Students can Download Economics Chapter 4 Consumption and Investment Functions Questions and Answers, Notes Pdf, Samacheer Kalvi 12th Economics Book Solutions Guide Pdf helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

Tamilnadu Samacheer Kalvi 12th Economics Solutions Chapter 4 Consumption and Investment Functions

Samacheer Kalvi 12th Economics Consumption and Investment Functions Text Book Back Questions and Answers

Part – A

Multiple Choice Questions.

Question 1.

The average propensity to consume is measured by –

(a) C / Y

(b) C × Y

(c) Y / C

(d) C + Y

Answer:

(a) C / Y

Question 2.

An increase in the marginal propensity to consume will:

(a) Lead to consumption function becoming steeper

(b) Shift the consumption function upwards

(c) Shift the consumption function downwards

(d) Shift savings function upwards

Answer:

(a) Lead to consumption function becoming steeper.

![]()

Question 3.

If the Keynesian consumption function is C = 10 + 0.8 Y then, if disposable income is Rs 1000, what is amount of total consumption?

(a) ₹ 0.8

(b) ₹ 800

(c) ₹ 810

(d) ₹ 0.81

Answer:

(c) ₹ 810

Question 4.

If the Keynesian consumption function is C = 10 + 0.8 Y then, when disposable income is Rs 100, what is the marginal propensity to consume?

(a) ₹ 0.8

(b) ₹ 800

(c) ₹ 810

(d) ₹ 0.81

Answer:

(a) ₹ 0.8

![]()

Question 5.

If the Keynesian consumption function is C = 10 + 0.8 Y then, and disposable income is ₹ 100, what is the average propensity to consume?

(a) ₹ 0.8

(b) ₹ 800

(c) ₹ 810

(d) ₹ 0.9

Answer:

(d) ₹ 0.9

Question 6.

As national income increases –

(a) The APC falls and gets nearer in value to the MPC.

(b) The APC increases and diverges in value from the MPC.

(c) The APC stays constant

(d) The APC always approaches infinity.

Answer:

(a) The APC falls and gets nearer in value to the MPC.

![]()

Question 7.

As increase in consumption at any given level of income is likely to lead –

(a) Higher aggregate demand

(b) An increase in exports

(c) A fall in taxation revenue

(d) A decrease in import spending

Answer:

(a) Higher aggregate demand

Question 8.

Lower interest rates are likely to:

(a) Decrease in consumption

(b) increase cost of borrowing

(c) Encourage saving

(d) increase borrowing and spending

Answer:

(d) increase borrowing and spending

Question 9.

The MPC is equal to:

(a) Total spending / total consumption

(b) Total consumption / total income

(c) Change in consumption / change in income

(d) None of the above

Answer:

(c) Change in consumption / change in income

![]()

Question 10.

The relationship between total spending on consumption and the total income is the –

(a) Consumption function

(b) Savings function

(c) Investment function

(d) aggregate demand function

Answer:

(a) Consumption function

Question 11.

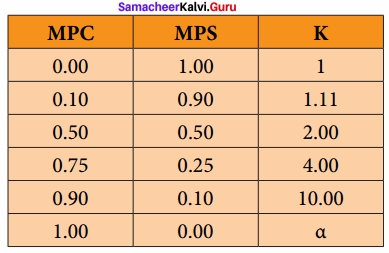

The sum of the MPC and MPS is –

(a) 1

(b) 2

(c) 0.1

(d) 1.1

Answer:

(a) 1

Question 12.

As income increases, consumption will –

(a) fall

(b) not change

(c) fluctuate

(d) increase

Answer:

(d) increase

![]()

Question 13.

When investment is assumed autonomous the slope of the AD schedule is determined by the –

(a) marginal propensity to invest

(b) disposable income

(c) marginal propensity to consume

(d) average propensity to consume

Answer:

(c) marginal propensity to consume

Question 14.

The multiplier tells us how much changes after a shift in –

(a) Consumption, income

(b) investment, output

(c) savings, investment

(d) output, aggregate demand

Answer:

(d) output, aggregate demand

![]()

Question 15.

The multiplier is calculated as –

(a) 1 / (1 – MPC)

(b) 1 / MPS

(c) 1 / MPC

(d) a and b

Answer:

(d) a and b

Question 16.

It the MPC is 0.5, the multiplier is –

(a) 2

(b) 1/2

(c) 0.2

(d) 20

Answer:

(a) 2

Question 17.

In an open economy import ………………………. the value of the multiplier

(a) Reduces

(b) increase

(c) does not change

(d) changes

Answer:

(a) Reduces

![]()

Question 18.

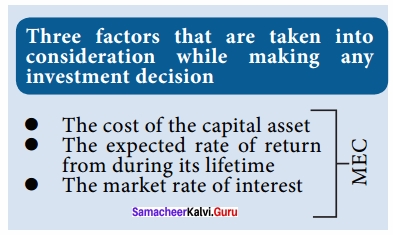

According to Keynes, investment is a function of the MEC and –

(a) Demand

(b) Supply

(c) Income

(d) Rate of interest

Answer:

(d) Rate of interest

Question 19.

The term super multiplier was first used by –

(a) J.R.Hicks

(b) R.G.D. Allen

(c) Kahn

(d) Keynes

Answer:

(a) J.R.Hicks

![]()

Question 20.

The term MEC was introduced by –

(a) Adam Smith

(b) J.M. Keynes

(c) Ricardo

(d) Malthus

Answer:

(b) J.M. Keynes

Part – B

Answer The Following Questions In One or Two Sentences

Question 21.

What is consumption function?

