Students can Download Accountancy Chapter 4 Ledger Questions and Answers, Notes Pdf, Samacheer Kalvi 11th Accountancy Book Solutions Guide Pdf helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

Tamilnadu Samacheer Kalvi 11th Accountancy Solutions Chapter 4 Ledger

Samacheer Kalvi 11th Accountancy Ledger Text Book Back Questions and Answers

I. Multiple Choice Questions

Choose the Correct Answer

Question 1.

Main objective of preparing ledger account is to ……………..

(a) Ascertain the financial position

(b) Ascertain the profit or loss

(c) Ascertain the profit or loss and the financial position

(d) Know the balance of each ledger account

Answer:

(d) Know the balance of each ledger account

Question 2.

The process of transferring the debit and credit items from journal to ledger accounts is called ……………..

(a) Casting

(b) Posting

(c) Journalising

(d) Balancing

Answer:

(b) Posting

![]()

Question 3.

J.F means ……………..

(a) Ledger page number

(b) Journal page number

(c) Voucher number

(d) Order number

Answer:

(b) Journal page number

Question 4.

The process of finding the net amount from the totals of debit and credit columns in a ledger is known as ……………..

(a) Casting

(b) Posting

(c) Journalising

(d) Balancing

Answer:

(d) Balancing

Question 5.

If the total of the debit side of an account exceeds the total of its credit side, it means

(a) Credit balance

(b) Debit balance

(c) Nil balance

(d) Debit and credit balance

Answer:

(b) Debit balance

Question 6.

The amount brought into the business by the proprietor should be credited to ……………..

(a) Cash account

(b) Drawings account

(c) Capital account

(d) Suspense account

Answer:

(c) Capital account

II. Very Short Answer Questions

Question 1.

What is a ledger?

Answer:

Ledger account is a summary statement of all the transactions relating to a person, asset, liability, expense or income which has taken place during a given period of time and it shows their net effect. From the transactions recorded in the journal, the ledger account is prepared. Ledger is known as principal book of accounts.

Question 2.

What is meant by posting?

Answer:

The process of transferring the debit and credit items from the journal to the ledger accounts is called posting.

Question 3.

What is debit balance?

Answer:

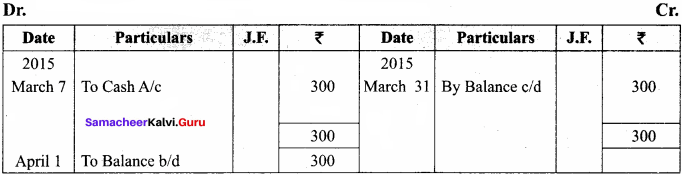

When the total of the debit side is more than the total of credit side the difference is debit balance and is placed on the credit side as ‘By Balance c/d’.

![]()

Question 4.

What is credit balance?

Answer:

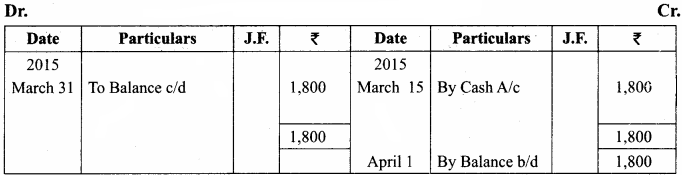

If the credit side total is more than the total of debit side, the difference is credit balance and is placed on the debit side as ‘To Balance c/d’.

Question 5.

What is balancing of an account?

Answer:

Balancing means that the debit side and credit side amounts are totalled and the difference between the total of the two sides is placed in the amount column as ‘Balance c/d’ on the side having lesser total, so that the total of both debit and credit columns are equal.

III. Short Answer Questions

Question 1.

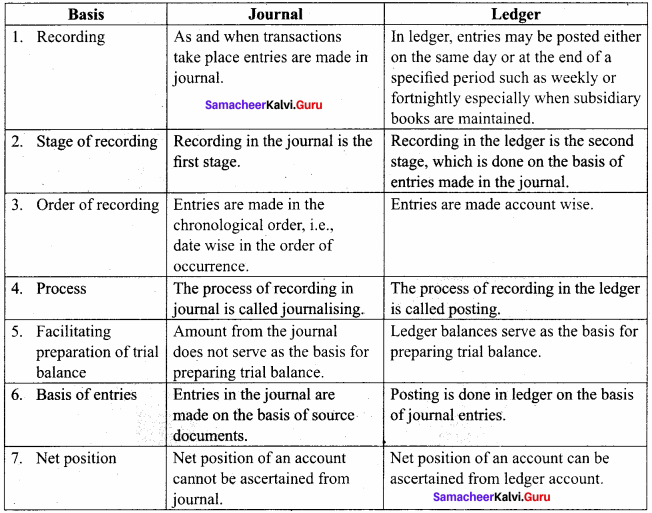

Distinguish between journal ad ledger.

Answer:

Following are the differences between journal and ledger:

Question 2.

What is ledger? Explain its utilities.

Answer:

1. Quick information about a particular account: Ledger account helps to get all information about a particular account like sales, purchases, machinery, etc., at a glance. For example, where there are several transactions with a debtor, the net amount due from a debtor can be known from the ledger account.

2. Control over business transactions: From the ledger balances extracted, a thorough analysis of account balances can be made which helps to have control over the business transactions.

3. Trial balance can be prepared: With the balances of ledger accounts, trial balance can be prepared to check the arithmetical accuracy of entries made in the journal and ledger.

4. Helps to prepare financial statements: From the ledger balances extracted, financial statements can be prepared for ascertaining net profit or loss and the financial position.

Question 3.

How is posting made from the journal to the ledger?

Answer:

The process of transferring the debit and credit items from the journal to the ledger accounts is called posting. The procedure of posting from journal to ledger is as follows:

1. Locate the ledger account that is debited in the journal entry. Open the respective account in the ledger, if already not opened. Write the name of the account in the top middle. If already opened, locate the account from the ledger index. Now entries are to be made on the debit side of the account.

2. Record the date of the transaction in the date column on the debit side of that account.

3. Record the name of the account credited in the journal with the prefix ‘To’ in particulars column.

4. Record the amount of the debit in the ‘amount column’.

5. Locate the ledger account that is credited in the journal entry. Open the respective account in the ledger, if already not opened. Write the name of the account in the top middle. If already opened, locate the account from the ledger index. Now entries are to be made on the credit side of the account. Record the date of the transaction in the date column. Record the name of the account debited in the journal entry in the particulars column with the prefix ‘By’ and write the amount in the amount column.

![]()

Question 4.

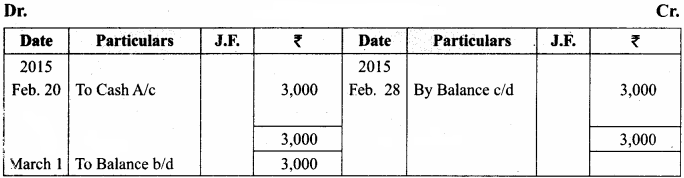

Explain the procedure for balancing a ledger account.

Answer:

Following is the procedure for balancing an account:

1. The debit and credit columns of an account are to be totalled separately.

2. The difference between the two totals is to be ascertained.

3. The difference is to be placed in the amount column of the side having lesser total. ‘Balance c/d’ is to be entered in the particulars column against the difference and in the date column the last day of the accounting period is entered.

4. Now both the debit and credit columns are to be totalled and the totals will be equal. The totals of both sides are to be recorded in the same line horizontally. The total is to be distinguished from other figures by drawing lines above and below the amount.

5. The difference has to be brought down to the opposite side below the total. ‘Balance b/d’ is to be entered in the particulars column against the difference brought down and in the date column, the first day of the next accounting period is entered.

6. If the total on the debit side of an account is higher, the balancing figure is debit balance and if the credit side of an account has higher total, the balancing figure is credit balance. If the two sides are equal, that account will show nil balance.

IV. Exercises

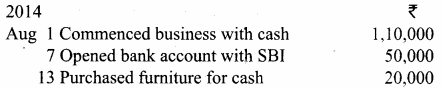

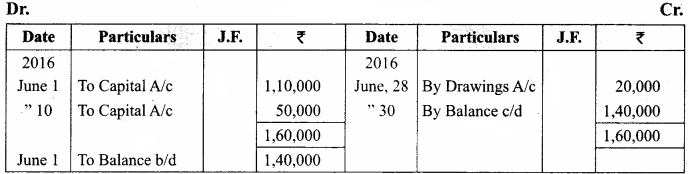

Question 1.

