Students can Download Accountancy Chapter 7 Company Accounts Questions and Answers, Notes Pdf, Samacheer Kalvi 12th Accountancy Book Solutions Guide Pdf helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

Tamilnadu Samacheer Kalvi 12th Accountancy Solutions Chapter 7 Company Accounts

Samacheer Kalvi 12th Accountancy Company Accounts Text Book Back Questions and Answers

I. Choose the Correct Answer

Question 1.

A preference share is one ……………..

(i) which carries preferential right with respect to payment of dividend at fixed rate

(ii) which carries preferential right with respect to repayment of capital on winding up

(a) Only (i) is correct

(b) Only (ii) is correct

(c) Both (i) and (ii) are correct

(d) Both (i) and (ii) are incorrect

Answer:

(c) Both (i) and (ii) are correct

Question 2.

That part of share capital which can be called up only on the winding up of a company is called ……………..

(a) Authorised capital

(b) Called up capital

(c) Capital reserve

(d) Reserve capital

Answer:

(d) Reserve capital

Question 3.

At the time of forfeiture, share capital account is debited with ……………..

(a) Face value

(b) Nominal value

(c) Paid up amount

(d) Called up amount

Answer:

(d) Called up amount

![]()

Question 4.

After the forfeited shares are reissued, the balance in the forfeited shares account should be transferred to ……………..

(a) General reserve account

(b) Capital reserve account

(c) Securities premium account

(d) Surplus account

Answer:

(b) Capital reserve account

Question 5.

The amount received over and above the par value is credited to ……………..

(a) Securities premium account

(b) Calls in advance account

(c) Share capital account

(d) Forfeited shares account

Answer:

(a) Securities premium account

Question 6.

Which of the following statement is false?

(a) Issued capital can never be more than the authorised capital

(b) In case of under subscription, issued capital will be less than the subscribed capital

(c) Reserve capital can be called at the time of winding up

(d) Paid up capital is part of called up capital

Answer:

(b) In case of under subscription, issued capital will be less than the subscribed capital

Question 7.

When shares are issued for purchase of assets, the amount should be credited to ……………..

(a) Vendor’s A/c

(b) Sundry assets A/c

(c) Share capital A/c

(d) Bank A/c

Answer:

(c) Share capital A/c

Question 8.

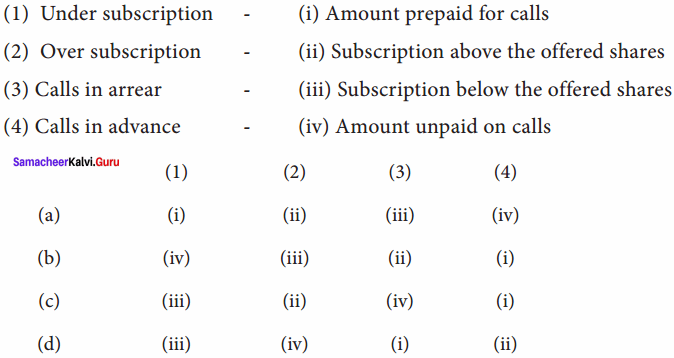

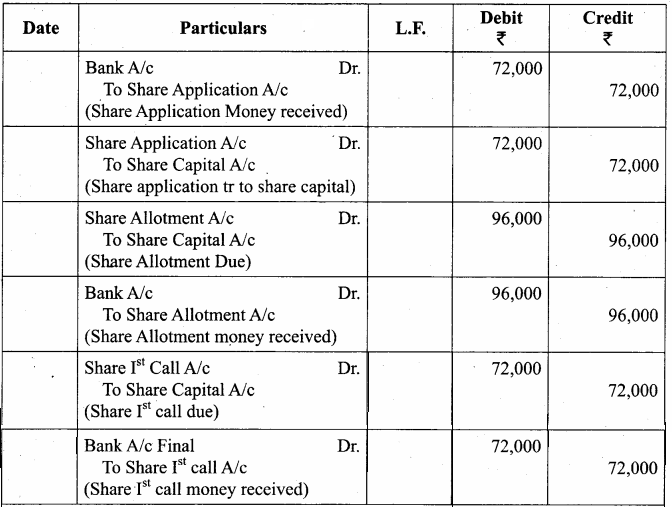

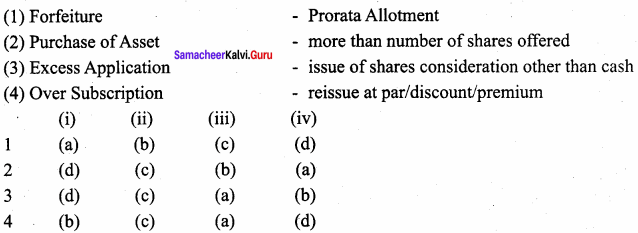

Match the pair and identify the correct option:

Answer:

(c) (iii) (ii) (iv) (i)

Question 9.

If a share of ₹ 10 on which ₹ 8 has been paid up is forfeited. Minimum reissue price is ……………..

(a) ₹ 10 per share

(b) ₹ 8 per share

(c) ₹ 5 per share

(d) ₹ 2 per share

Answer:

(d) ₹ 2 per share

Question 10.

Supreme Ltd. forfeited 100 shares of ₹ 10 each for non – payment of final call of ₹ per share. All these shares were re-issued at ₹ 9 per share. What amount will be transferred to capital reserve account?

(a) ₹ 700

(b) ₹ 800

(c) ₹ 900

(d) ₹ 1,000

Answer:

(a) ₹ 700

II. Very short answer questions

Question 1.

What is a share?

Answer:

The capital of companies is divided into small units called shares.

Question 2.

What is oversubscription?

Answer:

When the number of shares applied for is more than the number of shares offered for a subscription it is said to be oversubscription.

Question 3.

What is meant by calls in arrear?

Answer:

When a shareholder fails to pay the amount due on the allotment or on calls, the amount remaining unpaid is known as calls in arrears. In other words, the amount called up but not paid is calls in arrear.

![]()

Question 4.

Write a short note on the securities premium account.

Answer:

When a company issues shares at a price more than face value, the shares are said to be issued at a premium. The excess is called a premium amount and is transferred to a securities premium account. It is shown under “reserves and surplus” as a separate head in the note to accounts for the balance sheet.

Question 5.

Why are the shares forfeited?

Answer:

When a shareholder defaults in making payment of allotment and/or call money, the shares may be forfeited.

III. Short answer questions

Question 1.

State the difference between preference shares and equity shares?

Answer:

Question 2.

Write a brief note on calls – in – advance.

Answer:

The excess amount paid over the called up value of a share is known as cells in advance. It is the excess money paid on application or allotment or cells. Such excess amounts can be returned or adjusted towards future payments. If the company decides to adjust such amount towards future payment, the excess amount is transferred to a separate account called cells in the advance account.

Calls in advance do not form part of the company’s share capital and no dividend is payable on such amount.

As per Table F of the Indian Companies Act, 2013, interest may be paid on calls in advance if Articles of Association so provide not exceeding 12% per annum.

Question 3.

What is a reissue of forfeited shares?

Answer:

The directors of a company have the authority to reissue shares once forfeited by them due to non – payment of calls. They can reissue the forfeited shares at par, at a premium, or a discount. When forfeited shares are reissued at a premium, the amount of such premium will be credited to securities premium. If the reissue price is more than the amount unpaid of forfeited shares it results in profit and is transferred to the capital reserve account

![]()

Question 4.

