Students can Download Accountancy Chapter 6 Subsidiary Books – I Questions and Answers, Notes Pdf, Samacheer Kalvi 11th Accountancy Book Solutions Guide Pdf helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

Tamilnadu Samacheer Kalvi 11th Accountancy Solutions Chapter 6 Subsidiary Books – I

Samacheer Kalvi 11th Accountancy Subsidiary Books – I Text Book Back Questions and Answers

I. Multiple Choice Questions

Choose the Correct Answer

Question 1.

Purchases book is used to record ……………..

(a) all purchases of goods

(b) all credit purchases of assets

(c) all credit purchases of goods

(d) all purchases of assets

Answer:

(c) all credit purchases of goods

Question 2.

A periodic total of the purchases book is posted to the ……………..

(a) debit side of the purchases account

(b) debit side of the sales account

(c) credit side of the purchases account

(d) credit side of the sales account

Answer:

(a) debit side of the purchases account

![]()

Question 3.

Sales book is used to record ……………..

(a) all sales of goods

(b) all credit sales of assets

(c) all credit sales of goods

(d) all sales of assets and goods

Answer:

(c) all credit sales of goods

Question 4.

The total of the sales book is posted periodically to the credit of ……………..

(a) Sales account

(b) Cash account

(c) Purchases account

(d) Journal proper

Answer:

(a) Sales account

Question 5.

Purchase returns book is used to record ……………..

(a) returns of goods to the supplier for which cash is not received immediately

(b) returns of assets to the supplier for which cash is not received immediately

(c) returns of assets to the supplier for which cash is received immediately

(d) None of the above

Answer:

(a) returns of goods to the supplier for which cash is not received immediately

Question 6.

Sales return book is used to record ……………..

(a) Returns of goods by the customer for which cash is paid immediately

(b) Returns of goods by the customer for which cash is not paid immediately

(c) Returns of assets by the customer for which cash is not paid immediately

(d) Returns of assets by the customer for which cash is paid immediately

Answer:

(b) Returns of goods by the customer for which cash is not paid immediately

![]()

Question 7.

Purchases of fixed assets on credit basis is recorded in ……………..

(a) Purchases book

(b) Sales book

(c) Purchases returns book

(d) Journal proper

Answer:

(d) Journal proper

Question 8.

The source document or voucher used for recording entries in sales book is ……………..

(a) Debit note

(b) Credit note

(c) Invoice

(d) Cash receipt

Answer:

(c) Invoice

Question 9.

Which of the following statements is not true?

(a) Cash discount is recorded in the books of accounts

(b) Assets purchased on credit are recorded in journal proper

(c) Trade discount is recorded in the books of accounts

(d) 3 grace days are added while determining the due date of the bill

Answer:

(c) Trade discount is recorded in the books of accounts

Question 10.

Closing entries are recorded in ……………..

(a) Cash book

(b) Ledger

(c) Journal proper

(d) Purchases book

Answer:

(c) Journal proper

II. Very Short Answer Questions

Question 1.

Mention four types of subsidiary books.

Answer:

- Purchase Book

- Sales Book

- Purchase Return Book

- Sales Return Book

Question 2.

What is purchases book?

Answer:

Purchases book is a subsidiary book in which only credit purchases of goods are recorded. When business wants to know the information about the credit purchases of goods at a glance, the information can be made available if purchases of goods on credit are separately recorded.

![]()

Question 3.

What is purchases returns book?

Answer:

Purchases returns book is a subsidiary book in which transactions relating to return of previously purchased goods to the suppliers, for which cash is not immediately received are recorded. Since goods are going out to the suppliers, they are also known as returns outward and the book is called as ‘returns outward book or returns outward journal’.

Question 4.

What is sales book?

Answer:

Sales book is a subsidiary book maintained to record credit sale of goods. Goods mean the items in which the business is dealing. These are meant for regular sale. Cash sale of goods and sale of property and assets whether for cash or on credit are not recorded in the sales book. This book is also named as sales day book, sold day book, sales journal or sale register.

Question 5.

What is sales returns book?

Answer:

Sales returns book is a subsidiary book, in which, details of return of goods sold for which cash is not immediately paid are recorded. Just as goods may be returned to suppliers, goods may be returned by customers.

Question 6.

What is debit note?

Answer:

A ‘debit note’ is a document, bill or statement sent to the person to whom goods are returned. This statement informs that the supplier’s account is debited to the extent of the value of goods returned. It contains the description and details of goods returned, name of the party to whom goods are returned and net value of the goods so returned with reason for return.

Question 7.

What is credit note?

Answer:

A credit note is prepared by the seller and sent to the buyer when goods are returned indicating that the buyer’s account is credited in respect of goods returned. Credit note is a statement prepared by a trader who receives back the goods sold from his customer. It contains details such as the description of goods returned by the buyer, quantity returned and also their value.