Answer:

Meaning of Consumption Function:

1. The consumption function or propensity to consume refers to income consumption relationship. It is a “functional relationship between two aggregates viz., total consumption and gross national income.”

2. Symbolically, the relationship is represented as C = f (Y)

Where,

C = Consumption; Y = Income; f = Function

3. Thus the consumption function indicates a functional relationship between C and Y, where C is the dependent variable and Y is the independent variable, i.e., C is determined by Y. This relationship is based on the ceteris paribus (other things being same) assumption, as only income consumption relationship is considered and all possible influences on consumption are held constant.

![]()

Question 22.

What do you mean by propensity to consume?

Answer:

1. The consumption function or propensity to consume refers to income consumption relationship. It is a “functional relationship between two aggregates viz., total consumption and gross national income.”

2. Symbolically, the relationship is represented as C = f(Y) Where, C = Consumption; Y = Income; f = Function

3. Thus the consumption function indicates a functional relationship between C and Y, where C is the dependent variable and Y is the independent variable, i.e., C is determined by Y. This relationship is based on the ceteris paribus (other things being same) assumption, as only income consumption relationship is considered and all possible influences on consumption are held constant.

Question 23.

Define average propensity to consume (APC)?

Answer:

Average Propensity to Consume:

1. The average propensity to consume is the ratio of consumption expenditure to any particular level of income.” Algebraically it may be expressed as under:

Where, C = Consumption; Y = Income

APC = \(\frac{C}{Y}\)

Where, C = Consumption; Y = Income.

![]()

Question 24.

Define marginal propensity to consume (MPC)?

Answer:

Marginal Propensity to Consume:

1. The marginal propensity to consume may be defined as the ratio of the change in the consumption to the change in income. Algebraically it may be expressed as under:

MPC = \(\frac { \Delta C }{ \Delta Y } \)

Where, ∆C = Change in Consumption; ∆Y = Change in Income

MPC is positive but less than unity, 0 < \(\frac { \Delta C }{ \Delta Y } \) < 1.

Question 25.

What do you mean by propensity to save?

Answer:

- Thus the consumption function measures not only the amount spent on consumption but also the amount saved.

- This is because the propensity to save is merely the propensity not to consume.

- The 45° line may therefore be regarded as a zero – saving line, and the shape and position of the C curve indicate the division of income between consumption and saving.

![]()

Question 26.

Define average propensity to save (APS)?

Answer:

Average Propensity to Save (APS):

- The average propensity to save is the ratio of saving to income.

- APS is the quotient obtained by dividing the total saving by the total income. In other words, it is the ratio of total savings to total income. It can be expressed algebraically in the form of equation as under

- APS = \(\frac{S}{Y}\) Where, S = Saving; Y = Income

Question 27.

Define Marginal Propensity to Save (MPS)?

Answer:

Marginal Propensity to Save (MPS):

1. Marginal Propensity to Save is the ratio of change in saving to a change in income.

2. MPS is obtained by dividing change in savings by change in income. It can be expressed algebraically as MPS = \(\frac { \Delta S }{ \Delta Y } \)

∆S = Change in Saving; ∆Y = Change in Income

Since MPC + MPS = 1

MPS = 1 – MPC and MPC = 1 – MPS.

![]()

Question 28.

Define Multiplier?

Answer:

- The multiplier is defined as the ratio of the change in national income to change in investment.

- If AI stands for increase in investment and AY stands for resultant increase in income, the multiplier K =AY/AI.

- Since AY results from AI, the multiplier is called investment multiplier.

Question 29.

Define Accelerator?

Answer:

- “The accelerator coefficient is the ratio between induced investment and an initial change in consumption.”

- Assuming the expenditure of ₹50 crores on consumption goods, if industries lead to an investment of ₹100 crores in investment goods industries, we can say that the accelerator is 2.

- Accelerator = \(\frac { 100 }{ \Delta Y } \) = 2

Part – C

Answer The Following Questions In One Paragraph.

Question 30.

State the propositions of Keynes’s Psychological Law of Consumption?

Answer:

Propositions of the Law:

This law has three propositions:

1. When income increases, consumption expenditure also increases but by a smaller amount. The reason is that as income increases, we wants are satisfied side by side, so that the need to spend more on consumer goods diminishes. So, the consumption expenditure increases with increase in income but less than proportionately.

2. The increased income will be divided in some proportion between consumption expenditure and saving. This follows from the first proposition because when the whole • of increased income is not spent on consumption, the remaining is saved. In this way, consumption and saving move together.

3. Increase in income always leads to an increase in both consumption and saving. This means that increased income is unlikely to lead to fall in either consumption or saving. Thus with increased income both consumption and saving increase.

![]()

Question 31.

Differentiate autonomous and induced investment?

Answer:

Autonomous Investment:

- Independent

- Income inelastic

- Welfare motive

Induced Investment:

- Planned

- Income elastic

- Profit Motive

![]()

Question 32.

Explain any three subjective and objective factors influencing the consumption function?

Answer:

Subjective Factors:

- The motive of precaution: To build up a reserve against unforeseen contingencies. e.g. Accidents, sickness. ,

- The motive of foresight: The desire to provide for anticipated future needs. e.g. Old age.

- The motive of calculation: The desire to enjoy interest and appreciation. Consumption and Investment Functions.

Objective Factors:

1. Income Distribution:

If there is large disparity between rich and poor, the consumption is low because the rich people have low propensity to consume and high propensity to save.

2. Price level:

Price level plays an important role in determining the consumption function. When the price falls, real income goes up; people will consume more and propensity to save of the

society increases.

3. Wage level:

Wage level plays an important role in determining the consumption function and there is positive relationship between wage and consumption. Consumption expenditure increases with the rise in wages. Similar is the effect with regard to windfall gains.