Write a short note as:

- Authorized Capital

- Reserve Capital

Answer:

1. Authorised capital: It means such capital as is authorized by the memorandum of association. It is the maximum amount which can be raised as capital. It is also known as registered capital or nominal capital.

2. Reserve capital: The company can reserve a part of its subscribed capital to be called up only at the time of winding up. It is called reserve capital.

Question 5.

What is meant by the issue of shares for consideration other than cash?

Answer:

A company may issue shares for consideration other than cash when the company acquires fixed assets such as land, building, and machinery, etc. A company may also issue shares as consideration for the purchase of a business, to promotors for their services, and to brokers and underwriters for their commission.

IV. Exercises

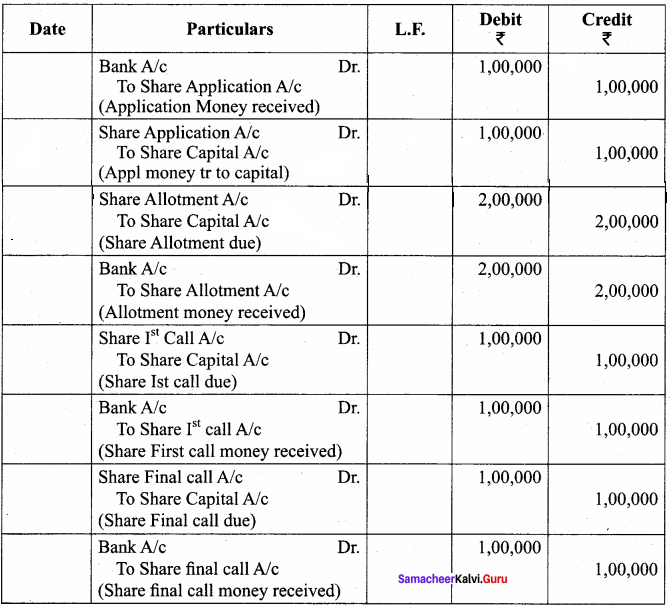

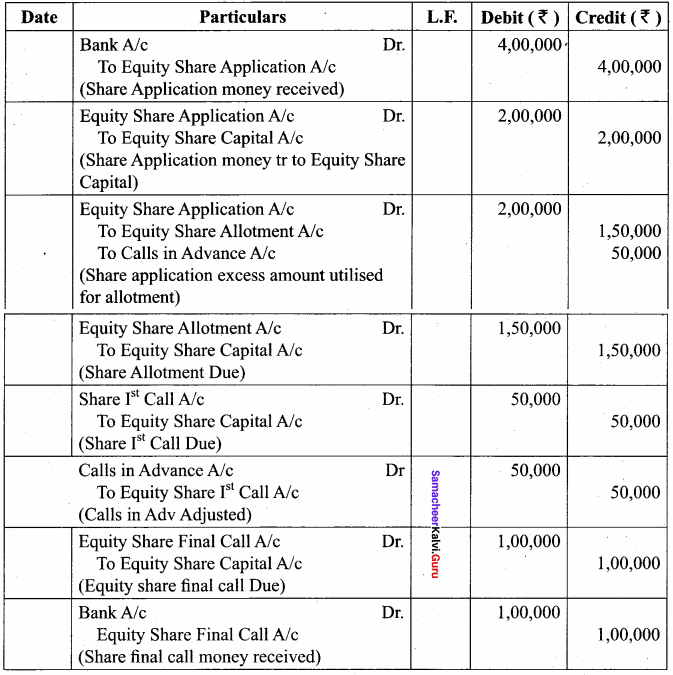

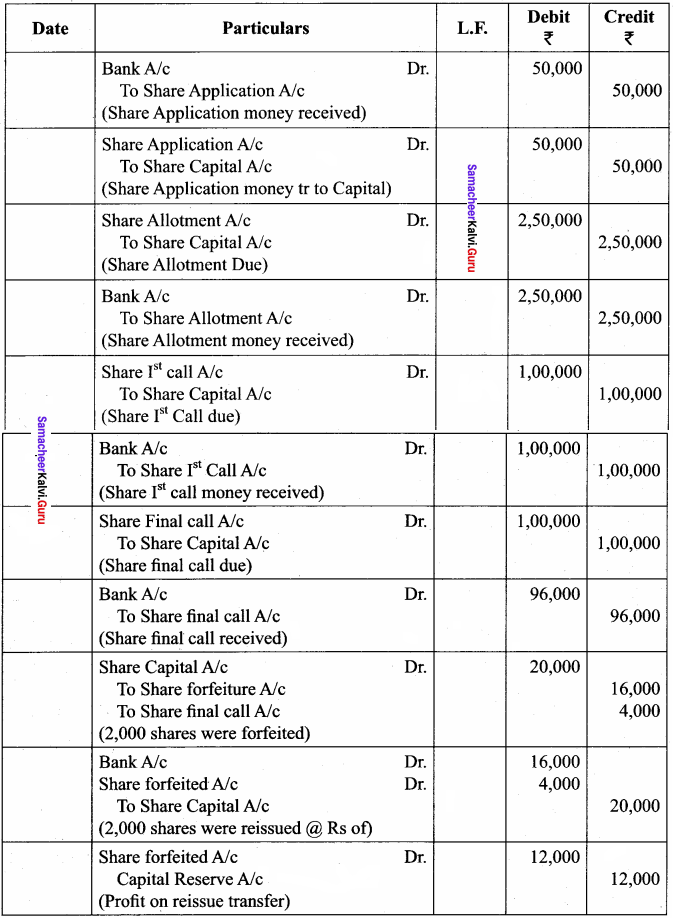

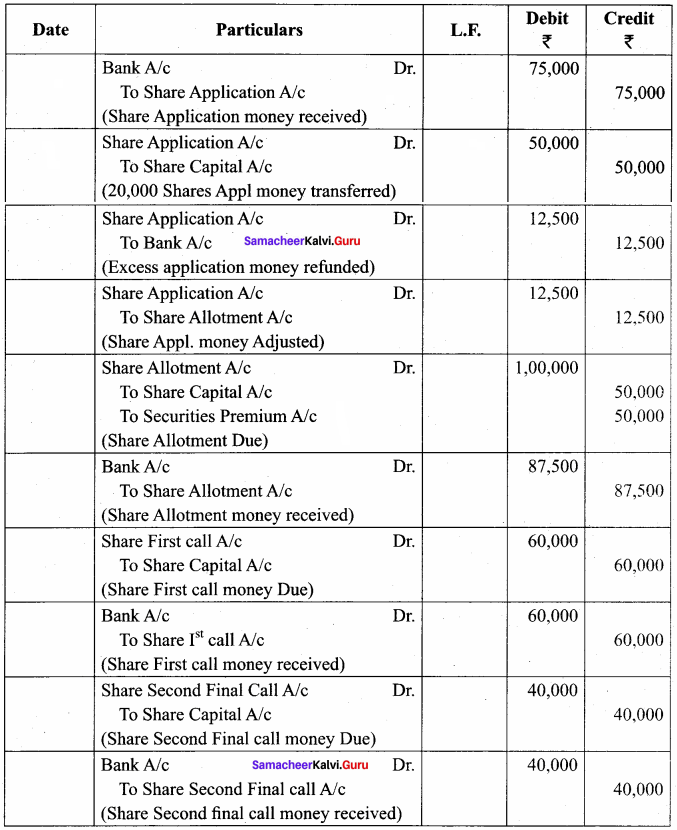

Question 1.