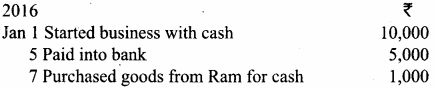

Journalise the following transactions and post them to ledger. (3 Marks)

Answer:

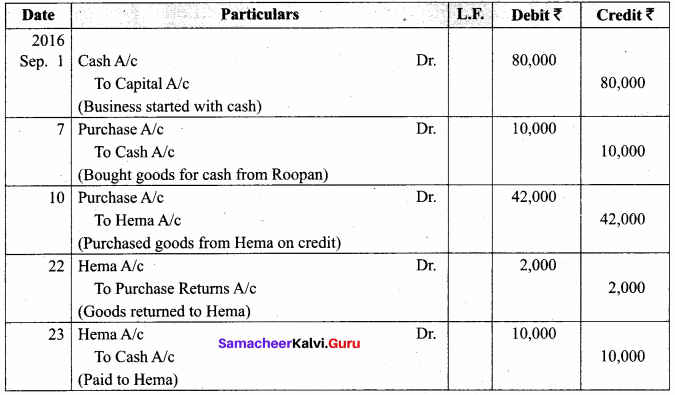

Journal

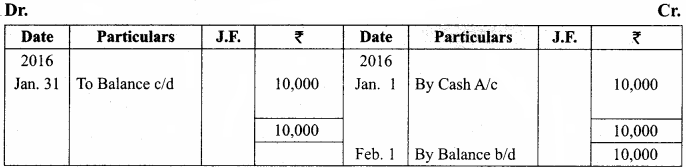

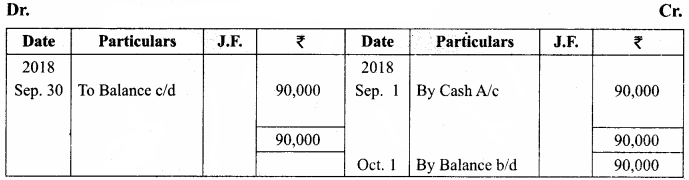

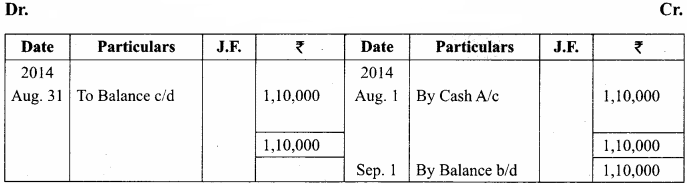

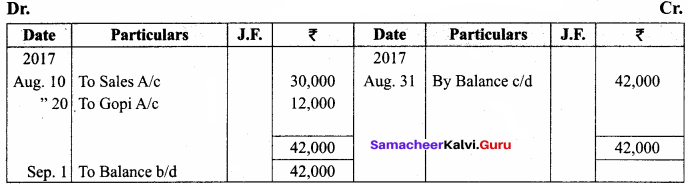

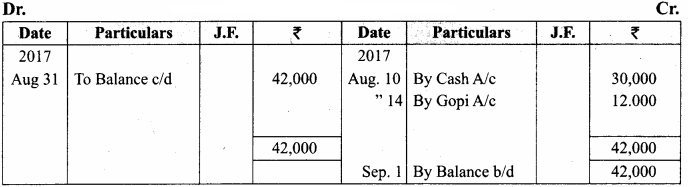

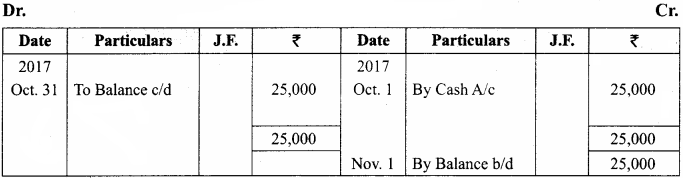

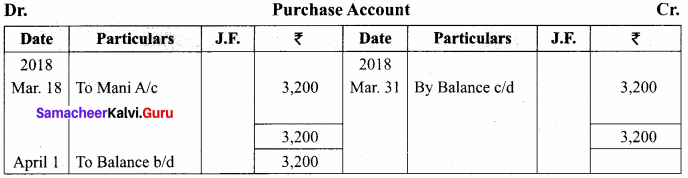

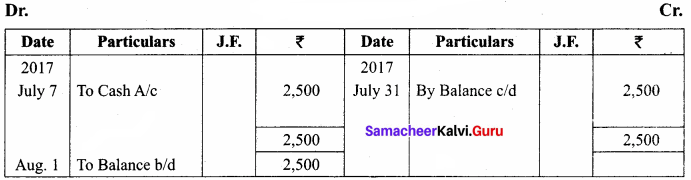

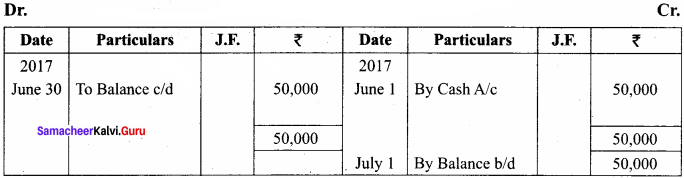

Ledger Cash Account

Capital Account

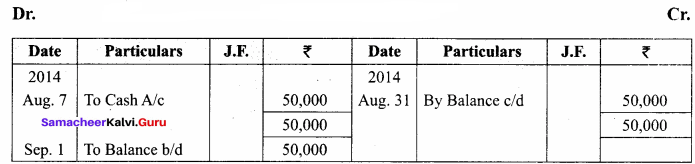

Bank Account

Purchase Account

Question 2.

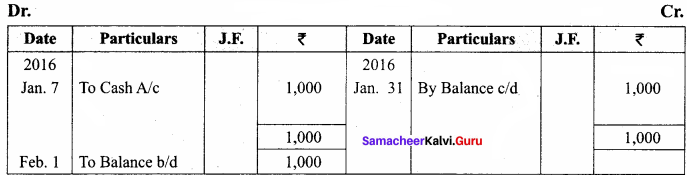

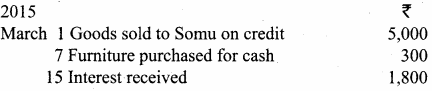

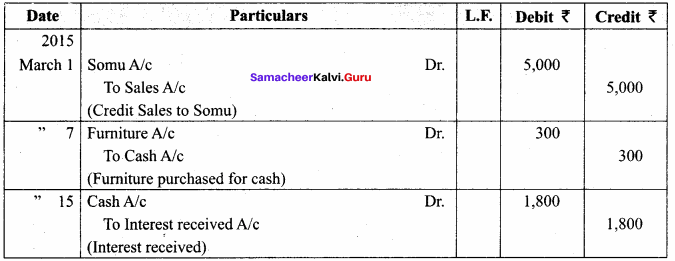

Give journal entries for the following transactions and post them to ledger. (3 Marks)

Journal Entries

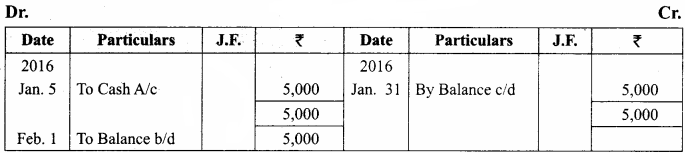

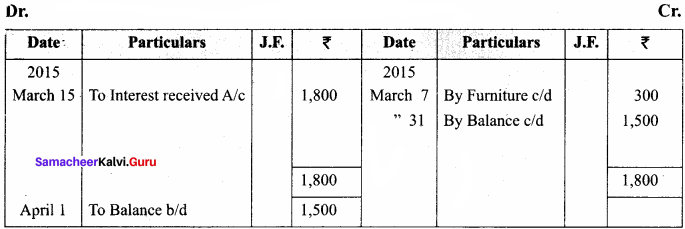

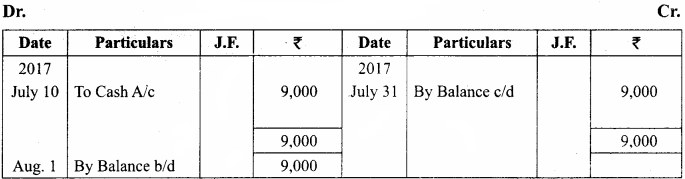

Ledger Cash Account

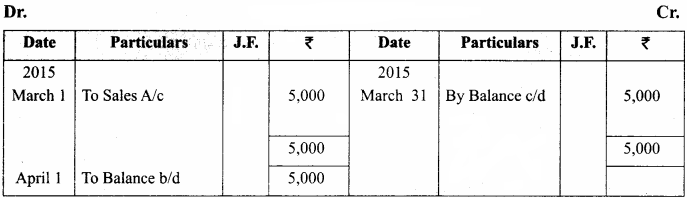

Somu Account

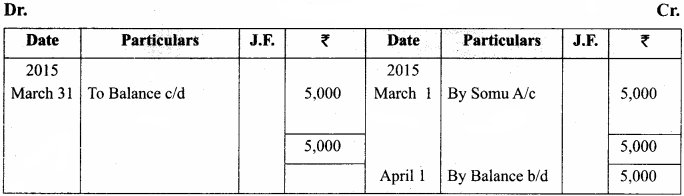

Sales Account

Furniture Account

Interest Received Account

Question 3.

