Students can Download Tamil Nadu 11th Accountancy Model Question Paper 1 English Medium Pdf, Tamil Nadu 11th Accountancy Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

TN State Board 11th Accountancy Model Question Paper 1 English Medium

General Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- All questions of Part I, II, III, and IV are to be attempted separately.

- Question numbers 1 to 20 in Part I are Multiple Choice Questions of one mark each.

These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer. - Question numbers 21 to 30 in Part II are two-mark questions. These are to be answered in about one or two sentences.

- Question numbers 31 to 40 in Part III are three-mark questions. These are to be answered in above three to five short sentences.

- Question numbers 41 to 47 in Part IV are five-mark questions. These are to be answered in detail Draw diagrams wherever necessary.

Time: 3 Hours

Maximum Marks: 90

Part – I

Answer all the questions. Choose the correct answer. [20 × 1 = 20]

Question 1.

……………is the amount incurred in order to produce and sell the goods and services. ‘

(a) Creditor

(b) Debtor

(c) Stock

(d) Expense

Answer:

(d) Expense

![]()

Question 2.

…………..is the incapability of a person or an enterprises to pay the debts.

(a) Asset

(b) Liability

(c) Insolvency

(d) Sales

Answer:

(c) Insolvency

Question 3

……………….requires analytical skill.

(a) Accounting

(b) Single entry

(c) Book-keeping

(d) Ledger

Answer:

(a) Accounting

Question 4.

The word ‘convention’ refers …………………

(a) Traditions

(b) Trade

(c) Business

(d) Accounting

Answer:

(a) Traditions

![]()

Question 5.

Goodwill is an example of …………….. accounts.

(a) Real

(b) Nominal

(c) Tangible real

(d) Intangible real

Answer:

(d) Intangible real

Question 6.

Journal means…………….

(a) Daily

(b) Monthly

(c) Yearly

(d) Weekly

Answer:

(a) Daily

Question 7.

Net position of an account cannot be ascertained from…………….

(a) Journal

(b) Ledger

(c) Trial balance

(d) Balance sheet

Answer:

(a) Journal

Question 8.

Total of debit > total of credit =…………….

(a) Debit balance

(b) Credit balance

(c) Nil balance

(d) Trial balance

Answer:

(a) Debit balance

![]()

Question 9.

Two methods of preparing a trial balance are…………….

(a) Financial method and total method

(b) Total method and normal method

(c) Balance method and financial method

(d) Balance method and total method

Answer:

(d) Balance method and total method

Question 10.

The accounts you would find in a sales ledger are those of ……………….

(a) Income and expenses

(b) Trade payables

(c) Trade receivables

(d) Assets

Answer:

(c) Trade receivables

Question 11.

The balance in the petty cash book is ……………

(a) An asset

(b) A liability

(c) An income

(d) None of these

Answer:

(a) An asset

Question 12.

The bank statement shows an overdrawn balance of ₹ 2,000. A cheque for ₹ 500 drawn in favour of a creditor has not yet been presented for payment. When the creditor prevents the cheque for payment, the bank balance will be…………….

(a) ₹ 1,500

(b) ₹ 2,500 (overdrawn)

(c) ₹ 2,500

(d) ₹ 3,500

Answer:

(b) ₹ 2,500 (overdrawn)

Question 13.

Suspense account will remain in the books until the location and ……………….

(a) Errors of principle

(b) Errors of omission

(c) Compensating errors

(d) Rectification of errors

Answer:

(d) Rectification of errors

![]()

Question 14.

Two-sided errors are not revealed by ……………..

(a) Debit balance

(b) Credit balance

(c) Balance sheet

(d) Trial balance

Answer:

(d) Trial balance

Question 15.

The amount of depreciation goes on decreasing year after year in proportion to the unexpired ………….

life of the

(a) Time

(b) Assets

(c) Maintenance

(d) Factors

Answer:

(b) Assets

Question 16.

The period for which an asset can be used in the enterprise is known as estimated useful…………….

(a) Life of an asset

(b) Actual cost of asset

(c) Other factors

(d) Scrap value of an asset

Answer:

(a) Life of an asset

Question 17.

The net loss which arises in a business is an example of…………….

(a) Revenue loss

(b) Capital loss

(c) Neither of the two

(d) None

Answer:

(a) Revenue loss

Question 18.

Sales account has credit balance and sales returns has ………………..