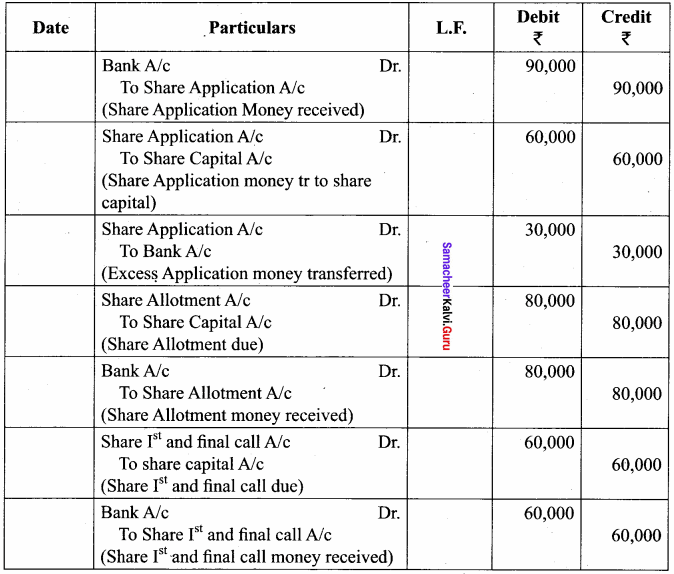

Progress Ltd. issued 50,000 ordinary shares of ₹ 10 each, payable ₹ 2 on the application, ₹ 4 on the allotment, ₹ 2 on the first call, and ₹ 2 on final call. All the shares are subscribed and the amount was duly received. Pass journal entries.

Answer:

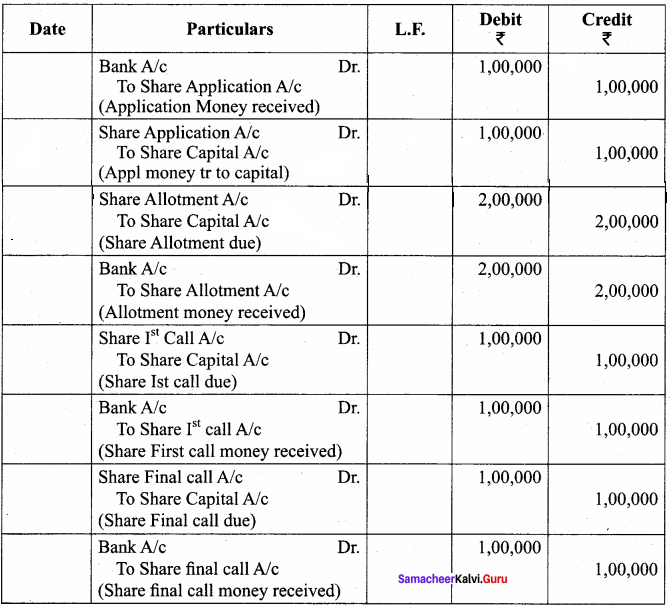

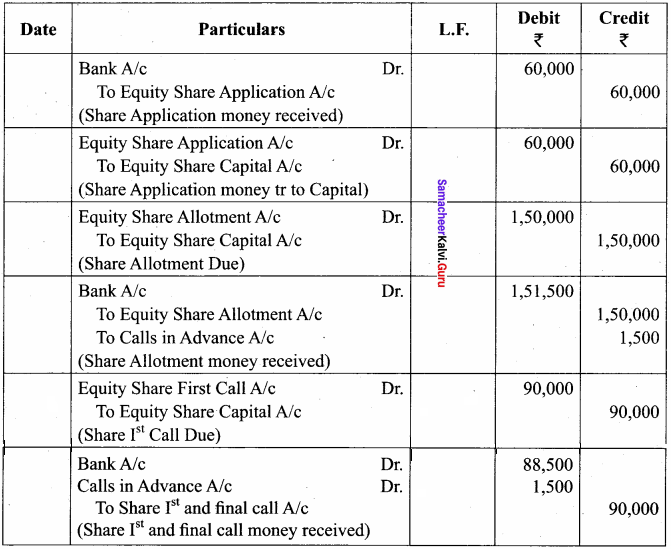

Question 2.

Sampath company issued 25,000 shares at ₹ 10 per share payable ₹ 3 on the application, ₹ 4 on the allotment, ₹ 3 on the first and final call. The public subscribed for 24,000 shares. The directors allotted all the 24,000 shares and received the money duly. Pass necessary journal entries.

Answer:

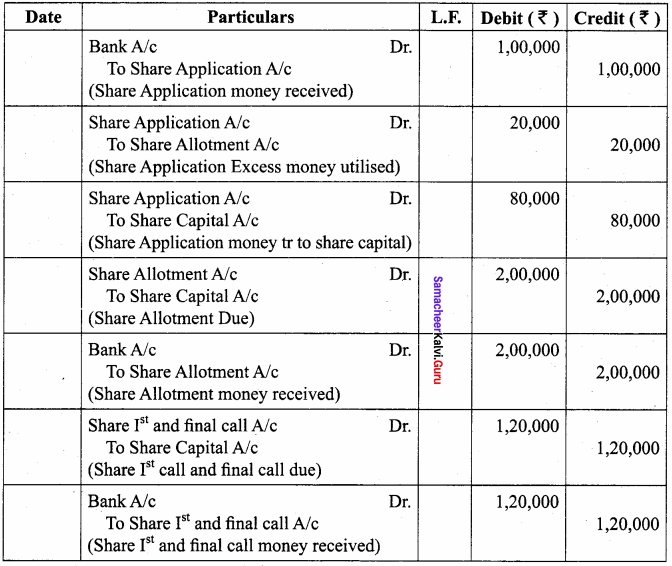

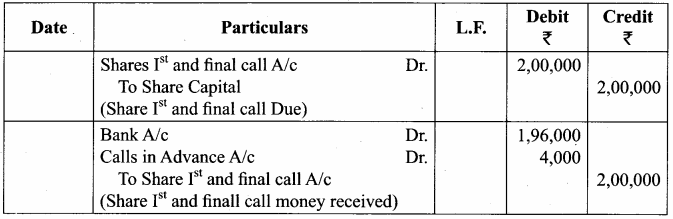

Question 3.

Saranya Ltd. issued 20,000 equity shares of ₹ 10 each to the public at par. The details of the amount payable on the shares are as follows:

On application ₹ 3 per share

On allotment ₹ 4 per share

On the first and final call ₹ 3 per share

Application money was received on 30,000 shares. Excess application money was refunded immediately. Pass journal entries to record the above.

Answer:

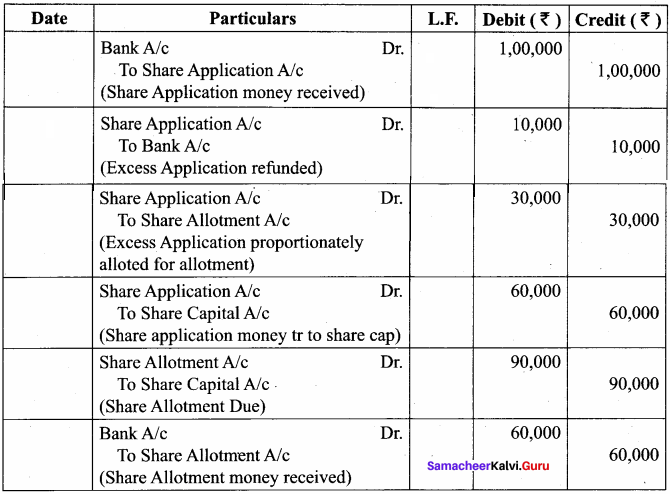

Question 4.