![]()

Question 33.

Mention the differences between accelerator and multiplier effect?

Answer:

Accelerator Effect Multiplier Effect:

1. Accelerator is the numerical value of the relation between an increase in consumption and the resulting increasing in Investment. Multiplier is the ration of the change in national income to change in Investment.

2. Accelerator (β) = \(\frac { \Delta I }{ \Delta C } \)

ΔI = Change in Investment

ΔC = Change in consumption demand Multiplier (K) = \(\frac { \Delta I }{ \Delta C } \)

ΔI = Increase in Investment ΔY = Increase in Income ΔY results from ΔI

3. Accelerator Effects are –

- Increase in consumer demand.

- Films get close to fill capacity.

- Film invest to meet rising demand. Multiplier Effects are

Multiplier Effect:

1. Multiplier is the ration of the change in national income to change in Investment.

2. Multiplier:

Multiplier (K) = \(\frac { \Delta Y }{ \Delta I } \)

ΔI = Increase in Investment

ΔY = Increase in Income

ΔY results from ΔI

Multiplier Effects are:

- Positive Multiplier an initial increases is an injection (or a decrease in a leakage) leads to a greater final increase in real GDP.

- Negative Multiplier an initial increases in an injection (or an increase in a leakage) leads to a greater final decrease in real GDP.

![]()

Question 34.

State the concept of super multiplier?

Answer:

Super Multiplier: (k and β interaction):

- The super multiplier is greater than simple multiplier which includes only autonomous investment and no induced investment, while super multiplier includes induced investment.

- In order to measure the total effect of initial investment on income, Hicks has combined the k and β mathematically and given it the name of the Super Multiplier.

- The super multiplier is worked out by combining both induced consumption and induced investment.

![]()

Question 35.

Specify the limitations of the multiplier?

Answer:

- There is change in autonomous investment.

- There is no induced investment

- The marginal propensity to consume is constant.

- Consumption is a function of current income.

- There are no time lags in the multiplier process.

- Consumer goods are available in response to effective demand for them.

- There is a closed economy unaffected by foreign influences.

- There are no changes in prices.

- There is less than full employment level in the economy.

Part – D

Answer The Following Questions In About A Page.

Question 36.

Explain Keynes psychological law of consumption function with diagram?

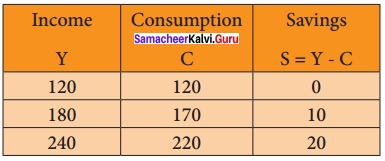

The three propositions of the law:

Proposition (1):

Income increases by ₹ 60 crores and the increase in consumption is by ₹ 50 crores.

Proposition (2):

The increased income of ₹ 60 crores in each case is divided in some proportion between consumption and saving respectively, (i.e., ₹ 50 crores and ₹ 10 crores).

Proposition (3):

As income increases consumption as well as saving increase. Neither consumption nor saving has fallen. Diagrammatically, the three propositions are explained in figure. Here, income is measured horizontally and consumption and saving are measured on the vertical axis. C is the consumption function curve and 45° line represents income consumption equality.

Proposition (1):

When income increases from 120 to 180 consumption also increases from 120 to 170 but the increase in consumption is less than the increase in income, 10 is saved.

Proposition (2):

When income increases to 180 and 240, it is divided in some proportion between consumption by 170 and 220 and saving by 10 and 20 respectively.

Proposition (3):

Increases in income to 180 and 240 lead to increased consumption 170 and 220 and increased saving 20 and 10 than before. It is clear from the widening area below the C curve and the saving gap between 45° line and C curve.

![]()

Question 37.

Briefly explain the subjective and objective factors of consumption function?

Answer:

Subjective Factors:

- The motive of precaution: To build up a reserve against unforeseen contingencies. e.g. Accidents, sickness

- The motive of foresight: The desire to provide for anticipated future needs, e.g. Old age

- The motive of calculation: The desire to enjoy interest and appreciation.

- The motive of improvement: The desire to enjoy for improving standard of living.

- The motive of financial independence.

- The motive of enterprise (desire to do forward trading).

- The motive of pride.(desire to bequeath a fortune)

- The motive of avarice.(purely miserly instinct)

Objective Factors:

1. Income Distribution:

If there is large disparity between rich and poor, the consumption is low because the rich people have low propensity to consume and high propensity to save.

2. Price level:

- Price level plays an important role in determining the consumption function.

- When the price falls, real income goes up; people will consume more and propensity to save of the society increases.

3. Wage level:

- Wage level plays an important role in determining the consumption function and there is positive relationship between wage and consumption.

- Consumption expenditure increases with the rise in wages.

- Similar is the effect with regard to windfall gains.

4. Interest rate:

- Rate of interest plays an important role in determining the consumption function.

- Higher rate of interest will encourage people to save more money and reduces consumption.

5. Fiscal Policy:

When government reduces the tax the disposable income rises and the propensity to consume of community increases.

6. Consumer credit:

- The availability of consumer credit at easy installments will encourage households to buy consumer durables like automobiles, fridge, computer.

- This pushes up consumption.

7. Demographic factors:

- Ceteris paribus, the larger the size of the family, the grater is the consumption.

- Besides size of family, stage in family life cycle, place of residence and occupation affect the consumption function.

8. Duesenberry hypothesis:

Duesenberry has made two observations regarding the factors affecting consumption.

- The consumption expenditure depends not only on his current income but also past income and standard of living.

- Consumption is influenced by demonstration effect. The consumption standards of low income groups are influenced by the consumption standards of high income groups.

9. Windfall Gains or losses:

Unexpected changes in the stock market leading to gains or losses tend to shift the consumption function upward or downward.