(a) Debit balance

(b) Journal

(c) Credit balance

(d) Sales

Answer:

(a) Debit balance

Question 19.

Capital contributed by proprietor is a liability to the ……………..

(a) Expense

(b) Income

(c) Debit

(d) Business

Answer:

(d) Business

![]()

Question 20.

Software are used by those enterprises where ……………. are somewhat peculiar in nature.

(a) Financial transactions

(b) Software

(c) Debit

(d) Business

Answer:

(a) Financial transactions

Part – II

Answer any seven questions in which question No. 21 is compulsory: [7 × 2 = 14]

Question 21.

What are the steps involved in the process of accounting?

Answer:

- Identifying

- Measuring

- Recording

- Classifying

- Summarising

- Interpreting and

- Communicating financial information

Question 22.

What is accounting equation?

Answer:

The relationship of assets with that of liabilities to outsiders and to owners in the equation form is.known as accounting equation.

Question 23.

What is meant by Posting?

Answer:

The process of transferring the debit and credit items from the journal to the ledger accounts is called posting.

Question 24.

State whether the balance of the following accounts should be placed in the debit or the credit column of the trial balance:

(i) Carriage outwards (ii) Carriage inwards (iii) Sales (iv) Purchases

Answer:

(i) Carriage outwards – Debit balance

(ii) Carriage inwards – Debit balance

(iii) Sales – Credit balance

(iv) Purchases – Debit balance

Question 25.

Define Bill of exchange.

Answer:

According to the Negotiable Instruments Act 1881, “Bill of exchange is an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of a certain person or to the bearer of the instrument”.

Question 26.

What is bank reconciliation statement?

Answer:

The bank reconciliation statement is a statement that reconciles the balance as per the bank column of cash book with the balance as per the bank statement by giving the reasons for such difference along with the amount.

![]()

Question 27.

What is Error of principle?

Answer:

It means the mistake committed in the application of fundamental accounting principles in recording a transaction in the books of accounts.

Question 28.

What is Annuity method?

Answer:

Under this method, not only the original cost of the asset but also the amount of interest on ‘ the investment is taken into account while computing depreciation. The idea of considering interest is that if the investment is made in any other asset instead of the relevant fixed asset, it would have earned certain rate of interest.

Question 29.

What is meant by deferred revenue expenditure?

Answer:

An expenditure, which is revenue expenditure in nature, the benefit of which is to be derived over a subsequent period or periods is known as deferred revenue expenditure.

Question 30.

What is meant by software?

Answer:

A set of programs that form an interface between the hardware and the user of a computer system are referred to as software.

Part – III

Answer any seven questions in which question No. 31 is compulsory: [7 × 3 = 21]

Question 31.

Write any three objectives of Accounting?

Answer:

- To keep a systematic record of financial transactions and events.

- To ascertain the profit or loss of the business enterprise.

- To ascertain the financial position or status of the enterprise.

Question 32.

Write any three principles of double entry system.

Answer:

- In every business transaction, there are two aspects.

- The two aspects involved are the benefit or value receiving aspect and benefit or value . giving aspect.

- These two aspects involve minimum two accounts, atleast one debit and atleast one credit.

Question 33.

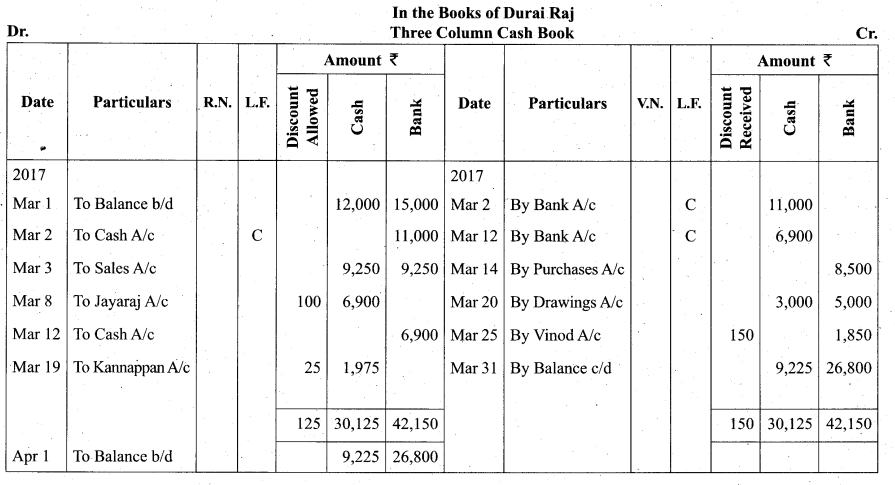

Dinesh, a customer is declared insolvent and 40 paise in a rupee is received from the estate for his due ₹ 10,000.