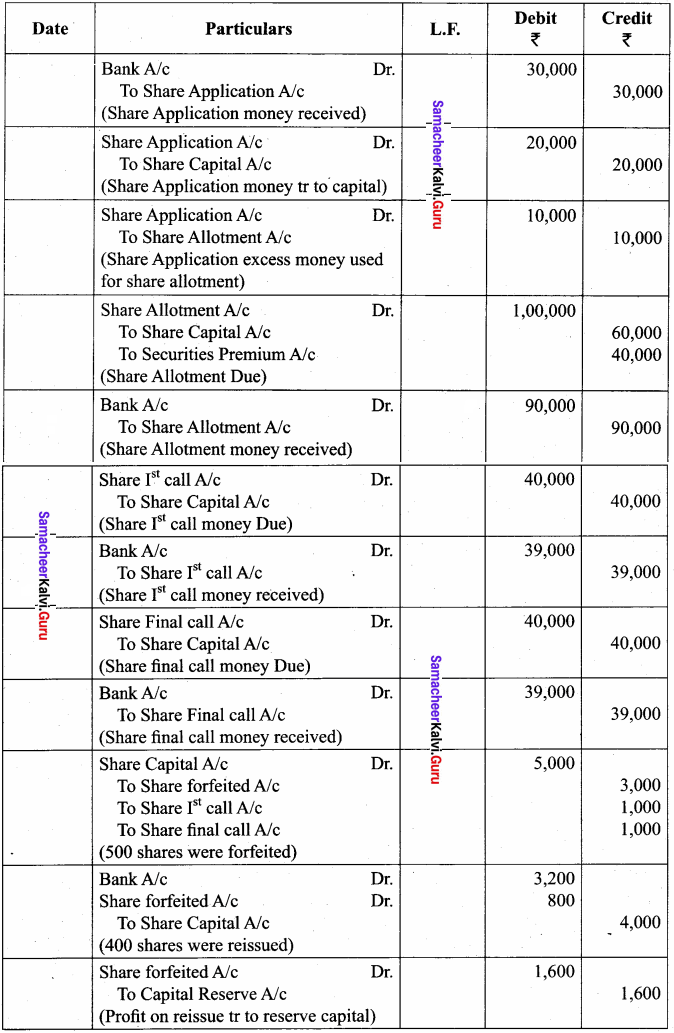

Gaja Ltd issued 40,000 shares of ₹ 10 each to the public payable ₹ 2 on the application, ₹ 5 on the allotment, and ₹ 3 on the first and final call. Applications were received for 50,000 shares. The Directors decided to allot 40,000 shares on a pro-rata basis and a surplus of application money was utilized for allotment. Pass journal entries assuming that the amounts due were received.

Answer:

Journal Entries

Question 5.

Lalitha Ltd. offered 30,000 equity shares of ₹ 10 each to the public payable ₹ 2 per share on the application, ₹ 3 on share allotment, and the balance when required. Applications for 50,000 shares were received on which the directors allotted as:

Applicants for 10,000 shares – Full

Applicants for 35,000 shares – 20,000 shares (excess money will be utilized for allotment)

Applicants for 5,000 shares – Nil

All the money due was received. Pass journal entries upto the receipt of allotment.

Journal Entries

Working Notes:

Question 6.

Das Ltd. offered 50,000 equity shares of ₹ 10 each to the public payable as follows:

On application ₹ 4; on allotment ₹ 3; on first call ₹ 1 and on second and final call ₹ 2. Applications were received for 1,00,000 shares. All the applicants were allotted 1 share for every two shares applied. Excess application money was used for the amount due on allotment and call. Pass necessary journal entries.

Answer:

Journal Entries

Question 7.

Anjali Flour Ltd. with a registered capital of ₹ 4,00,000 in equity shares of ₹ 10 each, issued 30,000 of such shares; payable ₹ 2 per share on application, ₹ 5 per share on allotment, and ₹ 3 per share on the first call. The issue was duly subscribed.

All the money payable was duly received but on allotment, one shareholder paid the entire balance on his holding of 500 shares. Give journal entries to record the transactions.

Answer:

Journal Entries

Question 8.

Muthu Ltd. issued 50,000 shares of ₹ 10 each payable as follows:

₹ 2 on the application; ₹ 4 on allotment; ₹ 4 on first and final call.

All money was duly received except one shareholder holding 1,000 shares failed to pay the call money. Pass the necessary journal entries for calls by using calls in arrear account.

Answer:

Journal Entries

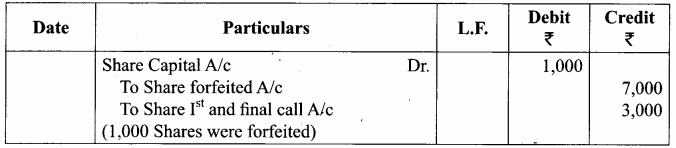

Question 9.

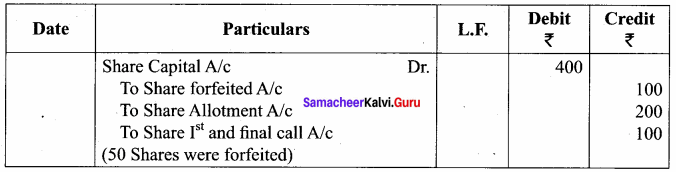

Arjun was holding 1,000 shares of ₹ 10 each of Vanavil Electronics Ltd, issued at par. He paid ₹ 3 on the application, ₹ 4 on the allotment but could not pay the first and final call of ₹ 3. The directors forfeited the shares for non – payment of call money. Give Journal entry for forfeiture of shares.

Answer:

Journal Entries

Question 10.

Lakshith was holding 50 shares of ₹ 10 each on which he paid ₹ 2 on application but could not pay ₹ 4 on the allotment and ₹ 2 on the first call. Directors forfeited the shares after the first call. Give journal entry for recording the forfeiture of shares.

Answer:

Question 11.

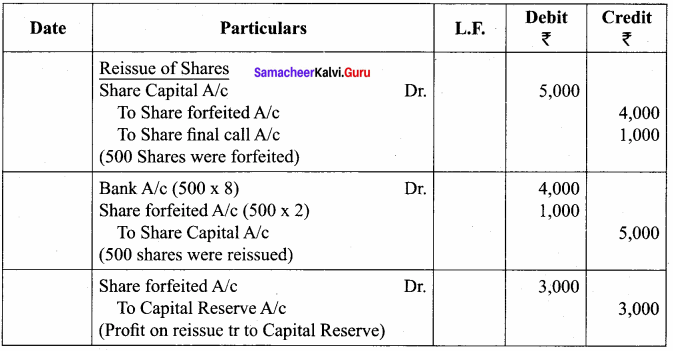

Goutham Ltd. forfeited 500 equity shares of ₹ 10 each issued at par held by Ragav for non – payment of the final call of ₹ 2 per share. The shares were forfeited and reissued to Madhan at ₹ 8 per share. Show the journal entries for forfeiture and reissue.