Question 38.

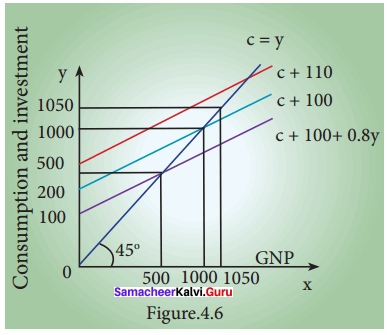

Illustrate the working of Multiplier?

Answer:

Working of Multiplier:

- Suppose the Government undertakes investment expenditure equal to ₹ 100 crore on some public works, by way of wages, price of materials etc.

- Thus income of labourers and suppliers of materials increases by ₹ 100 crore. Suppose the MPC is 0.8 that is 80 %.

- A sum of ₹ 80 crores is spent on consumption (A sum of ₹ 20 Crores is saved).

- As a result, suppliers of goods get an income of ₹ 80 crores.

- They intum spend ₹ 64 crores (80% of ₹ 80 cr).

- In this manner consumption expenditure and increase in income act in a chain like maimer.

The final result is ∆Y = 100 + 100 × 4/5 + 100 × [4/5]2 + 100 × [4/5]3 or,

∆Y = 100 + 100 × 0.8 + 100 × (0.8)2 + 100 × (0.8)3

= 100 + 80 + 64 + 51.2… = 500 .

that is 100 × 1/1 – 4/5

100 × 1/1/5

100 × 5 = ₹ 500 crores

For instance if C = 100 + 0.8Y, I = 100,

Then Y = 100 + 0.8Y + 100

0.2Y = 200

Y = 200/0.2 = 1000 → Point B

If I is increased to 110, then

0.2Y = 210

Y = 210/0.2 = 1050 → Point D

For ₹ 10 increase in I, Y has increased by ₹ 50.

This is due to multiplier effect.

At point A, Y = C = 500

C = 100 + 0.8 (500) = 500; S = 0

At point B, Y = 1000

C = 100 + 0.8 (1000) = 900; S = 100 = I At point D, Y = 1050

C = 100 + 0.8 (1050) = 940; S = 110 = I

When I is increased by 10, Y increases by 50.

This is multiplier effect (K = 5)

K = \(\frac{1}{0.2}\) = 5

![]()

Question 39.

Explain the operation of the Accelerator?

Answer:

Operation of the Acceleration Principle:

- Let us consider a simple example. The operation of the accelerator may be illustrated as follows.

- Let us suppose that in order to produce 1000 consumer goods, 100 machines are required.

- Also suppose that working life of a machine is 10 years.

- This means that every year 10 machines have to be replaced in order to maintain the constant flow of 1000 consumer goods. This might be called replacement demand.

- Suppose that demand for consumer goods rises by 10 percent (i.e. from 1000 to 1100).

- This results in increase in demand for 10 more machines.

- So that total demand for machines is 20. (10 for replacement and 10 for meeting increased demand).

- It may be noted here a 10 percent increase in demand for consumer goods causes a 100 percent increase in demand for machines (from 10 to 20).

- So we can conclude even a mild change in demand for consumer goods will lead to wide change in investment.

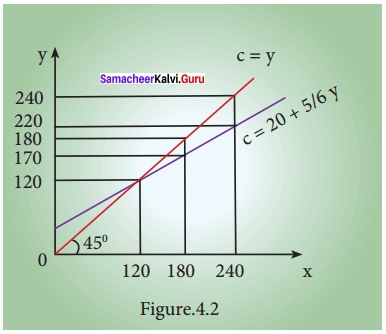

Diagrammatic illustration:

Operation of Accelerator.

- SS is the saving curve. II is the investment curve. At point E1 the economy is in equilibrium with OY1 income. Saving and investment are equal at OY1 Now, investment is increased from OI2 to OI4.

- This increases income from OY1 to OY3, the equilibrium point being E3 If the increase in investment by I2 I4 is purely exogenous, then the increase in income by Y1 Y3 would have been due to the multiplier effect.

- But in this diagram it is assumed that exogenous investment is only by I, I3 and induced investment is by I3I4.

- Therefore, increase in income by Y1 Y2 is due to the multiplier effect and the increase in income by Y2 Y3 is due to the accelerator effect.

![]()

Question 40.

What are the differences between MEC and MEI?

Answer:

Marginal Efficiency of Capital (MEC):

- It is based on a given supply price for capital.

- It represents the rate of return on all successive units of capital without regard to existing capital.

- The capital stock is taken on the X axis of diagram.

- It is a “stock” concept.

- It determines the optimum capital stock in an economy at each level of interest rate.

Marginal Efficiency of Investment (MEI):

- It is based on the induced change in the price due to change in the demand for capital.

- It shows the rate of return on just those units of capital over and above the existing capital stock.

- The amount of investment is taken on the X – axis of diagram.

- It is a “flow” concept.

- It determines the net investment of the economy at each interest rate given the capital stock.

Samacheer Kalvi 12th Economics Consumption and Investment Functions Additional Questions and Answers

part – A

I. Multiple Choice Questions.

Question 1.

Price level plays an important role in determining the ……………………

(a) Consumption function

(b) Income function

(c) Finance function

(d) Price function

Answer:

(a) Consumption function

Question 2.

The progressive tax system increases the ……………………….. of the people by altering the income distribution in favour of poor?

(a) price level

(b) wage level

(c) propensity to consume

(d) Fiscal policy

Answer:

(c) propensity to consume

![]()

Question 3.

…………………….. means purchase of stocks and shares, debentures, government bonds and equities?

(a) Consumption

(b) Investment

(c) Finance

(d) Saving

Answer:

(b) Investment

Question 4.

…………………… is influenced by demonstration effect.

(a) Investment

(b) Interest

(c) Expenditure

(d) Consumption

Answer:

(d) Consumption

Question 5.

Additional investment that is independent of income is called ……………………

(a) Autonomous Investment

(b) Autonomous Consumption

(c) Average Investment

(d) Marginal Investment

Answer:

(a) Autonomous Investment

![]()

Question 6.

Induced investment is motivated?

(a) Investment

(b) Capital

(c) Saving

(d) Profit

Answer:

(d) Profit

Question 7.

MEI is the expected rate of return on investment as additional units of ……………………

(a) Saving

(b) Investment

(c) Consumption

(d) Expenditure

Answer:

(b) Investment

Question 8.

Dynamic multiplier is also known as ……………………

(a) Sequence multiplier

(b) Static multiplier

(c) Double multiplier

(d) Single multiplier

Answer:

(a) Sequence multiplier

![]()

Question 9.

The combined effect of interaction of multiplier and accelerator is called ……………………

(a) Super accelerator

(b) Super multiplier

(c) Accelerator

(d) Multiplier

Answer:

(b) Super multiplier

Question 10.

The tendency to initiate Superior consumption pattern is called ……………………

(a) Accelerator effect

(b) Multiplier effect

(c) Super Multiplier effect

(d) Demonstration effect

Answer:

(d) Demonstration effect

Question 11.

The multiplier is the reciprocal of one minus ……………………

(a) MPC

(b) MPS

(c) Multiplier

(d) Accelerator

Answer:

(a) MPC

![]()

Question 12.

The concept of multiplier was first developed by ……………………

(a) J.M. Keynes

(b) David Ricardo

(c) R.F. Khan

(d) J.B. Say

Answer:

(c) R.F. Khan

Question 13.

…………………… the larger size of the family, the greater is the consumption?

(a) Demographic factors

(b) Income Distribution

(c) Duesenberry hypothesis

(d) Wage level

Answer:

(b) Income Distribution

Question 14.

MPS is the ratio of change in saving to a change in ……………………

(a) profit

(b) money

(c) finance

(d) income

Answer:

(d) income

![]()

Question 15.

Consumption function is called the relationship between ……………………….. and Income?

(a) Money

(b) Consumption

(c) Finance

(d) Investment

Answer:

(b) Consumption

Question 16.

Consumer’s surplus is useful to the Finance Minister in formulating ……………………….. policies?

(a) Surplus

(b) Consumption

(c) Taxation

(d) Income

Answer:

(c) Taxation

Question 17.

Consumer surplus is called potential price – ……………………………. price?

(a) real

(b) actual

(c) normal

(d) high

Answer:

(b) actual

![]()

Question 18.

Dynamic multiplier is also known as ………………………. Multiplier.

(a) Sequence

(b) Static

(c) Timeless

(d) Logical

Answer:

(a) Sequence

Question 19.

Static Multiplier is otherwise known as …………………………… Multiplier.

(a) Dynamic

(b) Leakage

(c) Simultaneous

(d) Multi effect

Answer:

(c) Simultaneous

Question 20.

The propensity to consume refers to the portion of Income spent on ……………………….

(a) Income

(b) Profit

(c) Expenditure

(d) Consumption

Answer:

(d) Consumption

![]()

Question 21.

………………………. redefined it as investment multiplier.

(a) R.K. Khan

(b) David Ricardo

(c) J.M. Keynes

(d) Marshall

Answer:

(c) J.M. Keynes

Question 22.

Accelerator Model was made by ……………………

(a) J.M. Keynes

(b) J.M. Clark

(c) R.F. Khan

(d) Marshall

Answer:

(b) J.M. Clark

Question 23.

The multiplier tells us …………………………. changes after a shift in ……………………

(a) income

(b) investment

(c) aggregate demand

(d) savings

Answer:

(c) aggregate demand

![]()

Question 24.

The simple accelerated model was made by J.M. Clark in ……………………

(a) 1915

(b) 1916

(c) 1914

(d) 1917

Answer:

(d) 1917

II. Match the following and choose the correct answer by using codes given below

Question 1.

A. Consumption function – (i) Consmption increased

B. Induced Investment – (ii) Borrowings

C. Income Increases – (iii) Subjective and objective

D. Autonomous consumption – (iv) Profit motive

Codes:

(a) A (iii) B (iv) C (i) D (ii)

(b) A (iv) B (i) C (ii) D (iii)

(c) A (i) B (ii) C (iii) D (iv)

(d) A (ii) B (iii) C (iv) D (i)

Answer:

(a) A (iii) B (iv) C (i) D (ii)

Question 2.

A. MPS – measured – (i) K = 1/MPS

B. Multiplier developed by – (ii) MEC

C. Investment depends on – (iii) ∆S/∆Y

D. Value of multiplier – (iv) R.F. Khan

Codes:

(a) A (i) B (ii) C (iv) D (iii)

(b) A (ii) B (iii) C (i) D (iv)

(c) A (iii) B (iv) C (ii) D (i)

(d) A (iv) B (i) C (iii) D (ii)

Answer:

(c) A (iii) B (iv) C (ii) D (i)

![]()

Question 3.

A. Reduced Investment – (i) 1930

B. Keynes employment dependes on – (ii) Highest interest rate

C. Fall in investment – (iii) Zero

D. Long fun autonomous consumption will – (iv) Investment

Codes:

(a) A (i) B (iii) C (iv) D (ii)

(b) A (ii) B (iv) C (i) D (iii)

(c) A (iii) B (i) C (ii) D (iv)

(d) A (iv) B (ii) C (iii) D (i)

Answer:

(b) A (ii) B (iv) C (i) D (iii)

Question 4.

A. MPS – (i) AC/AY

B. MPC – (ii) C/Y

C. APS – (iii) S/Y

D. APC – (iv) AS/AY

Codes:

(a) A (iv) B (i) C (iii) D (ii)

(b) A (i) B (ii) C (iv) D (iii)

(c) A (ii) B (iii) C (i) D (iv)

(d) A (iii) B (iv) C (ii) D (i)

Answer:

(a) A (iv) B (i) C (iii) D (ii)

![]()

Question 5.

A. Investment means – (i) Expenditure on capital formation

B. Uses of multiplier – (ii) Consumption forgone

C. Saving is – (iii) Achieve full employment

D. Autonomous investment – (iv) Stocks and shares

Codes:

(a) A (ii) B (i) C (iv) D (iii)

(b) A (iii) B (ii) C (iii) D (iv)

(c) A (iv) B (iii) C (ii) D (i)

(d) A (i) B (iv) C (i) D (ii)

Answer:

(c) A (iv) B (iii) C (ii) D (i)

III. State whether the statements are true or false.

Question 1.

(i) Keynes propounded the fundamental psychological law of consumption.

(ii) J.M. Keynes has divided factors influencing the consumption function.

(a) Both (i) and (ii) are true

(b) Both (i) and (ii) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(a) Both (i) and (ii) are true

![]()

Question 2.

(i) The kinds of multiplier is called Tax Multiplier, Employment Multiplier, Foreign trade Multiplier, Investment Multiplier.

(ii) Investment means money collecting.

(a) Both (i) and (ii) are true

(b) Both (i) and (ii) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(d) (i) is false but (ii) is true

Question 3.

(i) The term investment means purchase of stocks and shares, debentures, government bonds and equities.

(ii) The term Investment means expenditure on capital formation.

(a) Both (i) and (ii) are true

(b) Both (i) and (ii) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(c) (i) is true but (ii) is false

![]()

Question 4.

(i) Leakages of multiplier is payment only.

(ii) Leakages of multiplier limitation is called full employment situation.

(a) Both (i) and (ii) are true

(b) Both (i) and (ii) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(d) (i) is false but (ii) is true

![]()

Question 5.

(i) The types of Investment is called Autonomous Investment, Induced Investment.

(ii) Induced Investment is the expenditure on fixed assets and stocks.

(a) Both (i) and (ii) are true

(b) Both 0) and (if) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(a) Both (i) and (ii) are true

IV. Which of the following is correctly matched:

Question 1.

(a) J.M. Clark – Ceteris Paribus

(b) J.M. Keynes – Psychological law of consumption

(c) R.F. Khan – Accelerator model

(d) Duesenberry – Laissez – faire

Answer:

(b) J.M. Keynes – Psychological law of consumption

Question 2.

(a) Induced Investment – Profit motive

(b) MEC – Autonomous Investment

(c) MEI – Technology

(d) MPC – Accelerator

Answer:

(a) Induced Investment – Profit motive

![]()

Question 3.

(a) Dynamic Multiplier – Employment

(b) Static Multiplier – Wealth

(c) Accelerator Model – J.M. Clark

(d) Leakage Multiplier – Investment goods

Answer:

(c) Accelerator Model – J.M. Clark

Question 4.

(a) Afltalion – 1909

(b) Hawtrey – 1914

(c) Bickerdike – 1915

(d) J.M. Clark – 1916

Answer:

(a) Afltalion – 1909

![]()

Question 5.

(a) Aggregate Income – C

(b) Consumption expenditure – IA

(c) Autonomous Investment – Y

(d) Induced Private Investment – IP

Answer:

(d) Induced Private Investment – IP

V. Which of the following is not correctly matched

Question 1.

(a) Static multiplier – Simultaneous multiplier

(b) Dynamic multiplier – Sequence multiplier

(c) Leakage multiplier – Timeless multiplier

(d) Kinds of multiplier – Tax multiplier

Answer:

(c) Leakage multiplier – Timeless multiplier

Question 2.

(a) Ratio of the consumption – APC expenditure to Income

(b) Ratio of change in consumption – MPC to change in Income

(c) Ratio of the saving to Income – APS

(d) Ratio of change in saving to change in Income – PSM change in Income

Answer:

(d) Ratio of change in saving to change in Income – PSM change in Income

![]()

Question 3.

(a) Demonstration Effect – Superior consumption pattern

(b) Subjective factors – Psychological feeling

(c) Objective factors – Real and Measurable

(d) Super multiplier – Investment demand

Answer:

(d) Super multiplier – Investment demand

Question 4.

(a) Average propensity to consume – C/Y

(b) Marginal propensity to consume – AC/AY

(c) Average propensity to consume – S/Y

(d) Marginal propensity to save – AY/AS

Answer:

(d) Marginal propensity to save – AY/AS

![]()

Question 5.

(a) The motive of precaution – Accidents, Sickness

{b) The motive of foresight – Old age

(c) The motive of improvement – Improve standard of living

(d) The motive of calculation – Money collecting

Answer:

(d) The motive of calculation – Money collecting

VI. Pick the odd one out.

Question 1.

(a) ∆C – Change in consumption

(b) ∆Y – Change in expenditure

(c) ∆S – Change in saving 4

(d) ∆Y – Change in income

Answer:

(b) ∆Y – Change in expenditure

Question 2.

(a) APC – Algebraically Propensity to Consume

(b) MPC – Marginal Propensity to Consume

(c) APS – Average Propensity to Consume

(d) MPS – Marginal Propensity to Save

Answer:

(a) APC – Algebraically Propensity to Consume

![]()

Question 3.

Keynes’s Law is based on the Assumptions.

(a) Ceteris paribus

(b) Existence of Normal conditions

(c) Existence of a Laissez – Faire

(d) Existence of a Technical attributes

Answer:

(d) Existence of a Technical attributes

Question 4.

Investment means

(a) Purchase of stocks and shares

(b) Debentures

(c) Government bonds and equities

(d) Bank amount

Answer:

(d) Bank amount

![]()

Question 5.

MEC – Short Run Factors

(a) Supply for the product

(b) Liquid Assets

(c) Sudden changes in Income

(d) Current rate of Investment

Answer:

(a) Supply for the product

VII. Assertion and Reason.

1. Assertion (A): Keynes Law of propositions – when Income increases, consumption expenditure also increases but by a smaller amount.

Reason (R): Keynes Law of propositions – Increase in Income always lead to an increase in both consumption and saving.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

![]()

Question 2.

Assertion (A): J.M. Keynes has influencing consumption function into subjective factors are the Internal factors related to psychological feelings.

Reason (R): J.M. Keynes has influencing consumption function into objective factors are Internal factors are not measurable.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(c) ‘A’ is true but ‘R’ is false

Question 3.

Assertion (A): Autonomous Investment is the expenditure on capital formation.

Reason (R): Autonomous Investment is Independent of the change in Income, rate of Interest or rate of profit.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

![]()

Question 4.

Assertion (A): MEC – depends on the Demand yield from a capital asset.

Reason (R): MEC – depends on the Supply price of a capital asset.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(d) ‘A’ is false but ‘R’ is true

Question 5.

Assertion (A): Keynes theory of the Multiplier Assumption is change in autonomous Investment.

Reason (R): Keynes theory of the Multiplier Assumption is no Induced Investment.

(а) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(а) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

Part – B

Answer The Following Questions In One or Two Sentences.

Question 1.

Write “Propensity to consume” Equations?

Answer:

(i) The Average Propensity to Consume = \(\frac{c}{y}\)

(ii) The Marginal Propensity to Consume = \(\frac{∆c}{∆y}\)

(iii) The Average Propensity to Save = \(\frac{x}{y}\)

(iv) The Marginal Propensity to Save = \(\frac{∆s}{∆y}\)

![]()

Question 2.

Define “Ceteris paribus”?

Answer:

Ceteris paribus (constant extraneous variables):

The other variables such as income distribution, tastes, habits, social customs, price movements, population growth, etc. do not change and consumption depends on income alone.

Question 2.

Define “Laissez-Faire” – Capitalist Economy?

Answer:

Existence of a Laissez – faire Capitalist Economy:

The law operates in a rich capitalist economy where there is no government intervention. People should be free to spend increased income. In the case of regulation of private enterprise and consumption expenditures by the State, the law breaks down.

![]()

Question 3.

What do you mean “Windfall Gains” or “Losses”?

Answer:

Windfall Gains or losses:

Unexpected changes in the stock market leading to gains or losses tend to shift the consumption function upward or downward.

![]()

Question 4.

Define “Autonomous consumption”?

Answer:

Autonomous Consumption:

Autonomous consumption is the minimum level of consumption or spending that must take place even if a consumer has no disposable income, such as spending for . basic necessities.

Part – C

Answer the Following Questions In One Paragraph.

Question 1.

Explain the Keynes Psychological Law’ of consumption assumptions?

Answer:

Keynes’s Law is based on the following assumptions:

1. Ceteris paribus (constant extraneous variables):

The other variables such as income distribution, tastes, habits, social customs, price movements, population growth, etc. do not change and consumption depends on income alone.

2. Existence of Normal Conditions:

- The law holds good under normal conditions.

- If, however, the economy is faced with abnormal and extraordinary circumstances like war, revolution or hyperinflation, the law will not operate.

- People may spend the whole of increased income on consumption.

3. Existence of a Laissez – faire Capitalist Economy:

- The law operates in a rich capitalist economy where there is no government intervention.

- People should be free to spend increased income.

- In the case of regulation of private enterprise and consumption expenditures by the State, the law breaks down.

![]()

Question 2.

Explain the Marginal Efficiency of capital?

Answer:

Marginal Efficiency of Capital:

- MEC was first introduced by J.M Keynes in 1936 as an important determinant of autonomous investment.

- The MEC is the expected profitability of an additional capital asset.

- It may be defined as the highest rate of return over cost expected from the additional unit of capital asset.

- Meaning of Marginal Efficiency of Capital (MEC) is the rate of discount which makes the discounted present value of expected income stream equal to the cost of capital.

MEC depends on two factors:

- The prospective yield from a capital asset.

- The supply price of a capital asset.

Factors Affecting MEC:

Question 3.

Explain the uses of multiplier?

Answer:

Uses of multiplier

- Multiplier highlights the importance of investment in income and employment theory

- The process throws light on the different stages of trade cycle.

- It also helps in bringing the equality between S and I.

- It helps in formulating Government policies.

- It helps to reduce unemployment and achieve full employment.

![]()

Question 4.

Write the Accelerator Assumptions?

Answer:

Assumptions:

- Absence of excess capacity in consumer goods industries.

- Constant capital – output ratio

- Increase in demand is assumed to be permanent

- Supply of funds and other inputs is quite elastic

- Capital goods are perfectly divisible in any required size.

Question 5.

Write the “Leverage Effect” and Equation Explanation?

Answer:

Leverage Effect:

The combined effect of the multiplier and the accelerator is also called the leverage effect which may lead the economy to very high or low level of income propagation.

Symbolically

Y = C + IA + IP

Y = Aggregate income

C = Consumption expenditure

T = autonomous investment; IP = induced private investment

Part – D

Answer The Following Questions In One Page.

Question 1.

Briefly explain the Leakages of Multiplier?

Answer:

Leakages of multiplier:

- The multiplier assumes that those who earn income are likely to spend a proportion of their additional income on consumption.

- But in practice, people tend to spend their additional income on other items. Such expenses are known as leakages.

Payment towards past debts:

If a portion of the additional income is used for repayment of old loan, the MPC is reduced and as a result the value of multiplier is cut.

Purchase of existing wealth:

- If income is used in purchase of existing wealth such as land, building and shares money is circulated among people and never enters into the consumption stream.

- As a result the value of multiplier is affected.

Import of goods and services:

- Income spent on imports of goods or services flows out of the country and has little chance to return to income stream in the country.

- Thus imports reduce the value of multiplier.

Non availability of consumer goods:

- The multiplier theory assumes instantaneous supply of consumer goods following demand.

- But there is often a time lag.

- During this gap (D > S) inflation is likely to rise.

- This reduces the consumption expenditure and there by multiplier value.

Full employment situation:

- Under conditions of full employment, resources are almost fully employed.

- So, additional investment will lead to inflation only, rather than generation of additional real income.

![]()

Question 2.

Explain Marginal Propensity to Consume [MPC] and Multiplier with diagram and Diagrammatic explanation?

Answer:

Marginal propensity to consume and multiplier.

The propensity to consume refers to the portion of income spent on consumption.

The MPC refers to the relation between change in consumption (C) and change in income (Y).

Symbolically MPC = ∆C/∆Y

The value of multiplier depends on MPC

Multiplier (K) = 1/1 – MPC

The multiplier is the reciprocal of one minus marginal propensity to consume.

Since marginal propensity to save is 1 – MPC. (MPC + MPS = 1).

Multiplier is 1/ MPS.

The multiplier is therefore defined as reciprocal of MPS.

Multiplier is inversely related to MPS and directly with MPC.

Numerically if MPC is 0.75, MPS is 0.25 and k is 4.

Using formula k = 1/1 – MPC

1/1 – 0.75 = 1/0.25 = 4

Taking the following values, we can explain the functioning of multiplier.

C = 100 + 0.8 y; 1 = 100 1 = 10

Y = C + I

Y = 100 + 0.8y = 100 + (1000) = 900;

S = 100 = I

After I is raised by 10, now I = 110

Y = 100 + 0.8y + 110

0.2y = 210

Y = \(\frac{210}{0.2}\) = 1050

Here C = 100 = 0.8 (1050) = 940; S = 110 = 1

Diagrammatic Explanation.

At 45° line y = C + S

It implies the variables in axis and axis are equal.

The MPC is assumed to be at 0.8 (C = 100 + 0.8y)

The aggregate demand (C + I) curve intersects 45° line at point E.

The original national income is 500.

(C = 100 + 0.8y = 100 + 0.8 (500) = 500)

When I is 100, y = 1000, C = 900;

S = 100 = I

The new aggregate demand curve is C+F = 100 + 0.8y + 100 + 10

Y = \(\frac{210}{0.2}\) = 1050

C = 940; S = 110 = 1

![]()

Question 3.

Explain about Marginal Efficiency of Capital [MEC] short run factors and long run factors?

Answer:

(a) Short – Run Factors

1. Demand for the product:

- If the market for a particular good is expected to grow and its costs are likely to fall, the rate of return from investment will be high.

- If entrepreneurs expect a fall in demand for goods and a rise in cost, the investment will decline.

2. Liquid assets:

- If the entrepreneurs are holding large volume of working capital, they can take advantage of the investment opportunities that come in their way.

- The MEC will be high.

3. Sudden changes in income:

- The MEC is also influenced by sudden changes in income of the entrepreneurs.

- If the business community gets windfall profits, or tax concession the MEC will be high and hence investment in the country will go up.

- On the other hand, MEC falls with the decrease in income.

4. Current rate of investment:

- Another factor which influences MEC is the current rate of investment in a particular industry.

- If in a particular industry, much investment has already taken place and the rate of investment currently going on in that industry is also very large, then the marginal efficiency of capital will be low.

5. Waves of optimism and pessimism:

- The marginal efficiency of capital is also affected by waves of optimism and pessimism in the business cycle.

- If businessmen are optimistic about future, the MEC will be likely to be high.

- During periods of pessimism the MEC is under estimated and so will be low.

(b) Long – Run Factors

The long run factors which influence the marginal efficiency of capital are as follows:

1. Rate of growth of population:

- Marginal efficiency of capital is also influenced by the rate of growth of population.

- If population is growing at a rapid speed, it is usually believed that the demand of various types of goods will increase.

- So a rapid rise in the growth of population will increase the marginal efficiency of capital and a slowing down in its rate of growth will discourage investment and thus reduce marginal efficiency of capital.

2. Technological progress:

- If investment and technological development take place in the industry, the prospects of increase in the net yield brightens up.

- For example, the development of automobiles in the 20th century has greatly stimulated the rubber industry, the steel and oil industry etc.

- So we can say that inventions and technological improvements encourage investment in various projects and increase marginal efficiency of capital.

3. Monetary and Fiscal policies:

Cheap money policy and liberal tax policy pave the way for greater profit margin and so MEC is likely to be high.

4. Political environment:

Political stability, smooth administration, maintenance of law and order help to improve MEC.

5. Resource availability:

Cheap and abundant supply of natural resources, efficient labour and stock of capital enhance the MEC.