Answer:

Question 34.

What are the limitations of trial balance? (any three)

Answer:

- It is possible to prepare trial balance of an organisation, only if the double entry system . is followed.

- Even if some transactions are omitted, the trial balance will tally.

- Trial balance may be even though errors arc committed in the books of account.

Question 35.

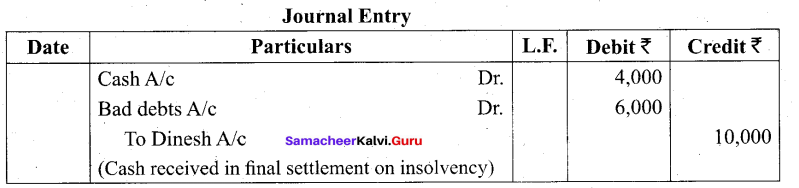

Enter the following transactions in returns inward book of Magesh a textile dealer:

Answer:

![]()

Question 36.

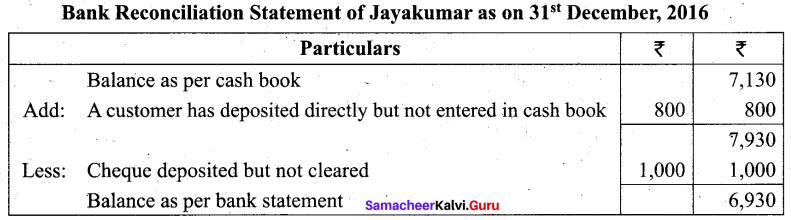

From the following particulars prepare a bank reconciliation statement of Jayakumar as on 31st December, 2016.

a. Balance as per cash book ₹ 7,130.

b. Cheques deposited but not cleared ₹ 1,000.

c. A customer has deposited ₹ 800 into the bank directly.

Answer:

Question 37.

Rectify the following errors:

1. Sales book is undercast by ₹ 200.

2. Purchases book is overcast by ₹ 300.

3. The total of salary account is carried forward ₹ 2,000 excess.

Answer:

1. Sales account should be credited with ₹ 200.

2. Purchases account shoftld be credited with ₹ 300.

3. Salary account is to be credited with ₹ 2,000.

Question 38.

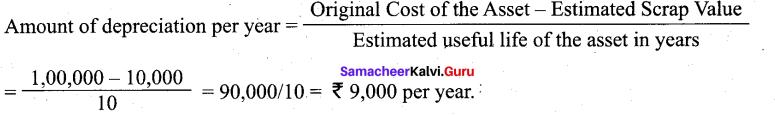

On 01.01.2017 a firm purchased a machine at a cost of ₹ 1,00,000. Its life was estimated to be 10 years with a scrap value of ₹ 10,000. Compute the amount of depreciation to be charged at the end of each year.

Answer:

Question 39.

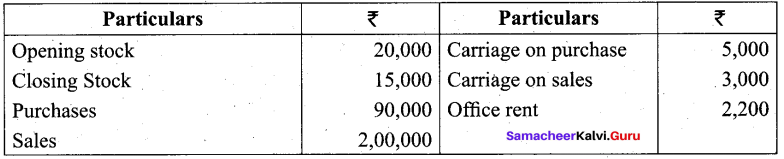

Ascertain gross profit or gross loss from the following:

Answer:

Note: Carriage on sales and office rent are indirect expenses, so they should be shown in profit and loss account.

Question 40.

List out the various reports generated by computerised accounting system.

Answer:

Day books/Joumals, Ledgers, Trial balance, Trading account, Profit and loss account, Balance sheet, etc.

In accounting, computer is commonly used in the following areas:

- Recording of business transactions.

- Payroll accounting.

- Stores accounting and

- Generation of accounting reports.

![]()

Part – IV

Answer all the questions: [7 × 5 = 35]

Question 41.

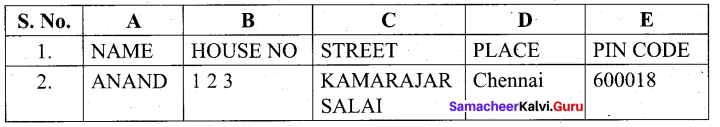

(a) From the data given below (concatenate).