Answer:

Journal Entries

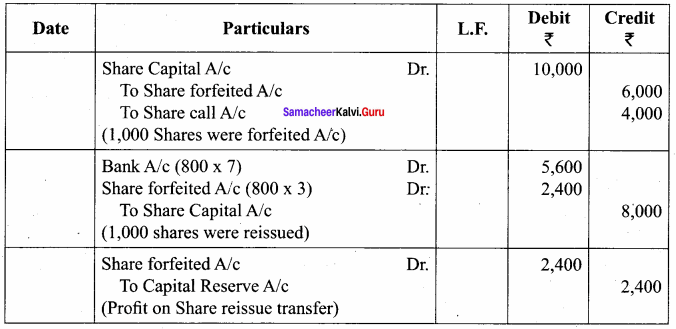

Question 12.

Nivetha Ltd. forfeited 1,000 equity shares of ₹ 10 each for non-payment of call of ₹ 4 per share. Of these 800 shares were reissued @ ₹ 7 per share. Pass journal entries for forfeiture and reissue.

Answer:

Journal Entries

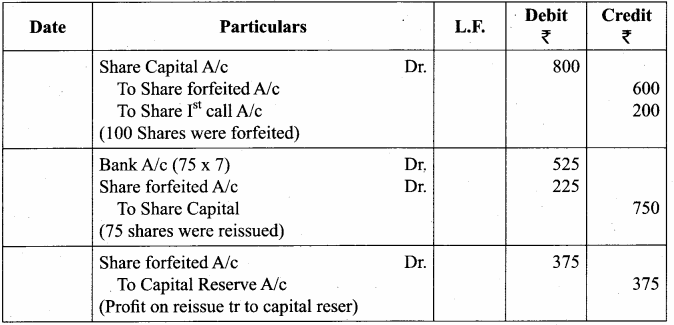

Question 13.

Nathiya Textiles Ltd. forfeited 100 shares of ₹ 10 each, ₹ 8 called up, on which Mayuri had paid application and allotment money of ₹ 6 per share. Of these 75 shares were re-issued to Soundarya by receiving ₹ 7 per share. Pass journal entries for forfeiture and reissue.

Answer:

Question 14.

Simon Ltd issued 50,000 equity shares of ₹ 10 each at par payable on application ₹ 1 per share, on allotment ₹ 5 per share, on first call ₹ 2 per share, and on second and final call ₹ 2 per share. The issue was fully subscribed and all the amounts were duly received with the exception of 2,000 shares held by Chezhian, who failed to pay the second and final call. His shares were forfeited and reissued to Elango at ₹ 8 per share. Journalise the above transactions.

Journal Entries

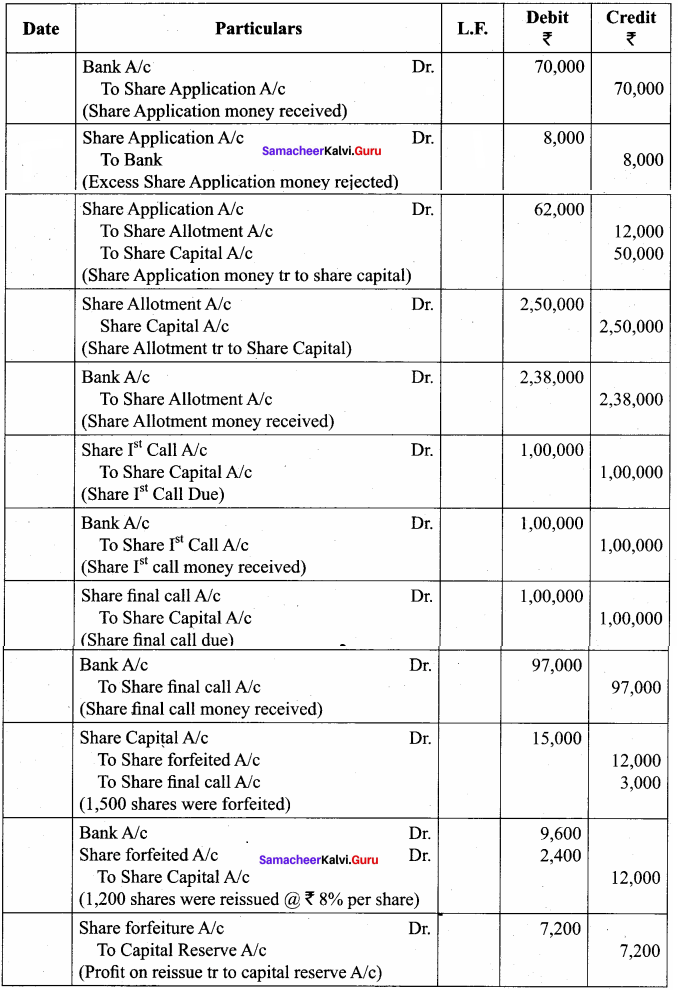

Question 15.

Kanchana Ltd. issued 50,000 shares of ₹ 10 each payable as under.

On application – ₹ 1

On allotment – ₹ 5

On first call – ₹ 2

On final call – ₹ 2

Applications were received for 70,000 shares. Applications for 8,000 shares were rejected and allotment was made proportionately towards the remaining applications. The directors made both the calls and the all the amounts were received except the final call on 1,500 shares which were subsequently forfeited. Later 1,200 forfeited shares were reissued by receiving ₹ 8 per share. Give journal entries.

Answer:

Journal Entries

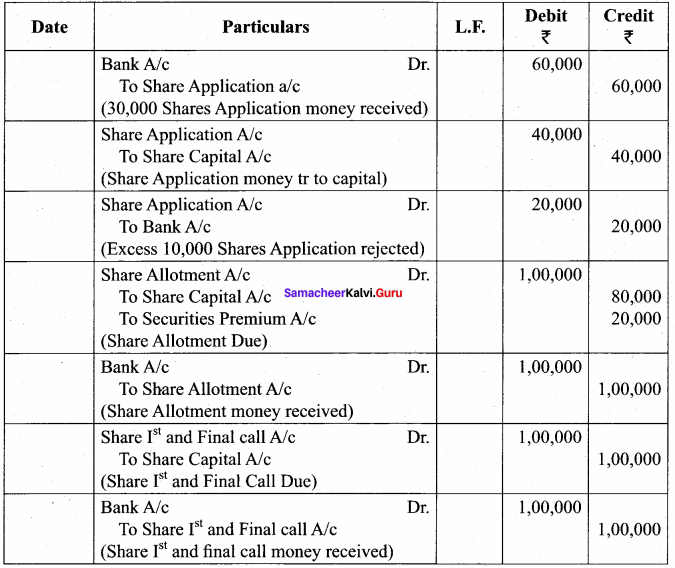

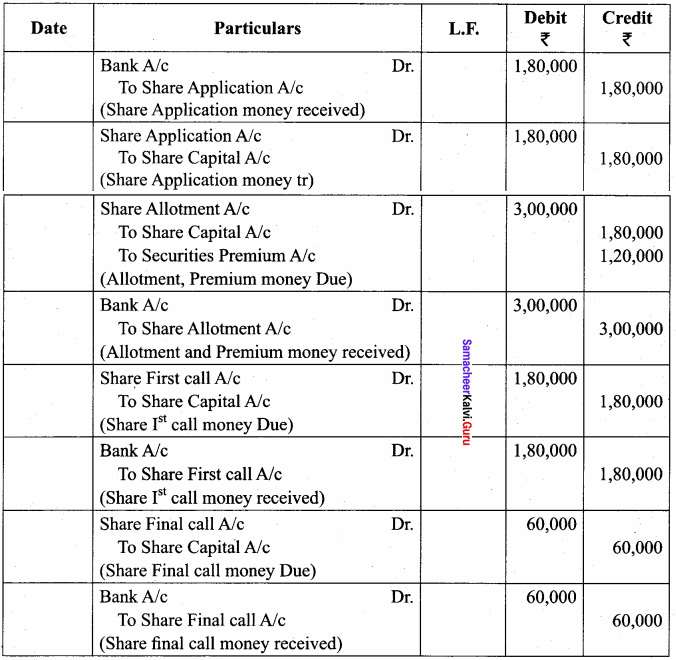

Question 16.

