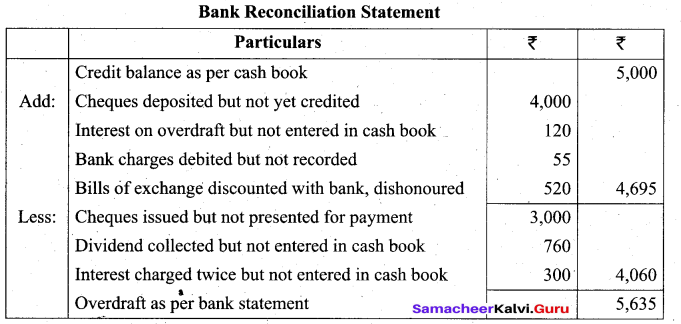

(b) Prepare Bank reconciliation statement from the following data:

1. Credit balance as per cash book ₹ 5,000.

2. Cheques issued, but not yet presented for payment ₹ 3,000.

3. Cheques deposited but not yet credited ₹ 4,000.

4. Interest on overdraft charged by the bank, not yet entered in the cash book ₹ 120.

5. Dividend collected by the bank not shown in the cash book ₹ 760.

6. Interest charged by bank recorded twice in the cash book ₹ 300.

7. Bills of exchange discounted with the bank, dishonoured ₹ 520.

8. Bank charges debited by the bank on dishonoured of the bill ₹ 55.

Answer:

Question 46.

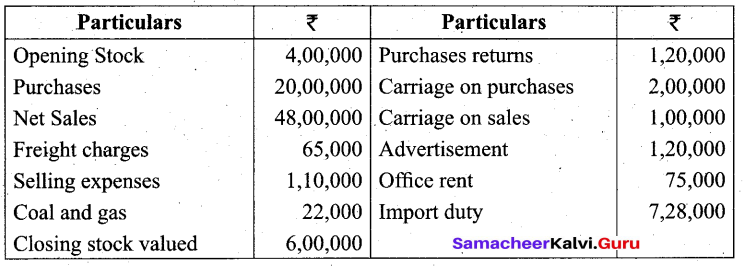

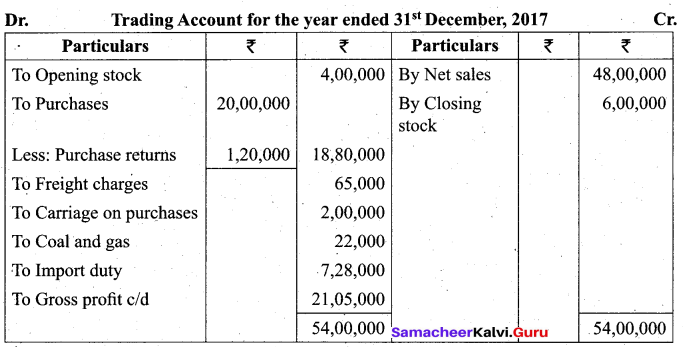

(a) Prepare Trading account for the year ended 31stDecember 2017, from the following balances:

Answer:

Note: Selling expenses, Carriage on sales, Advertisement and office rent will not appear in trading account, as they are indirect expenses.

[OR]

(b) Identify the following items into capital or revenue.

1. Audit fees paid ₹ 10,000.

2. Labour welfare expenses ₹ 5,000.

3. ₹ 2,000 paid for servicing the company vehicle.

4. Repair to furniture purchased second hand ₹ 3,000.

5. Rent paid for the factory ₹ 12,000.

Answer:

1. Revenue

2. Revenue

3. Revenue

4. Capital

5. Revenue

![]()

Question 47.

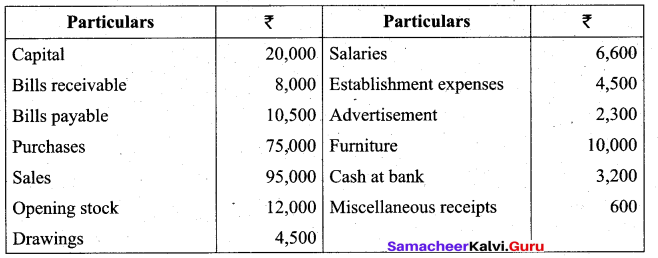

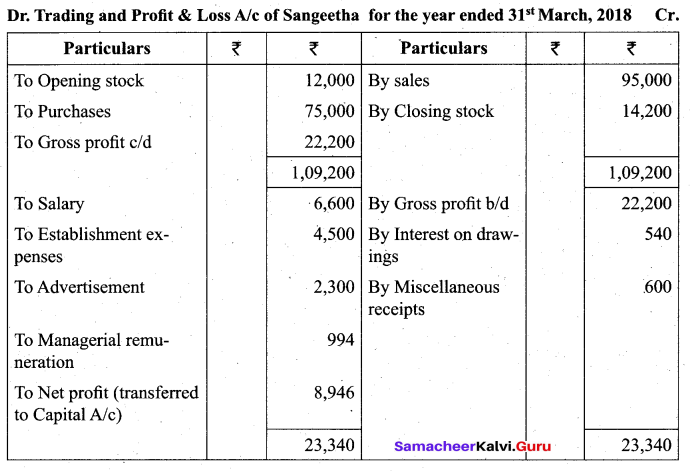

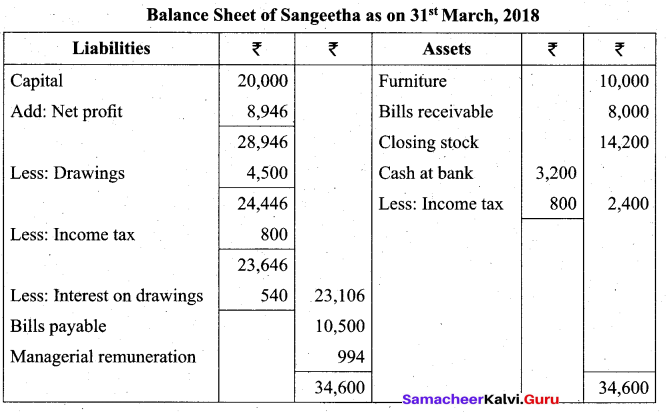

(a) From the following information, prepare Trading and Profit and Loss A/c and Balance Sheet in the books of Sangeetha for the year ended 31st March, 2018.

Adjustments:

1. Stock on 31st March, 2018 ₹ 14,200.

2. Income tax of Sangeetha paid ₹ 800.

3. Charge interest on drawings @ 12% p.a.

4. Provide managerial remuneration @ 10% of net profit before charging such commission.

Answer:

![]()

[OR]

(b) Prepare Petty Cash book on the imprest system.