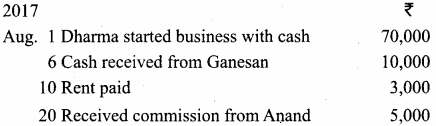

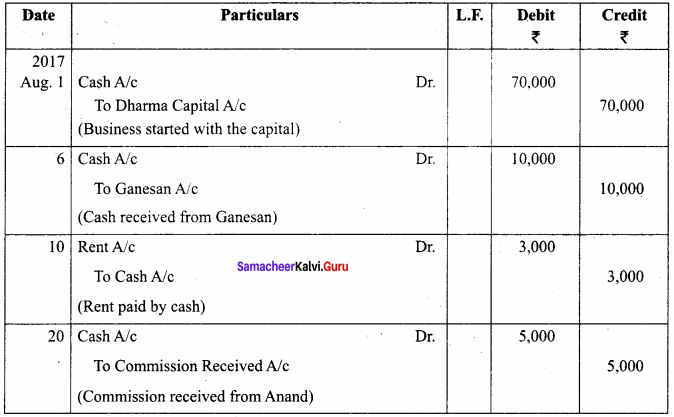

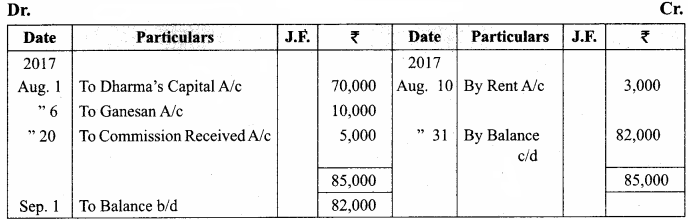

Pass journal entries for the following transactions and post them to ledger. (3 Marks)

Answer:

Journal Entries

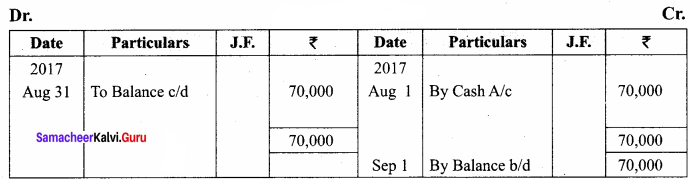

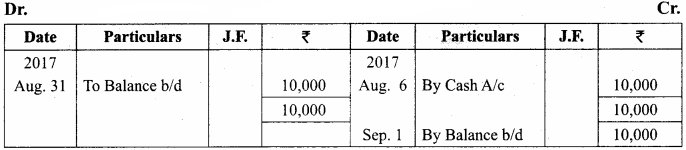

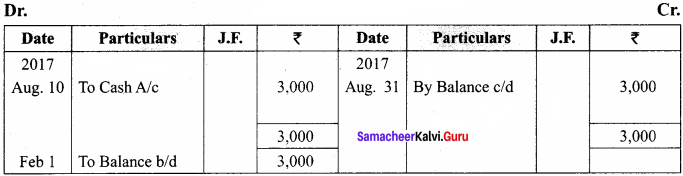

Ledger in the Books of Dharma

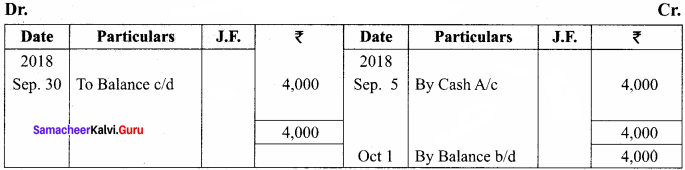

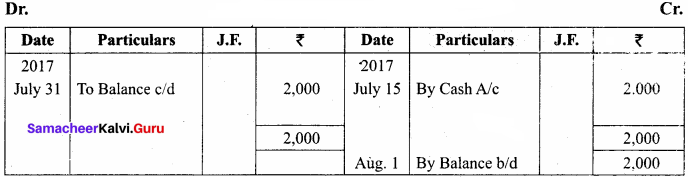

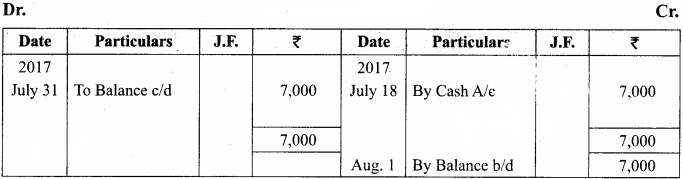

Cash Account

Capital Account

Ganesan Account

Rent Account

Received Commission Account

Question 4.

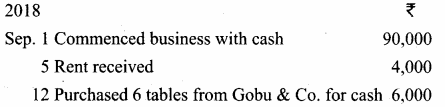

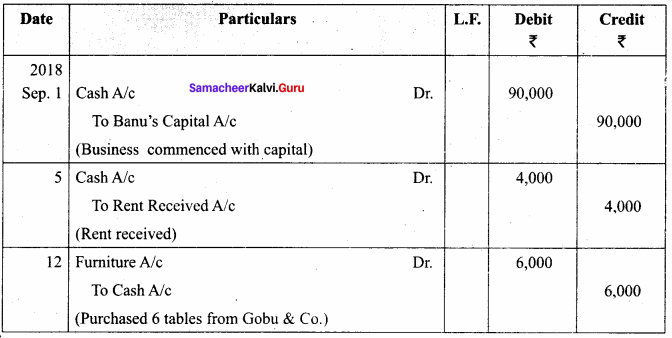

Record the following transactions in the journal of Banu and post them to the ledger.

Answer:

Journal Entries in the Book of Banu

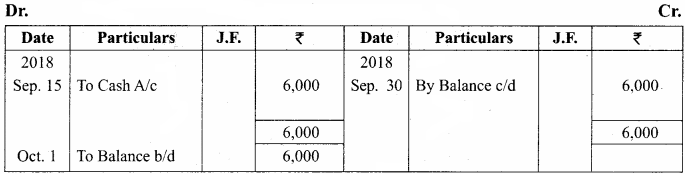

Cash Account

Capital Account

Rent Received Account

Furniture Account

Question 5.

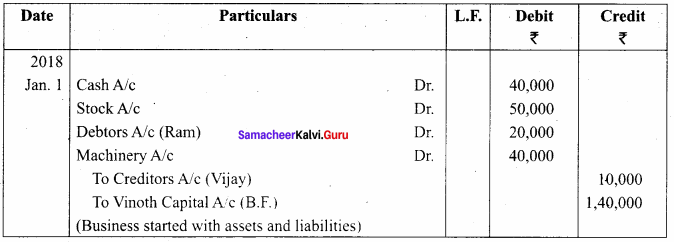

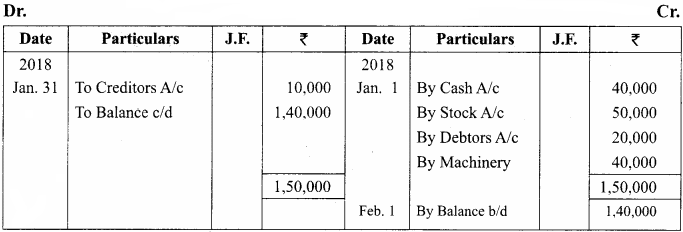

The following balances appeared in the books of Vinoth on Jan 1, 2018

Assets: Cash ₹ 40,000; Stock ₹ 50,000; Amount due from Ram ₹ 20,000;

Machinery ₹ 40,000 Liabilities: Amount due to Vijay ₹ 10,000

Pass the opening journal entry and post them to Vinoth’s Capital account. (2 Marks)

Answer:

Opening Entry in the Books of Vinoth

Vinoth’s Capital Account

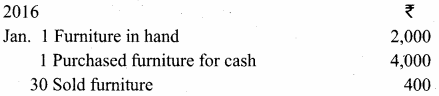

Question 6.