Viswanath Furniture Ltd. invited applications for 20,000 shares of ₹ 10 each at a premium of ₹ 2 per share payable.

₹ 2 on application

₹ 5 (including premium) on allotment

₹ 5 on first and final call

There were oversubscription and applications were received for 30,000 shares and the excess applications were rejected by the directors. Pass the journal entries.

Answer:

Journal Entries

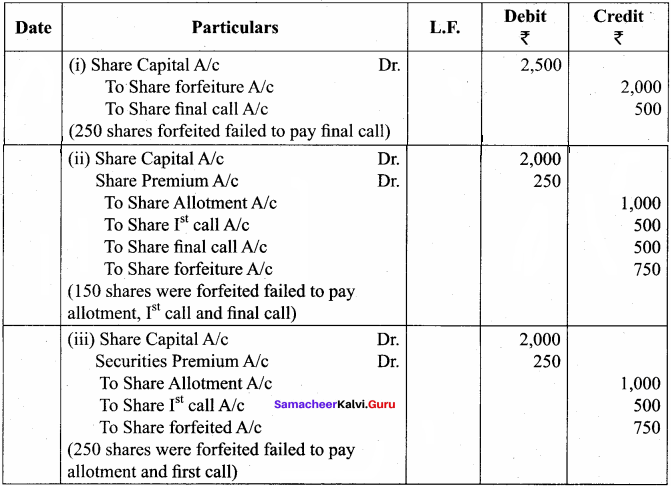

Question 17.

United Industries Ltd. issued shares of ₹ 10 each at 10% premium payable ₹ 3 on application, ₹ 4 on allotment (including premium), ₹ 2 on first call and ₹ 2 on final call.

Journalise the transactions relating to forfeiture of shares for the following situations: Manoj who holds 250 shares failed to pay the second and final call and his shares were forfeited. Manoj who holds 250 shares failed to pay the allotment money and first call and second and final call and his shares were forfeited. Manoj who holds 250 shares failed to pay the allotment money and first call money and his shares were forfeited after the first call.

Answer:

Journal Entries

Question 18.

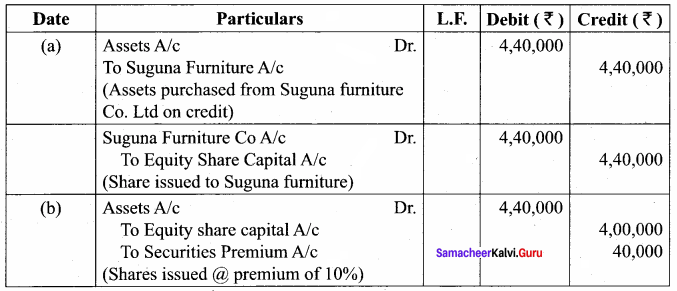

Kasthuri Ltd. had allotted 20,000 shares to applicants of 30,000 shares on a pro-rata basis. The amount payable was ₹ 1 on application, ₹ 5 on allotment (including premium of ₹ 2 each), and ₹ 2 on the first call and ₹ 2 on final calls. Subin, a shareholder failed to pay the first call and final call on his 500 shares. All the shares were forfeited and out of the 400 shares were re-issued @ ₹ 8 per share. Pass necessary journal entries.

Answer:

Journal Entries

Question 19.

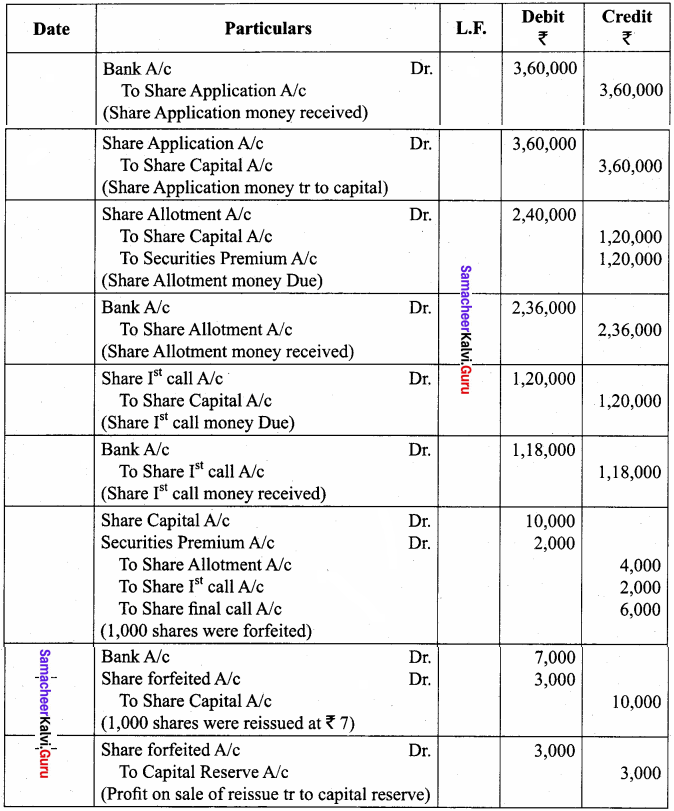

Vairam Ltd. issued 60,000 shares of ₹ 10 each at a premium of ₹ 2 per share payable as follows:

On application ₹ 6

On allotment ₹ 4 (including premium)

On the first and final call ₹ 2

Issue was fully subscribed and the amounts due were received except Saritha to whom 1,000 shares were allotted who failed to pay the allotment money and first and final call money. Her shares were forfeited. All the forfeited shares were reissued to Parimala at ₹ 7 per share. Pass journal entries.

Answer:

Journal Entries

Question 20.

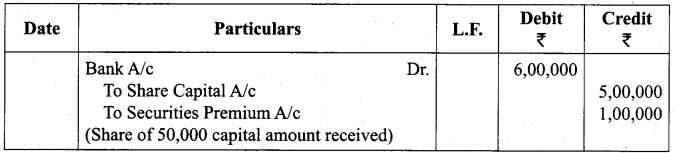

Abdul Ltd. issues 50,000 shares of ₹ 10 each at a premium of ₹ 2 per share. Pass journal entry if the amount is fully received along with a premium amount of ₹ 2 per share.

Question 21.

Paradise Ltd. purchased assets of ₹ 4,40,000 from Suguna Furniture Ltd. It issued equity shares of ₹ 10 each fully paid in satisfaction of their claim. What entries will be made if such issue is: (a) at par and (b) at a premium of 10%.

Answer:

Total Amount = ₹ 4,40,000 Face value of shares is 10.

Premium @ 10% = Premium amt Rs. 1.