(i) Fill the address in B3 using CONCATENATE FUNCTION.

(ii) Change KAMARAJAR SALAI given in C2 as lower case in C3.

(iii) Change Chennai given in D2 as upper case in D3.

Answer

Procedure:

(i) To fill the address

- Open a new spread sheet in MS – Excel

- Enter all given values as given in the question

- Enter the formula in the cell B3 as = CONCATENATE (“A2”, “B2”, “C2”, “D2”, “H2”)

Answer: ANAND 123 KAMARAJAR SALAI Chennai 600018

(ii) To change KAMARAJAR SALAI given in C2 as lower case in C3

Enter the formula in the cell C3 as = LOWER (C2)

Answer: Kamarajar Salai

(iii) To change Chennai given in D2 as UPPER case in D3.

Enter the formula in the cell D3 as = UPPER (D2).

Answer: CHENNAI

[OR]

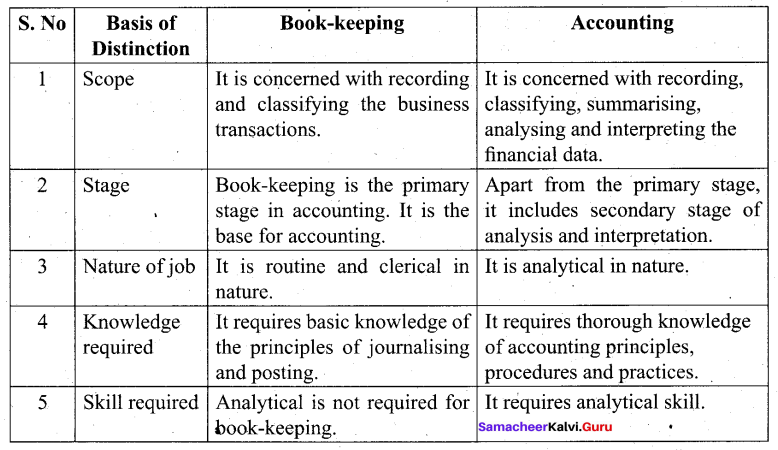

(b) What are the differences between book-keeping and accounting?

Answer:

![]()

Question 42.

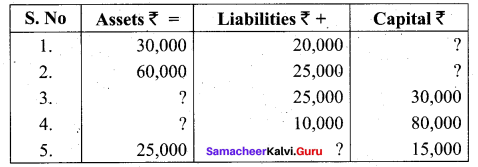

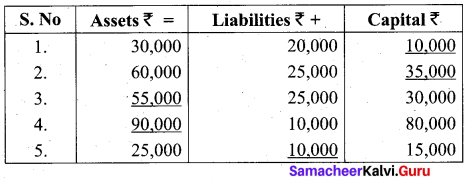

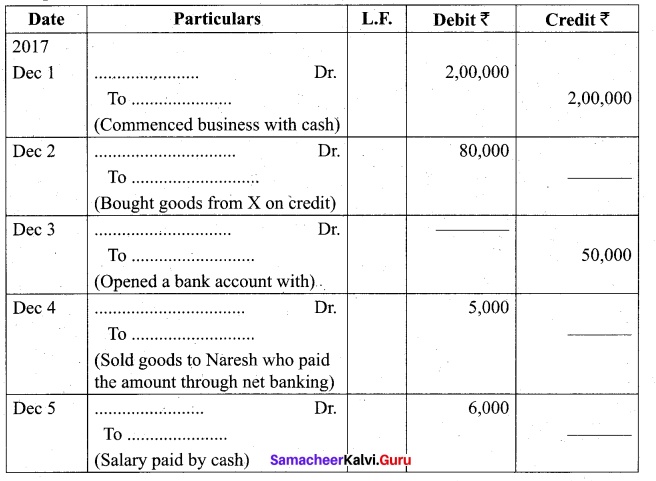

(a) Complete the missing items.

Answer:

[OR]

(b) Complete and rewrite the missing.