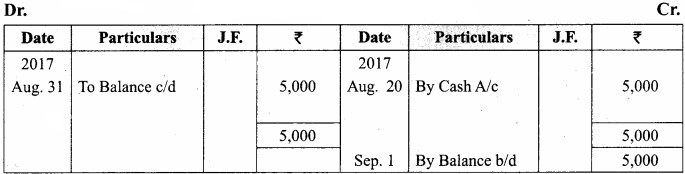

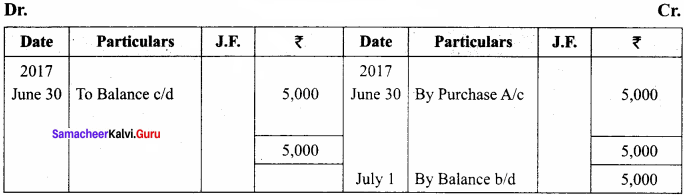

Prepare Furniture A/c from the following transactions (2 Marks)

Answer:

Question 7.

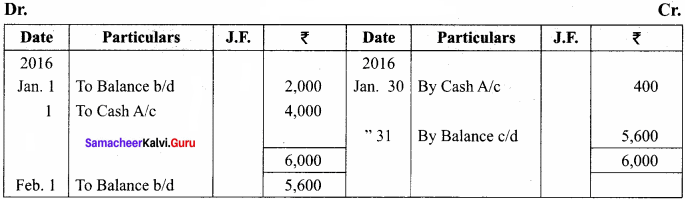

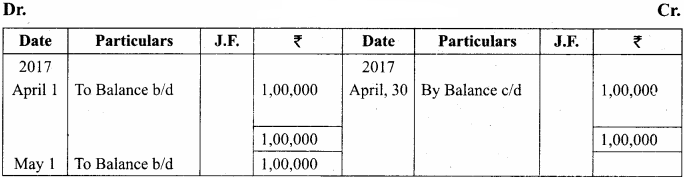

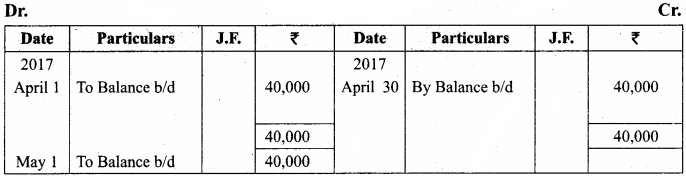

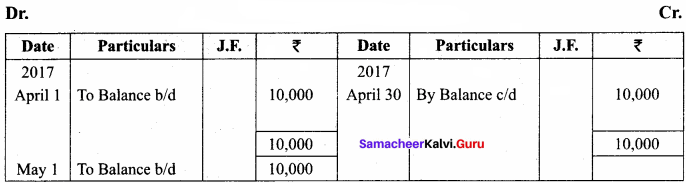

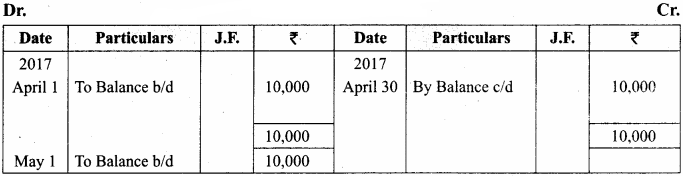

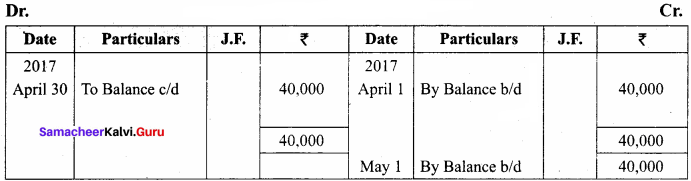

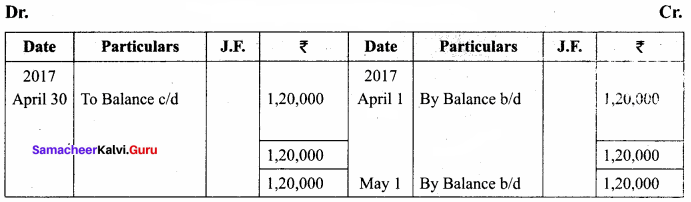

The following balances appeared in the books of Kumaran on April 1, 2017. (5 Marks)

Assets: Cash ₹ 1,00,000; Stock ₹ 40,000; Amount due from Rohit ₹ 10,000,

Furniture ₹ 10,000; Liabilities: Amount due to Anush ₹ 40,000;

Kumaran’s capital ₹ 1,20,000

Find the capital and show the ledger posting for the above opening balances.

Answer:

Opening Entry

Cash Account

Stock Account

Rohit (Debtors) Account

Furniture Account

Creditors Account

Kumaran’s Capital Account

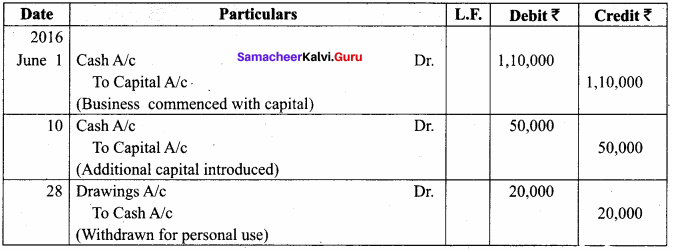

Question 8.

Give journal entries and post them to cash account. (3 Marks)

Answer:

Journal Entry

Cash Account

Question 9.

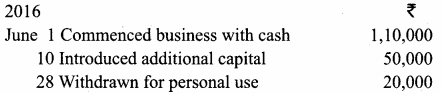

Give journal entries from the following transactions of Mohit, dealing in Textiles and post them to ledger: (3 Marks)

Answer:

Journal Entries in the Book of Mohit

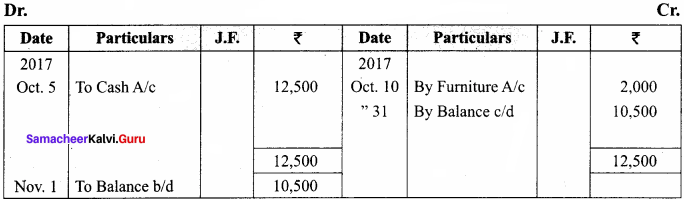

Ledger Cash Account

Mohit’s Capital Account

SBI Account

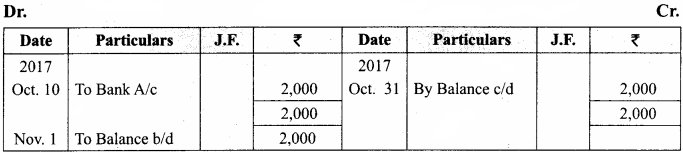

Furniture Account

Question 10.

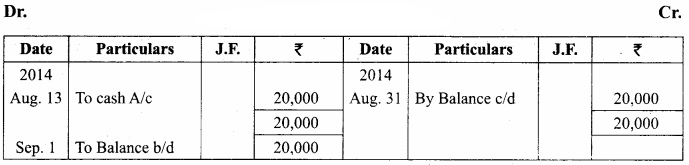

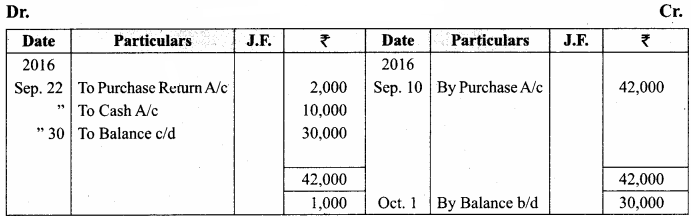

Give journal entries from the following transactions and post them to ledger: (3 Marks)

Answer:

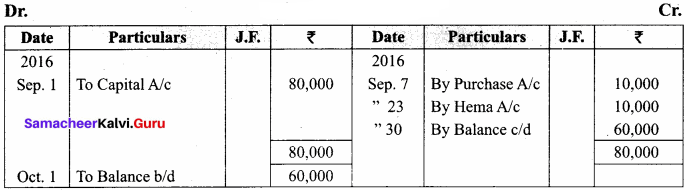

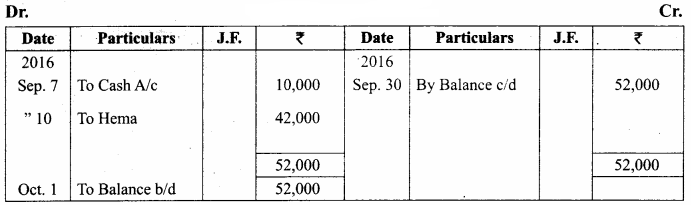

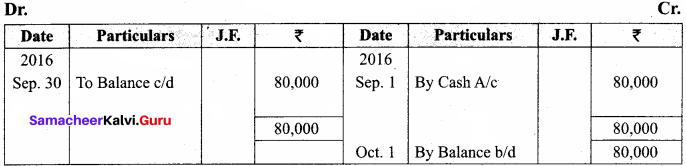

Journal Entries

Ledger Cash Account

Purchase Account

Capital Account

Hema Account

Purchase Returns Account

Question 11.