![]()

Question 8.

What is journal proper?

Answer:

Journal proper is a residuary book which contains record of transactions, which do not find a place in the subsidiary books such as cash book, purchases book, sales book, purchases returns book, sales returns book, bills receivable book and bills payable book. Thus, journal proper or general journal is a book in which the residual transactions which cannot be entered in any of the sub divisions of journal are entered.

Question 9.

Define bill of exchange.

Answer:

According to the Negotiable Instruments Act, 1881, “Bill of exchange is an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of a certain person or to the bearer of the instrument”.

Question 10.

What is an opening entry?

Answer:

Journal entry made in the beginning of the current year with the balances of assets and liabilities of the previous year is opening journal entry. In this entry, asset accounts are debited, liabilities and capital accounts are credited.

Question 11.

What is an invoice?

Answer:

Entries in the purchases day book are made from invoices which are popularly known as bills. Invoice is a business document or bill or statement, prepared and sent by the seller to the buyer giving the details of goods sold, such as quantity, quality, price, total value, etc. Thus, the invoice is a source document of prime entry both for the buyer and the seller.

III. Short Answer Questions

Question 1.

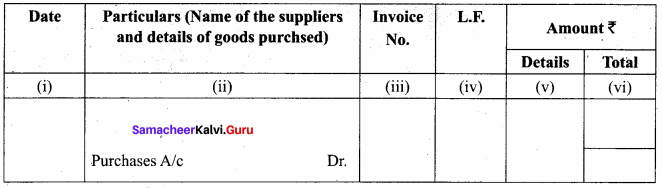

Give the format of purchases book.

Answer:

Format of Purchases book / Purchases Journal

Question 2.

Mention the subsidiary books in which the following transactions are recorded

- Sale of goods for cash

- Sale of goods on credit

- Purchases of goods on credit

- When the proprietor takes goods for personal use

- Goods returned to suppliers for which cash is not received immediately

- Asset purchased as credit.

Answer:

- Cash book

- Sales book

- Purchase book

- Journal proper

- Purchase return book

- Journal proper

![]()

Question 3.

What are the advantages of subsidiary books?

Answer:

The advantages of maintaining subsidiary books are:

1. Proper and systematic record of business transactions: All the business transactions are classified and grouped conveniently as cash and non cash transactions, which are further classified as credit purchases, credit sales, returns, etc. As separate books are used for each type of transactions, individual transactions are properly and systematically recorded in the subsidiary books.

2. Convenient posting: All the transactions of a particular nature are recorded at one place, i.e., in one of the subsidiary books. For example, all credit purchases of goods are recorded in the purchases book and all credit sales of goods are recorded in the sales book. It facilitates posting to purchases account, sales account and concerned personal accounts.

3. Division of work: As journal is sub-divided, the work will be sub – divided and different persons can work on different books at the same time and the work can be speedily completed.

4. Efficiency: The sub – division of work gives the advantage of specialisation. When the same work is done by a person repeatedly the person becomes efficient in handling it. Thus, specialisation leads to efficiency in accounting work.

5. Helpful in decision making: Subsidiary books provide complete details about every type of transactions separately. Hence, the management can use the information as the basis for deciding its future actions. For example, information regarding sales returns from the sales returns book will enable the management to analyse the causes for sales returns and to adopt effective measures to remove deficiencies.

6. Prevents errors and frauds: Internal check becomes more effective as the work can be divided in such a manner that the work of one person is automatically checked by another person. With the use of internal check, the possibility of occurrence of errors or fraud may be avoided or minimised.

7. Availability of requisite information at a glance: When all transactions are entered in one journal, it is difficult to locate information about a particular item. When subsidiary books are maintained, details about a particular type of transaction can be obtained from subsidiary books. The maintenance of subsidiary books helps in obtaining the necessary information at a glance.

8. Detailed information available: As all transactions relating to a particular item are entered in a subsidiary book, it gives detailed information. It is easy to arrive at monthly or quarterly totals.

9. Saving in time: As there are many subsidiary books, work of entering can be done simultaneously by many persons. Thus, it saves time and accounting work can be completed quickly.

10. Labour of posting is reduced: Labour of posting is reduced as posting is made in periodical totals to the impersonal account, for example, Purchases account.

![]()

Question 4.

Write short notes on:

- Endorsement of a bill and

- Discounting of a bill

Answer:

1. Endorsement means signing on the face or back of a bill for the purpose of transferring the title of the bill to another person. The person who endorses is called the “Endorser”. The person to whom a bill is endorsed is called the “Endorsee”. The endorsee is entitled to collect the money.

2. When the holder of a bill is in need of money before the due date of a bill, cash can be received by discounting the bill with the banker. This process is referred to as the discounting of bill. The banker deducts a small amount of the bill which is called discount and pays the balance in cash immediately to the holder of the bill.

IV. Exercises

Question 1.

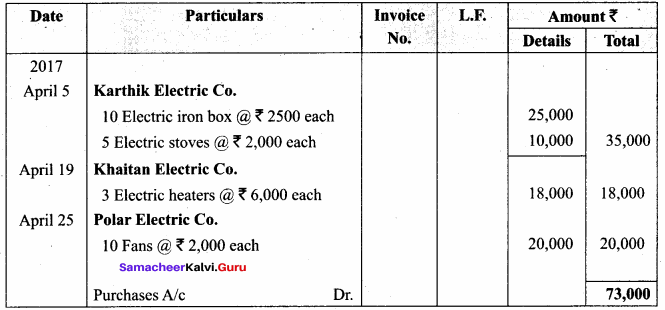

Enter the following transactions in the Purchases book of M/s. Subhashree Electric Co., which deals in electric goods. (3 Marks)

2017:

April 5 – Purchased from Karthik Electric Co., on credit

10 Electric iron box @ ₹ 2,500 each

5 electric stoves @ ₹ 2,000 each

April 19 – Purchased on credit from Khaitan Electric Co.,

3 electric heaters @ ₹ 6,000 each

April 25 – Purchased from Polar Electric Co., on credit.

10 Fans @ ₹ 2,000 each

April 29 – Purchased from M & Co. for cash

10 electric stoves @ ₹ 3,000 each

Solution:

In the books of M/s Subhashree Electric Co.

Purchases book

Question 2.

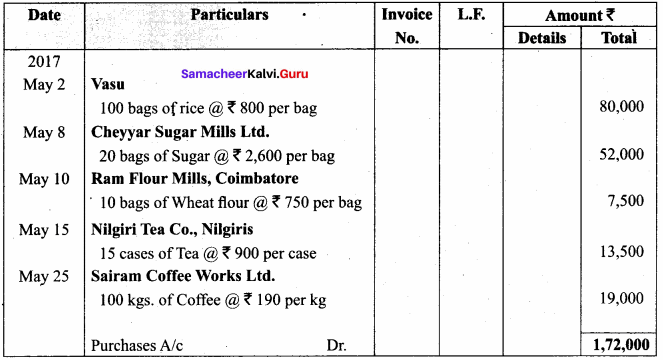

Enter the following credit transactions in the purchases book of Manoharan, a Provisions Merchant. (5 Marks)

2017:

- May 2 – Bought from Vasu 100 bags of rice @ ₹ 800 per bag

- May 8 – Bought from Cheyyar Sugar Mills Ltd., 20 bags of sugar @ ₹ 2,600 per bag

- May 10 – Bought from Ram Flour Mill, Coimbatore, 10 bags of wheat flour @ ₹ 750 per bag

- May 15 – Bought from Nilgiri Tea Co., Nilgiris, 15 cases of tea @ ₹ 900 per case

- May 25 – Bought from Sairam Coffee Works Ltd., 100 kgs of Coffee @ ₹ 190 per kg.

- May 29 – Bought from X & Co. furniture worth ₹ 2,000

Solution:

In the books of Manoharan, a Provisions Merchant

Purchase book

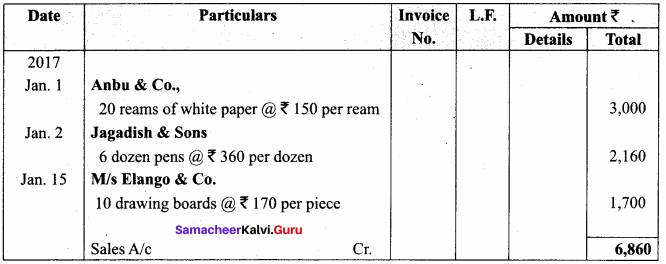

Question 3.

From the following transactions write up the Sales day book of M/s. Ram & Co., a stationery merchant. (3 Marks)

2017:

- Jan. 1 – Sold to Anbu & Co., on credit 20 reams of white paper @ ₹ 150 per ream

- Jan. 2 – Sold to Jagadish & Sons on credit 6 dozen pens @ ₹ 360 per dozen

- Jan. 10 Sold old newspapers for cash @ ₹ 620

- Jan. 15 – Sold on credit M/s. Elango & Co., 10 drawing boards @ ₹ 170 per piece

- Jan. 20 – Sold to Kani & Co., 4 writing tables at ₹ 1,520 per table for cash

Solution:

In the books of M/s Ram & Co., Stationery Merchant

Sales book

Question 4.

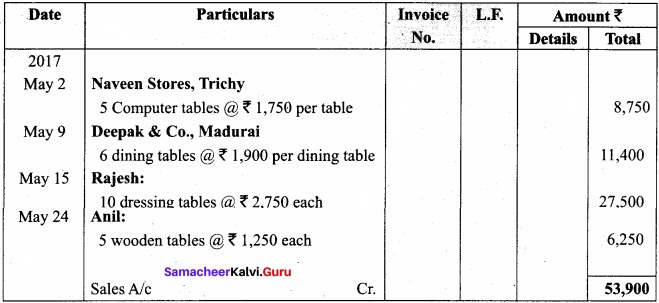

Enter the following transactions in the Sales book of Kamala Stores, a furniture shop. (3 Marks)

2017:

- May 2 – Sold to Naveen Stores, Trichy on credit 5 computer tables @ ₹ 1,750 per table

- May 9 – Sold to Deepa & Co., Madurai on credit 6 dining tables @ ₹ 1,900 per dining table

- May 15 – Sold to Rajesh 10 dressing tables @ ₹ 2,750 each on credit

- May 24 – Sold to Anil 5 wooden tables @ ₹ 1,250 per table on credit

- May 27 – Sold to Gopi 3 old computers @ ₹ 3,500 each

- May 29 – Sold 50 chairs to Anil @ ₹ 275 each for cash

Solution:

In the books of Kamala Stores, a furniture shop

Sales book

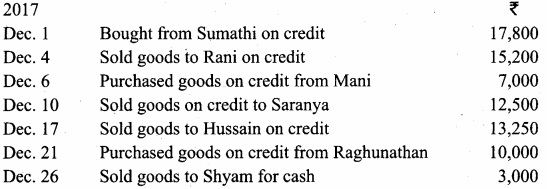

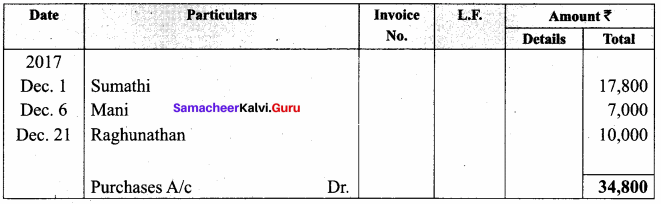

Question 5.

Enter the following transactions in the purchases and sales books of Kannan, an automobile dealer, for the month of December, 2017.

Solution:

In the books of Kannan, an automobile dealer

Purchases book

Sales Book

Question 6.

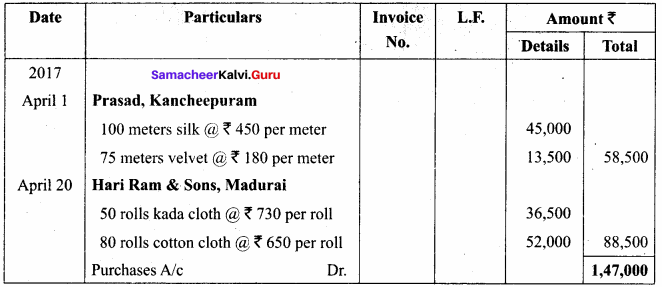

Prepare Purchases book and Sales book in the books of Santhosh Textiles Ltd., from the following transactions given for April, 2017. (5 Marks)

2017:

April 1 Purchased goods from Prasad, Kancheepuram on credit

100 meters Silk @ ₹ 450 per meter

75 meters Velvet @ ₹ 180 per meter

April 10 Sold goods to Rathinam, Chennai on credit

60 meters Silk @ ₹ 490 per meter

50 meters Velvet @ ₹ 210 per meter

April 18 Nathan & Sons purchased from us on credit

100 meters Silk @ ₹ 510 per meter

April 20 Purchased goods from Hari Ram & Sons, Madurai on credit

50 rolls kada cloth @ ₹ 730 per roll

80 rolls cotton cloth @ ₹ 650 per roll

April 24 Purchased from Mohan, Karur for cash

Shirting cloth @ ₹ 7,000

Sarees @ ₹ 25,000

Solution:

In the books of Santhosh Textiles Ltd.,

Purchase book

Sales book

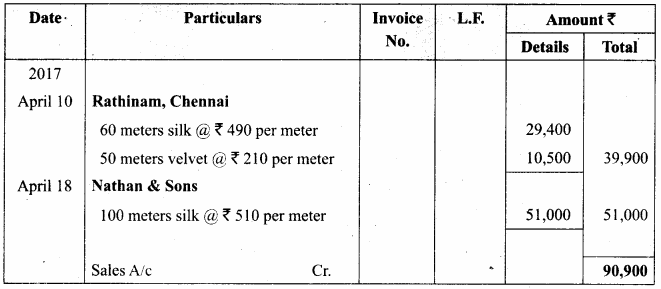

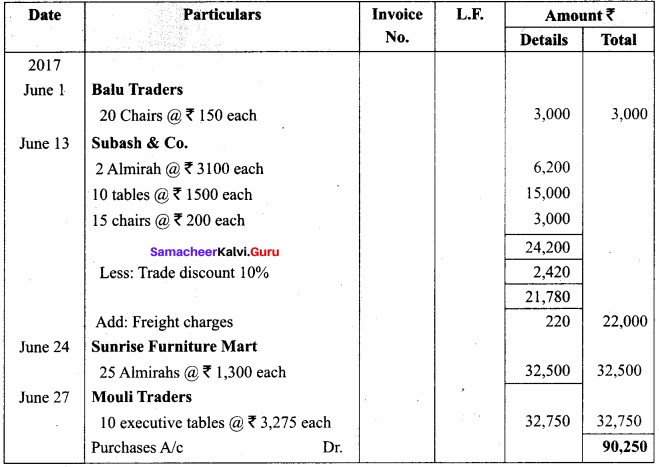

Question 7.

From the following information, prepare purchase day book and purchases returns book for the month of June, 2017 and post them into ledger accounts in the books of Robert Furniture Mart. (5 Marks)

2017:

June 1 – Purchased from Balu Traders 20 chairs @ ₹ 150 each on credit

June 13 – Bought from Subash & Co., on credit

2 Almirah @ ₹ 3,100 each

10 tables @ ₹ 1,500 each

15 chairs @ ₹ 200 each

Less: 10 % Trade discount on all items

Add: Freight charges ₹ 220

June 21 – Returned 2 damaged chairs to Balu Traders and cash not received

June 24 – Purchased from Sunrise Furniture Mart on credit

25 Almirahs @ ₹ 1,300 each

June 27 – Purchased from Mouli Traders on credit

10 executive tables @ ₹ 3,275 each

June 29 – Returned 3 Almirahs to Sunrise Furniture Mart and cash not received

Solution:

In the books of Robert Furniture Mart

Purchases book

In the books of Robert Furniture Mart

Purchases Return book

Ledger Acconts

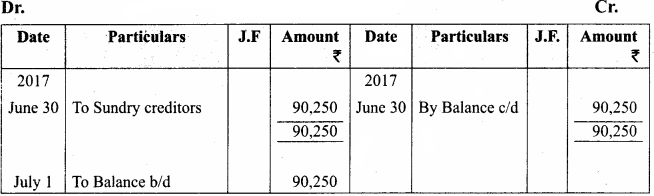

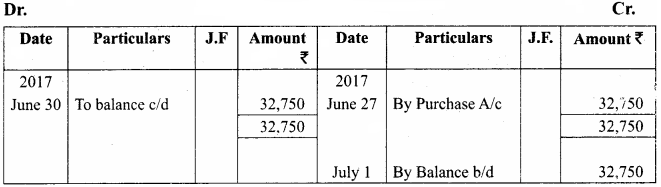

Purchase A/c

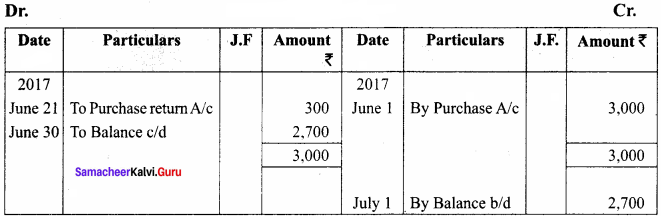

Balu Traders A/c

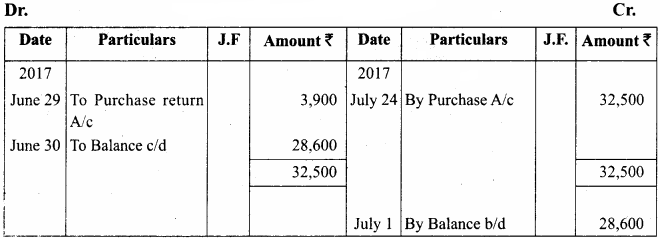

Sunrise Furniture Mart A/c

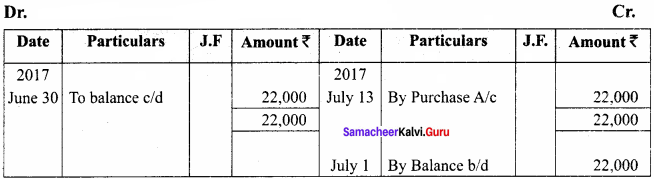

Subash & Co.A/c

Mouli Traders A/c

Ledger Accounts

Purchase Return A/c

Question 8.

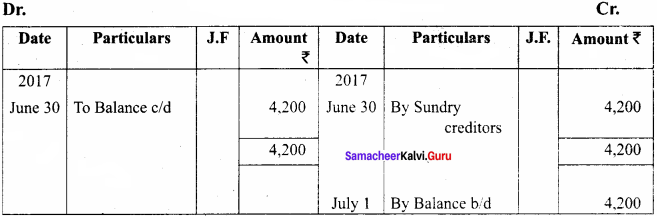

Enter the following transactions in the proper subsidiary books of Suman who is dealing in electronic goods for the month of January, 2017. (5 Marks)

2017

Jan. 2 – Purchased from M/s. Raj Electronics on credit

20 cell phones @ ₹ 5,500 per piece

10 colour TVs @ ₹ 14,500 per piece

Jan. 5 Purchased from M/s. Ruby Electronics on credit

10 radios @ ₹ 1,650 per piece

8 Tape recorders @ ₹ 2,500 per piece

Trade discount on all items @ 10%

Jan. 10 Returned to M/s. Raj Electronics 4 cell phones damaged and cash not received

Jan. 20 Purchased from M/s. Suganthi Electronics on credit

10 radios @ ₹ 3,700 per piece

2 Sony colour TVs @ ₹ 27,000 per piece

Trade discount @ 5% on all items

Solution:

In the books of Suman

Purchase book

In the Books of Suman

Purchase returns book

Question 9.

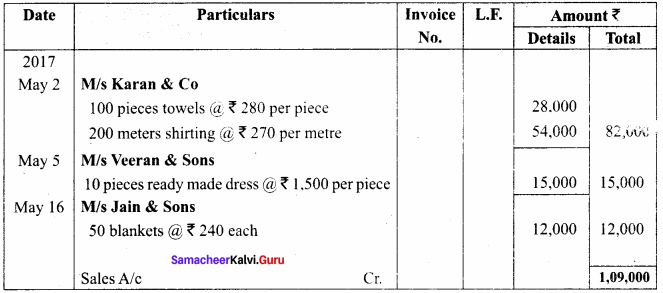

Enter the following transactions in the sales book and sales returns book of M/s. Guhan & Sons, who is a textile dealer. (5 Marks)

2017

May 2 – Sold to M/s. Karan & Co., on credit

100 pieces towels @ ₹ 280 per piece

200 metres shirtings @ ₹ 270 per metre

May 5 – Sold to M/s. Veeran & Sons on credit

10 pieces ready – made dress @ ₹ 1,500 per piece

May 16 – Sold to M/s. Jain & Sons on credit

50 blankets @ ₹ 240 each

May 20 Damaged 10 pieces towels returned by Karan & Co. and cash not paid

May 25 Sold old furniture to M/s. Saran & Co., on credit ₹ 18,000

May 27 Returned 2 pieces ready-made dresses by M/’s. Veeran&Sons due to inferior qualityand cash not paid

Solution:

In the books of M/s Guhan & Sons, a textile dealer

Sales book

Sales return book

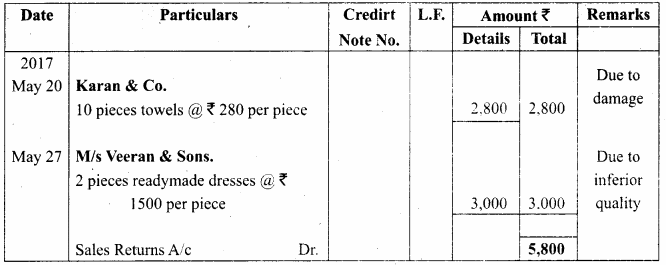

Question 10.

Record the following transactions in the sales book and sales returns book of M/s. Ponni & Co., and post them to ledger. (5 Marks)

2017:

- Aug. 1 – Sold goods to Senthil as per Invoice No. 68 for ₹ 20,500 on credit

- Aug. 4 – Sold goods to Madhavan as per Invoice No. 74 for ₹ 12,800 on credit

- Aug. 7 – Sold goods to Kanagasabai as per Invoice No. 78 for ₹ 7,500 on credit

- Aug. 15 – Returns inward by Senthil as per Credit Note no. 7 for ₹ 1,500 for which cash is not paid

- Aug. 20 – Sold goods to Selvam for ₹ 13,300 for cash

- Aug. 25 – Sales returns of ₹ 1,800 by Madhavan as per Credit Note No. 11 for which cash is , not paid

Solution:

In the books of M/s Ponni & Co.,

Sales book

Sales returns book

Ledger Accounts in the books of M/s Ponni & Co.

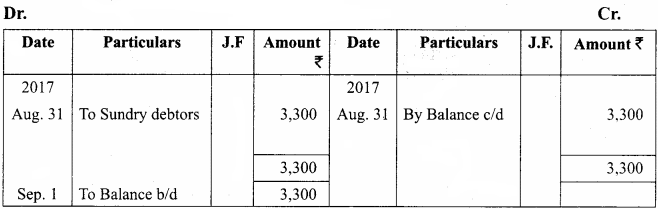

Sales A/c

Sales Return A/c

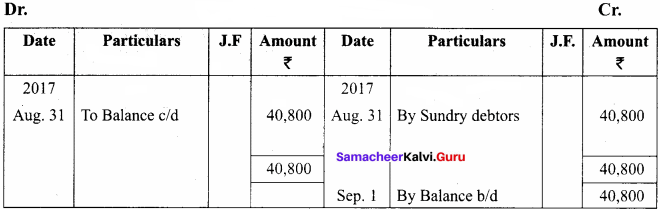

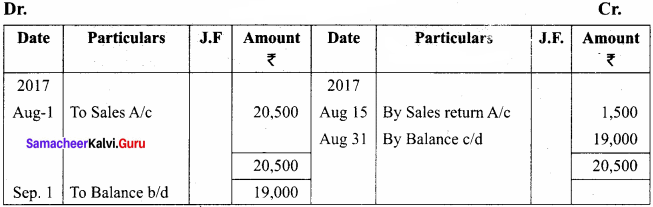

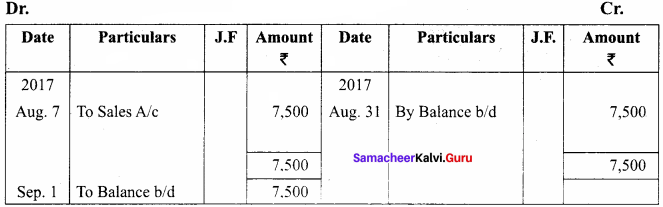

Senthil A/c

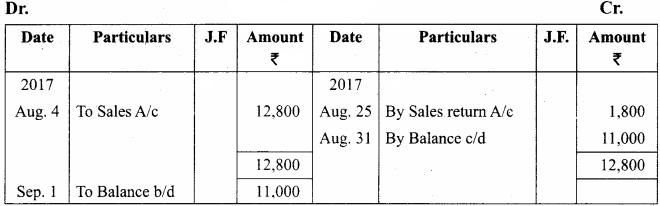

Madhavan A/c

Kanagasabai A/c

Question 11.

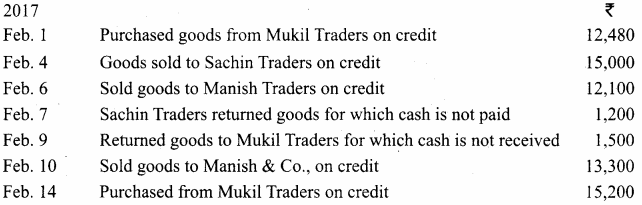

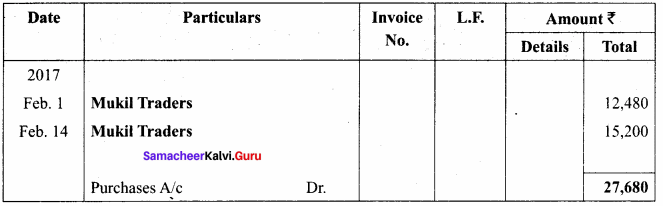

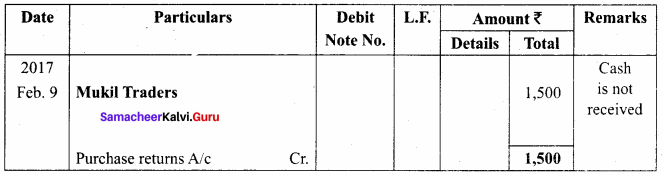

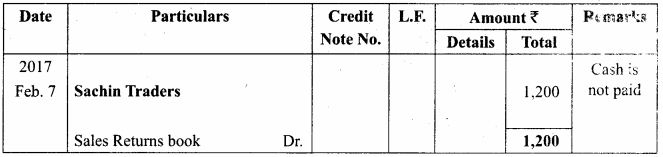

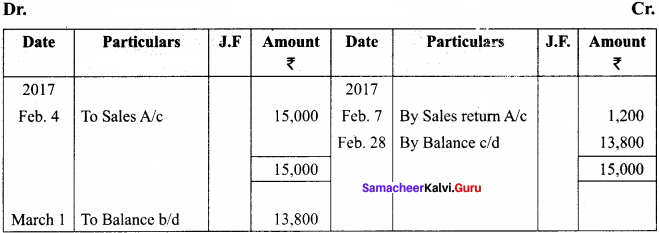

Prepare necessary subsidiary books in the books of Niranjan and also Sachin account and Mukil account from the following transactions for the month of February, 2017.

In the books of Niranjan

Purchase book

Sales book

Purchase return book

Sales return book

Sachin A/c

Mukil A/c

Question 12.

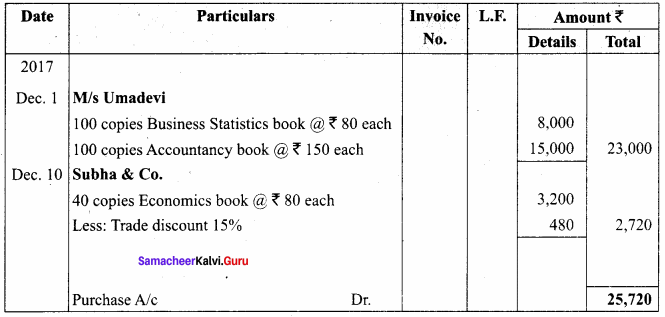

From the following information, prepare the necessary subsidiary books for Nalanda Book Stores.

2017:

Dec. 1 – Bought from M/s. Umadevi on credit

100 copies of Business Statistics Book @ ₹ 80 each

100 copies of Accountancy Book @ ₹ 150 each

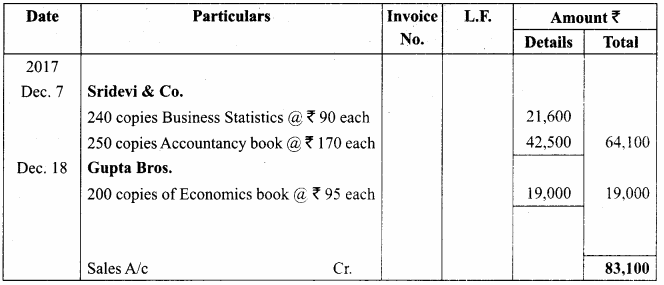

Dec.7 – Sold to Sridevi & Co., on credit

240 copies of Business Statistics @ ₹ 90 each

250 copies of Accountancy books @ ₹ 170 each

Dec. 10 – Bought from Subha & Co.,

40 copies of Economics Books @ ₹ 80 each

Less: 15% Trade Discount

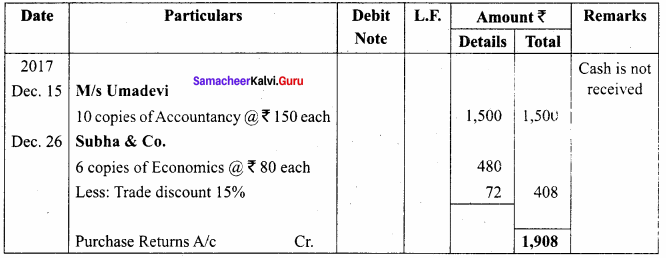

Dec. 15 Returned to M/s. Uma Devi 10 copies of damaged Accountancy book for which cash is not received

Dec. 18 Sold to Gupta Bros., on credit

200 copies of Economics book @ ₹ 95 each

Dec. 26 Returned 6 copies of Economics books to Subha & Co.,

Solution:

In the books of Nalanda Book Store

Purchase book

Sales book

Purchase Return book

Textbook Case Study Solved

Mr. Joseph started a trading business of selling readymade clothes. In the earlier period, he dealt only with cash, because he felt that would be risk-free. But, later on, he had to give credit period for his regular customers in order to retain them. For some customers, when they made bulk purchase, he offered them some discount. That brought him even more customers. But, some of his customers are not prompt in making the payment.

He expanded his business and employed few staff. As the credit transactions were numerous, he found it difficult to maintain properly. One of his friends, who is a Chartered Accountant advised him to maintain subsidiary books.

Discuss on the following points.

Question 1.

What could be the reason for Joseph’s feeling that dealing in cash is risk free?

Answer:

When we sell the goods, immediately we can get cash at once. So no debts had occurred in the business.

Question 2.

What type of discount is offered by Joseph?

Answer:

He offered trade discount.

![]()

Question 3.

Suggest some ways to Joseph for making his customers to pay on time.

Answer:

The cash discount may be offered by Joseph to his customers to pay on time.

Question 4.

Do you think that maintaining the subsidiary books will be useful to Joseph?

Answer:

Yes. it is useful.

- Sales book

- Sales returns book

- Purchases book

- Purchase returns book

Question 5.

What business documents are needed to maintain the subsidiary books?

Answer:

- Invoice

- Debit note

- Credit note