Answer:

![]()

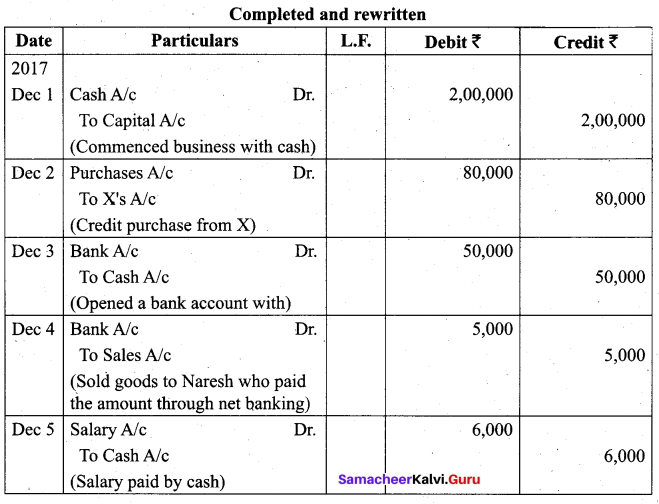

Question 43.

(a) Prepare ledger accounts from the following transactions.

| Date |

Particulars |

| 2017 June 1 |

Started business with cash 2,00,000 |

| June 2 | Opened bank account with 80,000 |

| June 3 | Bought goods on credit from Ram for 30,000 |

| June 4 | Goods purchased for cash 15,000 |

| June 5 | Paid to Ram 30,000 through NEFT |

Answer:

![]()

[OR]

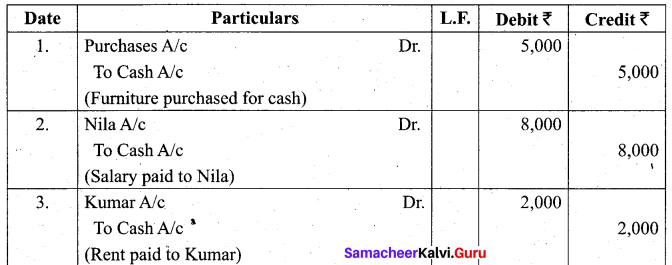

(b) Rectify the following Journal Entries.

Answer:

![]()

Question 44.

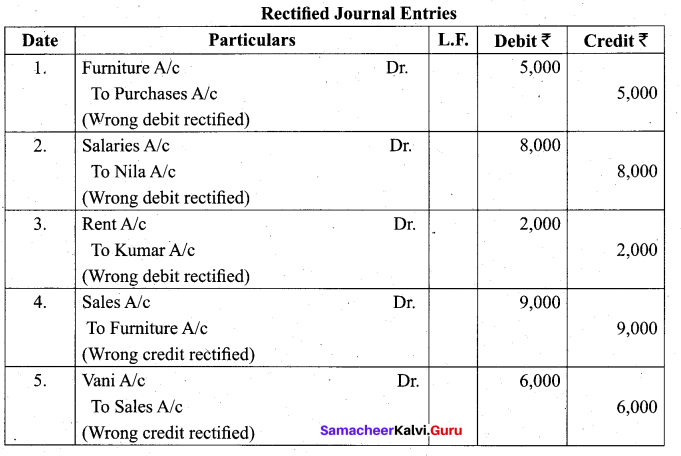

(a) Prepare Trial balance of Chitra as on 31st March, 2017.

Answer:

[OR]

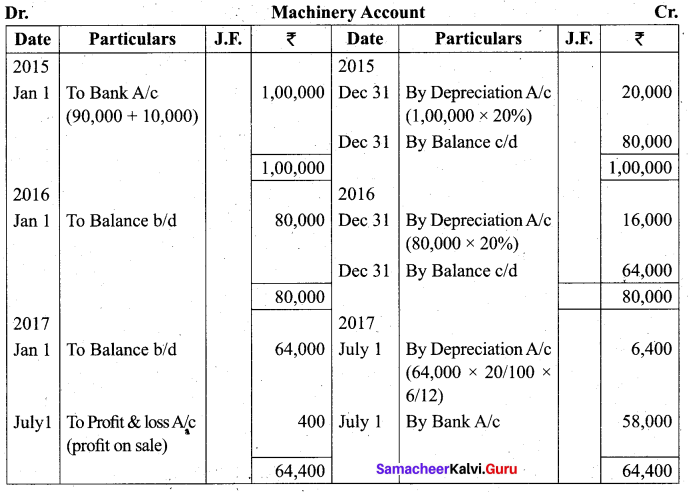

(b) A company purchased machinery costing X 90,000 on January 1, 2015 and spent X 10,000 on its erection. On July 1, 2017, the machinery was sold for X 58,000. The company written off depreciation at 20% p.a. under written down value method. Prepare machinery account. The books are closed on 31st December every year.