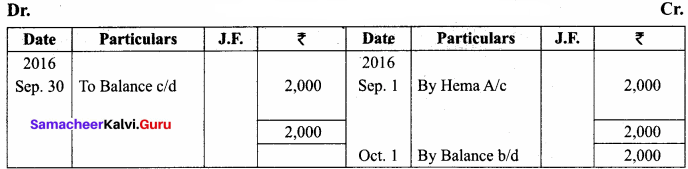

Give journal entries from the following transactions and post them to Cash A/c and Sales A/c: (3 Marks)

Answer:

Journal Entries

Cash Account

Sales Account

Question 12.

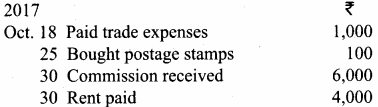

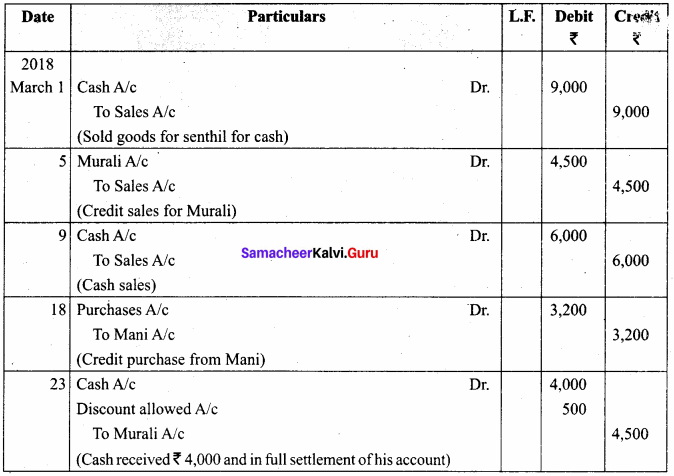

Journalise the transactions given below and post them to ledger. (5 Marks)

Answer:

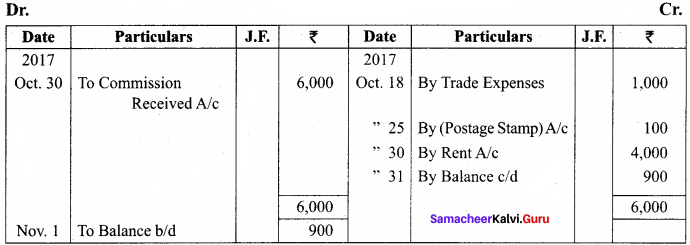

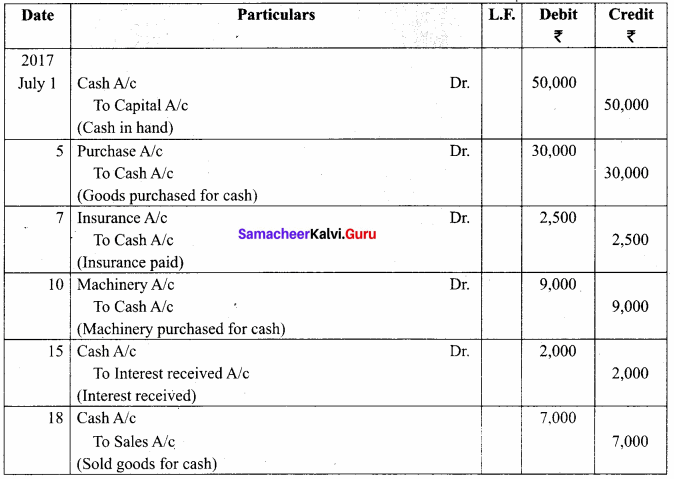

Journal Entries

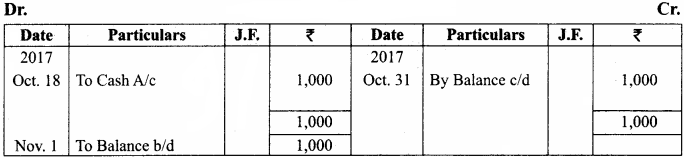

Trade Expenses Account

Stationary (Postage Stamps) Account

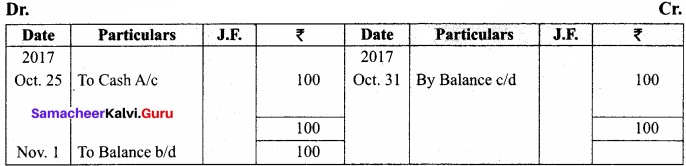

Commission Received Account

Rent Account

Cash Account

Question 13.

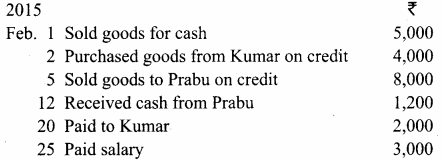

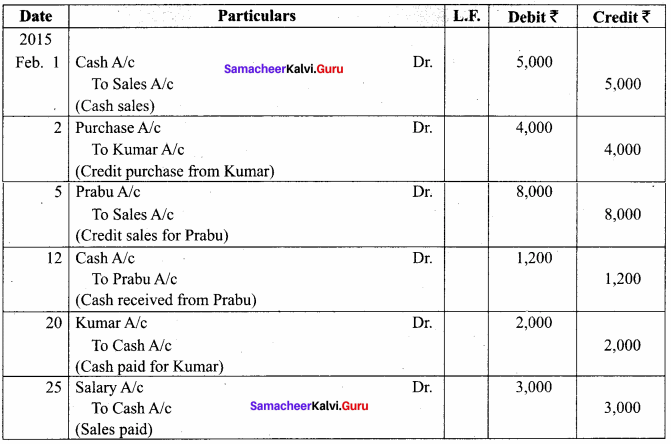

Journalise the transactions given below and post them to ledger. (5 Marks)

Answer:

Journal Entries

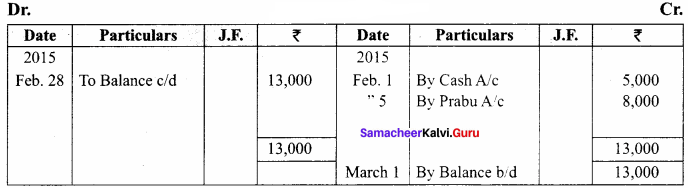

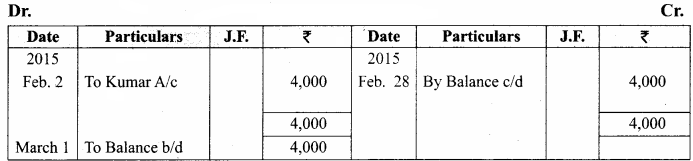

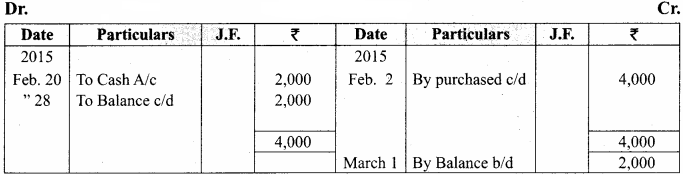

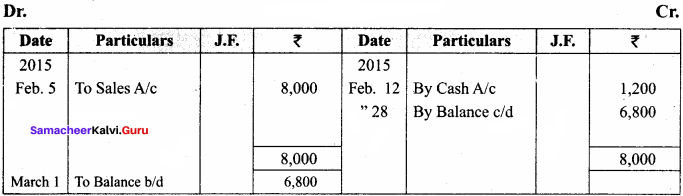

Cash Account

Sales Account

Purchase Account

Kumar Account

Prabu Account

Salary Account

Question 14.

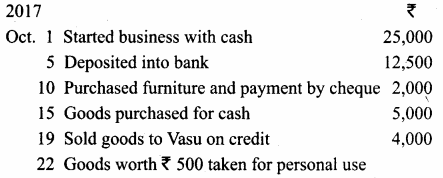

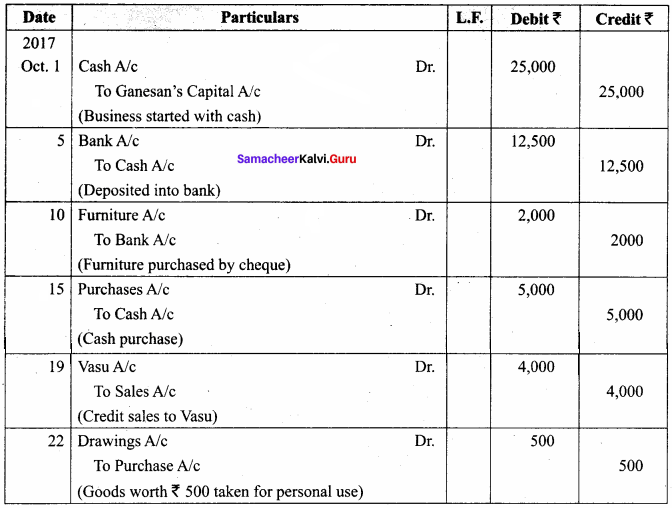

Enter the following transactions in the books of Ganesan and post them into ledger. (5 Marks)

Answer:

Journal Entries in the Books of Ganesan

Cash Account

Ganesan’s Capital Account

Bank Account

Furniture Account

Purchase Account

Sales Account

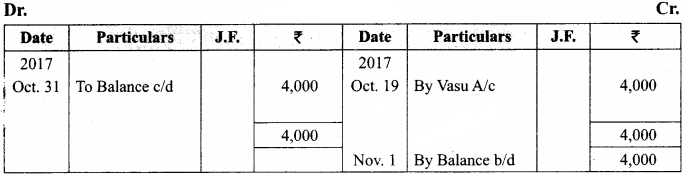

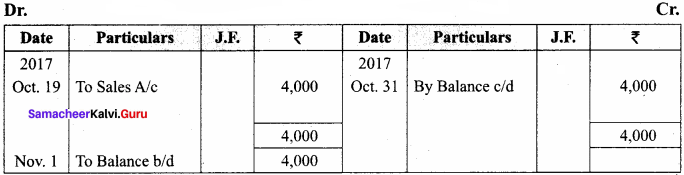

Vasu Account

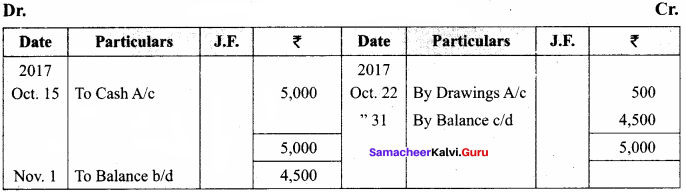

Drawing Account

Question 15.

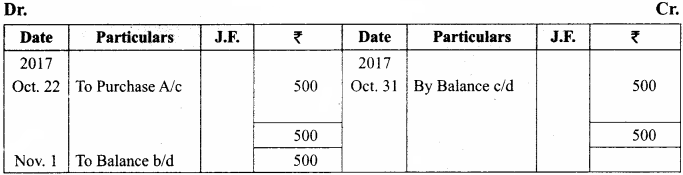

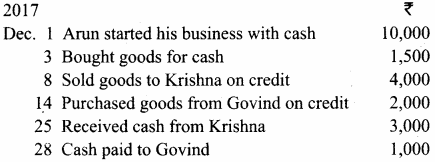

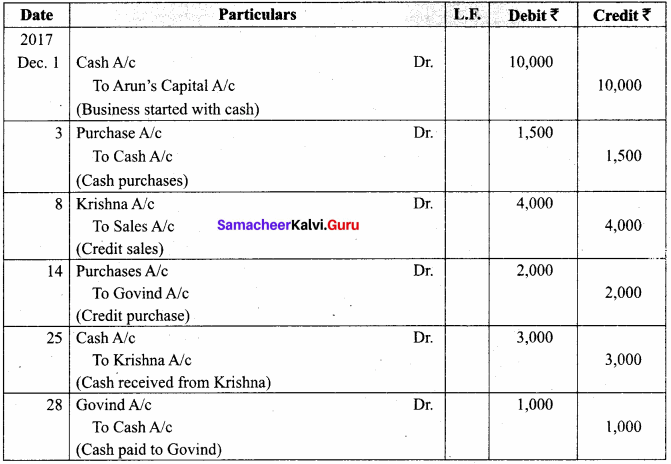

Journalise the following transactions in the books of Aran and post them to ledger accounts. (5 Marks)

Answer:

Journal Entries in the Books of Arun

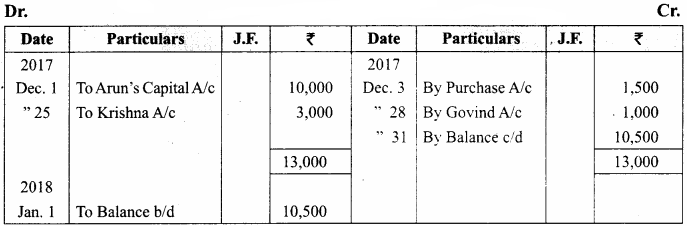

Cash Account

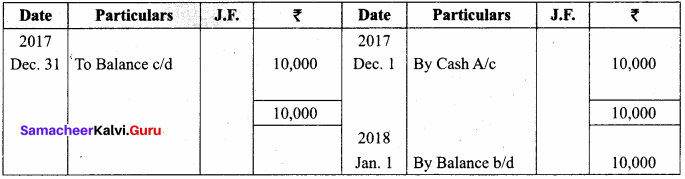

Arun’s Capital Account

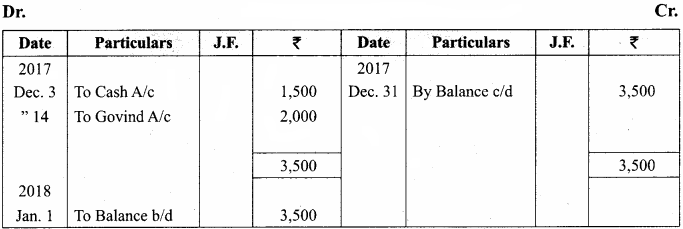

Purchase Account

Sales Account

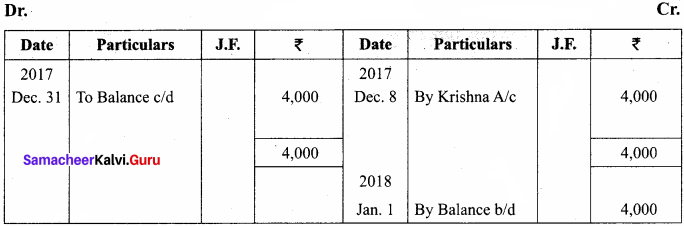

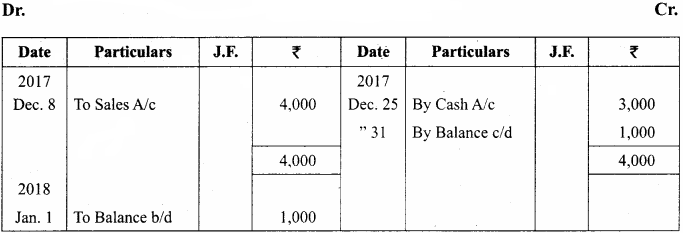

Krishna Account

Govind Account

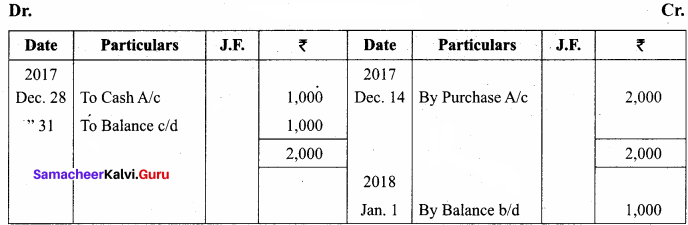

Question 16.

Journalise the following transactions and post them to ledger in the books of Raja. (5 Marks)

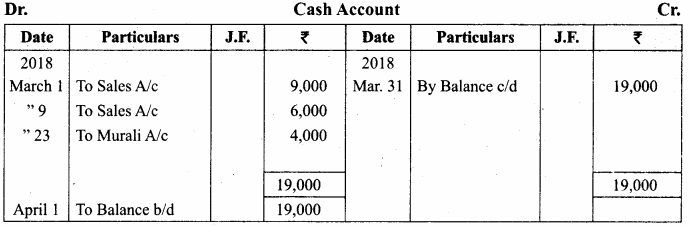

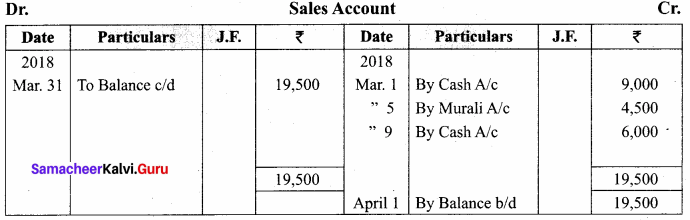

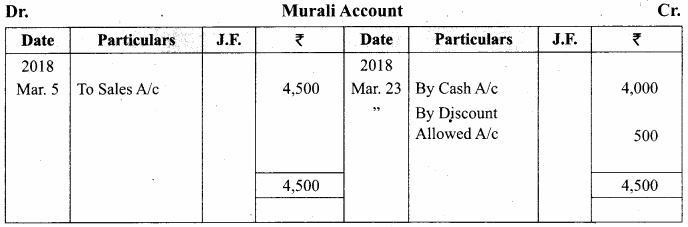

Answer:

Journal Entries in the Books of Raja

Cash Account

Sales Account

Murali Account

Purchase Account

Mani Account

Discount Allowed Account

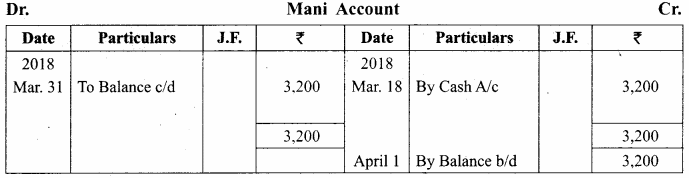

Question 17.

Journalise the following transactions and post them to ledger. (5 Marks)

Answer:

Journal Entries in the Books of Raja

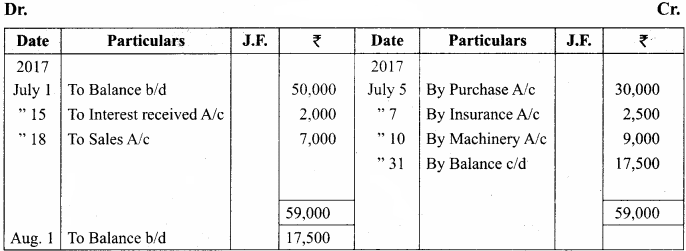

Cash Account

Capital Account

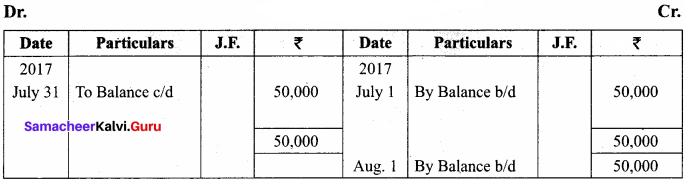

Purchase Account

Insurance Account

Machinery Account

Interest Received Account

Sales Account

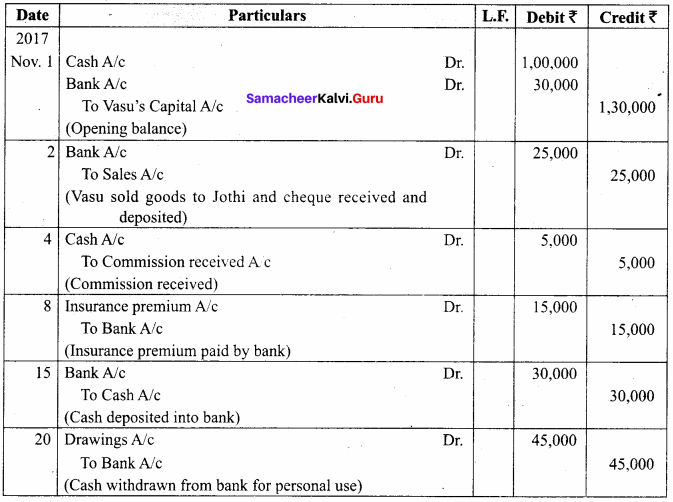

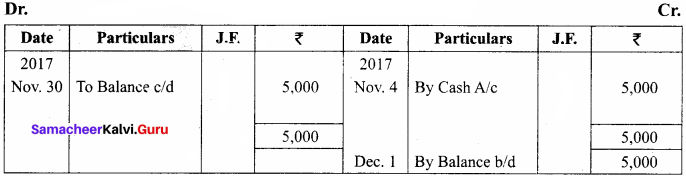

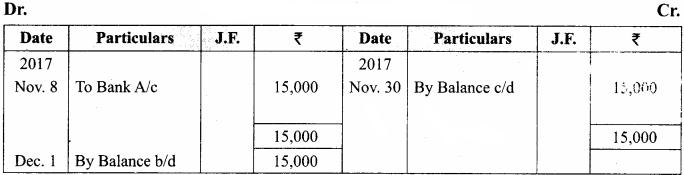

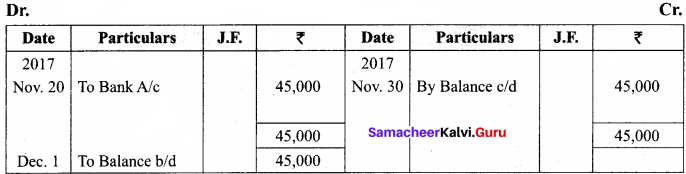

Question 18.

Journalise the following transactions in the books of Vasu and post them to ledger accounts. (5 Marks)

2017 November:

1 – Cash in hand ₹ 1,00,000; Cash at bank: ₹ 30,000.

2 – Vasu sold goods to Jothi for ₹ 25,000 against a cheque and deposited the same in the bank.

4 – Received as commission ₹ 5,000.

8 – Bank paid ₹ 15,000 directly for insurance premium of Vasu.

15 – Cash deposited into bank ₹ 30,000.

18 – Cash withdrawn from bank for personal use ₹ 45,000.

Answer:

Journal entries in the Books of Vasu

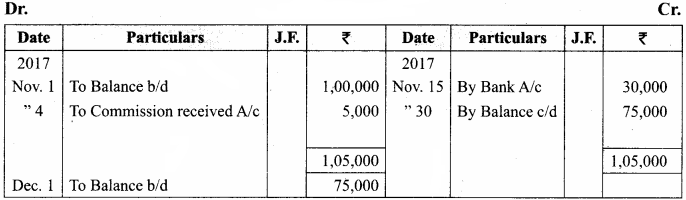

Cash Account

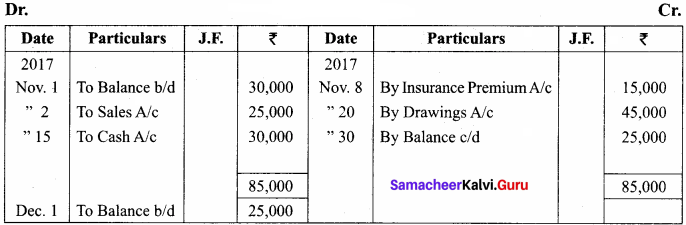

Bank Account

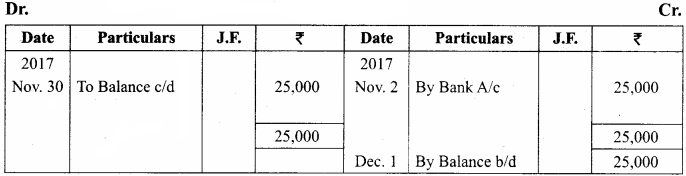

Sales Account

Commission Received Account

Insurance Account

Drawings Account

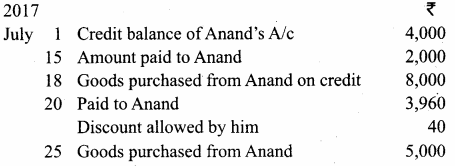

Question 19.

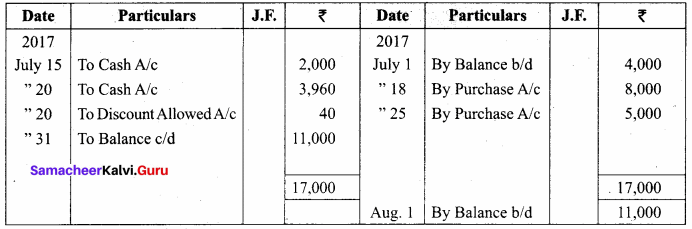

Prepare Anand’s account from the following details. (3 Marks)

Answer:

Anand’s A/c

Question 20.

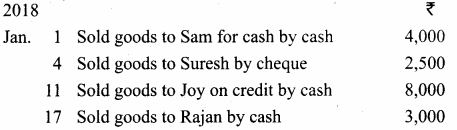

Prepare a Sales account from the following transactions

Sales Account

Answer:

Question 21.

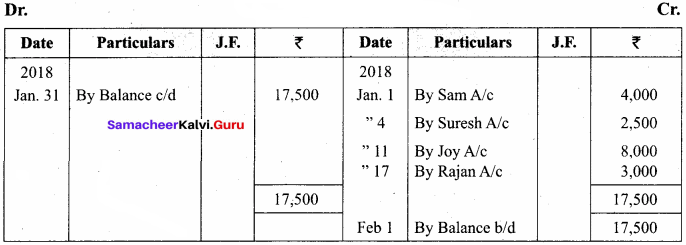

Show the direct ledger postings for the following transactions: (5 Marks)

2017 June:

1 Raja commenced business with cash ₹ 50,000.

6 Sold goods for cash ₹ 8,000.

8 Sold goods to Devi on credit ₹ 9,000.

15 Goods purchased for cash ₹ 4,000.

20 Goods purchased from Shanthi on credit ₹ 5,000.

Answer:

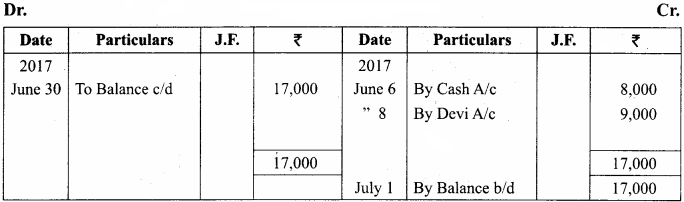

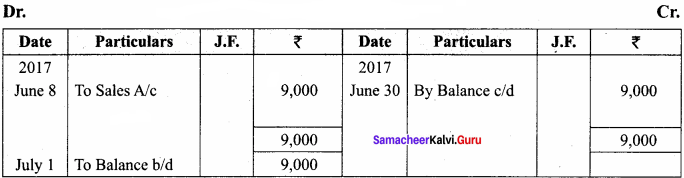

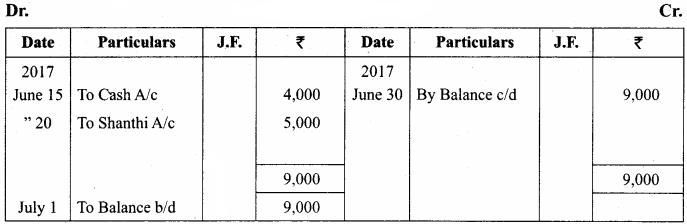

Cash Account

Capital Account

Sales Account

Devi Account

Purchase Account

Shanthi Account

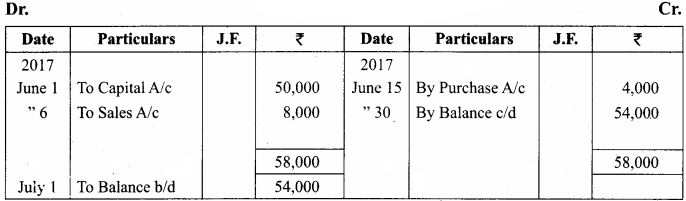

Question 22.

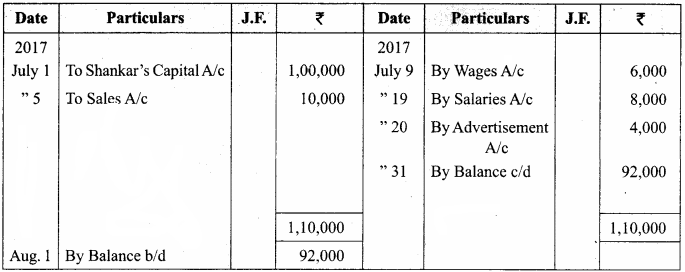

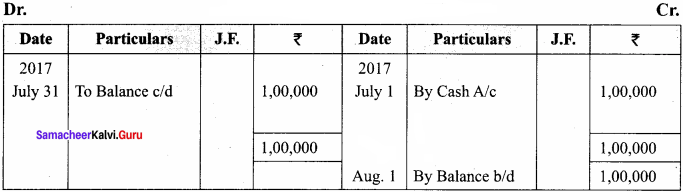

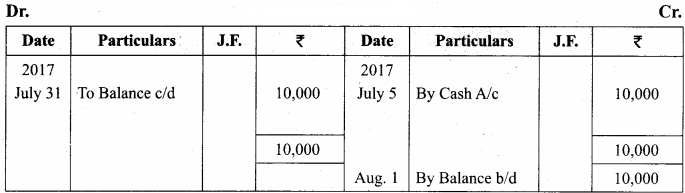

Show the direct ledger postings for the following transactions: (5 Marks)

2017 July:

1 – Shankar commenced business with cash ₹ 1,00,000.

6 – Sold goods for cash ₹ 10,000.

9 – Wages paid ₹ 6,000.

19 – Salaries paid ₹ 8,000.

20 – Advertisement expenses paid ₹ 4,000.

Answer:

Cash Account

Shankar’s Capital Account

Sales Account

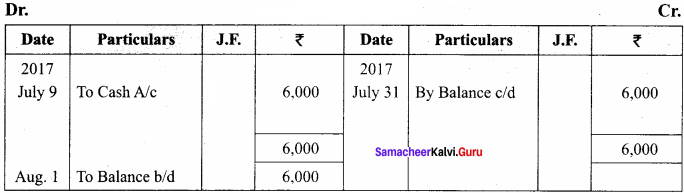

Wages Account

Salaries Account

Advertisement Account

Textbook Case Study Solved

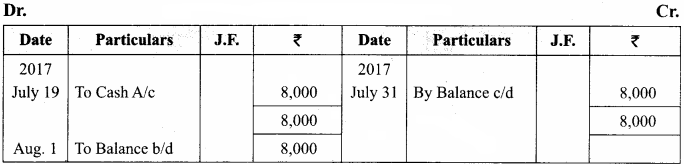

Imagine you have been called for an interview with an auditor. The auditor shows you the following ledger account of Mr. Raheem, a dealer in food products.

Sita A/c

The auditor wants you to explain each posting in the above account and also to state where will the double entry for each posting be found.

Here Sita is a debtor of Mr. Reheem. So in Raheem ledger Sita A/c shows the balances.

- April 1. The opening balance of Sita A/c ₹ 7,000

- April 12. She deposited ₹ 5,000

- May 2 Cash received from Sita ₹ 2,000

- Sept. 25 Credit sales for Sita ₹ 10,000

- Oct. 3 Goods returned by Sita ₹ 1,000

- Nov. 17 Cash paid by Sita ₹ 3,000

- Dec. 21 Sita deposited ₹ 4,000

- Dec. 29 Credit sales to Sita ₹ 10,000

- Dec. 31 Closing debtors ₹ 12,000

So from the Sita ledger the owner of the business Raheem can find out the closing balance of debtor (Sita) ₹ 12,000.

Samacheer Kalvi 11th Accountancy Ledger Additional Questions and Answers

I. Multiple Choice Questions

Choose the correct answer

Question 1.

………………. is known as principal book of accounts.

(a) Journal

(b) Ledger

(c) Trial balance

(d) Transaction

Answer:

(b) Ledger

Question 2.

………………. accounts show the values of assets.

(a) Real

(b) Personal

(c) Nominal

(d) Journal

Answer:

(a) Real

![]()

Question 3.

………………. accounts give the net amount due to creditor and the net amount due from debtors.

(a) Real

(b) Personal

(c) Nominal

(d) Ledger

Answer:

(b) Personal

Question 4.

Net position of an account cannot be ascertained from ……………….

(a) Journal

(b) Ledger

(c) Trial balance

(d) Balance sheet

Answer:

(a) Journal

Question 5.

Net position of an account can be ascertained from ……………….

(a) Journal

(b) Ledger

(c) Trial balance

(d) Balance sheet

Answer:

(b) Ledger

Question 6.

The term balance brought down is used in the name of ……………….

(a) balance b/d

(b) balanced c/d

(c) debit balance

(d) credit balance

Answer:

(a) balance b/d

Question 7.

When a journal entry has more than one debit or more than one credit or both, it is called ……………….

(a) Compound entry

(b) Single entry

(c) Journal entry

(d) Ledger entry

Answer:

(a) Compound entry

![]()

Question 8.

Total of credit > Total of debit =

(a) Debit balance

(b) Credit balance

(c) Nil balance

(d) Trial balance

Answer:

(b) Credit balance

Question 9.

Total of debit > Total of credit =

(a) Debit balance

(b) Credit balance

(c) Nil balance

(d) Trial balance

Answer:

(a) Debit balance