Students can Download Commerce Chapter 22 The Negotiable Instruments Act 1881 Questions and Answers, Notes Pdf, Samacheer Kalvi 12th Commerce Book Solutions Guide Pdf helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

Tamilnadu Samacheer Kalvi 12th Commerce Solutions Chapter 22 The Negotiable Instruments Act 1881

Samacheer Kalvi 12th Commerce The Negotiable Instruments Act 1881 Textbook Exercise Questions and Answers

I. Choose the Correct Answer

Question 1.

Negotiable Instrument Act was passed in the year ________

(a) 1981

(b) 1881

(c) 1994

(d) 1818

Answer:

(b) 1881

![]()

Question 2.

Negotiable Instrument is freely transferable by delivery if it is a ________ instrument.

(a) Order

(b) Bearer

(c) Both a and b

(d) None of the above

Answer:

(b) Bearer

Question 3.

The transferee of a Negotiable Instrument is the one ________

(a) Who transfer the instrument

(b) On whose name it is transferred

(c) Who enchases it

(d) None of the above

Answer:

(b) On whose name it is transferred

Question 4.

Number of parties in a bill of exchange are ________

(a) 2

(b) 6

(c) 3

(d) 4

Answer:

(c) 3

Question 5.

Section 6 of Negotiable Instruments Act 1881 deals with ________

(a) Promissory Note

(b) Bills of exchange

(c) Cheque

(d) None of the above

Answer:

(c) Cheque

![]()

Question 6.

________ cannot be a bearer instrument.

(a) Cheque

(b) Promissory Note

(c) Bills of exchange

(d) None of the above

Answer:

(a) Cheque

Question 7.

When crossing restrict further negotiation ________

(a) Not negotiable crossing

(b) General Crossing

(c) A/c payee crossing

(d) Special crossing

Answer:

(a) Not negotiable crossing

Question 8.

Which endorsement relieves the endorser from incurring liability in the event of dishonour?

(a) Restrictive

(b) Facultative

(c) Sans recourse

(d) Conditional

Answer:

(b) Facultative

Question 9.

A cheque will become stale after ________ months of its date.

(a) 3

(b) 4

(c) 5

(d) 1

Answer:

(a) 3

Question 10.

Document of title to the goods exclude ________

(a) Lorry receipt

(b) Railway receipt

(c) Airway bill

(d) Invoice

Answer:

(d) Invoice

II. Very Short Answer Questions

Question 1.

What is meant by Negotiable Instrument?

Answer:

A negotiable instrument is a document which entitles a person to a certain sum of money and which is transferable from one person to another by mere delivery or by endorsement and delivery.

Question 2.

Define Bill of Exchange.

Answer:

According to section 5 of the Negotiable Instruments Act, “a bill of exchange is an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of a certain person or to the bearer of the – instrument”.

Question 3.

List three characteristics of a Promissory Note.

Answer:

Characteristics of a Promissory Note:

- A promissory note must be in writing.

- The promise to pay must be unconditional.

- It must be signed by the maker.

Question 4.

What is meant by a cheque?

Answer:

According to section 6 of the Negotiable Instruments Act, 1881 defines a cheque as “a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand”.

![]()

Question 5.

Define Endorsement.

Answer:

“When the maker or holder of a negotiable instrument signs the name, otherwise that as such maker for the purpose of negotiation, on the back or face thereof, or on a slip of paper annexed thereto.”

III. Short Answer Questions

Question 1.

Explain the nature of a Negotiable Instrument.

Answer:

A negotiable instrument is transferable from one person to another without any formality, such as affixing stamp, registration, etc. When the instrument is held by holder in due course in the process of negotiation, it is cured of all defects in the instrument with respect to ownership. Though a bill, a promissory note or a cheque represents a debt, the transferee is entitled to sue on the instrument in his own name in case of dishonour, without giving notice to the debtor that he has become its holder.

Question 2.

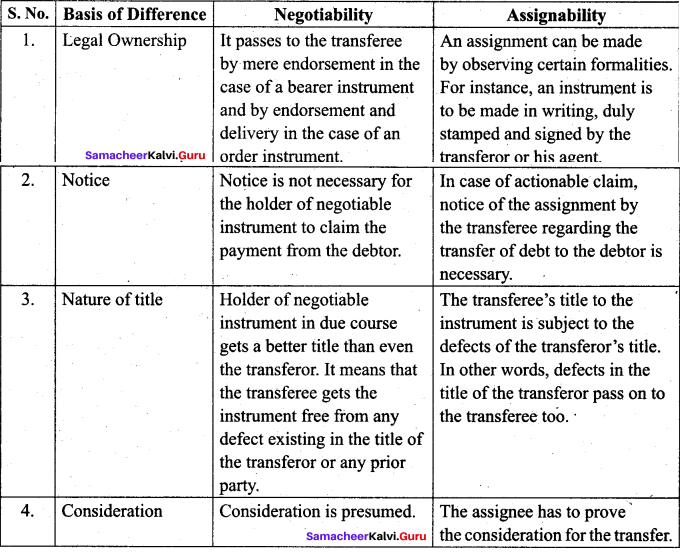

Distinguish between Negotiability and Assignability.

Answer:

Question 3.

What are the characteristics of a bill of exchange?

Answer:

Characteristics of a Bill of Exchange:

- A bill of exchange is a document in writing.

- The document must contain an order to pay.

- The order must be unconditional.

- The instrument must be signed by the person who draws it.

- The name of the person on whom the bill is drawn must .be specified in the bill itself.

Question 4.

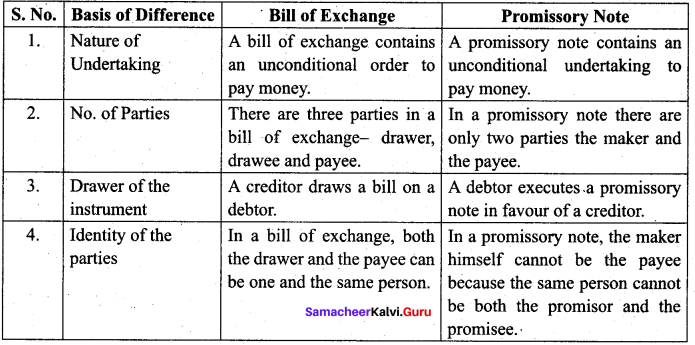

Distinguish between Bill of Exchange and Promissory Note.

Answer:

IV. Long Answer Questions

Question 1.

Mention the presumptions of Negotiable Instruments.

Answer:

Presumptions of Negotiable Instrument:

- Every negotiable instrument is presumed to have been drawn and accepted for consideration.

- Every negotiable instrument bearing, a date is presumed to have been made or drawn on such a date.

- It is presumed to have been accepted within a reasonable time after the date and before its maturity.

- The transfer of a negotiable instrument is presumed to have been made before maturity.

- When a negotiable instrument has been lost, it is presumed to have been duly stamped.

- The holder of a negotiable instrument is presumed to be a holder in due course.

![]()

Question 2.

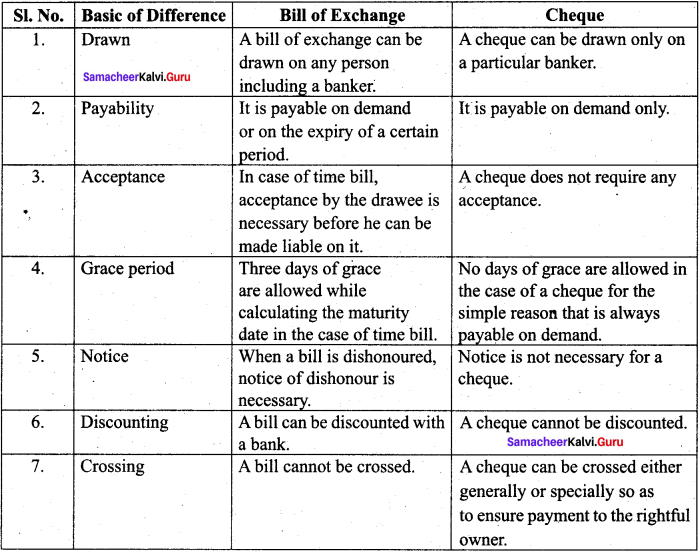

Distinguish a cheque and a bill of exchange.

Answer:

Question 3.

Discuss in detail the features of a cheque.

Answer:

A cheque is a negotiable instrument drawn on a particular banker.

Features:

(i) Instrument in Writings:

A cheque or a bill or a promissory note must be an instrument in writing. Though the law does not prohibit a cheque being written in pencil, bankers never accept it because of risks involved. Alternation is quite easy but detection is impossible in such cases.

(ii) Unconditional Orders:

The instrument must contain an order to pay money. It is not necessary that the word ‘order’ or its equivalent must be used to make the document a cheque. It does not cease to be a cheque just because the world ‘please’ is used before the word pay. Further the order must be unconditional.

(iii) Drawn on a Specified Banker Only:

The cheque is always drawn on a specified banker. A cheque vitally differs from a bill in this respect as latter can be drawn on any person including a banker. The customer of a banker can draw the cheque only on the particular branch of the bank where he has an account.

(v) A Certain Sum of Money Only:

The order must be for payment of only money. If the banker is asked to deliver securities, the document cannot be called a cheque. Further, the sum of money must be certain.

(v) Payee to be Certain:

The cheque must be made payable to a certain person or to the order of a certain person or to the bearer of the instrument. The word, person includes corporate bodies, local authorities, associations, holders of office of an institution etc.

(vi) Signed by the Drawer:

The cheque is to be signed by the drawer. Further, it should tally with specimen signature furnished to the bank at the time of opening the account.

![]()

Question 4.

What are the requisites for a valid endorsement?

Answer:

If an endorsement is to be valid, it must possess the following requisites:

- Endorsement is to be made on the face of the instrument or on its back.

- When there is no space for making further endorsements a piece of paper can be attached

- Endorsement for only a part of the amount of the instrument is invalid.

- Endorsement is complete only when delivery of the instrument is made.

- Signing in block letters does not constitute regular endorsement.

- If the payee is an illiterate person, he can endorse it by affixing his thumb impression on the instrument.

Question 5.

Explain the different kinds of endorsements. .

Answer:

When the person signs on the back of the instrument to transfer his interest, it is known as endorsement. The endorsement are of various types:

(i) Blank or general endorsement:

When the endorser puts his mere signature on the back of an instrument without mentioning the name of the person to whom the endorsement is made, it is called Blank Endorsement

(ii) Endorsement in full or special endorsement:

If the endorser, in addition to his signature, mentions the name of the person to whom it is endorsed, is known as endorsement in full or special endorsement.

(iii) Conditional endorsement:

When the endorser of a negotiable instrument makes his liability dependent upon the happening of an event which may or may not happen, it is called conditional endorsement,

(iv) Restrictive endorsement:

When an endorsement restricts or prohibits further negotiability of the instrument, it is called Restrictive Endorsement.

(v) Partial Endorsement:

Where the endorsement seeks to transfer only a part of the amount payable under the instrument, the endorsement is called Partial Endorsement.

Samacheer Kalvi 12th Commerce The Negotiable Instruments Act 1881 Additional Questions and Answers

I. Choose the Correct Answer

Question 1.

A bill of exchange drawn on a specified banker is

(a) promissory note

(b) cheque

(c) hundi

(d) share

Answer:

(b) cheque

![]()

Question 2.

Grace days allowed to a Bill of exchange for calculation of due date is

(a) 4

(b) 10

(c) 3

(d) 5

Answer:

(c) 3