Answer:

Question 45.

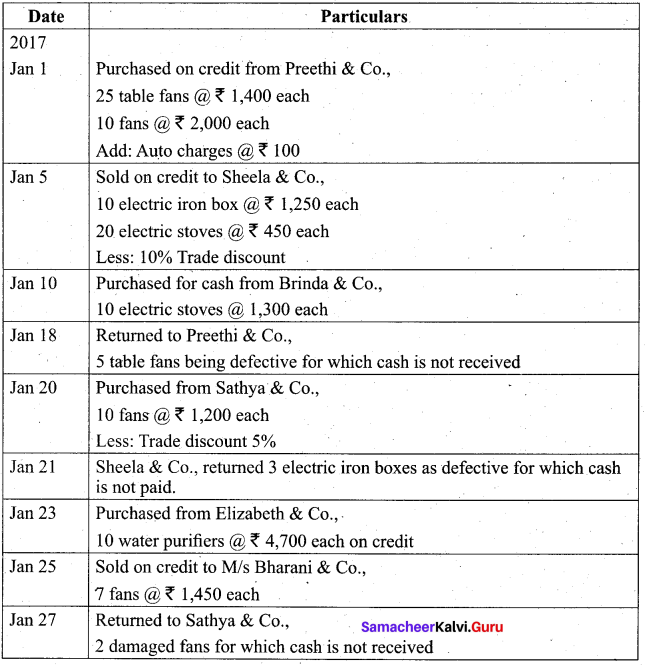

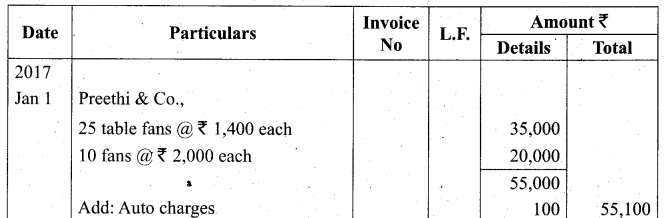

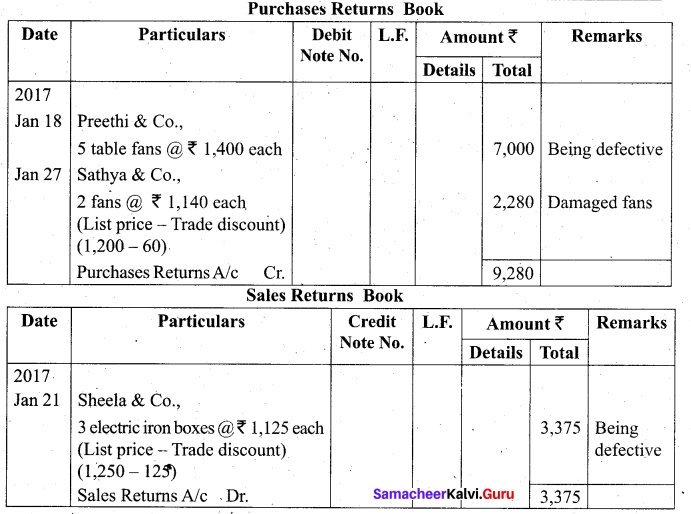

(a) Record the following transactions of Vijay Electrical & Co., in the purchase book, purchase returns book, sales book and sales return book.

Answer:

![]()

[OR]

(b) Identify the following items into capital or revenue.

1. Audit fees paid ₹ 10,000

2. Labour welfare expenses ₹ 5,000

3. ₹ 2,000 paid for servicing the company vehicle.

4. Repair to furniture purchased second hand ₹ 3,000.

5. Rent paid for the factory ₹ 12,000.

Answer:

1. Revenue

2. Revenue

3. Revenue

4. Capital

5. Revenue

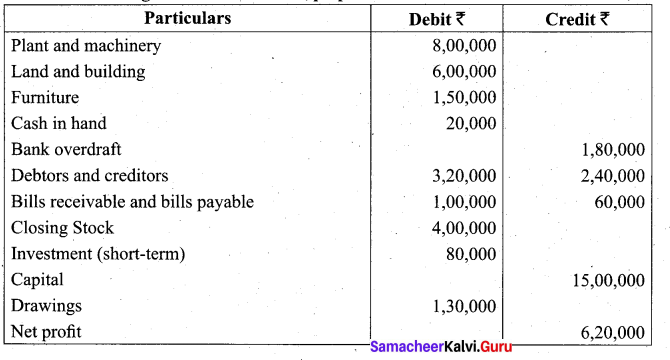

Question 46.