Issue Price = Face Value + Securities Premium 10 + 1 = 11

No. of Equity Shares = \(\frac{\text { Total amount }}{\text { Issue price }}\) = \(\frac { 440000 }{ 11 }\) = 40,000 Shares

Samacheer Kalvi 12th Accountancy Company Accounts Additional Questions and Answers

I. Choose the correct answer

Question 1.

Equity Shareholders are ………………

(a) Creditors

(b) Owners

(c) Directors

(d) None of these

Answer:

(b) Owners

Question 2.

Money received in advance from share holders before it is actually called – up by the director is

(a) debited to calls – in – advance A/c

(b) Cr to Calls – in – advance A/c

(c) Dr to calls A/c

(d) none of the above

Answer:

(b) Cr to Calls – in – advance A/c

Question 3.

Securities Premium Reserve can be used for ………………

(a) Paying interest on debentures

(b) meeting the cost of issue of shares

(c) Paying tax liability

(d) Paying dividend as shares

Answer:

(b) meeting the cost of issue of shares

![]()

Question 4.

When share are allowed which of the following account is credited?

(a) Share capital A/c

(b) Share Allotment A/c

(c) Share Application Ac

(d) Shareholders Ac

Answer:

(a) Share capital Ac

Question 5.

Right issue of shares is issued to ………………

(a) Directors

(b) Employees

(c) Existing Shareholders

(d) Shareholder A/c

Answer:

(c) Existing Shareholders

Question 6.

At what rate a company is required to change interest on calls – in – arrears?

(a) 12% p.a.

(b) 10% p.a.

(c) 5% p.a.

(d) 6% p.a.

Answer:

(b) 10% p.a.

Question 7.

At what rate a company is required to pay interest on calls – in – arrears?

(a) 6% p.a.

(b) 12% p.a.

(c) 10% p.a.

(d) 5% p.a.

Answer:

(b) 12% p.a.

Question 8.

According to the Companies Act 2000, a company limited by share can issue ……………… kinds of shares.

(a) 1

(b) 2

(c) 3

Answer:

(b) 2

![]()

Question 9.

The maximum number of calls that a company can make is ………………

(a) one

(b) two

(c) three

Answer:

(c) three

Question 10.

Capital Reserve is shown on the side of balance sheets ………………

(a) Assets

(b) Liability

(c) Both

Answer:

(b) Liability

II. Fill in the blanks

Question 11.

When excess application money is adjusted towards allotment it is called as ……………… allotment.

Answer:

Pro-rata

Question 12.

There should be a time gap of between the two calls.

Answer:

One month

Question 13.

Capital Reserve represent ……………… profit.

Answer:

Capital

![]()

Question 14.

Reserve Capital can be issued at the time of ………………

Answer:

Winding-up

Question 15.

A Company may also issue shares as consideration for business, to ……………… for their services ……………… for their commission.

Answer:

Promotors, Brokers

III. Assertion and Reason

Question 16.

(i) Assertion: When a shareholder defaults in making payment of allotment/call money share may be forfeited.

(ii) Reason: Share forfeited can be reissued at par, discount, or premium.

(a) (i) and (ii) are correct

(b) (i) is correct (ii) is incorrect

(c) (i) and (iii) are incorrect

(d) (i) is incorrect (ii) is correct

Answer:

(a) (i) and (ii) are correct

IV. Match the following

Question 17.

Answer:

(3) (d) (c) (a) (b)

V. Very Short Answer Questions

Question 1.

Name different types of share capital.

Answer:

- Authorised share capital.

- Issued share capital.

- Subscribed share capital.

- Called – up – share capital.

- Paid-up – share capital and.

- Reserve capital.

Question 2.

What is meant by Authorised Capital?

Answer:

This is the amount stated in the capital clause of the memorandum of association with which the company was registered. It is the maximum amount a company can raise during the lifetime.

Question 3.

What do you mean by Capital Reserve?

Answer:

It is that reserve which is created out of capital profits such as profit on sale of fixed assets, profit on revaluation of assets, premium on issue of shares and debentures, etc.

![]()

Question 4.

What is meant by Pro-rata Allotment of shares?

Answer:

Pro-rata allotment is that allotment of shares when applications may be allotted in less number of shares than they have applied for.

Question 5.

Define Equity shares.

Answer:

Equity shares are those shares which are not entitled to a fixed rate of dividend. The dividend is paid on these shares after it is paid on preference shares. Equity share capital is returned only when preference shares is returned.

VI. Short Answer Questions

Question 1.

For what purpose Securities Premium Reserve Amount is used?

Answer:

According to Section 52(2) of the Companies Act 2013. Securities Premium Reserve can be used.

- To issue fully paid-up bonus shares to the shareholders.

- To write off preliminary expenses of the companies.

- To write off the commission paid or discount/exp on the issue of shares/debentures.

- To pay premium on the redemption of preference shares or debentures of the company.

Question 2.

What are the difference between under subscription and oversubscription?

Answer:

| S. No. | Basis for Difference | Under Subscription | Over Subscription |

| 1. | Meaning | The number of shares applied for is less than shares offered to the public for subscription. | The number of shares applied for is more than the shares offered to the public for subscription. |

| 2. . | Minimum Subscription | The problem of minimum subscription may arise | The problem of minimum subscription does not arise. |

| 3. | Allotment of Shares | All the applications for shares are allotted. | Some applications are to be rejected. |

| 4. | Refund | There is no question of refund of money. | Money is refunded to applicants whose applications are rejected. |

VII. Exercise

Question 1.

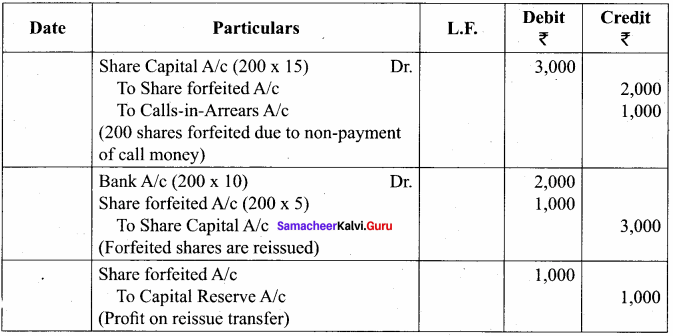

A company forfeited 200 shares of ₹ 20 each, ₹ 15 per share called upon which ₹ 10 per share had been paid. Directors reissued all the forfeited shares. @ ₹ 15 per share paid up for the payment of ₹ 10 each. Give the journal entries.

Answer:

Journal Entries

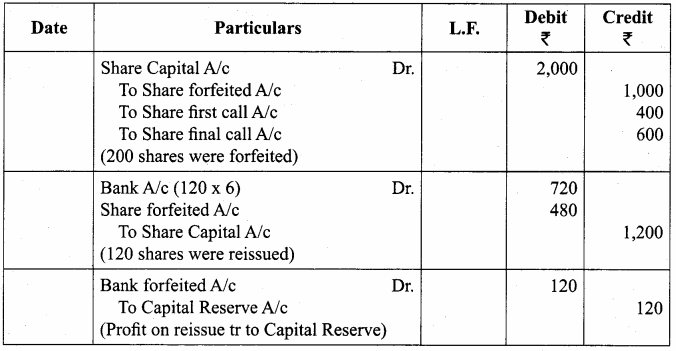

Question 2.

A company forfeited 200 shares of ₹ 10 each fully called up for non – payment of the first call of ₹ 2/- per share and final call of ₹ 3 per share. 120 of these shares were reissued at ₹ 6/- per share fully paid up. Give the necessary entries.

Answer:

Calculation of Amount Transfer to Capital Reserve:

No of shares x (Reissue price – paid up amount)

= 120 x (6 – 5)

= 120 x 1 = ₹ 120.

Question 3.

Global Ltd issued 6000 shares of ₹ 100/- each at premium of ₹ 20 per share payable as follow

₹ 30 on Application

₹ 50 on Allotment (including premium)

₹ 30 on First call and

₹ 10 on final call

All shares were duly subscribed and money due were received. Pass Journal Entries.

Answer:

Journal Entries

Question 4.

Sun Ltd offered for subscription 20,000 shares of ₹ 10/- each payable

₹ 2.50 in Application

₹ 5 on Allotment

₹ 3 on the First call

₹ 2 on Final call

Applications were received for 30,000 shares.

The application for 5,000 shares was rejected. Application money for other 5,000 shares was applied towards the amount due on allotment. Pass Journal Entries.

Question 27.

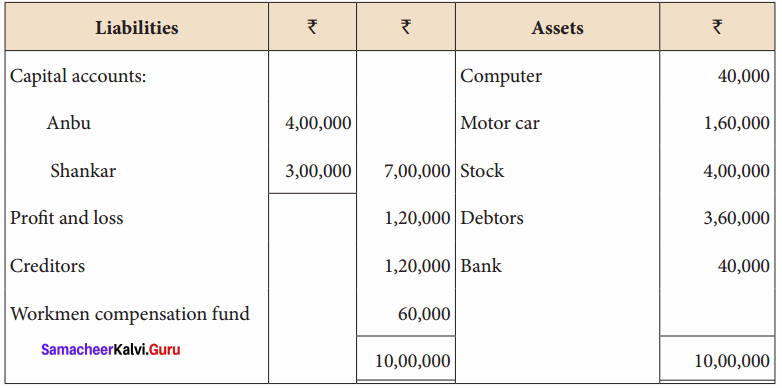

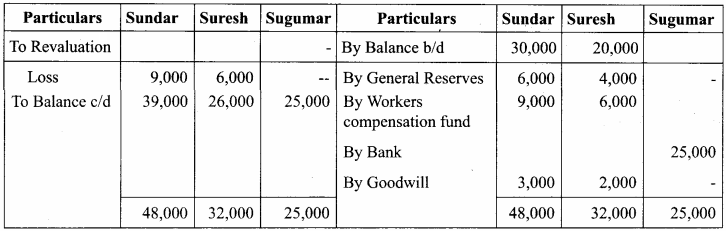

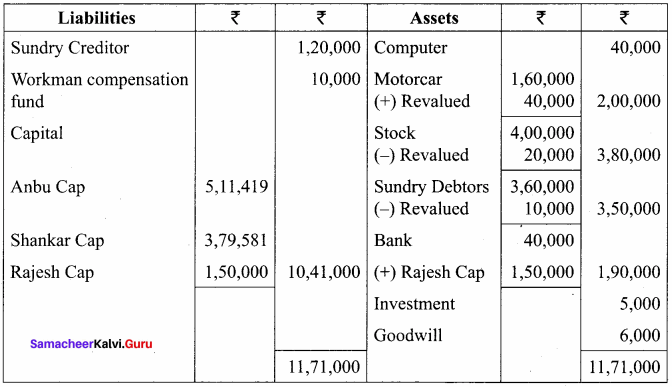

Anbu and Shankar are partners in a business sharing profits and losses in the ratio of 7 : 5. The balance sheet of the partners on 31.03.2018 is as follows:

Rajesh is admitted for 1/5 share on the following terms:

- Goodwill of the firm is valued at ₹ 80,000 and Rajesh brought cash ₹ 6,000 for his share of goodwill.

- Rajesh is to bring ₹ 1,50,000 as his capital.

- Motor car is valued at ₹ 2,00,000; stock at ₹ 3,80,000 and debtors at ₹ 3,50,000.

- Anticipated claim on workmen compensation fund is ₹ 10,000

- Unrecorded investment of ₹ 5,000 has to be brought into account.

Prepare revaluation account, capital accounts and balance sheet after Rajesh’s admission.

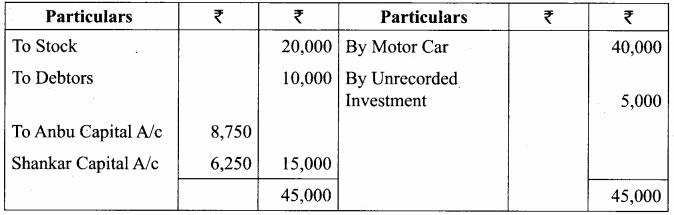

Revaluation Account

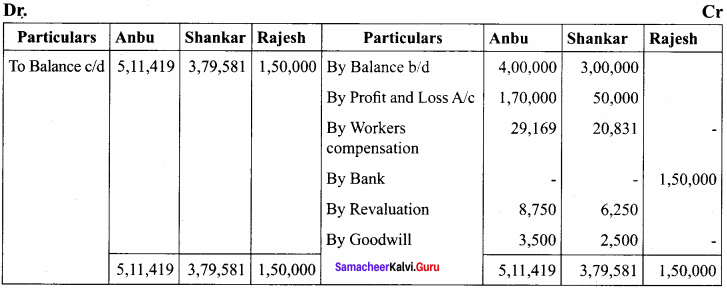

Capital Account

Balance Sheet as on 31.03.2018

Samacheer Kalvi 12th Accountancy Admission of a Partner Additional Questions and Answers

I. Choose the correct answer

Question 1.

At the time of admission of a partner calculation of new profit ratio is ………………

(a) not necessary

(b) necessary

(c) optional

Answer:

(b) necessary

Question 2.

In admission, undistributed profit or loss transferred to ………………

(a) New Partners only

(b) Old Partners only

(c) All the Partners

Answer:

(b) Old Partners only

Question 3.

To get sacrificing ratio should be deducted from old share ………………

(a) Gaining share

(b) New share

(c) Neither of the two

Answer:

(b) new share

![]()

Question 4.

A person who is admitted to the firm is known as ………………

(a) Outgoing partners

(b) Incoming partner

(c) Both

Answer:

(b) incoming partner

Question 5.

At the time of admission of a new partner the following are revalued ………………

(a) Assets

(b) Liabilities

(c) Both

Answer:

(c) Both

Question 6.

New profit ratio is calculated at the time of admission, by deducting ………………

(a) Sacrifice from the old ratio

(b) Old ratio from the sacrifice

(c) Sacrifice from the new ratio

Answer:

(a) Sacrifice from the old ratio

Question 7.

On the admission of a new partner ………………

(a) Old firm has to be dissolved

(b) Old partnership has to be dissolved

(c) Both old firm and partnership have to be dissolved

(d) Neither partnership nor firm has to be dissolved

Answer:

(b) Old partnership has to be dissolved

Question 8.

When a new partner brings his share of goodwill in cash, the amount is debited to ………………

(a) Premium A/c

(b) Cash A/c

(c) Capital A/c of old partner

(d) Capital A/c of new partner

Answer:

(b) Cash A/c

Question 9.

Goodwill already appearing in the Balance sheet at the time of admission of a partner is transferred to ………………

(a) New Partners’ Capital A/c

(b) Old Partners’ Capital A/c

(c) Revaluation A/c

(d) None of the above

Answer:

(b) Old Partners’ Capital A/c