(a) From the following balances of Niruban, prepare balance sheet as on 31st December, 2017.

Answer:

![]()

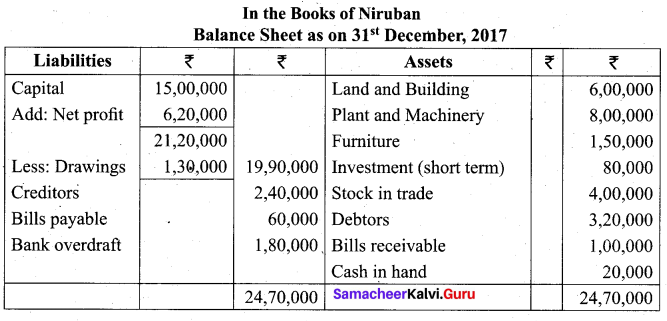

[OR]

(b) Give necessary entries to adjust the following on 31st December, 2017.

| S.No. | Particulars |

₹ |

| 1 | Outstanding salaries | 1,200 |

| 2 | Outstanding rent | 300 |

| 3 | Prepaid insurance premium | 450 |

| 4 | Interest on investments accrued | 400 |

| 5 | Bad debts written off | 200 |

Answer:

Question 47.

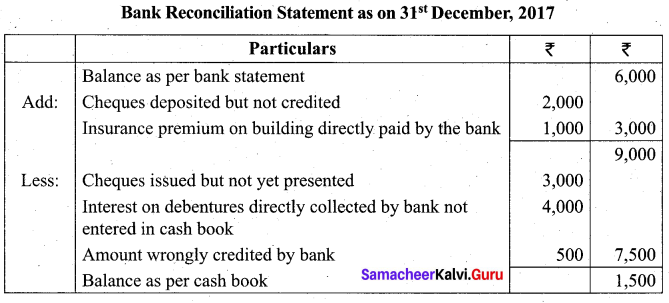

(a) From the following information, prepare bank reconciliation statement as on 31st December, 2017 to find out the balance as per bank statement.

| S.No. | Particulars |

₹ |

| 1 | Balance as per bank statement | 6,000 |

| 2 | Cheques deposited on 28th December, 2017 but not yet credited | 2,000 |

| 3 | Cheques issued for 10,000 on 20th December, 2017 but not yet presented for payment | 3,000 |

| 4 | Interest on debentures directly collected by the bank not recorded in cash book | 4,000 |

| 5 | Insurance premium on building directly paid by the bank | 1,000 |

| 6 | Amount wrongly credited by bank | 500 |

Answer:

[OR]

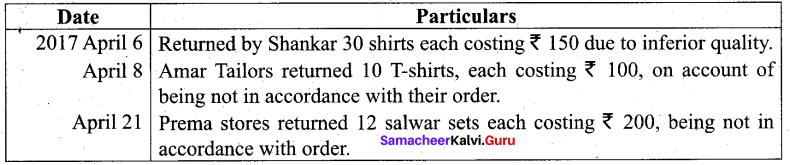

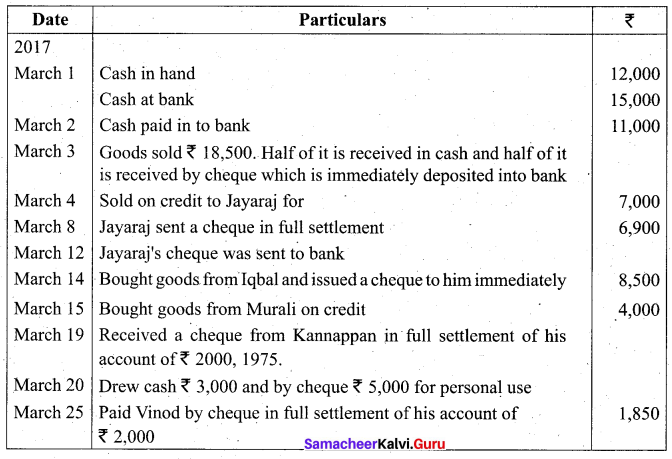

(b) Prepare three column cash book in the books of Thiru Durairaj.

Answer: